Document

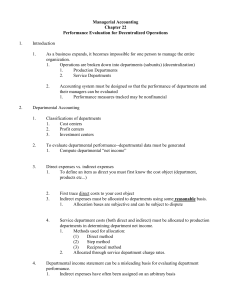

advertisement

Chapter 22 Decentralization & Performance Evaluation Departmental Accounting – giving managers more effective control over smaller area. Primary goals Provide information for managers to use in performance evaluation. Assign costs to managers who are responsible for controlling the costs. Balanced Scorecard (Decision Insight – pg 889) • Contains financial and non-financial performance measures. • Tracks progress toward company goals. • Balances long-run and short-run objectives. • Links performance to goals. Four Perspectives of Performance • The balanced scorecard contains information from four key viewpoints. Financial - financial measures of profitability or growth Customer - measures of satisfaction, market share, etc. Internal Business Process - what process are we trying to improve Learning and Growth - what is needed to support other goals Follow the flow!!! • Increases in Learning and Growth • Lead to improvements in Internal Processes • Which enable us to meet Customer needs. • Which in turn, leads to Financial success For Each Perspective... • We develop objectives measures of performance to track progress target levels of performance • At the end of the period we report actual performance to monitor progress/success • items are strategy specific Responsibility Accounting • Another idea that is important in evaluating performance is the notion of responsibility. We assign responsibility for actions to the appropriate levels in the organization and then gather data to evaluate their performance against the goals identified early on. Types of Responsibility Centers • This author identifies two types of responsibility centers. Cost Center – accountable for controllable costs only because it does not generate revenues Profit Center – manager is accountable for both revenues and expenses incurred. (individual store in a chain, or department in a store) • Other types of responsibility centers Discretionary Cost Centers Revenue Centers Investment Centers Performance Evaluation • These responsibility centers will be evaluated, using both financial and nonfinancial measures, on how well they meet the goals of the center (controlling costs, generating operating profit, etc.) • Managers of these various centers should not be held accountable for costs or revenues that are not under their control. • We typically compare actual results to a flexible budget for the center. Allocating Department Expenses • Allocating expenses across multiple departments is an accounting challenge: Direct Expenses – incurred for the sole benefit of one department Indirect Expenses are • Incurred for the benefit >1 department • Allocated across multiple departments who receive the benefits based upon Cause – effect relationship Estimates approximating the benefit received by each department • There is no standard rule for allocating indirect expenses; judgment is required. Common Bases for Allocating Indirect Expenses Service Department Costs Question ABCO allocates its $300,000 personnel cost to operating departments based on the number of employees in each department. The assembly department has 100 employees and the packing department has 150 employees. What amount of cost is allocated to assembly? a. $100,000 b. $120,000 c. $150,000 d. $180,000 Service Department Costs Question ABCO allocates its $300,000 personnel cost to operating departments based on the number of employees in each department. The assembly department has 100 employees and the packing department has 150 employees. What amount of cost is allocated to assembly? a. $100,000 Assembly percentage = 100 ÷ (100 + 150) = 40% b. $120,000 40% of $300,000 = $120,000 c. $150,000 d. $180,000 Departmental Income Stmts Combined $ 88,000 38,000 $ 50,000 Sales Cost of goods sold Gross profit on sales Operating expenses Salaries $ Supplies Rent Utilities Service Department One Service Department Two Total operating expenses $ Net income $ 17,000 1,100 8,000 800 2,200 3,400 32,500 17,500 Sales Sales Dept. One Dept. Two $ 40,000 $ 48,000 20,000 18,000 $ 20,000 $ 30,000 $ 6,000 400 3,000 300 1,000 1,400 $ 12,100 $ 7,900 $ 11,000 700 5,000 500 1,200 2,000 $ 20,400 $ 9,600 Departmental Contribution to Overhead Departmental revenue – Direct expenses = Departmental contribution Departmental contribution . . . Is used to evaluate departmental performance. Is not a function of arbitrary allocations of indirect expenses. A department may be eliminated when its departmental contribution is negative. Departmental Contribution to Overhead Net income for the company is still $17,500. Departmental Contribution to Overhead Departmental contributions to indirect expenses (overhead) are emphasized. Departmental Contribution to Overhead Departmental contributions are positive so neither department is a candidate for elimination. Controllable Costs Costs are controllable if the manager has the power to determine, or strongly influence, the amounts incurred. A manager’s performance evaluation should be based on controllable costs. Distinguishing Controllable and Direct Costs Direct costs are traced to departments, but may not be controllable by the department manager. • Example: Department managers usually have no control over their own salaries. Controllable costs are identified with a particular manager and a definite time period. • All costs are controllable at some level of management if the time period is long enough. Investment Center Evaluation • Investment center – is like a profit center except the manager is also responsible for effectively using the center’s assets to generate income (division of a company) • Several measures used to evaluate an investment center. ROI = Operating income/Avg total assets Or Profit margin x asset turnover where Profit margin = operating income/sales Asset turnover = sales/avg total assets • May be used to compare performance across divisions, to establish targets for employee evaluation, or to determine whether to reinvest resources in center That’s the last lecture!