File

Student Name: _______________________

Semester 1 Exam Study Guide

Terms

1. Accounting Equation

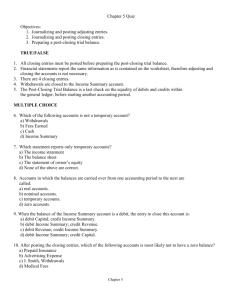

2. Adjusting Entries

3. Balance Sheet

4. Chart of Accounts

5. Closing Entries

6. Expense

7. Income Statement

8. Permanent Accounts

9. Post-Closing Trial Balance

10. Posting

11. Proprietorship

12. Revenue

13. Service Business

14. Source Document

15. T account

16. Temporary Accounts

17. Trial Balance

18. Work Sheet

19. Ledger

20. Journal

21. Sales Invoice

22. Memorandum

Accounting Practices

1. When do should you fill in the post reference of the journal?

2. What are the types of endorsements used on checks?

3. Which endorsement allows a check to be cashed by whoever holds it?

4. When petty cash is replenished does it change the balance or keep it the same?

5. What is the Matching Expenses with Revenue concept?

6. Why are adjustments done?

7. How/why are temporary accounts used? To accumulate info. until transferred to the owner’s capital account

8. What do closing entries do?

9. Prepaid Insurance that is used up during a period is what type of account?

(asset or expense) What is this account called?

10. Prepaid Insurance is what type of account? (asset or expense)

11. How is the Net Income or Net Loss found on a worksheet?

12. What is an Expense Component Percentage? What statement is it found on?

13. How do you find the current capital to be reported on a balance sheet?

14. What are temporary accounts? What is their balance at the beginning of each fiscal period?

Student Name: _______________________

15. What is the source document for an EFT

16. Are the transactions recorded in the journal permanent?

17. What time frame does a balance sheet cover?

18. Name the temporary accounts that are closed out at the end of the fiscal period.

19. What is the last step in the posting procedure?

20.

An account number in the journals post reference column shows…

21. When is a petty cash fund replenished?

22. On a worksheet the balance of the Sales account is extended to the

______ _________ ______ column.

23. What two columns would a net loss be found on a work sheet?

24. Preparing financial statements at the end of the accounting cycle is using what accounting concept? (Adequate Disclosure, Going Concern,

Objective Evidence, or Accounting Period Cycle)

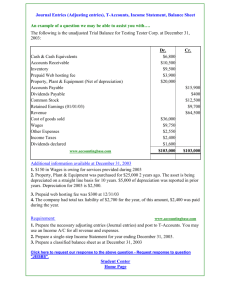

25. What is the journal entry to adjust supplies?

26. What does the Supplies Expense account represent?

27. What is the order of closing entries?

28. What is the journal entry to establish a petty cash fund?

29. Following the same accounting procedures in the same way in each accounting p eriod is an application of the accounting concept…?

(Matching Expenses With Revenue, Accounting Period Cycle, Going

Concern, or Consistent Reporting)

Journalizing

Marcus Spano owns a service business called Spano's Advisory Service. Spano's uses the following accounts:

Cash Accounts Payable—Supplies

Warehouse

Marcus Spano, Capital Petty Cash

Accounts Receivable—Priority Company Marcus Spano, Drawing

Supplies Sales

Prepaid Insurance

Accounts Payable—Abbott Company

Miscellaneous Expense

Rent Expense

Directions:

Journalize the following selected transactions completed by Spano's Advisory Service during August of the current year. Use page 3 of the general journal given on this test.

Source documents are abbreviated as follows: check, C; memorandum, M; receipt, R; sales invoice, S; calculator tape, T.

Student Name: _______________________

Transactions

Aug. 1. Received cash from owner as an investment, $12,000.00. R1.

2. Bought supplies, $165.00, using debit card. M1.

2. Paid cash to establish a petty cash fund, $100.00. C1.

3. Paid cash for insurance, $900.00. C2.

4. Bought supplies on account from Supplies Warehouse, $350.00.

M2.

4. Paid cash for one month's rent, $1,300. C3.

9. Sold services on account to Priority Company, $780.00. S1.

10. Bought supplies on account from Abbott Company, $695.00.

M3.

14. Paid cash on account to Supplies Warehouse, $350.00. C4.

22. Paid cash on account to Abbott Company, $695.00, using EFT.

M4.

24. Received cash on account from Priority Company, $500.00. R2.

28. Paid cash to owner for personal use, $2,000.00. C5.

29. Recorded bank service charge, $6.00. M5.

29. Received notice from the bank of a dishonored check from

Priority Company, $500.00, plus $25.00 fee; total, $525.00. M6.

31. Received cash from sales, $3,200.00. T31.

31. Paid cash to replenish the petty cash fund, $28.00: supplies,

$12.00; miscellaneous expense, $16.00. C6.

Student Name: _______________________

Essay

Know the steps of the accounting cycle, what is done at each step, and explain why we do each step.

1. Analyze Source Documents:

2. Journalizing source documents:

3. Posting to the ledger:

4. Create a worksheet (4 reasons pg. 153):

5. Prepare financial statements:

6. Journalize adjusting and closing entries

7. Post Adjusting and closing entries

8. Post Closing Trial Balance