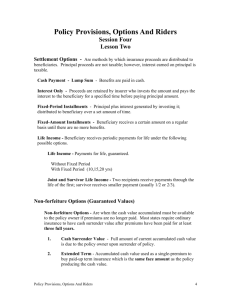

chapter one - basics of life insurance

advertisement