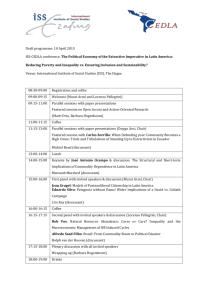

Tentative Mid-Atlantic Research Conference in Finance Program

advertisement

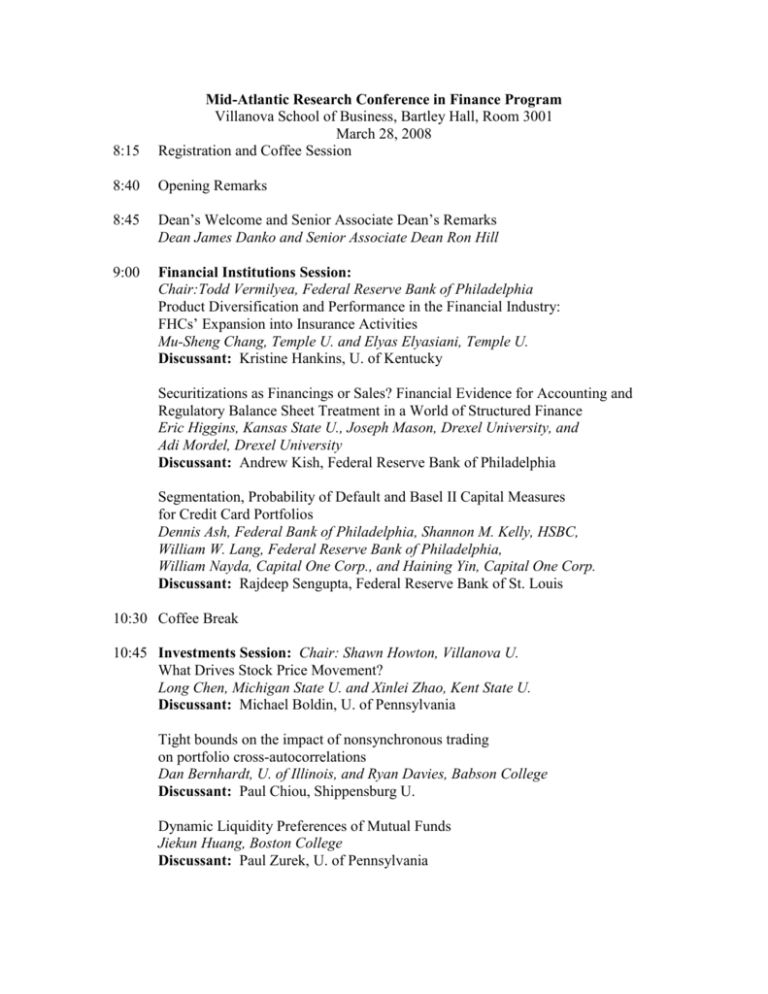

8:15 Mid-Atlantic Research Conference in Finance Program Villanova School of Business, Bartley Hall, Room 3001 March 28, 2008 Registration and Coffee Session 8:40 Opening Remarks 8:45 Dean’s Welcome and Senior Associate Dean’s Remarks Dean James Danko and Senior Associate Dean Ron Hill 9:00 Financial Institutions Session: Chair:Todd Vermilyea, Federal Reserve Bank of Philadelphia Product Diversification and Performance in the Financial Industry: FHCs’ Expansion into Insurance Activities Mu-Sheng Chang, Temple U. and Elyas Elyasiani, Temple U. Discussant: Kristine Hankins, U. of Kentucky Securitizations as Financings or Sales? Financial Evidence for Accounting and Regulatory Balance Sheet Treatment in a World of Structured Finance Eric Higgins, Kansas State U., Joseph Mason, Drexel University, and Adi Mordel, Drexel University Discussant: Andrew Kish, Federal Reserve Bank of Philadelphia Segmentation, Probability of Default and Basel II Capital Measures for Credit Card Portfolios Dennis Ash, Federal Bank of Philadelphia, Shannon M. Kelly, HSBC, William W. Lang, Federal Reserve Bank of Philadelphia, William Nayda, Capital One Corp., and Haining Yin, Capital One Corp. Discussant: Rajdeep Sengupta, Federal Reserve Bank of St. Louis 10:30 Coffee Break 10:45 Investments Session: Chair: Shawn Howton, Villanova U. What Drives Stock Price Movement? Long Chen, Michigan State U. and Xinlei Zhao, Kent State U. Discussant: Michael Boldin, U. of Pennsylvania Tight bounds on the impact of nonsynchronous trading on portfolio cross-autocorrelations Dan Bernhardt, U. of Illinois, and Ryan Davies, Babson College Discussant: Paul Chiou, Shippensburg U. Dynamic Liquidity Preferences of Mutual Funds Jiekun Huang, Boston College Discussant: Paul Zurek, U. of Pennsylvania 12:15 Lunch and Keynote Speaker Why Do Large Financial institutions Hold So Much Capital? Mark Flannery, University of Florida 1:30 Market Microstructure Session: Chair: Michael Pagano, Villanova U. Earnings Quality and Information Asymmetry: Evidence from Trading Costs Neil Bhattacharya, Southern Methodist U., Hemang Desai, Southern Methodist U., and Kumar Venkataraman, Southern Methodist U. Discussant: Jay Coughenour, U. of Delaware Does Removing the Short-sale Constraint Improve Liquidity? Evidence from Hong Kong Pengjie Gao, Northwestern U., Jia Hao, U. of Utah, and Tongshu Ma, Binghamton U. Discussant: Srinivasan Krishnamurthy, SUNY - Binghamton Geographic Proximity and Price Discovery: Evidence from Nasdaq Amber Anand, Syracuse University, Vladimir Gatchev, U. of Central Florida, Leonardo Madureira, Case Western U., Christo Pirinsky, California State U., Fullerton, and Shane Underwood, Rice U. Discussant: Paul Laux, U. of Delaware 3:00 Coffee Break 3:15 Corporate Finance Session: Chair: David Becher, Drexel U. Shareholders’ Say on Pay: Does It Create Value? Jie Cai, Drexel U., and Ralph Walkling, Drexel U. Discussant: Jay Dahya, Baruch College / CUNY Dividends, Investment, and Financial Flexibility Naveen Daniel, Drexel U., David Denis, Purdue U., & Lalitha Naveen, Temple U. Discussant: David Cicero, U. of Delaware Evidence on Board Size and Its Impact on CEO Pay-Performance Sensitivity Ning Gao, Towson U., Joanne Li, Towson U., and Kenneth Small, Coastal Carolina U. Discussant: Anne Anderson, Lehigh U. 4:45 Wine and Beer Reception in the Faculty / Staff Lounge