Overview 3

advertisement

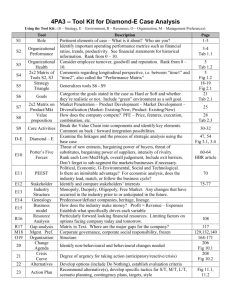

Mergers & Acquisitions Database 1 CONTENTS PAGE Overview 3 What is SDC Platinum Sources Deals Tracked & Not Tracked Why Use SDC 3 3 4 4 Getting Started 5 Logging On 5 The Search Items Menu 6 Explantion of each Tabs 6 Sample Sessions 8 Basic – Beginners level Advanced – Intermediate to Advanced level 8 14 Logical Set Operations 19 Sample session 19 Saving a Session 21 Saving a Custom Report Format or League Table 21 Saving and Loading a list of Selections 22 Helpful Tips 22 Contacts 22 2 OVERVIEW What is SDC Platinum (M&A) SDC Platinum is the world’s most comprehensive M&A database, with US deals dating back to 1979 and other International transactions dating back to 1985. SDC enables you to identify comparable transactions, monitor markets and industries, prospect for new business and evaluate advisors. Sources SDC M&A data include over 200 English and foreign news sources, SEC filings (and global equivalents), trade press publications, banks surveys and direct contact with the relevant advisors. Institutions involved in league tables are especially diligent when it comes to reporting and maintaining a feed of information to research, primarily to help ensure as high a placement as possible. The premier sources, particularly at the deal initiation stage, are press releases from PR companies acting for companies involved in transactions, and RNS announcements. The wall street journal The new York Times Dow Jones Newswire PR Newswire Corporate News Releases Quarterly Investment Bank Surveys Proxy Statements William Act Filings (14D-1, D-9, 13E-3, E-4) 8-Ks and other Periodic SEC Reports S-4s, S-3s, S-1s, S-2s Reuters Bloomberg All International Newspapers Although the data is collected globally, the European research team is based in Tunbridge Wells, now also the home of SDC’s European venture capital research. An average of over 50 deals a day are input in Tunbridge Wells, before being processed overnight in the US. Most data entered into SDC is input one day after the announcement, with domestic transactions worth over $50m announced prior to 2pm generally entered on to the system the same day. 3 Deals Tracked on SDC Deals not Tracked on SDC Acquisitions Asset Acquisitions Divestitures distributor Equity Exchange Offers (offers involving equity or securities convertible into equity) Leverage Buyouts Mergers Partial Acquisitions Purchases of Interests in Joint Ventures Recapitalizations involving an equity (or securities convertible into equity) buyback, which pay special one-time dividends Self-Tenders Spinoffs to shareholders Spinoffs to investors when 100% of the shares outstanding are offered to the public, (except for privatisations in which case any percentage is tracked) Stock Repurchases (both completed and authorized) of equity or securities convertible into equity Tender Offers Joint Ventures Rumoured Transactions (i.e. when a possible transaction is neither confirmed or denied by the participants but the transaction is tracked by major news services) Commercial office building sales Conversion of a company to a limited partnership Distribution rights from a manufacturer to a Film Rights Formation of joint ventures Land sales Oil lease sales by a government Redemption of securities Sales and leaseback of property or equipment Sales of minority stakes to the public (IPOs) Ships (except for cruise ships, which we treat as hotels) . So why use SDC Platinum??? The most common uses for SDC information are as follows: - Comparable Deal Analysis Look at historical deals with financings, to see how a deal should be structured and how the deal should be priced. Competitive Analysis To determine where one bank lies in context of all the players in that market; to compare one’s bank to competitors. SDC League tables are used to rank the competition. New Business Presentation To create pitch books in order to prospect for new business. SDC can show off the bank’s strengths by manipulating the data to emphasise the business successes and advantages while emphasising other banks’ weaknesses i.e. One bank may be strong in advising UK Telecom companies although its ranking in the overall telecom market may be lower. 4 Market Trend Analysis To determine what markets are strong, to look at overall market activity, i.e. if a bank is advising a company on doing a telecom deal, one can look at the activity in the market through volume totals and other reports to determine if the markets are conducive for a deal at that time. Getting Started The requirements for SDC SDC is an online product, which dials up through either a modem or the Internet Logging onto SDC Platinum To log into SDC Platinum: 1. Double-click on the SDC Platinum icon 2. Click on login 3. Enter your registered users initials and click on OK (The SDC Bulletin Board appears) 4. Click on OK 5. If prompted, enter a project description of further billing information and click on OK 6. Select Mergers & Acquisitions Tab from the database selection – Fig 1. Fig 1. 5 7. Select both US Targets & Non US Targets for a Global search 8. In the Announcement Date window select the specific date range required 9. This will then default to main database screen for M&A where the Search Items Menu will appear. – Fig 2. The Search Items Menu Fig 2. The Search Items are made up of six tabs to ensure easy access to specific searchable items. Company The Company tab covers any relevant information about the Target or Acquiror (nation, industry, public status and any parentage information). There is also an option to search for ‘Specific Deals’ (NB: To use this option it is best to have the announcement date set to ALL to ensure every deal is captured) Deal The Deal tab covers any relevant information with regards to the actual transactions. Some of the most common items used are as follows: Deal Value (US$ mil) Date Effective/Unconditional Acquisition Techniques Consideration Offered Deal Attitude Deal Status Deal Synopsis Deal Type Number of Consideration Types Offered 6 Advisors/Fees The Advisor/Fee tab covers information relating to either the Target or Acquiror Advisors of the transactions. The fee information will also be available as long as it has been disclosed. Financials The Financials tab covers the financials relating to the ‘Target’ company as well as Ratio’s and also Premiums. The information will only be available if it has been disclosed. There is very limited data on Private Companies as they are not regulated the same way Public Companies are, in terms of ‘Disclosure, there is no incentive for them to do so. Some of the common items used are as follows: Cash Flow last Twelve Months (US$ mil) Net Sales last Twelve Months (US$ mil) Ratio of Deal Value to Cash Flow Ration Deal Value to EBIT Offer Price to Target Stock Price 1 Day Prior to Announcement All Items The All Items tab covers the whole database; this contains over 2000 searchable items. This is used when items are not available under the above four tabs. My Favourites My Favourites tab allows users to save any items from the All Items tab to create their own commonly used items. NB. Throughout the ‘Search Items’ menu there is a ‘Definition’ button available to give a brief description of each item. - Fig 3. Fig 3. 7 Basic Sample Searches Session 1 Run an All Data Report on the Mannesmann/Orange deal which was announced in October 1999. 1. Select both US and Non US targets from the front screen 2. Select All Dates for announcement 3. Under the Company Tab select Specific Deal and type in Mannesmann as the Acquiror and then click on search 4. A list will then appear of all deals Mannesmann have been involved as the Acquiror, double click on the specific deal you require – Fig 4 Fig 4 4. Once selected, click on the Execute button on the right hand side of the tool bar. 5. You will now have 1 hit in your session. 6. Click on Report at the very top of the tool bar on the left and select Open Existing – All Data. The report will run automatically and should be seen on your screen – Fig 5 8 Fig 5 NB. These reports cannot be saved only printed. 7. 8. To exit from the search screen, click on Session select Close SDC Platinum will prompt you to save your steps for future reference. Session 2 Find All True M&A deals since 1995 where Mannesmann AG was involved in any capacity. Create a custom report to show: Date Announced, Target Name, Acquiror Name, Deal Value, Status. 1. 2. 3. 4. Select US & Non US Targets. Click OK Date Announved, Type 1995 in the From box. Click OK Under Company Tab. Double click on Target/Acquiror/Seller/Investor. Enter Mannesmann AG in the company name box. Click on search Double click on Mannesmann AG and click OK. Close the search screen and click on execute. – Fig 6. 9 Fig 6. 4. 5. Click on Report at the very top of the Tool Bar and select New Custom Click on the boxes you require for each item to appear in the report – Fig 7 Fig 7. 10 6. 7. Once selected click on OK. The Custom Report Format will appear click on OK. This will then prompt you to save the format. A Title & Options page will appear – Fig8 Fig 8. 8. Type your title and then click OK 11 9. Execute once again to view the report – Fig 9 Fig 9. 10. To export the report into excel, click on the Save Button and change files of type to MS excel. Session 3 To run a Top 25 Financial Advisor League Table in Telecommunications in Europe for Year 2000. 1. 2. 3. 4. Select US and Non US Targets from the front screen Announcement Date type 2000 in the From box and 2000 in the To box Double click on Target Nation, highlight Europe and right click. Select highlighted Items and click OK. Double click on Target All SIC and scroll down until you find Telecommunications. Highlight your selection and right click. Select Highlighted Items and click OK– Fig 10 Fig 10. 12 5. 6. 7. 8 Close the search screen and click on Execute. There are three buttons on the tool bar Report / League / Analysis. Click on League and the Standard League Table will appear. Highlight Financial Advisors and click OK. The Report & Options page will appear this is optional to input a title (see Fig 8.) Click OK and then Execute. The Top 25 advisor League table will appear – Fig 11. Fig 11. 13 10. 11. To save the table click on the Save Button and export into excel. To compile charts (pie,bar & line). Go to Tool Bar above the league table and click on Chart / Chart Rank – Fig 12. Fig 12. Advanced Sample Searches 14 Session 1 The Top 10 comparable deals in the Internet Sector in Europe during 2000. Design a Custom Report showing financial data. 1. 2. 3. 4. 5. 6. 7. Select US & Non US Targets from the front screen. Announcement date From 2000 to 2000 Company Tab Select Target Nation Europe Company Tab Select Target High Tech Industry – Type Internet in the find box and then select. Financials Tab – Select Ratio of Deal value to Cash Flow (this will cover most financial categories) Type in 0.001 to Hi – This will ensure all deals have disclosed a value for this field – Fig 13 Execute Fig 1. 8. 9. 10. 11. To select the Top 10 deals, Above the Tool Bar select Utilities and scroll down to Top N Deals, change the Item Code to Value of Transaction and select OK. Execute To design a Custom Report select Report above the Tool Bar and then select New Custom. Tick the following Item s and save as before :Announcement date, Effective Date, Target Name & Nation , Acquiror Name & Nation, Deal value, EBITDA, Net Assets, Net Income, Sales Execute The Custom Report will appear for the 10 deals showing the financial data – Fig 14. 15 Fig 14. 12. From this screen it is also possible to drill down to an All Data Report by double clicking on the Announcement Date of the specific deal . Session 2 Top 10 League Table showing the underlying deals for the Advisors looking at all 3 allocation methods. 1. 2. 3. 4. Use the same steps as Session 1 from 1 – 4 Select League Tables above the Tool Bar and select New Custom double click on Financial Advisors. Select all 3 allocation methods and change List top n Managers to 10 – Fig 15 Select the Advanced Tab and type 10 in Display Underlying Data for Top N … - Fig 16 Fig 15. 16 Fig 16. 5. Click on Ok and save the Custom Rank. 6. An option for a title may be entered and then select Execute 7. Three tables will appear by, the first shown – Fig 17 8. Scrolling down you will also see the underlying deals for each advisor – Fig 18 Fig 17. 17 Fig 18. Session 3 18 What was the activity during 2000 in Europe in Telecoms. 1. 2. 3. 4. 5. 6. 7. 8. 9. Select US & Non Us Targets Date Announced 2000 to 2000 Company tab – Target Nation Europe Company Tab – Target Industry Sector – Telecommunications Select OK and Execute Click on the Analysis button on the tool bar Select Target Tab – Target Nation – OK Execute The result will show a table looking at the activity in each European country in Telecommunications – Fig 19 Fig 19 10. These tables can also be exported into excel Logical Set Operations 19 Logical Operations: Union(or), Intersect(and), Difference All Deals in 2000, over $1000 (bil) in the biotechnology industry, where the target is from Europe. The deals must not exclude Goldman Sachs irrespective of size or industry 1. 2. 3. 4. 5. 6. 7. Select Non US Targets Date Announced – 2000 to 2000 Target Nation – Europe Deal Value $ 1000 to Hi Target High Tech Industry – All Biotechnology Close the Search Items box Highlight Request 2 and click on the USE button – Fig 20 Fig 20 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. Click on the Search Button Advisor Tab – Target Financial Advisors – Select Goldman Sachs Close the Serach Items box Click on Utilites above the tool bar Scroll down to Logical Set Operations Drag Request 4 and 6 into the box – Fig 21 Select Union within the box Execute Click back on Search Financials Tab – Select Ratio to Deal Value to Cash Flow – 0.001 to Hi Execute Design a Custom Report showing the financials – Fig 22 20 Fig 21 Fig 22 The Logical Set Operations search result in terms of a diagram. 21 Goldman & Biotech = 89 Deals All Deals in 2000 Target = Europe and in Biotech Deal Value >$1000(bil) = 10 Deals Goldman Sach’s Deals = 79 Deals Saving A Session Saving a Session will save all the requestslisted in the Request Description list box of the main session window. After a session is saved it can be retrieved at any time. Once retrieved it is possible to modify any session . 1/ 2/ 3/ 4/ Click on the Save button or from the Session menu select Save As Select the drive and folder where you wish to save the session In the session name text box, type the name of the session Click on OK SDC Platinum saves the session. Saving a Custom Report Format or League Table 1/ 2/ 3/ 4/ 5/ Create your custom report format and click OK or Create your custom league table criteria and click OK Select the drive and folder where you wish to save the report or league table In the custom report or rank name text box, type the name of the custom report format or league table Type a description and comments if you wish and click OK The Output Options window appears. This enables you to add titles, search details, summary statistics and sort data. SDC Platinum saves the report format and league table Saving and Loading a list of Selections 22 You can save groups of frequently used CUSIP numbers, SIC codes, ticker symbols etc for use in later searches. You can load and use the saved lists to search any SDC database. To create a list of selections, you must be in the specific window. Eg. To create a list of Target SIC codes you must be in the Target SIC codes window To create a list of Selections:1/ 2/ 3/ From the Search Items window to open a pick list or company window Select the items to include in your list From the List Management menu, select Save Selection As List. The Save List window appears 4/ Select the drive and folder where you wish to save the list 5/ In the List Name text box type in the name of the list 6/ Type in a description and comments if you wish 7/ Click OK SDC will save the list To load a saved list of selections:1/ 2/ 3/ 4/ 5/ Use the Search Items window to open the pick list or company window From the List Management menu, select Load Saved List Select the drive and folder that contain the list In the Saved Lists of Selections list box, click on the list name Click OK SDC displays the list of selections in the company identifier or pick list window. Helpful Tips Utilites (on the tool bar) Statistics – This automatically calculates the average, minimum, maximum and median Top n Deals – This automatically selects the largest number of deals Financials When looking for comparable deals the best item to select is Ratio of Deal Value to Cash Flow enter 0.001 in the from box to Hi. This will ensure all deals have the relevant information. Financials are not always disclosed especially if it’s a private company. Contact Numbers London Tel – +(44) (0) 207 369 7944 Frankfurt Tel – +(49) (0) 69 97 17 53 00 Paris Tel – +(33) (0) 1 44 53 78 50 Fax – +(44) (0) 207 369 7711 Fax – +(49) (0) 69 07 17 53 50 Fax – +(33) (0) 1 44 53 78 55 Email mailto:support@tfibcm.com 23