Newsletter - Virginia State Bar

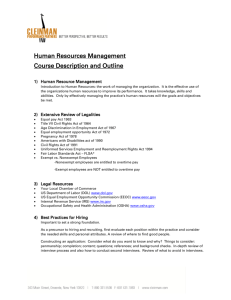

advertisement

N E W S L E T T E R Trusts and Estates Published by the Virginia State Bar Trusts and Estates Section for its members Volume 21, No. 1 Letter from the Chair The Board of Governors of the Trusts and Estates Section of the Virginia State Bar is pleased to bring to its members the Fall 2006 newsletter. The first article, by Katherine Ramsey, discusses the charitable giving provisions under the Pension Protection Act of 2006. Katherine covers the new rules with respect to making tax-free distributions from IRAs to charity for 2006 and 2007. She also discusses the new deductibility rules for conservation easements and other changes in tax law with respect to conservation easements. Finally, Katherine covers the deductibility rules for gifts of tangible property, as well as the recordkeeping and substantiation requirements for gifts to charity. The second article, by Mark Cohen, discusses the law of insurable interests in trusts in light of the Chawla decisions, and how states, such as Virginia, have enacted statutes to address the concerns raised by Chawla. The third article, by Jay Turner, covers the new early termination provisions for trusts under the Virginia Uniform Trust Code. Jay discusses the practical considerations in distributing assets upon early termination of a trust, as well as the tax considerations in terminating a trust early. Jay also discusses some special issues that may arise in early termination of life insurance trusts, QTIP trusts and charitable trusts. Winter 2007 I hope that you find the articles in this newsletter informative. If you would like to write an article for an upcoming newsletter, or have ideas for topics for future articles, please contact Julie King, our newsletter editor. If you should have any questions or comments about this newsletter or the Trusts and Estates Section, please contact me, the newsletter editor or any of the other members of the Board of Governors. Our contact information is listed at the end of this newsletter. Donna Esposito Fincher, Chair TABLE OF CONTENTS Congress Giveth and Congress Taketh Away: Charitable Giving Provisions of the Pension Protection Act of 2006 Katherine E. Ramsey .................Page 2 Insurable Interest in Trusts Mark Cohen ...............................Page 7 Practical Considerations in Terminating Trusts Under Virginia’s Uniform Trust Code John H. Turner, III ....................Page 11 If you are reading this newsletter and are not a member of the Trust and Estates Section, please join us. You can become a member by contacting the Virginia State Bar and paying a minimal additional fee. The Trusts and Estates Newsletter is published by the Virginia State Bar Section on Trusts and Estates for its members to provide information to attorneys practicing in these areas. Statements, expressions of opinion, or comments appearing herein are those of the editors or contributors and not necessarily those of the Virginia State Bar or the Section on Trusts and Estates. CONGRESS GIVETH AND CONGRESS TAKETH AWAY: Charitable Giving Provisions of the Pension Protection Act of 2006 by Katherine E. Ramsey Hunton & Williams LLP “Real charity doesn’t care if it’s taxdeductible or not.” – Dan Bennett deductions or whose deductions are subject to phase-out can benefit. Mr. Bennett may be right, but it is of course essential for professionals to be able to advise their clients properly regarding the deductibility of a charitable gift for income and transfer tax purposes. On August 17, 2006, President Bush signed the Pension Protection Act of 2006 (“PPA”), P.L. 109-280, into law. Among its many provisions are new rules pertaining to the deductibility of certain charitable gifts. This article describes the most significant of these changes. Although many of them are applicable only to gifts made in 2006 or 2007, others are not. Practitioners should be familiar with all of them if they hope to help their clients avoid an unpleasant surprise. It is important to note that a distribution from a donor’s Roth IRA, SEP, SIMPLE IRA or 401(k) plan is not eligible for the special treatment, nor is one made to a private foundation, supporting organization or donor-advised fund. Furthermore, the donor must be the individual for whose benefit the IRA is maintained (that is, the owner or the owner’s spouse, if he or she has rolled the IRA over into his or her own IRA or elected to treat the deceased spouse’s IRA as his or her own), and the gift must pass directly from the IRA administrator to the charity. Gifts to a split-interest trust or gifts of funds distributed to the taxpayer do not qualify. Also, the entire distribution must be otherwise includible in gross income and deductible under Section 170 of the Internal Revenue Code (the “I.R.C.”), determined without regard to applicable percentage limitations. When applying this requirement in cases where only part of the distribution would normally be included in income under I.R.C. Section 72 (for example, if the donor has previously made non-deductible contributions to the IRA), the entire distribution is generally treated as coming first from the taxable portion. Tax-Free IRA Distributions A taxpayer who has attained age 70½ (at the time of the gift) may give up to $100,000 per year from his or her individual retirement account (“IRA”) to charity in 2006 or 2007 without having to include the distributed amount in his or her gross income for tax purposes. The distribution counts toward the minimum distribution requirements. Because the distribution is excluded from income rather than deducted, it does not affect the donor’s ability to make other, deductible charitable gifts subject to the usual percentage limitations. It also does not increase the donor’s income for social security purposes or for applying the itemized deduction floors for medical and miscellaneous expenses. Even donors who do not itemize Lastly, the donor may not receive anything from the charity in exchange for the gift. This restriction prevents a taxpayer from using an excluded distribution to satisfy a binding pledge. Page 2 Incentives for Conservation Easements A corporate taxpayer does not benefit from the higher 50% AGI limit, but it may deduct the value of an easement given in 2006 or 2007 up to 100% AGI if (1) its stock is not publicly traded; (2) it is a qualified farmer or rancher; (3) the easement is placed upon property used in (or available for) agriculture or livestock production; and (4) the easement requires that the property remain available for such use. The deduction is limited by the corporation’s taxable income, reduced by the amount of any other deductible charitable contributions (that is, those subject to the usual 10% taxable income limit) made during the year. Like an individual, a corporate donor may carry forward any unused deduction related to a farm conservation easement for up to 15 years. Generally, an individual may deduct charitable gifts of long-term capital gain property (including real estate) to a public charity up to 30% of his or her adjusted gross income (“AGI”), with a fiveyear carryover period. In the case of corporations, the charitable contribution deduction for all charitable gifts is limited to 10% of the corporation’s taxable income, with a five-year carryover period. However, for qualified conservation easements made in 2006 or 2007, the PPA allows individuals to deduct the value of the easement up to 50% of AGI. For individuals who are also “qualified farmers or ranchers” for the tax year in which the easement is placed (that is, he or she receives more than one half of his or her gross income for the year from the trade or business of farming), the AGI limit is increased to 100%. If the easement is placed on property that is used in (or available for) agriculture or livestock production, then the 100% AGI limit applies only if the easement requires that it remain available for such use. If the property is used in (or available for) agriculture or livestock production, but the easement does not ensure that it will remain available for that use, then the 50% AGI cap is applied to that donation before the 100% AGI is applied to any other donation. An individual taxpayer may carry forward any unused deduction for up to 15 years. Advisors should also be aware of important related changes to the Virginia Land Preservation Tax Credit program. Effective for conservation easements granted on or after January 1, 2007, the Virginia tax benefits associated with conservation easements will become less generous. Among other provisions: For example, assume an individual qualified farmer has AGI of $200,000. In 2006, he grants a $150,000 easement on non-agricultural, beachfront property and a $150,000 easement on his farm. Unfortunately, he does not preserve the right to continue farming in the latter case. The $150,000 non-qualifying farm easement is subject to the 50% AGI cap, so only $100,000 of that contribution is deductible for 2006 (the remaining $50,000 carries forward). This allowed $100,000 deduction reduces the total amount deductible under the 100% AGI cap for 2006. Consequently, only $100,000 of the beachfront easement is deductible in 2006 under that provision. Page 3 The 50% Virginia tax credit for conservation easements is reduced to 40% of the fair market value of the easement. Va. Code Section 58.1-512.A. The total amount of credits that may be issued to all taxpayers for 2007 is $100,000,000 (to be adjusted for inflation in future years). Credits will be issued in the order that each complete application is received, until the cap is reached. Va. Code Section 58.1-512.D.4.a. Claimed tax credits of over $1,000,000 (including the value of credits allowed in the past 11 years to the same or related taxpayers with respect to the same parcel) will be subject to “verification” by the Department of Conservation and Recreation, based on criteria adopted by the Virginia Land Conservation Foundation. Va. Code Section 58.1512.D.3. presumably apply because the gift was not completed “before” the donor’s death. A sale or distribution of tax credits will incur a fee of 2% of the easement value or $10,000, whichever is less. Va. Code Section 58.1-513.C.2. Non-profit land conservation organizations holding one or more conservation easements will no longer be permitted to obtain credits. Va. Code Section 58.1512.C.5. However, the five-year carry-forward period is extended to 10 years. Va. Code Section 58.1-512.C.1. Third, any income or gift tax deduction previously allowed will be recaptured (together with interest and a 10% penalty) if the charity does not retain “substantial” physical possession of the property and use it in a manner related to its exempt purposes during the period beginning on the date of the contribution and ending on the earlier of 10 years after the initial gift or the donor’s death. Lastly, the PPA makes gifts of appreciating property much less attractive. If a taxpayer makes a deductible gift of an undivided fractional interest in tangible property and then later donates part or all of the remainder, the tax deduction for the second gift is limited to the lesser of (i) the value used for determining the deduction for the initial gift and (ii) the property’s fair market value at the time of the additional contribution. Presumably, then, in the case of a partial interest gift where the donor dies before the gift can be completed, not only will the income tax deduction be recaptured (together with interest and a 10% penalty), but the donor’s retained interest will also be included in his or her gross estate at its full fair market value. However, assuming that the donor leaves the remainder of the property to the charity under his or her will, the estate tax deduction associated with the bequest will be limited to the value of the property at the time of the initial gift. Gifts of Undivided Fractional Interests in Tangible Property Perhaps in response to taxpayers who claimed charitable deductions for gifts of undivided fractional interests in artwork or other tangible property in situations that did not require the donor to give up any actual enjoyment of the property, The PPA severely restricts the deductibility of any such gifts made after August 17, 2006 in several ways. First, in order to qualify for an income or gift tax deduction, the tangible property must be owned entirely by the donor (or the donor and the charitable donee). Future Treasury regulations or IRS guidance may extend the donation to gifts of tangible property owned by multiple individuals (for example, a donor and his or her spouse), provided all owners contribute a pro rata share of their interests. Gifts of Exempt-use Tangible Property Generally, the allowable charitable deduction for a gift of a donor’s entire interest in tangible personal property that is to be used by the donee charity in a manner related to its exempt purpose is its fair market value. If the charity will not put the property to a related use, the deduction is limited to the donor’s adjusted basis. I.R.C. Section 170(e)(1)(B)(i). Second, any income or gift tax deduction previously allowed will be subject to recapture (plus interest and a 10% penalty) if the donor does not contribute the remainder to the same charity (or if it is no longer existing, to another charity) before the earlier of (i) 10 years after the initial gift and (ii) the donor’s death. As drafted, the PPA creates a potential trap for the unwary if the donor dies unexpectedly within 10 years of making the gift. Even if the donor’s will bequeaths the remainder of the property to the correct charity, the recapture provisions However, applicable to returns filed after September 1, 2006 (which could include donations made in 2005, if the donor’s income tax return was put on extension), if a donor gives a charity “exempt use” tangible property worth Page 4 more than $5,000, but the charity either (i) sells or disposes of such property in the year of contribution or (ii) fails to certify under oath how the property will be used to further its exempt purposes, the donor’s deduction is limited to his or her adjusted basis. (The charity is subject to a $10,000 penalty if it certifies property as exempt use, if it knows that it is not.) However, for tax years beginning after August 17, 2006, any donor wishing to claim a deduction for any donation by cash, check or other monetary instrument, regardless of amount, must maintain a bank record or written communication from the charity showing the charity’s name, the date of the contribution and the amount. Charitable Gifts by S Corporations If the charity provides the donor with the required certification, but then sells or disposes of the claimed “exempt use” property after the last day of the year in which the gift was made but before the last day of the three-year period beginning on the date of contribution, the donor must recapture the difference between the claimed fair market value and the donor’s basis in the property. Effective for contributions made by S corporations in taxable years beginning in 2006 or 2007, a shareholder’s basis in his or her stock is reduced only by his or her pro rata share of the corporation’s adjusted basis in the donated property. Prior to the enactment of the PPA, the shareholder’s basis would have been reduced by the donated property’s fair market value. So, if the donor makes a gift on December 31, 2006, a three-year recapture period runs from January 1, 2007 through December 31, 2009. On the other hand, if the donor makes the gift on January 1, 2007, there is a two-year recapture period from January 1, 2008 through December 31, 2009; any sale or disposition of the property during 2007 would simply limit the initial claimed deduction to basis. Gifts of Clothing and Household Items Although enforcement of existing valuation rules would disallow any deduction for worthless property, Congress seemed to find it necessary to address donations of used clothing or household items of questionable value specifically. Referenced by some practitioners as the “used underwear” provision, the PPA requires all items of clothing or household goods donated after August 17, 2006 to be in “good condition.” If an item is not in good condition and the claimed deduction is more than $500, the donor must attach a qualified appraisal to his or her tax return. In addition, Congress has authorized the Secretary to issue regulations denying any deduction for items of “minimal” value. Of course, it remains to be seen what will be considered “good condition” or “minimal” value. Fortunately, the taxpayer may avoid recapture if the charity certifies under oath to the IRS that it intended to use the donation for its exempt purposes at the time of the contribution (and presumably, its earlier certification of such use), but that it later became impossible or infeasible actually to use it as such. Recordkeeping and Substantiation Requirements Donors have always been required to keep reliable written records of their charitable contributions in order to support their claimed deductions. For contributions of $250 or more, the donor must obtain contemporaneous written acknowledgment of the gift from the charity. I.R.C. Section 170(f)(8). Additional requirements regarding appraisals, etc. apply for contributions of highvalue property. I.R.C. Section 170(f)(11). Katherine E. Ramsey, an associate at Hunton & Williams LLP, in Richmond, Virginia, practices primarily in the areas of estate planning and administration and exempt organizations. After earning her B.A. in International Studies from Virginia Tech and an M.S. in Management from Boston University, she received her J.D. from the University of Virginia Law School in 1998. In addition to many writing projects, Ms. Ramsey has presented Virginia continuing legal education Page 5 seminars on various estate planning topics and guest-lectured at the T.C. Williams School of Law at the University of Richmond. Ms. Ramsey is a member of the Virginia Gift Planning Council, the Richmond Estate Planning Council and the Richmond Trust Administrators’ Council, as well as the Legislative Committee of the Virginia Bar Association’s Section on Wills, Trusts and Estates and the Virginia Museum of Fine Arts Planned Giving Advisory Committee. Page 6 INSURABLE INTEREST IN TRUSTS by Mark Cohen Cohen and Burnett, P.C. Before the first Chawla1 decision came down, I had never been concerned over whether a trust, as an entity unto itself, would need to have an insurable interest on the life of the insured. After all, we have been putting life insurance into trusts for years without such problems. Nevertheless, the district court in Chawla shocked us by construing Maryland law to require that a trust, not the beneficiaries of the trust, have an insurable interest in the life of the insured. On appeal,2 the Fourth Circuit vacated that part of the district court’s holding because it was unnecessary to the decision, but did not refute its rational. Thus, we now have a district court opinion that, although vacated as unnecessary, can still be cited as authority for the proposition that a trust as an entity is required to have an insurable interest in the insured, independent of the beneficiaries. in which the procurer lacks an insurable interest in the insured are mere gambling contracts and as such are against the public interest. The theory is that “the public has an interest, independent of the consent and concurrence of the parties,” in discouraging one party from wagering upon the life of another.5 In light of the strong public policy which underlies the insurable interest doctrine, courts have held that “[t]he parties to a contract of insurance cannot, even by solemn agreement, override the public policy which requires the beneficiary to have an insurable interest.”6 While the courts and legislatures of this country have generally agreed that an insurable interest is required for an individual to procure insurance upon the life of another, they have experienced some difficulty in determining what interest constitutes an insurable interest. If true, it would be the rare insurance trust that has an insurable interest in the life of the insured. In Chawla, for example, the district court held that the trust did not have an insurable interest in the insured, even though the insured was the sole lifetime beneficiary of the trust.3 Generally, when there is no insurable interest, the insurance company may rescind the policy, or, in some states, the proceeds are held in resulting trust for the benefit of the insured’s estate. This article discusses the law of insurable interest, the Chawla cases, and concludes with the statutory fix that is being considered in Virginia’s 2007 legislative session. The Supreme Court defined insurable interest 124 years ago as: Common Law of Insurable Interest The Texas Supreme Court in Drane v. Jefferson Standard Life Ins. Co.,8 provided a more definitive explanation of what is meant by an insurable interest that is based on a reasonable expectation of pecuniary benefit or advantage from the continued life of another. The court stated that it [s]uch an interest, arising from the relations of the party obtaining the insurance, either as creditor of or surety for the assured, or from the ties of blood or marriage to him, as will justify a reasonable expectation of advantage or benefit from the continuance of his life . . . . there must be a reasonable ground, founded upon the relations of the parties to each other, either pecuniary or of blood or affinity, to expect some benefit or advantage from the continuance of the life of the assured.7 Under the common law, “[b]efore a person can validly procure insurance upon the life of another, he must have an insurable interest in that life.”4 This rule is premised upon the view that contracts Page 7 is an interest determined by monetary considerations, viewed from the standpoint of the beneficiary - would the beneficiary regard himself as better off from the standpoint of money, would he enjoy more substantial economic returns should the insured continue to live, or would he have more in the form of the proceeds of the policy should the insured die.9 statutes then typically add a third part, which is really an expansion of the second (economic interest) for buy/sell agreements, partnership and operating agreements, and pensions.11 A small, but growing number of states are enacting statutes that address insurable interest in trusts.12 Whether an individual has an insurable interest in another also may be determined by examining the “loss or disadvantage [which] will naturally and probably arise, to the party in whose favor the policy is written, from the death of the person whose life is insured.”10 Vera Chawla was a close friend of Harald Giesinger, who, by age 72, when he filled out the insurance application, was not in good health. He was suffering from a significant alcohol-abuse problem, as well as a slowly growing brain tumor that had required surgeries in both Austria and at George Washington University Hospital. On the insurance application, which was signed by both Giesinger and Chawla, he lied about these and other serious medical conditions. Transamerica denied coverage at first because it correctly concluded that Mrs. Chawla did not have an insurable interest in Giesinger. Chawla then resubmitted the application as trustee of the “Harold Giesinger Special Trust,” of which Harold Giesinger was the sole lifetime beneficiary, remainder to Chawla, and the policy was issued. Chawla, A Simple Insurance Fraud Case That Went Too Far To summarize the common law, an insurable interest falls into three broad categories: (i) The insured. The insured has an unlimited insurable interest in his or her life, and can designate anyone as the beneficiary; (ii) Someone who has a close relationship, either by blood or marriage, with the insured. In this case, there is no need to show monetary needs associated with the insured’s continued life; and Giesinger died a year later from heart failure and Chawla filed a claim to collect the proceeds ($2.45 million). Transamerica refused to pay and rescinded the policy on the grounds that (i) there were material misrepresentations in the policy, and (ii) the trust did not have an insurable interest. Chawla sued to collect the death benefits. The district court held for Transamerica on both grounds, finding that either one alone would be a sufficient ground to rescind the policy. (iii) A person or entity that gains some monetary benefit or avoids some loss from the continued life of the insured. The value of the monetary benefit or loss determines the amount of the insurable interest. This is typical of business buy/sell agreements and pension trusts. Insurable interest must exist at the time the policy is procured, but it need not exist thereafter. The rationale for the second ground is what shocked us. The district court, construing the Maryland statute on insurable interests, determined that, in order to procure an insurance policy, the benefits must be payable to a person with an insurable interest at the time the policy was issued. Since the trust procured the insurance policy, the court held that the trust, not the beneficiary of the trust, must have an insurable Statutory Definitions An informal survey of the state statutes on insurable interest shows that they tend to track the common law rule by breaking down the definition of insurable interest into two parts: the first being a close relationship; the second being an economic interest in the insured’s continued life. The Page 8 interest in the life of the insured. The court then reviewed the Maryland statute on insurable interest and found in each case that the trust did not have an insurable interest: of the doctrine of judicial restraint has particular application when a federal court is seemingly faced with a state-law issue of first impression.15 Plaintiff fails to demonstrate the existence of an insurable interest as defined by statute. Maryland law creates various classes of insurable interests. For example, one has an insurable interest in those “related closely by blood or law, a substantial interest engendered by love and affection is an insurable interest.” Md. Code Ann., Ins. Section 12-201(b)(2)(i). An insurable interest may also exist where one has “a lawful and substantial economic interest in the continuation of the life, health, bodily safety of the individual.” Md. Code Ann., Ins. Section 12-201(b)(3)… 13 Unfortunately, the Fourth Circuit did not reverse the district court’s second holding; it merely vacated it, without determining whether the district court judge’s opinion was good law. Thus, there is now an argument that an insurer may deny a trustee’s claim for policy proceeds on the grounds that the trust did not have, and in most cases, cannot have an insurable interest. The potential problem is compounded in states that impose a constructive trust on the proceeds in favor of the estate of the insured. First, the proceeds are included in the estate of the insured for estate-tax purposes under Internal Revenue Code Section 2042(1). Second, they may be taxed as ordinary income. Only payments in the nature of insurance proceeds qualify for the exclusion from gross income, and if there is no insurable interest, the payments are not “insurance.” In the instant case, the Trust had title to the decedent's residence. During his lifetime, the decedent possessed the right to receive all income from the Trust and the right to occupy the residence. However, upon the death of the decedent, the Trust assets were distributed to Plaintiff who sold them for an amount in excess of the mortgage. Consequently, the Trust promised to gain more assets upon the decedent's death, i.e. death benefits under the policy, than it would have in the event that decedent had lived. Further, the Trust suffered no detriment, pecuniary or otherwise, upon the death of the decedent. As such, the Trust maintained no insurable interest in the life of the decedent.14 State Law to the Rescue If the district court’s rational is correct, a simple solution is to have the insured procure the policy first and then assign it to the trust. Assuming the purchase and immediate assignment is not held to be a purchase by the trust through the insured as its agent; the trust will have no issue with insurable interest. The draw back, of course, is that the proceeds will be brought back into the estate of the insured, if the insured dies within three years of the transfer.16 Unfortunately, that approach will not help with existing irrevocable life insurance trusts. On appeal, the Fourth Circuit affirmed the district court’s first holding, rescission of the policy on the ground of material misrepresentation. With respect to the second holding, the court stated: A better approach is to create the trust and procure the insurance policy in a state that has enacted a statute giving a trust an insurable interest. As indicated above, a number of states have such statutes and more are considering them. States which have not already done so should seriously consider enacting such statutes to clear up any uncertainty in the law. Because the district court correctly awarded summary judgment to Transamerica on the misrepresentation issue, its alternative ruling appears to have unnecessarily addressed an important and novel question of Maryland law. And, as a general proposition, courts should avoid deciding more than is necessary to resolve a specific case. This important aspect Page 9 Virginia, in its 2007 legislative session will be considering the following amendment to its insurable interest rules, Section 38.2-301, which is patterned after the law in the State of Washington: 5. In the case of a fiduciary, as defined in Section 64.1-196.1, other than the trustee of a domestic business trust or foreign business trust, as defined in Section 13.1-1201, the lawful and substantial economic interest required in subdivision 2 shall be deemed to exist in (i) the individual insured who established the fiduciary relationship or for whose benefit the fiduciary holds the insurance policy, and (ii) each individual in whom the individual insured who established the fiduciary relationship or for whose benefit the fiduciary holds the insurance policy has an insurable interest; This paragraph shall determine the lawful and substantial economic interest required in subdivision 2, with respect to life insurance policies, whether owned by a fiduciary before or after the date of enactment. Conclusion Thanks to the district court’s decision in Chawla, and the lack of direction from the Fourth Circuit, the life insurance industry has been presented with a rational for rescinding virtually all policies currently held in irrevocable life-insurance trusts. One can only imagine the trouble such an approach would create. All states should enact legislation, such as that under consideration in Virginia, to resolve the uncertainty created by the Chawla cases. Mark Cohen is the founder of Cohen and Burnett, P.C. and Legacy Analytics, L.L.C. Mark received his Bachelor of Arts Degree in Political Science from California State University, Long Beach in 1980. He received his Juris Doctor from the University of Arizona in 1984. In 1989 he received his Master of Laws in Taxation from William and Mary. Mark also received his Certified Financial Planning License in 2000. From 1984 until 1988 Mark served as a Judge Advocate for the United States Navy. He then became a tax manager at Goodman & Company, and later became an associate for Adams, Porter & Radigan before opening his own firm in 1991. Mark is a past president of the Northern Virginia Estate Planning Council, and currently serves on the Legislative Committee for the Wills, Trusts, and Estates Section of the Virginia Bar Association. He is a member of the Virginia Bar Association, Arizona Bar Association, and the American Bar Association Mark is the Virginia Reporter to the UTC, and is a popular speaker at estate planning seminars. 1 Chawla, ex rel Geisinger v. Transamerica Occidental Life Ins. Co., No. Civ. 03-1215, 2005 U.S. Dist. LEXIS 3473 (E.D. Va. 2005), aff’d in part, vac’d in part, 440 F.3d 639 (4th Cir., 2006). 2 440 F.3d 639 (4th Cir., 2006). 3 Chawla, Id. at 19-20. 4 2 J. Appleman, Insurance Law and Practice Section 761, at 101 (1966). 4 Interstate Life & Accident Co. v. Cook, 19 Tenn. App. 290, 86 S.W.2d 887, 889 (1935), quoting 1 Couch, Cyc. of Insurance Law, Section 295, at 769-70. 5 Interstate Life & Accident Co. v. Cook, 19 Tenn. App. 290, 86 S.W.2d 887, 889 (1935), quoting 1 Couch, Cyc. of Insurance Law, Section 295, at 769-70. 6 Id. See also Rubenstein v. Mutual Life Ins. Co. of New York, 584 F. Supp. 272, 279 (E.D. La. 1984) ("[b]ecause an insurable interest is required by law in order to protect the safety of the public by preventing anyone from acquiring a greater interest in another person's death than in his continued life, the parties cannot, even by solemn contract, create insurance without an insurable interest"). 7 Warnock v. Davis, 104 U.S. 775, 779, 26 L. Ed. 924, 926 (1882). 8 Drane v. Jefferson Standard Life Ins. Co., 139 Tex. 101, 104, 161 S.W.2d 1057, 1058-59 (1942). 9 Id. 161 S.W.2d at 1059. 10 Cooper's Adm'r v. Lebus' Adm'rs, 262 Ky. 245, 250, 90 S.W.2d 33, 36 (1935) quoting Adams' Adm'r v. Reed, 38 S.W. 420, 422, 18 Ky. L. Rep. 858, (App.1896). 11 See Leimberg Information Services, Inc. at www.leimbergservices.com for a recently updated, comprehensive collection of state insurable interest statutes. 12 See, e.g., 18 Del. C. Section 2704 (Delaware); Rev. Code. Wash. (ARCW) Section 48.18.030 (Washington). 13 Chawla, supra, 2005 U.S. Dist. LEXIS 3473, 17 (4th Cir. 2006). 14 Id. at 18. 15 440 F.3d 639, 648 (4th Cir., 2006). 16 IRC Section 2035. To pay the tax in such a case, many policies now offer a rider to double the coverage if the insured dies within three years of the purchase of the policy. Page 10 PRACTICAL CONSIDERATIONS IN TERMINATING TRUSTS UNDER VIRGINIA’S UNIFORM TRUST CODE by John H. Turner III SunTrust Bank I. Introduction. Virginia’s version of the Uniform Trust Code (the “UTC”)1 has been in effect since July 1, 2006, and provides much needed clarification to Virginia’s trust law. The UTC applies to most trusts, whether created under a trust agreement or under a will. However, for trusts under will, the UTC does not apply where there are other specific provisions made for them in Title 26 or elsewhere in the Virginia Code or where clearly not applicable to such trusts.2 With very few exceptions, the UTC is a set of default rules. Therefore, to the extent there is a conflict between the UTC and the trust instrument, the language in the trust instrument will generally prevail over the UTC. There are a number of limited exceptions to the default rule within the UTC that deal primarily with the requirements for creating a valid trust and the broad power of courts over trusts.3 In most cases, a settlor may include specific termination provisions within the trust instrument which will prevail regardless of the terms of the UTC. Several of the UTC provisions deal directly with termination of trusts. This article will discuss the UTC requirements and identify practical concerns in terminating trusts under these provisions. II. The Early Termination Rules. A. Pre-UTC Virginia Law. Prior to its repeal with the enactment of the UTC, Section 55-19.4 provided statutory authority for the court (on petition) to approve termination of a non-charitable trust. Under this section, the circuit court could terminate (or otherwise modify) a trust on a showing of good cause. The court could not order termination under this section where the trust included a spendthrift clause unless the court found that the costs of administration would impair the trust purposes. The statute also required the court to find, as a prerequisite to ordering a termination, that the termination would not materially impair the accomplishment of the trust purposes or adversely affect any beneficiary. Similarly, repealed Section 55-31.1 provided statutory authority for the court to order termination of charitable trusts. B. New Termination Provisions under the UTC. The UTC greatly expands the manner in which trusts may be terminated. Under the UTC, a court may terminate a trust where: (i) the settlor and all of the beneficiaries agree to terminate a noncharitable trust,4 (ii) all of the beneficiaries agree to terminate a noncharitable trust and continuance of the trust is not necessary to achieve any material purpose of the trust,5 (iii) because of unanticipated circumstances, termination will further the purposes of the trust,6 (iv) the purposes of a charitable trust have become unlawful, impracticable, impossible to achieve or wasteful,7 or (v) the value of the trust property is insufficient to justify the costs of continuing to administer the trust.8 In addition, a trustee may terminate the trust without court approval9 where the market value of the trust property is less than $100,000 and the trustee concludes that the value of the trust property is insufficient to justify the costs of continuing to administer the trust.10 In addition, under the UTC a trust terminates to the extent it is revoked or expires pursuant to its terms, no purpose of the trust remains to be Page 11 achieved, or the purposes of the trust have become unlawful, contrary to public policy or impossible to achieve.11 1. Termination of Noncharitable Irrevocable Trust by Consent. On a petition under Section 55-544.11, the court shall terminate a trust where the settlor and all of the beneficiaries12 consent to the termination, even if the termination is inconsistent with a material trust purpose. If the settlor is unwilling or unable to consent, a noncharitable irrevocable trust may be terminated with consent of all of the beneficiaries if the court concludes that continuance of the trust is not necessary to achieve any material purpose of the trust. If all of the beneficiaries of a trust do not consent, the court may still terminate the trust if the court is satisfied that: (i) if all of the beneficiaries had consented, the trust could have been terminated under Section 55-544.11, and (ii) the interests of the beneficiary who does not consent will be adequately protected. Upon termination under Section 55-544.11, the trustee shall distribute the trust property as agreed by the beneficiaries. Note that Section 55-542.06 provides the methods for representation in judicial proceedings and will be particularly helpful in determining who may represent minor or incapacitated beneficiary. 2. Termination Because of Unanticipated Circumstances or Inability to Administer Trust Effectively. Under Section 55-544.12, the court may terminate a trust if, because of circumstances not anticipated by the settlor, termination will further the purposes of the trust. Upon termination of a trust under this section, the trustee shall distribute the trust property in a manner consistent with the purposes of the trust. 3. Termination of a Trust by Virtue of the Cy Pres Doctrine. Under Section 55-544.13, if a charitable purpose becomes unlawful, impracticable, impossible to achieve, or wasteful, a court may apply the doctrine of cy pres to modify or terminate the trust by directing that the trust property be applied or distributed, in whole or in part, in a manner consistent with the settlor’s charitable purposes. 4. Termination of Uneconomic Trusts. Under Section 55-544.14, the trustee of a trust consisting of trust property having a total value of less than $100,000 may terminate the trust without a judicial proceeding.13 In order to terminate a trust under this section, the trustee must give notice to all of the qualified beneficiaries14 and must conclude that the value of the trust property is insufficient to justify the cost of administration. The court may also terminate a trust of any size if it determines that the value of the trust property is insufficient to justify the cost of administration. Upon termination, the trustee must distribute the trust property to or for the benefit of the beneficiaries in a manner consistent with the purposes of the trust. The virtual representation sections of the UTC (Section 55-543.01 through Section 55-543.05) are particularly helpful in giving notice to minor or incapacitated beneficiaries. III. Practical Considerations. A. Distribution of Trust Assets. If termination is being pursued under Section 55544.11 (by consent), the trustee will distribute the trust property as agreed by the beneficiaries. If termination is being pursued under either Section 55-544.12 (by the court) or Section 55-544.14 (by the trustee), the trustee must distribute the trust assets in a manner consistent with the purposes of the trust. For terminations pursuant to Section 55544.12, the trustee will need to consider what the settlor would have intended had the settlor been aware of the unanticipated circumstances resulting in the trust’s termination. For terminations of uneconomic trusts under Section 55-544.14, the National Conference of Commissioners on Uniform State Laws (“NCCUSL”) Comments to the corresponding provision of the uniform act suggest that “distribution under this section will typically be Page 12 made to the qualified beneficiaries in proportion to the actuarial value of their interests.” potential gift tax implications of such distributions (see discussion at C.2 below). One method for calculating the actuarial value of life and remainder interests is provided by Internal Revenue Code (the “I.R.C.”) Section 7520.15 Section 7520 of the I.R.C. can be used to determine the present value of annuities, remainder interests, life estates, term of years and reversionary interests. The calculations under that section are performed using a “discounted rate” that is revised each month (published by the Internal Revenue Service) and a mortality table which is revised every 10 years (currently the 1999 table). While the actual calculations under I.R.C. Section 7520 are quite complex, there are several software programs that can perform these calculations.16 B. Additional Distribution Considerations. Actuarial calculations will not work neatly in all situations. For example, an “income” beneficiary may have discretionary rights to principal for health, support, education or other standards, may have a 5 and 5 power, or may have a limited or general power of appointment over the trust assets. In such situations, an actuarial calculations based on I.R.C. Section 7520 may be impractical.17 In such cases, the trustee may need to make adjustments to the “actuarial” values or may have to determine values based solely on the history of principal distributions, likelihood of future principal distributions, apparent exercise or nonexercise of powers of appointment and other relevant factors. In these cases, or in other cases where the beneficiaries have asked that the trust be distributed in a manner other than through an actuarial division, it is important for the trustee to consider requiring a distribution agreement from the beneficiaries. If the trustee can secure a distribution agreement from all of the beneficiaries (see discussion at B.5 below), there will generally be little risk to the trustee in making such distributions. However, if the distributions will not or cannot be done actuarially (using the methods required under I.R.C. Section 7520) it is imperative for the beneficiaries to understand the 1. Timing. Under Section 55-548.17, upon the occurrence of an event terminating or partially terminating a trust, the trustee must expeditiously distribute the trust property to the persons entitled to it, subject to the right of the trustee to retain a reasonable reserve for the payment of debts, taxes and other expenses including the preparation of the final income tax returns. 2. Termination Report to Beneficiaries. Under Section 55-548.13, for irrevocable trusts created after July 1, 2006 (or revocable trusts that become irrevocable after that date), at the termination of the trust a trustee must send to the distributees or permissible distributees of trust income or principal, and to other qualified or nonqualified beneficiaries who request it, a report of the trust property, liabilities, receipts, and disbursements, including the source and amount of the trustee's compensation, a listing of the trust assets and, if feasible, their respective market values. 3. Proposed Distribution Schedule. Upon termination or partial termination of a trust, Section 55-548.17 allows the trustee to send the beneficiaries a proposal for distribution. So long as the proposal informs the beneficiaries of their rights to object to the proposed distribution and informs the beneficiaries that they only have thirty days within which to lodge an objection, they will be bound by the proposal if they fail to object within that period. The trustee should send the proposal by certified mail/return receipt in order to establish the 30 day period. 4. Payments to Minor or Incompetent Beneficiaries. If upon termination an interest in the trust is payable to a minor or incapacitated person and the trust does not otherwise provide for such distributions, Section 55-548.16(A)(21) permits the trustee under certain circumstances to distribute the assets to: (a) a conservator or Page 13 guardian, (b) a custodian under the Uniform Transfers to Minors Act, (c) a custodial trustee under the Uniform Custodial Trust Act, (d) an adult relative or other person with custody of the beneficiary, or to retain the assets as a separate fund for the beneficiary, subject to the beneficiary's withdrawal rights. 5. Distribution Agreement. Where early termination is being performed without a court order (i.e., termination of uneconomic trusts), the trustee should consider having the beneficiaries enter into a distribution agreement. Under Section55-548.17(C), a beneficiary may release a trustee from liability for termination if: (i) the release was not obtained by improper trustee conduct and (ii) the beneficiary was aware of the beneficiary’s rights and of all material facts relating at the time of such release.18 The beneficiary should be given the opportunity to seek separate counsel to review the agreement. The representation sections of the UTC (Section 55-543.01 through Section 55-543.05) are also useful here for binding minor and incapacitated beneficiaries to the agreement. A properly executed distribution agreement will provide the trustee protection against later claims arising out of the trust termination. C. Tax Considerations. 1. Income Taxation. Generally, the early termination of a trust does not result in additional income taxation to the trust or beneficiaries.19 However, the Internal Revenue Service (the “Service”) has issued several private letter rulings20 where early termination of a charitable remainder trust results in the recognition of capital gain. Under these rulings, the distribution of the present value of the income interest is treated as the sale or exchange of the income interest itself. The income beneficiary is treated as having a zero basis and the entire amount realized by the beneficiary is long-term capital gain. A trust does not typically pay taxes in its final year as all income, including capital gains which would ordinarily be taxed to the trust, is allocated to the beneficiaries. If a trust has deductions in excess of gross income in its final year, the excess deductions may also pass out to the beneficiaries.21 However, charitable deductions and the trust’s personal exemption are not allowed as excess deductions to be passed out in the final year. 2. Gift Taxation. I.R.C. section 2501 imposes a tax on transfers of property by gift. The method selected for dividing the assets can affect the gift tax treatment of the trust termination. When possible, the safest approach is to select a division of the trust based on the actuarial calculation of the beneficiaries’ interests.22 An actuarial calculation may not be available or desirable in all situations. For example, an “income” beneficiary may have discretionary rights to principal for health, support, education or other standards, may have a 5 and 5 power, or may have a limited or general power of appointment over the trust assets. In such situations, an actuarial calculation under I.R.C. Section 7520 may be inapplicable.23 In such cases, the trustee may want to secure a distribution agreement among the beneficiaries whereby all of the beneficiaries (or their representatives) agree to the methodology for the division of the trust. Under Treasury Regulation Section25.2512-8, a sale, exchange or other transfer of property made in a transaction which is bona fide, at arms’ length, and free from any donative intent will be considered as made for adequate and full consideration in money or money’s worth and, therefore, not a gift. Where parties give up some present or future interest in a trust in an exchange that is free from donative intent, such transactions should not be treated as gifts. However, the Service does not generally consider intra-family agreements to be at arms’ length unless the parties’ claims were bona fide and a division made, to the extent possible, on an economically fair basis.24 Therefore, where a trust division agreement is made between family members, it will be particularly important that the division be made on an economically fair basis.25 If the parties agree to divide the assets in a manner that is clearly inconsistent with the beneficiaries’ Page 14 interests in the trust, a gift may occur.26 Likewise, if the termination and division is approved by the circuit court, arguably there would be no “gift” if the court ordered division was based on arms’ length negotiations between the parties and results in an economically fair division.27 Even if there were a “gift” made upon termination, that gift would be of a present interest in property and would therefore qualify for the annual gift tax exclusion under I.R.C. Section 2503 (currently $12,000 per donee). 3. Generation-Skipping Taxation. Certain trusts may be subject to a generation skipping transfer (“GST”) tax on the distribution of assets or termination of the trust. If the trust is GST tax exempt by its terms or because of an allocation of GST tax exemption, early termination of the trust should not affect the GST tax status of the trust. If a trust is exempt from GST tax due to its status as a “grandfathered trust,” it is unclear whether an “early” termination of the trust would be considered a “modification” of the trust’s governing instrument jeopardizing the grandfathered status of the trust.28 Therefore, early termination of grandfathered GST tax exempt trusts should be pursued cautiously. If the trust is not fully exempt from generation-skipping taxation, the termination would be considered a “taxable termination” and GST tax would be owed. This tax is required to be reported on Form 706-GS(T) by April 15th of the calendar year following the year in which the termination occurred and is payable by the trustee of the trust out of the trust assets. 4. Excise Taxation. Charitable trusts treated as private foundations are subject to certain excise tax provisions found in I.R.C. SectionSection 4941 through 4947. The Internal Revenue Service (the “Service”) has ruled in several private letter rulings29 that an early termination of a charitable remainder trust30 and the distribution of trust property based on the actuarial interest of the respective beneficiaries under I.R.C. Section 7520 will not be a termination of a private foundation, an act of selfdealing under I.R.C. Section 4941, or a taxable expenditure under I.R.C. Section 4945. The Service considered several factors in determining that there were no excise tax violations, including: (i) there were no known medical conditions or other circumstances likely to result in a shorter life expectancy of the income beneficiaries (as supported by a statement from the beneficiaries and their doctors), (ii) the termination was permitted under state law, (iii) all of the beneficiaries favored early termination, (iv) the trustees will use the formulas provided under I.R.C. Section 7520 for determining the income and remainder interest valuations and (v) distributions will be made in a pro rata manner. Note, however, that the Service has recently “revoked” one of its prior rulings in this area and has apparently put a temporary hold on issuing letter rulings dealing with early terminations of CRUTs. It is also reported that the Service is considering changing its position going forward and will only rule favorably on the termination of a CRUT where the charitable beneficiary is a public charity and not a private foundation.31 5. Delayed Inheritance Taxation. While becoming less and less common, a trustee should be aware that distributions from a trust created prior to 1980 could be subject to a deferred Virginia inheritance tax (sometimes referred to as an “in-remainder tax”). The best method for determining whether a deferred Virginia inheritance tax is due is to review the inheritance tax return32 filed at the settlor’s death. IV. Miscellaneous Issues. A. Terminating Life Insurance Trusts. Terminating life insurance trusts that maintain current life insurance policies creates additional considerations for the trustee. 1. Other Policies or Estate Planning. In terminating a life insurance trust it is prudent to confirm in writing with the settlor(s) that there are no other life insurance policies in force that are payable to the trust and that the trust being terminated is not otherwise intended to be part of Page 15 settlor’s estate plan at death. A trustee does not want to terminate a trust only to find out later that other policies were payable to the trust or that assets pour over to the trust upon someone’s subsequent death. 2. Split-Dollar Agreement. The trustee should make sure that the policy is not subject to a current split-dollar agreement. If the trust is subject to a split-dollar agreement, the trustee may need to make payment from the trust for release of the collateral assignment prior to termination.33 3. Accrued Withdrawal Rights (Hanging Powers). The trustee should be cognizant of hanging powers held by Crummey withdrawal beneficiaries and the effect any accrued withdrawal right might have on the proper division of the trust assets. 4. Consider Taking a Life or Viatical Settlement. In determining whether to distribute the policy to the beneficiaries or to “cash out” the policy, a trustee should also consider whether a “life settlement” or “viatical settlement” is appropriate. A life settlement is the sale, assignment or transfer of the death benefits or ownership of a life insurance policy by the owner of the policy where the insured does not have a catastrophic or lifethreatening illness or condition. Typically, the owner of the policy receives cash and the life settlement company becomes the new owner and beneficiary of the policy and is responsible for the payment of all future premiums. Men and women who are at least aged 65 meet the eligibility requirements for a life settlement. The settlement typically works best for men 70 and older, and women 77 and older who have experienced changes in their health condition since the policy was issued. There are no maximum policy limits; however, minimum limits are typically $250,000 in face value. All policy types are accepted as long as they are past the contestability period. A viatical settlement is the sale, assignment or transfer of the death benefits or the ownership of a life insurance policy by the owner of the policy to a viatical settlement company where the insured has a catastrophic or life-threatening illness or condition. Typically, the owner of the policy receives cash from the viatical settlement company; and the viatical settlement company becomes the new owner and beneficiary of the policy and is responsible for payment of future premiums. Upon the death of the insured, the death benefit is paid to the viatical settlement company. B. Terminating Testamentary Trusts. While Section 55-541.02 makes it clear that the UTC applies to Virginia testamentary trusts (with limited exceptions), some Commissioners of Account have taken the position that the trustee must have court approval to terminate an uneconomic trust under Section 55-544.14. While this position is not supported by the UTC, prudence suggests discussing the proposed termination with the commissioner before terminating a trust under this section. In all cases where testamentary accountings have been required, the Commissioner will require that a final accounting be filed and approved prior to discharging the trustee. C. Terminating Marital QTIP Trusts. Where a trust qualifies for a marital deduction under I.R.C. Section 2057(b)(7) (a “QTIP Trust”), the rules under I.R.C. Section 2519 will apply to an early termination of that trust. Under I.R.C. Section 2519(a), for gift and estate tax purposes, any disposition of all or part of a qualifying income interest for life in any property is treated as a transfer of all interests in the property other than the qualifying income interest. Under Section 25.2519-1(a) of the Treasury Regulations, if a spouse makes a disposition of all or part of a qualifying income interest for life in QTIP property, the spouse is treated, for purposes of the estate and gift tax, as transferring all interests in property other than the qualifying income interest. Section 25.2519-1(c)(1) of the Treasury Regulations provides that the amount treated as a transfer upon disposition of all or part of the QTIP Page 16 property is equal to the fair market value of the entire property, determined on the date of the disposition less the value of the qualifying income interest in the property on the date of the disposition. The term “disposition” as used in I.R.C. Section 2519 applies broadly to circumstances in which the surviving spouse’s right to receive the income is relinquished or otherwise terminated by whatever means. For purposes I.R.C. Section 2519, a division of qualified terminable interest property based on the actuarial values of the spousal life interest and remainder (i.e., a commutation) is considered a disposition by the spouse of the qualifying income interest resulting in a gift of the remainder interest.34 D. Terminating Charitable Trusts Technically, a charitable organization is not a “beneficiary.” However, a charitable organization expressly designated to receive distributions under the terms of a charitable trust35 that would otherwise qualify as a qualified beneficiary if it were an individual has the rights of a qualified beneficiary. The NCCUSL Comments to the act provide that (i) charitable organizations that receive distributions only in the trustee’s discretion and (ii) organizations having remainder interests subject to a contingency do not have the rights of a qualified beneficiary. The Attorney General of Virginia “has the rights of a qualified beneficiary with respect to a charitable trust having its principal place of administration” in Virginia. However, the Attorney General need not be given reports or other information required under the duty to inform and report (Section55-548.13) or notices typically required when a trustee resigns, unless otherwise requested by the Attorney General. Having the “rights of a qualified beneficiary” would include the right to receive notice as well as the right to object or consent to certain contemplated actions (except as limited above for the Attorney General). In terminating a charitable trust, written notice should be delivered to the Attorney General’s office. The Attorney General’s office should not need to take any affirmative action. However, the trustee might want to incorporate the 30 day right to object language found in Section 55-548.17 rather than waiting for an affirmative response from the Attorney General’s office. V. Conclusion The early termination provisions in the UTC can be very helpful to trustees and beneficiaries seeking to terminate trusts under a variety of circumstances. Where a trust is less than $100,000 and the size of the trust no longer justifies the cost of administration, termination may be especially attractive as it may be possible to terminate without court approval. A trustee must, however, be aware of the tax ramifications of early termination and of unique issues that can arise in terminating life insurance trusts, QTIP trusts and charitable trusts. John H. Turner III (Jay) serves as Senior Counsel for SunTrust Bank in Richmond, Virginia where he provides guidance to trust officers in the areas of estate and trust administration. Jay serves on the Board of Governors for the Virginia State Bar Trust and Estates Section and the Legislative Committee of the Virginia Bar Association's Wills, Trusts and Estates Section. He is also a member of the Trust Administrators Council and the Estate Planning Council of Richmond. Jay received his undergraduate degree from Hampden-Sydney College, his law degree from the Thomas M. Cooley School of Law and an LL.M. in taxation from Georgetown University Law Center. 1 Section 55-541.01, et seq. of the Virginia Code (references herein to the “Code” shall mean the Virginia Code). An excellent overview of Virginia’s Uniform Trust Code by John E. Donaldson was previously published in Vol. 20, No. Page 17 2 of the Virginia State Bar Trusts and Estates Newsletter (Spring 2005). 2 Section 55-541.02 of the Code. 3 Section 55-541.05 of the Code. 4 Section 55-544.11 of the Code. 5 Section 55-544.11 of the Code. 6 Section 55-544.12 of the Code. 7 Section 55-544.13 of the Code. 8 Section 55-544.14 of the Code. 9 The NCCUSL Comments to Section 414(a) of the Uniform Code [Section 55-544.14.A. of the Code] states “Subsection (a) assumes that a trust with a value of $50,000 [$100,000 in Virginia] or less is sufficiently likely to be inefficient to administer that a trustee should be able to terminate it without the expense of a judicial termination proceeding.” 10 Section 55-544.14 of the Code. 11 Section 55-544.10 of the Code. 12 Under Section 55-541.03, the term “beneficiary” means a person that: a. has a present or future beneficial interest in a trust, vested or contingent; or b. in a capacity other than that of trustee, holds a power of appointment over trust property. Note that the use of the term “beneficiary” rather than “qualified beneficiary” is significant. The term “beneficiary” includes not only the qualified beneficiaries but also the more remote contingent beneficiaries. The representation sections found in Section 55-542.06 may be helpful in determining who can represent whom in such a proceeding. 13 The NCCUSL Comments to Section 414(a) of the Uniform Code [Section 55-544.14.A. of the Code] states: “Subsection (a) assumes that a trust with a value of $50,000 [$100,000 in Virginia] or less is sufficiently likely to be inefficient to administer that a trustee should be able to terminate it without the expense of a judicial termination proceeding.” 14 Under Section 55-541.03 of the Code, the term “qualified beneficiary” means a beneficiary who, on the date the beneficiary’s qualification is determined: a. is a distributee or permissible distributee of trust income or principal; b. would be a distributee or permissible distributee of trust income or principal if the interests of the distributees described above in (a) terminated on that date; or c. would be a distributee or permissible distributee of trust income or principal if the trust terminated on that date. 15 Note that Section 55-269.1, et seq. of the Code also address the calculation of a life tenant’s interest upon commutation. Because the calculations under that section are based on a set “discounted rate” and annuity table, the calculations will not typically match the calculations under I.R.C. Section 7520. Therefore, for Federal gift tax purposes it would be safer to use the valuation methods provided in I.R.C. Section 7520. 16 There are numerous programs that perform actuarial calculations, including: Number Cruncher (found at www.leimberg.com), Tiger Tables (found at www.tigertables.com), and Brentmark Software (found at www.brentmark.com). 17 Some programs will do an actuarial calculation for an “income” interest coupled with a 5 and 5 power. 18 The NCCUSL Comments to Section 817(c) of the Uniform Code states that this section is a limited application of Section 1009 (Section 55-550.09 of the Code) dealing with releases given upon termination. 19 See P.L.R. 9802031 (October 14, 1997). 20 Please note that unless the Secretary of the Treasury establishes otherwise by regulations, a “written determination” such as IRS private letter rulings and technical advice memorandum may not be used or cited as precedent by another taxpayer. I.R.C. Section 6110(j)(3). 21 See Treasury Regulation Section1.642(h)-2. 22 Even in situations where the beneficiary holds only an income interest, I.R.C. Section 7520 may not apply. Under Treasury Regulation Section 25.7520-3(b), the rules under I.R.C. Section 7520 may not be used if there is a 50% or greater possibility that the individual who is the measuring life will die within one year. 23 In P.L.R. 9802031(October 14, 1997) the Service addressed an early termination where a surviving spouse was eligible to receive discretionary distributions of income and principal in the trustee’s discretion for health, support, maintenance and education. The surviving spouse did not want any of the assets upon termination and the assets were distributed in the same manner as they would have had the spouse died (between a child and charity). The Service held that the relinquishment of the spouse’s interest at termination would be a gift and the value of the gift should be determined by “all relevant factors such as the projected needs of the spouse for health, education, support and maintenance for the remainder of his life.” See also Revenue Ruling 75-550, 1975-2 C.B. 357. 24 See P.L.R. 8902045 (October 21, 1988). 25 The NCCUSL Comments to Section 411 of the Uniform Code suggest that no gift tax consequences result from a termination as long as the beneficiaries agree to distribute property in accordance with the value of their proportionate interest. 26 See P.L.R. 9308032 (November 30, 1992). 27 However, the Service could always challenge the decision based on the Supreme Court’s holding in Commissioner v. Estate of Bosch, 387 U. S. 456 (1967). In Bosch, the U.S. Supreme court held that where the Service is not a party to a proceeding it will only be bound by underlying state law issues decided by the state’s highest court. If there is no high court decision, then the federal authority only has to give “proper regard” to the state trial court’s determination of state law. Accordingly, a circuit court decree determining property rights under state law might not be binding for federal tax purposes. Page 18 28 P.L.R. 9510071 (December 15, 1994) holding that a renunciation resulting in early termination did not result in a modification of the trusts for GST purposes (decided prior to the issuance of the current GST regulations). 29 See e.g. P.L.R. 200441024 (June 10, 2004), P.L.R. 200403051 (September 30, 2003), P.L.R. 200324035 (March 4, 2003), P.L.R. 200314021(December 24, 2002) and 200127023 (April 4, 2001). 30 Note that different rules apply to charitable lead trusts (CLATS and CLUTS) which trusts must prohibit commutation and therefore may not be terminated early. See PLR 9734057(May 28, 1997), citing Revenue Ruling. 8827. 31 The Service issued P.L.R. 200525014 (March 30, 2005) in which it found no problems with the early termination of a CRUT and division of the assets on an actuarial manner. However, in P.L.R. 200614032 (January 9, 2006) the Service revoked its previous ruling in P.L.R. 200525014. The revocation apparently did not result in an “adverse” ruling on these types of issues as a whole, but was instead triggered by the fact that a private foundation was the ultimate beneficiary of the trust. Under the Service’s previous rulings, there is a legal fiction that the early termination of a CRUT results in a sale of the income beneficiary’s interest. Where there is such a sale between a private foundation and the beneficiary, there is an issue of “self-dealing” under the excise tax rules applying to private foundations. Finally, the Service issued P.L.R. 200616035 (January 25, 2006) which approved the transaction listed in P.L.R. 200525014 when the charitable beneficiary was changed from a private foundation to public charities. See Lawrence P. Katzenstein, Internal Revenue Service Revokes 2005 Private Letter Ruling on Early Termination of Charitable Remainder Trust –PLR 200614032, ALI-ABA Advanced Estate Planning and Practice Update—Spring 2006. 32 Virginia Department of Taxation Form Inh. 44. 33 See American Law Institute - American Bar Association Continuing Legal Education, July 16, 1998 Estate Planning for the Family Business SPLIT DOLLAR LIFE INSURANCE Charles L. Ratner SD10 ALI-ABA 325 for a discussion of options to be considered in releasing the collateral assignment. 34 See Section 25.2519-1(f) of the Treasury Regulations; Revenue Ruling 98-8, 1998-7 I.R.B. 24. 35 The term “charitable trust” is a defined term meaning “a trust, or portion of a trust, created for a charitable purposes”. Page 19 VIRGINIA STATE BAR TRUSTS AND ESTATES SECTION 2006-2007 BOARD OF GOVERNORS Donna Esposito Fincher Chair Vaughan, Fincher & Sotelo, PC Suite 400 8619 Westwood Center Drive Vienna, VA 22182 (703) 506-1810 dfincher@vfspc.com Julie A. King Newsletter Editor McGuireWoods LLP Suite 300 310 4th Street, NE Charlottesville, VA 22902 (434) 980-2207 jaking@mcguirewoods.com Victoria Jean Roberson Vice Chair Suite 100 13702 Village Mill Drive Midlothian, VA 23114 (804) 423-5700 vroberson@cavtel.net Neal Paul Brodsky Asst. Newsletter Editor LeClair Ryan, P.C. Suite 2525 999 Waterside Drive Norfolk, VA 23114 (757) 624-1454 nbrodsky@leclairryan.com Laura Okin Pomeroy Immediate Past Chair 11804 Shadow Run Drive Glen Allen, VA 23059 (804) 353-7384 laura.pomeroy@comcast.net John Thomas Midgett Secretary Midgett & Preti, PC 477 Viking Drive, Suite 430 Virginia Beach, VA 23452 (757) 687-8888 john.midgett@midgettpreti.com Farhad Aghdami Williams Mullen 1021 East Cary Street P. O. Box 1320 Richmond, VA 23218-1320 (804) 783-6440 aghdami@williamsmullen.com John Anthony DiJulio Williams Mullen Suite 1700 222 Central Park Avenue Virginia Beach, VA 23462-3035 (757) 499-8800 jdijulio@williamsmullen.com Suzanne Wightman Doggett 3315 Martha Custis Drive Alexandria, VA 22302 (703) 671-9187 gmgsd@aol.com Erin Sheehey Downs Jones, King & Downs, P.C. P. O. Box 1689 Bristol, VA 24203 (423) 764-5535 erin@jkdlaw.com William A. Truban, Jr. Owen and Truban, PLC 103 N. Braddock Street Winchester, VA 22601 (540) 678-0995 btruban@owentruban.com John H. Turner, III SunTrust Bank CS-HDQ-6418 919 East Main Street Richmond, VA 23219 (804) 782-5812 Jay.H.Turner@SunTrust.com Thomas D. Yates Yates, Campbell & Yates 4155 Chain Bridge Road Fairfax, VA 22030 (703) 273-4230 tyates@ycynet.com Newsletter Editor – Julie A. King, McGuireWoods LLP .