Hypothetical Case Documents

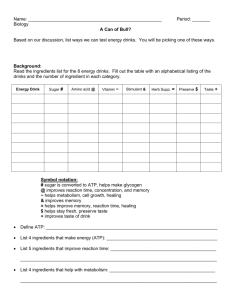

advertisement