Internal Control

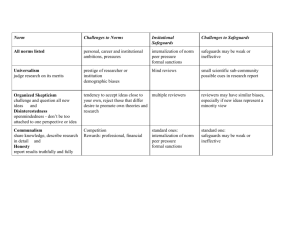

advertisement

Accounting Solution Worksheet ____________________________________________________________________ Name: Date: ____________________________________________________________________ Topic: INTERNAL CONTROL ____________________________________________________________________ Question 1 What role does the Accountant play in the 21st Century? Preparing the accounts and annual reports Forecasting and budgeting Analysing and interpreting data Providing management with information for decision making Safeguard the business to ensure reasonable chance of long term success. Question 2 Auditing standards set out what four objectives? Correct authorisation for appropriate business transactions Accounting records from the transaction to the final reports are executed in the appropriate manner while maintaining promptness and accounting policy Access to assets is permitted only in accordance with management authorisation Steps are taken to ensure recording of assets and the existence of the assets are compared at regular intervals and safeguards are instituted to minimise any differences. Question 3 To have an effective internal accounting control system, what six major principles apply? (i) (ii) (iii) (iv) (v) (vi) Segregation of incompatible functions Authorisation procedures Documentation procedures Accounting records and procedures Physical control Independent internal verification Question 4 List four safeguards that should be in place for cash payments. (Any four) (i) (ii) (iii) (iv) (v) all major payments should be made by cheque and require dual signatures cheques issued in numerical order and marked “Not Negotiable” multi column cash journals maintained remittance advice forwarded with cheques small payments should be handled through a Petty Cash Imprest System © Kramzil Pty Ltd trading as Academic Teacher Resources Accounting Solution Worksheet ____________________________________________________________________ (vi) regular bank reconciliation statements Question 5 What safeguards should be put in place concerning cash receipts? (i) (ii) (iii) (iv) (v) (vi) receipts issued whenever possible, in numerical order daily banking and vary banking times money kept on the premises in a safe and secured location independent checks carried out on till tape and money totals multi – column cash journals regular bank reconciliation statements Question 6 What safeguards should be put in place concerning accounts receivable? (i) (ii) (iii) (iv) (v) (vi) before credit is granted to clients, check references credit limits should be enforced prompt invoicing and monthly statements review ageing of Accounts Receivable and create Allowance for Doubtful Debts Interest charged on overdue accounts or discounts for early payment Control Accounts and Subsidiary Ledgers introduced Question 7 List six safeguards that should be put in place for non-current assets. (i) (ii) (iii) (iv) (v) (vi) Control including purchasing, maintenance, recording, storing, access and disposal Subsidiary ledger and registered asset cards correct personnel allocated responsibility capital expenditure officer has long term plan for the business storage or replacement of non-current assets planned carefully certain assets be left in one location, and assets that are portable safeguards to individuals of responsibility including insurance Question 8 What safeguards should be in place concerning staffing? (i) (ii) (iii) when employing staff, it is critical that references and qualifications are checked staffing records should be brought up to date regularly all staff to be reviewed and evaluated annually Question 9 What does “division of duties” mean? Wherever possible, certain tasks or jobs should be divided so no one individual has full control over a set division or section. Each person can have a specialist role, but has not got full control or authority that security is not put into jeopardy. © Kramzil Pty Ltd trading as Academic Teacher Resources