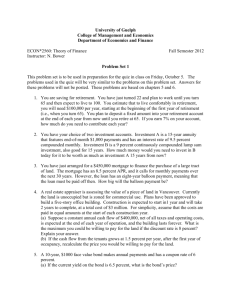

Final Exam 2009

advertisement

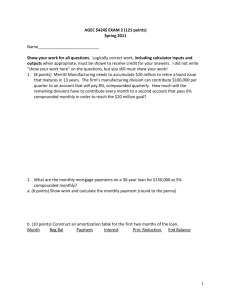

2009 FINAL EXAM AGEC $424$ (233 total points) Name___________________________ You must show logically correct work, including calculator inputs and outputs for all problems to receive credit. Ratio Profit margin(PM = ROS) Total Asset Turnover Debt ratio (TL/TA) DSO (also called ACP) ITO (COGS/inventory) ROE Accounts payable deferral Industry median 4% 3x 50% 25 days 10 x 24% 20 days Agribusiness Inc. 5% 1x 80% 10 days 15 x 48% 20 days Use the above data for questions 1-3. 1. (10 points) Construct the extended Du Pont equation for both Agribusiness Inc. and for the industry. Then analyze each of the three components of the company's ROE in a side-by-side comparison to the industry. 2. (10 points) Show a side by side comparison of the cash conversion cycle for Agribusiness Inc. with the industry. Use the CCC to analyze working capital management for Agribusiness Inc. in comparison to the industry. Say which is best and why? 3. (5 points) Based on questions 1 and 2 point out any red flags or successes that you see for Agribusiness Inc. 1 4. (10 points) Jill's Wigs Inc. had the following balance sheet last year: Last Factor 800 450 950 34,000 Cash Accounts rec. Inventory Net fixed A. $ Total assets $36,200 Next Last Factor Accounts payable $ 350 Accrued wages 150 Notes payable 2,000 Mortgage 26,500 Common stock 3,200 Retained earnings 4,000 Total liabilities and equity $36,200 Next Jill has just invented a non-slip wig for men which she expects will cause sales to double, increasing after-tax net income to $1,000. She operated at 75% of capacity next year. (1) Will Jill need any outside capital if she pays out 50% of net income as dividends? (2) If so, how much? Show calculations beyond those shown above in the space below. 5. (4 points) Nu-Mode Fashions Inc. manufactures quality women’s wear, and needs to borrow money to get through a brief cash shortage. Unfortunately, sales are down, and lenders consider the firm risky. The CFO has asked you to estimate the interest rate Nu-Mode should expect to pay on a one year loan. She’s told you to assume a 3% default risk premium even though the loan is relatively short, and to assume the liquidity and maturity risk premiums are each ½%. Inflation is expected to be 4% over the next twelve months. Economists believe the pure interest rate is currently about 3½%. 6a. (5 points) What is the monthly mortgage payment on a 30-year loan for $200,000 at 8%? b. (15 points) Construct an amortization table for the first 2 months of the loan. Month 2 Beg Bal PMT INT Prin. Reduction End Bal 7. (8 points) Mr. Moore is 35 years old today and is beginning to plan for his retirement. He wants to set aside an equal amount at the end of each of the next 25 years so that he can retire at age 60. He expects to live to about 80, and wants to be able to withdraw $25,000 per year from the account on his 61st through 80th birthdays. The account is expected to earn 10 percent per annum for the entire period of time. Determine the size of the annual deposits that must be made by Mr. Moore. Include a timeline in your answer. 8. (9 points) Adam Wilson just purchased a home and took out a $250,000 mortgage for 30 years at 7%, compounded monthly. a. How much is Adam’s monthly mortgage payment? b. How much sooner would Adam pay off his mortgage if he made an additional $100 payment each month? c. Assume Adam makes his normal mortgage payments and at the end of five years, he refinances the balance of his loan at 6%. If he continues to make the same mortgage payments, how soon after the first five years will he pay off his mortgage? 3 9. (20 points) Additional Funds needed with financial feedback It is 2005 and you have been given the attached information on the Crum Company. Crum expects sales to grow by 50% in 2006, and variable costs should increase the same percentage. Fixed costs will increase proportionately with fixed assets. Fixed assets were being operated at 80% of capacity in 2005. Current assets and spontaneous liabilities should increase at the same rate as sales during 2006. The company plans to finance any external funds needed as 50% notes payable and 50% common stock. After taking financing feedbacks into account, and after the second pass, what are Crum’s additional notes payable and common stock needed? The blank worksheet for the projected balance sheet method follows. Show calculations of capacity and interest on the right side. Information on the Crum Company: 2006 2006 2005 Factor 1st pass Feedback 2nd pass Sales $1,000.00 Variable costs 400.00 Capacity: Fixed Costs ___400.00 ________ EBIT Interest $ 200.00 16.00 ________ _________ EBT Taxes (40%) $ 184.00 73.60 _________ ________ _________ ________ _________ ________ _________ ________ _________ ________ _________ Net Income Dividends (60%) $ Add'n to R.E. $ Current Assets Net fixed Assets $ 110.40 66.24 44.16 700.00 300.00 _________ Total assets $1,000.00 A/P and Accruals N/P 8.00% Common stock Retained earnings $ Total Liab & Equity 150.00 200.00 150.00 500.00 _________ $1,000.00 Additional Funds needed each pass: First pass AFN breakdown: Notes Payable____% $_________ Stock Total AFN (two passes) ____% $_________ $____________ Additional notes payable needed $____________ Additional common stock needed 4 $____________ Interest: 10. (8 points) Jen and Barry Inc. has a $1000 face value, 10 year remaining life, semi-annual, 9% coupon bond outstanding. Investors require a 12% rate of return on bonds of this risk. What is the intrinsic value of the bond? 11. (8 points) Joe Kool Inc. has a $1000 face value, 12 year remaining life, semi-annual, 9% coupon bond outstanding. It is selling for $955. What is the yield to maturity for this bond? 12. (4 points) What is the current yield on the bond in number 11? Why is it less than the YTM? 13. (8 points) Blue Inc. has a $1000 face value, 4 years to call, semi-annual, 15% coupon bond outstanding. Investors require an 8% rate of return on bonds of this risk. The call premium on this bond is $100. What is the value of the bond assuming it will be called? 14. (8 points) Black and Gold Inc. has a $1000 face value, 6 years to call, semi-annual, 15% coupon bond outstanding. The bond has a call premium of one year's worth of interest at the coupon rate. It is currently selling for $1300. What is the yield to call? 5 15. (15 points) Long Life Insurance Inc just paid a dividend of $1.50, and projects supernormal growth at of 12% for the next three years. After that growth is expected to slow down to a normal 4% and go on at that rate for the foreseeable future. Similar stocks are earning a return of 10%. How much would you pay for a share of Long Live today? 16.(4 points) Assume a firm’s bonds are currently yielding new investors 6%. The combined federal and state tax rate is 40%. What is the firm’s after-tax cost of debt is? a. 3.6% b. 4.0% c. 4.8% d. 6.0% 17. (4 points) Allegheny Valley Power Company common stock has a beta of 0.80. If the current riskfree rate is 6.5% and the expected return on the stock market as a whole is 16%, determine the cost of retained earnings for the firm (using the SML from the CAPM). a. 14.1% b. 7.6% c. 6.5% 18. (4 points) Northeast Airlines has a current dividend of $1.80. Dividends are expected to grow at 7% into the foreseeable future. What is the firm’s cost of equity from new stock if its shares can be sold to net the company $46 after administrative expenses (flotation costs)? a. 10.9% b. 11.2% c. 7.2% d. none of the above 19. (4 points) Hatter Inc. has the following capital components and costs. Calculate Hatter’s WACC. Component Value Cost Debt 15,500 10% Preferred Stock 7,500 12% Common Equity 10,000 14% a. 11.67% b. 12.41% c. 13.73% d. 14.55% 6 20. (4 points) Zylon Inc. plans net income of $10 million next year and typically pays 40% of its earnings in dividends. Its capital structure is one third equity and two thirds debt with no preferred stock. Zylon’s MCC curve will break at: a. $ 4,000,000 b. $ 6,000,000 c. $12,000,000 d. $18,000,00 21. (4 points) Illinois Tool Company’s (ITC) fixed operating costs are $1,260,000 and its variable cost ratio (i.e., variable costs as a fraction of sales) is 0.70. The firm’s debt consists of a $6,000,000 bond issue (par value), which pays a coupon rate of 9%. Sales are $9 million per year. What is ITC’s degree of financial leverage? a. 1.20 b. 1.875 c. 3.0 d. 1.60 22. (4 points) Last year Avator’s operating income (EBIT) increased by 22 percent while its dollar sales increased by 15%. What is Avator’s degree of operating leverage (DOL)? a. . 68 b. 2.0 c. 1.47 d. . 32 23. (6 points) Assume the following facts about a firm that sells just one product: Selling price per unit Variable costs per unit Total monthly fixed costs = $24.00 = $18.00 = $2,500 What is the firm’s annual breakeven volume in units? 24. (12 points) A project has the following cash flows C0 C1 C2 ($700) $200 $500 a. What is the project’s payback period? C3 $244 b. Calculate the projects NPV at 12% and Calculate the project’s IRR. c. Calculate the EAA of the project. 7 25. (40 points) Meals on Wings Inc. supplies prepared meals for corporate aircraft and is considering the purchase of new broilers. If the broilers are purchased, they will replace old broilers purchased 10 years ago for $105,000, which are being depreciated on a straight line basis to a zero salvage value for depreciation (15-year depreciable life). The old broilers can be sold for $60,000 today, but would be worth only $15,000 in 4 more years. The new broilers will cost $200,000 installed and will be depreciated using MACRS over their 5-year class life (the percentages are 20, 32, 19, 12, 11, 6); they will be sold for $20,000 at the end of the 4th year. The firm expects to increase its revenues by $68,500 per year if the new broilers are purchased, but cash expenses will also increase by $3,500 per year. The firm's required rate of return is 10 percent and its tax rate is 40 percent. Determine the cash flows, NPV, IRR, and payback on the attached sheet. Recommend either acceptance or rejection and say why. 26. (3 points extra credit) Conestoga Ltd. has the following estimated probability distribution of returns. Return Probability 4% .20 12% .50 14% .30 Calculate Conestoga’s expected return, the variance and standard deviation of its expected return and the return’s coefficient of variation. 8 Question 25 Initial Outlay Depreciation [initial basis = ] Operating Cash flow minus deprec. EBT less taxes EAT Dep. Add back OCF Terminal CF 9 Timeline, calculator inputs/outputs and investment decision