BTB110

advertisement

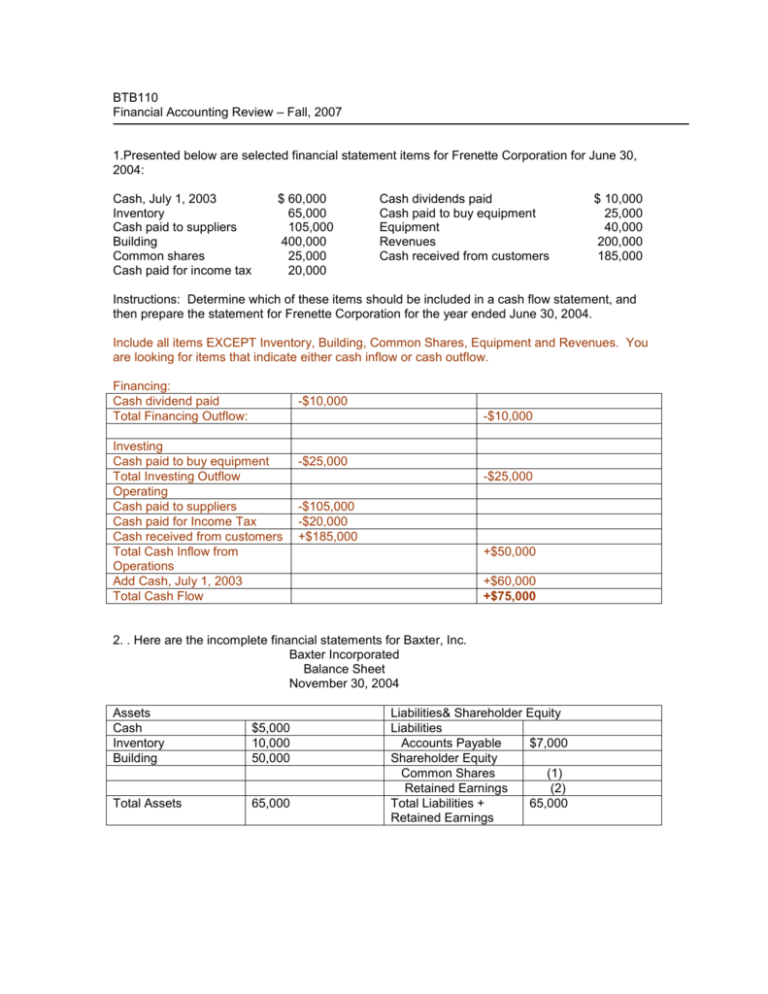

BTB110 Financial Accounting Review – Fall, 2007 1.Presented below are selected financial statement items for Frenette Corporation for June 30, 2004: Cash, July 1, 2003 Inventory Cash paid to suppliers Building Common shares Cash paid for income tax $ 60,000 65,000 105,000 400,000 25,000 20,000 Cash dividends paid Cash paid to buy equipment Equipment Revenues Cash received from customers $ 10,000 25,000 40,000 200,000 185,000 Instructions: Determine which of these items should be included in a cash flow statement, and then prepare the statement for Frenette Corporation for the year ended June 30, 2004. Include all items EXCEPT Inventory, Building, Common Shares, Equipment and Revenues. You are looking for items that indicate either cash inflow or cash outflow. Financing: Cash dividend paid Total Financing Outflow: -$10,000 -$10,000 Investing Cash paid to buy equipment Total Investing Outflow Operating Cash paid to suppliers Cash paid for Income Tax Cash received from customers Total Cash Inflow from Operations Add Cash, July 1, 2003 Total Cash Flow -$25,000 -$25,000 -$105,000 -$20,000 +$185,000 +$50,000 +$60,000 +$75,000 2. . Here are the incomplete financial statements for Baxter, Inc. Baxter Incorporated Balance Sheet November 30, 2004 Assets Cash Inventory Building $5,000 10,000 50,000 Total Assets 65,000 Liabilities& Shareholder Equity Liabilities Accounts Payable $7,000 Shareholder Equity Common Shares (1) Retained Earnings (2) Total Liabilities + 65,000 Retained Earnings Baxter Incorporated Statement of Earnings Year Ended November 30, 2004 Revenues Operating Expenses Earnings before Income Tax Income Tax Expense Net Earnings Baxter Incorporated Statement of Retained Earnings Year Ended November 30, 2004 Beginning retained earnings Net Earnings Dividends Ending Retained Earnings $80,000 (3) $30,000 10,000 (4) $10,000 (5) ($5000) $25,000 Required: a) Determine the missing amounts for items 1-5 b) Assume that the statements shown above give a net earnings figure on the cash basis. Using the information given below, recalculate net earnings to reflect accounting on the accrual basis. 1. A review of records at the end of November indicates that Baxter has earned $4750 in November, but will be receiving it in January, 2005. 2. A review of records indicates that Baxter owes suppliers $2500 for goods purchased in November. Baxter plans to pay for those goods in December. 3. A review of company records indicates that $225 of office supplies (listed in the inventory account ) has been used up during November, 4. Company records show that $750 included in the cash account represents unearned revenue. The customer paid in advance, nad has not yet received the service he paid for. Solution: You can’t always fill in the blanks from top to bottom. You have to begin where you have the most information. In this problem, it is simplest to begin with the Statement of Retained Earnings: Ret. Earn(begin) + net earnings – dividends paid = Ret Earn (end) $10,000 + x $5,000 = $25,000 x = $25,000+ $5,000 - $10,000 x = $20,000 (5) and (4) Come to think of it, you could also have solved for (4) and indicated that as the answer for (5) In any event, from the income statement, we have the following: Revenue – Oper. Expenses = Income before taxes $80,000 x = $30,000 Oper. Exp. = $80,000 - $30,000 = $50,000 (3) Earning before tax – tax = Net Income $30,000 - $10,000 = $20,000 (4) Assets = Liabilities + Shareholder Equity $65,000 = $7,000 + x x = $65,000 - $7,000 x = $58,000 Shareholder Equity = Capital Stock +Retained Earnings $58,000 = x + $25,000 (2) – given as the balance in the Retained Earnings Statement Cap Stock = $58,000 - $25,000 = $33,000(1) Part B Net Income = $20,000 Cash Basis To Convert to the Accrual Basis (i.e., revenue declared is the amounts earned in a period whether received or not, and expenses declared in the same period are the costs incurred in that period to run the business) 1. Revenue earned but not yet received…..Increased Revenue increases Net Income Add $4750 to Net Income 2. An undeclared expense ….increasing expenses decrease net income Deduct $2500 from Net Income 3. An undeclared expense…increasing expenses decreases net income Deduct $225 from Net Income 4.Revenue received but not yet earned…a decrease to revenue for the period decreases net income Deduct $750 from Net Income $20,000 + $4750 - $2500 - $225 - $750 =$21,275 3.On January 2, 2001, Powell Company purchased an electroplating machine to help manufacture a part for one of its key products. The machine cost $182,250, and was estimated to have a useful life of 4 years after which it could be sold for $18,500. Compute each year’s depreciation expense under the following depreciation methods: (5 marks) a. straight-line b. double declining balance (CCA) Year 2001 2002 2003 2004 Straight-line $40,937.50 $40,937.50 $40,937.50 $40,937.50 Cost = $182,250 Salvage Value = $18,500 Useful Life = 4 years Straight Line Depreciation: Cost – Salvage Est. Life $182,250 - $18,500 4 $163,750/4 = $40,937.50/yr. Double Declining Balance $91,125 $45,562.50 $22,781.25 $4,281.25 Double Declining Balance: As asset that will last 4 years is depreciated at a rate of 25% per year. Therefore, the double declining rate is 2* 25% = 50% per year on the cost excluding the salvage. Year 1 depn expense = 50% * 182,250 = $91,125 Accum depn = $91,125 Net Book Value = $182,250 - $91,125 = $91,125 Year 2 depn = 50% * $91,125 = $45,562.50 Accum depn =$91,125 +$45,562.50 = $136,687.50 Net Book Value = $182,250 - $136,687.50 = $45,562.50 Year 3 Depn = 50% * 45,562.50 = $22,781.25 Accum Depn = $136,687.50 + $22,781.25 = $159,468.75 Net Book Value = $182,250 – $159,468.75 = $22,781.25 Salvage Value = $18,500 Therefore Year 4 depreciation = $22,781.25 - $18,500 = $4,281.25 4. The Agricultural Genetics Company Cash account reported a balance of $7,393 on May 31, 2005. On the same date, the company’s bank statement from the Western Bank reported a balance of $9,134. A comparison of the details in the bank statement with the details in the Cash account revealed the following facts: 1. The bank statement included a debit memo for $50 for bank service charges. 2. Cash sales of $638 on May 12 were deposited in the bank. The company correctly recorded the sale in their books, however the bank statement shows a deposit for $386 on this date. 3. The May 31 deposit of $1,141 was not included in the deposits on the May bank statement. 4. Outstanding cheques at May 31 totalled $1679. 5. On May 18, the company issued cheque #1181 for $585 to L. Kingston on account. The bank paid out $585 to L. Kingston, but the bookkeeper incorrectly recorded the cheque value as $855 in the company books. 6. A review of the bank statement revealed that the Agricultural Genetics Company received $2,031 in electronic payments from customers on account during May. The bank had also credited the company’s account with $24 interest revenue on May 31. Agricultural had no prior notice of these amounts. 7. On May 31, the bank statement showed an NSF charge of $820 for a cheque issued by Pete Dell, a customer of Agricultural Genetics Company on account. This amount includes a $20 service charge by the bank. Bank Reconciliation Statement for Agricultural Genetics (May 31, 2005) Balance as per Bank Statement $ 9,134 Balance as per Company Cash Account $7,393 Add: Deposit in Transit (3) $ 1,141 Add: Amounts Collected by Bank: Subtotal $10,275 Electronic Transfer (6) $2,031 Less: Outstanding cheques(4) ($ 1,679) Interest Revenue (6) $ 24 Subtotal $ 8,596 Subtotal $9,448 Add: To Balance due to Bank $ 252 Less: NSF cheque (includes ($ 820) Error in deposit (638-386) (2) $20 service charge) (7) Adjusted Bank Balance . $ 8,848 Less: Bank Charges (1) Subtotal Add: Bookkeeper error (5) (855 – 585 = 270) Adjusted Cash Account Balance ($ 50) $8,578 $ 270 $8,848