THE LAW OF AGENCY The following supplement is provided to

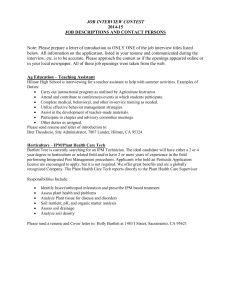

advertisement