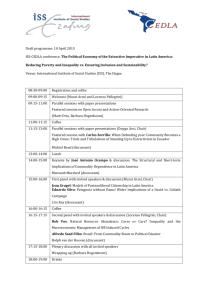

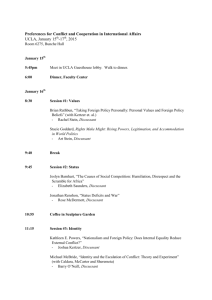

Programme FRIDAY, 09 JULY 2010 Registration 8:15am Welcome

advertisement

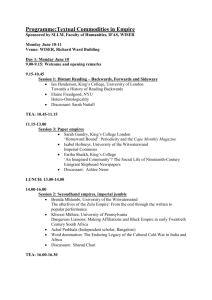

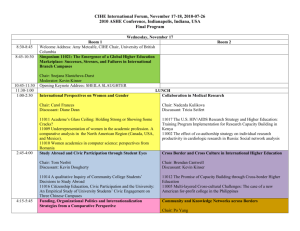

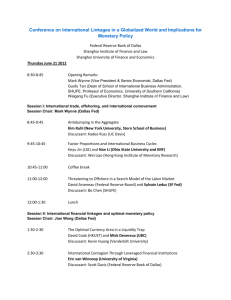

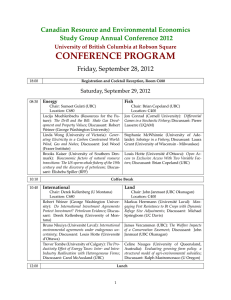

Programme FRIDAY, 09 JULY 2010 Registration 8:15am Welcome Remarks 8:45 – 9:00am Bernard Yeung Dean and Stephen Riady Distinguished Professor NUS Business School Keynote Speech 9:00 – 10:00am “Do International Cross-Listings Still Matter?” G. Andrew Karolyi Professor of Finance and Global Business Alumni Chair in Asset Management S.C. Johnson Graduate School of Management Cornell University Coffee Break 10:00 – 10:30am Session I: Mergers & Acquisitions Session Chair: Allaudeen Hameed (NUS Business School) Paper 1 10:30 – 11:15am “Acquirer-Target Social Ties and Merger Outcomes” Joy L. Ishii (Stanford Graduate School of Business) Yuhai Xuan* (Harvard Business School) Discussant: Emir Hrnjic (NUS Business School) Paper 2 11:15 – 12:00noon “The Value of CEOs Industry Expertise-Evidence from Mergers & Acquisitions” Daniel Metzger* (London School of Economics & Political Science) Claudia Custodio (London School of Economics & Political Science) Discussant: Andy (Young Han) Kim (Nanyang Business School) Luncheon 12:00 – 2:00pm Session II: Mutual Funds Session Chair: Tarun Chordia (Emory University) Paper 3 2:00 – 2:45pm “A Test of Self-Serving Attribution Bias: Evidence from Mutual Funds” Darwin Choi* (Hong Kong University of Science & Technology) Dong Lou (London School of Economics & Political Science) Discussant: Jay Ritter (University of Florida) Paper 4 2:45 – 3:30pm “Finding Bernie Madoff: Detecting Fraud by Investment Managers” Stephen G. Dimmock* (Nanyang Technological University) William Christopher Gerken (Auburn University) Discussant: Jay Patel (Harvard University and OurGlobalFunds) Paper 5 3:30 – 4:15pm “Mutual Fund Risk and Market Share Adjusted Fund Flows" Matthew I. Spiegel (Yale School of Management) Hong Zhang* (INSEAD) Discussant: Joe Zhang (Singapore Management University) Coffee Break (End) 4:15 – 4:45pm SATURDAY, 10 JULY 2010 Registration 8:30am Session III: Institutional Investors Session Chair: Laura T. Starks (University of Texas at Austin) Paper 6 9:00 – 9:45am “Do Institutional Investors Have an Ace Up Their Sleeves? Evidence from Confidential Filings of Portfolio Holdings” Vikas Agarwal* (Georgia State University) Wei Jiang (Columbia Business School) Yuehua Tang (Georgia State University) Baozhong Yang (Georgia State University) Discussant: Pedro Matos (USC Marshall School of Business) Paper 7 9:45 – 10:30am “Does Governance Travel Around the World? Evidence from Institutional Investors” Reena Aggarwal (Georgetown University) Isil Erel (Ohio State University) Miguel Almeida Ferreira (Universidade Nova de Lisboa) Pedro Matos* (USC Marshall School of Business) Discussant: Jiekun Huang (NUS Business School) Coffee Break 10:30 – 11:00am Session IV: Law & Finance Session Chair: Joseph Cherian (NUS Business School) Paper 8 11:00 – 11:45am “Legal-System Arbitrage and MNC Capital Structure” Suman Banerjee (Nanyang Business School) Thomas H. Noe* (Oxford and Tulane University) Discussant: Sugato Bhattacharyya (University of Michigan) Paper 9 11:45 – 12:30pm “Political Risk, Development Banks and the Choice of Recourse in Syndicated Lending” Stefanie Kleimeier* (Maastricht University) Christa Hainz (Ifo Institute for Economic Research) Discussant: Michael Lemmon (University of Utah) Luncheon 12:30 – 2:30pm Session V: Behavioral Finance Session Chair: Chuan Yang Hwang (Nanyang Business School) Paper 10 2:30 – 3:15pm “Nature or Nurture: What Determines Investor Behavior?” Amir Barnea (Claremont McKenna) Henrik Cronqvist* (Claremont McKenna) Stephan Siegel (University of Washington) Discussant: David Hirshleifer (University of California, Irvine) Paper 11 3:15 – 4:00pm “Does Information Dissemination Mitigate Bubbles?” Sandro C. Andrade* (University of Miami) Jiangze Bian (University of International Business and Economics) Timothy R. Burch (University of Miami) Discussant: Li Jin (Harvard Business School) Farewell Coffee *Paper Presenter 4:00 – 4:30pm