BTB110

advertisement

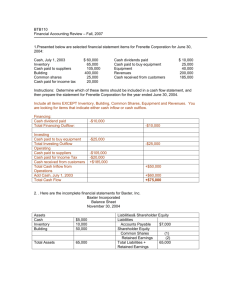

BTB110 Assignment 1; Spring, 2005 Due: Tuesday, March 22 Value: 10% 1.Presented below are some of the accounting concepts dicussed in Chapter 1 of your Accounting text: 1. Adequate disclosure 3. Cost 5. Unit of measure 2. Accounting period 4. Going concern 6. Business entity Instructions: Use the numbers from the above list to identify the accounting concept that is described in each statement below. Do not use a number more than once. (a)_____States the rationale why property, plant, and equipment are not reported at liquidation value. (Do NOT use the cost concept here) (b)_____Indicates that personal and business record keeping should be separately maintained . (c)_____Assumes that the dollar is the measure used to report on financial performance. (d)_____Separates financial information into time periods for reporting purposes. (e)_____Indicates that the market value changes subsequent to the purchase are not recorded in the accounts. (f)_____Dictates that all circumstances and events that make a difference to financial statement users should be disclosed. 2.Financial decisions often depend on one financial statement more than the others. Consider each of the following independent hypothetical situations: (a)An Ontario investor is considering purchasing the common shares of Total Fitness Ltd., which operates 13 fitness centers in the Toronto area. The investor plans on holding the investment for at least three years. (b)Comeau Ltee. is considering extending credit to a new customer. The terms of the credit would require the customer to pay within 45 days of receipt of goods. Instructions: For each situation, state whether the individual would pay most attention to the information provided by the statement of earnings, balance sheet, or cash flow statement. Choose only one financial statement in each case, and provide a brief justification for your choice. 3. Presented below are selected financial statement items for Frenette Corporation for June 30, 2004: Cash, July 1, 2003 Inventory Cash paid to suppliers Building Common shares Cash paid for income tax $ 60,000 65,000 105,000 400,000 25,000 20,000 Cash dividends paid Cash paid to buy equipment Equipment Revenues Cash received from customers $ 10,000 25,000 40,000 200,000 185,000 Instructions: Determine which of these items should be included in a cash flow statement, and then prepare the statement for Frenette Corporation for the year ended June 30, 2004. . 4. From your studies, indicate which strategy most closely reflects that chosen by Brad, John and Courtney for their business. Support your choice by 2 examples from the Movies Door to Door text. 5. Review the first 4 chapters of Movies Dorr to Door.com, and determine the following: a) Where did the owners get their financing from ? What accounts on the balance sheet would be affected by this financing? b) What did the owners of the company invest in while setting up their company? In which financial statement would this information be recorded? c) Which financial statement would be used to keep track of the operations data for Movies Dorr toDoor.com? 6. Here are the incomplete financial statements for Baxter, Inc. Baxter Incorporated Balance Sheet November 30, 2004 Assets Cash Inventory Building $5,000 10,000 50,000 Total Assets 65,000 Liabilities& Shareholder Equity Liabilities Accounts Payable $7,000 Shareholder Equity Common Shares (1) Retained Earnings (2) Total Liabilities + 65,000 Retained Earnings Baxter Incorporated Statement of Earnings Year Ended November 30, 2004 Revenues Operating Expenses Earnings before Income Tax Income Tax Expense Net Earnings Baxter Incorporated Statement of Retained Earnings Year Ended November 30, 2004 Beginning retained earnings Net Earnings Dividends Ending Retained Earnings $80,000 (3) $30,000 10,000 (4) $10,000 (5) ($5000) $25,000 Required: a) Determine the missing amounts for items 1-5 b) Assume that the statements shown above give a net earnings figure on the cash basis. Using the information given below, recalculate net earnings to reflect accounting on the accrual basis. 1. A review of records at the end of November indicates that Baxter has earned $4750 in November, but will be receiving it in January, 2005. 2. A review of records indicates that Baxter owes suppliers $2500 for goods purchased in November. Baxter plans to pay for those goods in December. 3. A review of company records indicates that $225 of office supplies (listed in the inventory account ) has been used up during November, 4. Company records show that $750 included in the cash account represents unearned revenue. The customer paid in advance, nad has not yet received the service he paid for.