UNIT 7

advertisement

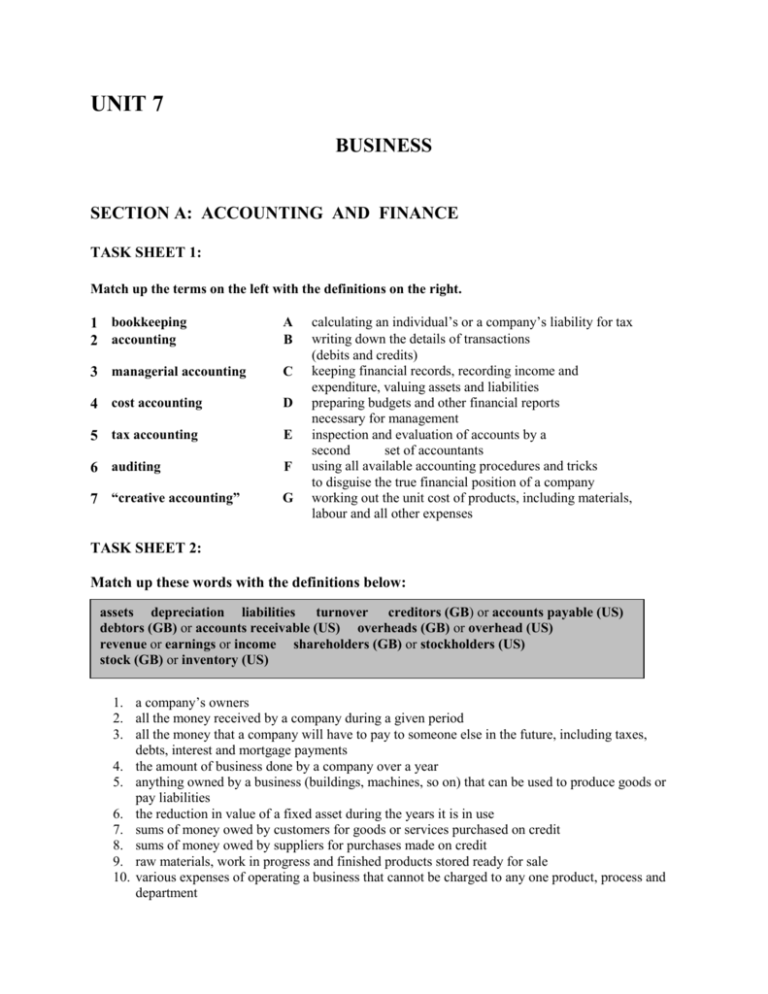

UNIT 7 BUSINESS SECTION A: ACCOUNTING AND FINANCE TASK SHEET 1: Match up the terms on the left with the definitions on the right. 1 bookkeeping 2 accounting A B 3 managerial accounting C 4 cost accounting D 5 tax accounting E 6 auditing F 7 “creative accounting” G calculating an individual’s or a company’s liability for tax writing down the details of transactions (debits and credits) keeping financial records, recording income and expenditure, valuing assets and liabilities preparing budgets and other financial reports necessary for management inspection and evaluation of accounts by a second set of accountants using all available accounting procedures and tricks to disguise the true financial position of a company working out the unit cost of products, including materials, labour and all other expenses TASK SHEET 2: Match up these words with the definitions below: assets depreciation liabilities turnover creditors (GB) or accounts payable (US) debtors (GB) or accounts receivable (US) overheads (GB) or overhead (US) revenue or earnings or income shareholders (GB) or stockholders (US) stock (GB) or inventory (US) 1. a company’s owners 2. all the money received by a company during a given period 3. all the money that a company will have to pay to someone else in the future, including taxes, debts, interest and mortgage payments 4. the amount of business done by a company over a year 5. anything owned by a business (buildings, machines, so on) that can be used to produce goods or pay liabilities 6. the reduction in value of a fixed asset during the years it is in use 7. sums of money owed by customers for goods or services purchased on credit 8. sums of money owed by suppliers for purchases made on credit 9. raw materials, work in progress and finished products stored ready for sale 10. various expenses of operating a business that cannot be charged to any one product, process and department TASK SHEET 3: ACCOUNTING AND FINANCIAL STATEMENTS Insert the words in the box above in the gaps of the following text: In accounting it is always assumed that a business is a “going concern” that it will continue indefinitely into the future, which means that the current market value of its fixed assets is irrelevant, as they are not for sale. Consequently, the most common accounting system is historical cost accounting, which records (1) ……………… at their original purchase price, minus accumulated depreciation charges. In times of inflation, this understates the value of appreciating assets such as land, but overstates profits as it does not record the replacement cost of plant or (2)…………… The value of a business’s assets under historical cost accounting – purchase price minus (3)………………… - is known as its net book value. Company law specifies that (4) ……………… must be given certain financial information. Companies generally include three financial statements in their annual reports. The profit and loss account (GB) or income statement (US) shows (5) ……………… and expenditure. It usually gives figures for total sales or (6) …………………, and costs and (7)…………………….. The first figure should obviously be higher than the second, namely there should be a profit. Part of the profit goes to the government in taxation, part is usually distributed to shareholders as a dividend and part is retained by the company, for it to be able to cope with possible future threats. The balance sheet shows a company’s financial situation on a particular date, generally the last day of the financial year. It lists the company’s assets, its (8) ……………… and shareholders’ funds. A business’s assets include (9) …………… and it is assumed that these will be paid. Liabilities include (10) ……………, as these will have to be paid. Negative items on financial statements, such as creditors, taxation and dividends paid are usually enclosed in brackets. In accordance with the principle of double-entry bookkeeping (that all transactions are entered as a credit in one account and as a debit in another), the basic accounting equation is: Assets = Liabilities + Owners’ Equity This can be rewritten as: Assets – Liabilities = Owners’ Equity or Net Assets This includes share capital (money received from the issue of shares), share premium (GB) or paid-in surplus (US) (any money realized by selling shares at above their nominal value) and the company’s reserves (including the year’s retained profits). Shareholders’ equity or net assets are generally less that a company’s market capitalization (the total value of its shares at any given moment, meaning the number of shares times their market price), because net assets do not record items such as good will. The third financial statement has various names, including the source and application of funds statement and the statement of changes in financial position. This shows the flow of cash in and out of the business between balance sheet dates. Sources of funds include trading profits, depreciation provisions, sales of assets, borrowing and the issuing of shares. Application of funds includes purchases of fixed or financial assets, payment of dividends, repayment of loans and trading losses. TASK SHEET 4: Match the definitions with the correct money word: 1. a fixed amount which is paid, usually monthly, to workers of higher rank 2. an amount of money which you lend to someone 3. a sum of money which is owed to someone 4. paid while travelling, especially on public transport, buses, trains, etc. 5. paid to the government for services that the state provides 6. paid as a punishment for breaking the law 7. money paid by a company or the state on your retirement 8. money paid by the state, usually to students 9. money paid for professional services, e.g. to a doctor 10. money which is in the form of coins and notes, not cheques 11. an amount of money you receive, usually weekly, in return for labour or service 12. money paid by divorced father to his former wife to upkeep his children 13. tax on imported articles paid to the customs 14. paid at a restaurant after eating 15. extra percentage paid on a loan salary fare taxes loan debt cash fee limon duty interest grant pension fine bill wage TASK SHEET 5: Give the name for the following definitions: a) money paid to authors or inventors according to the sales of their work b) a sum of money used to make more money from something that will increase in value c) the money which a building society or bank lends to someone to buy a house d) the money that a person pays to an insurance company to protect against loss or damage e) money, usually from a relative, to live on f) an amount of money, related to the value of goods sold, which is paid to a salesman for his services g) part- payment of money which you make to stop the seller from selling his goods to others h) part of the value of a company that you may buy i) money paid by divorced or separated people to support the former husband or wife j) the amount of money that goes to a shareholder k) money received from someone in his or her will l) the amount of money borrowed from a bank, greater than that which is in your account m) an additional payment which is a reward to those who work for a company for their extra work an a-------a m------a s---r-------a p-----an o-------m---------a l----an I--------a d------a d-----c--------a b---- TASK SHEET 6: Choose the correct answer and fill in the blanks: 1. The…..of the pound has fallen recently. a. expense b. price c. value d. worth 2. The accounts show a …..of $ 500 this month. a. decrease b. deficit c. deterioration d. devaluation 3. The bank will require three signatures when you open an account. a. natural b. sample c. specimen d. trial 4. I’m afraid that the bank will refuse my application for an extended ……. . a. balance b. compensation c. estimate d. overdraft 5. At this bank you can get 17%…..on your own savings. a. interest b. rate c. rent d. salary 6. I want $ 500 worth of French francs. What is the ……rate, please? a. currency b. exchange c. market d. money 7. Miss Positive……the bank manager that she would be able to repay the loan. a. assured b. ensured c. certified d. insured 8. The debt should be paid……within thirty days of receiving this statement. a. all over b. as a whole c. for good d. in full 9. Please find enclosed our……scale for life insurance premiums. a. gauging b. raising c. sliding d. slipping 10. Reminders must be sent out to all customers whose accounts are more than a month…… . a. indebted b. overdue c. unbalanced d. unpaid SECTION B: BANKING, STOCK AND SHARES, BONDS PERSONAL BANKING TASK SHEET 1: Match up the following terms with the definitions on the right: 1. cash card A. a card which guarantees payment for goods and services purchased by the cardholder, who pays back the bank or finance company at a later date 2. cash dispenser B. a fixed sum of money on which interest is paid, lent for a fixed period and, usually, for a specific purpose 3. credit card C. a loan, usually to buy property, which serves as a security for the loan 4. home banking D. doing banking transactions by telephone or from one’s personal computer, linked to the bank via a network 5. loan E. one that pays interest, but usually cannot be used for paying checks and on which notice is often required to withdraw money 6. mortgage F. one that generally pays little or no interest, but allows the holder to withdraw his or her cash without any restrictions 7. overdraft G. a plastic card issued to bank customers for use in cash dispensers 8. standing order H. an instruction to a bank to pay fixed sums of money to certain people or organizations at stated times 9. current account (GB) checking account (US) I. a computerized machine that allows bank customers to withdraw money, check their balance and so on 10. deposit account (GB) time or notice account (US) J. an arrangement by which a customer can withdraw more from a bank account than has been deposit in it, up to an agreed limit; interest on the debt is calculated daily TASK SHEET 2: TYPES OF BANKING 1. COMMERCIAL BANKING Commercial or retail banks are businesses that trade in money. They receive and hold deposits, pay money according to customers’ instructions, lend money, offer investment advice, exchange foreign currency and so on. They make a profit from the difference (known as a spread or a margin) between the interest rates they pay to lenders or depositors and those they charge to borrowers. Banks also create credit, because the money they lend, from their deposits, is generally spent (either on goods or services, or to settle debts) and in this way transferred to another bank account – often by way of a bank transfer or a check rather than the use of notes or coins – from where it can be lent to another borrower and so on. When lending money, bankers have to find a balance between yield and risk and between liquidity and different maturities. 2. INVESTMENT BANKING Merchant banks in Britain raise funds for industry on the various financial markets, finance international trade, issue and underwrite securities, deal with takeovers and mergers and issue government bonds. They also generally offer stockbroking and portfolio management services to rich corporate and individual clients. Investment banks in the USA are similar, but they can only act as intermediaries offering advisory services and do not offer loans themselves. Investment banks make their profits from the fees and commissions they charge for their services. 3. UNIVERSAL BANKING In the USA, the Glass-Steagall Act of 1934 imposed a strict separation between commercial banks and investment banks or stockbroking firms. Yet the distinction between commercial and investment banking has become less clear in recent years. Deregulation in the USA and Britain is leading to the creation of “financial supermarkets”: conglomerates combining the services previously offered by banks, stockbrokers, insurance companies, and so on. In some European countries (notably Germany, Austria and Switzerland) there have always been universal banks combining deposit and loan banking with share and bond dealing and investment services. 4. INTEREST RATE A country’s minimum interest rate is usually fixed by the central bank. This is the discount rate, at which the central bank makes secured loans to commercial banks. Banks lend to blue chip borrowers (very safe large companies) at the base rate or the prime rate; all other borrowers pay more, depending on their credit standing (or credit rating or creditworthiness): the lender’s estimation of their present and future solvency. Borrowers can usually get a lower interest rate if the loan is secured or guaranteed by some kind of asset, known as collateral. 5. EUROCURRENCIES In most financial centers, there are also branches of lots of foreign banks, largely doing Eurocurrency business. A Eurocurrency in any currency held outside its country of origin. The first significant Eurocurrency market was for US dollars in Europe, but the name is now used for foreign currencies held anywhere in the world (e.g. yen in the US, DM in Japan). Since the US dollar is the world’s most important trading currency – and because the US has for many years had a huge trade deficit – there is a market of many billions of Eurodollars, including the oil-exporting countries “petrodollars”. Although a central bank can determine the minimum lending rate for its national currency it has no control over foreign currencies. Furthermore, banks are not obliged to deposit any of their Eurocurrency assets at 0% interest with the central bank, which means that they can usually offer better rates to borrowers and depositors than in the home country. TASK SHEET 3: Match the following definitions with the words and expressions from the previous text: 1. to place money in a bank; or money placed in a bank A. solvency 2. the money used in countries other than one’s own B. currencies 3. how much money a loan pays, expressed as a percentage C. collateral 4. available cash and how easily other assets can be turned into cash D. deposit 5. the date when a loan becomes repayable E. yield 6. to guarantee to buy all the new shares that a company issues, if they can’t be sold in public F. maturity 7. when a company buys or acquires another one G. merger 8. when a company combines with another one H. portfolio management 9. buying and selling stocks or shares for clients I. takeover 10. taking care of all a client’s investments J. blue chip borrowers 11. the ending or relaxing of legal restrictions K. conglomerate 12. a group of companies, operating in different fields, that have joined together L. underwrite 13. a company considered to be without risk M. stock 14. ability to pay liabilities when they become due N. liquidity 15. anything that acts as a security or a guarantee for a loan O. deregulation TASK SHEET 4: Match up the verbs and nouns below to make common collocations: charge do exchange issue make offer pay raise receive underwrite advice bonds business currencies deposits funds interest loans profits security issues TASK SHEET 5: STOCKS AND SHARES Read the following text and answer the questions: 1. Why do people form limited companies? 2. Why do companies issue shares? 3. Why do people buy the shares? COMPANIES Individuals and groups of people doing business as a partnership, have unlimited liability for debts, unless they form a limited company. If the business does badly and can’t pay its debts, any creditor can have it declared bankrupt. The unsuccessful business people may have to sell nearly all their possessions in order to pay their debts. This is why most people doing business form limited companies. A limited company is a legal entity separate from its owners and is only liable for the amount of capital that has been invested in it. If a limited company goes bankrupt, it is wound up and its assets are sold, liquidated in order to pay the debts. If the assets don’t cover the liabilities or the debts, they remain un paid. The creditors simply do not get all their money back. Most companies begin as private limited companies. Their owners have to put up the capital themselves, or borrow from friends or a bank, perhaps a bank specializing in venture capital. The founders have to write a Memorandum of Association (GB) or a Certificate of Incorporation (US), which states the company’s name. Its purpose, its registered office or premises and the amount of authorized share capital. They also write Articles of Association (GB) or Bylaws (US), which set out the duties of directors and the rights of shareholders (GB) or stockholders (US). They send these documents to the registrar of companies. A successful company can apply to a stock exchange to become a public limited company (GB) or a listed company (US). Newer and smaller companies usually join “over-the-counter” markets. Very successful businesses can apply to be quoted or listed (i.e. to have their shares traded) on major stock exchanges. Publicly quoted companies have to fulfill a large number of requirements, including sending their shareholders an independently-audited report every year, containing the year’s trading results and a statement of their financial position. The act of issuing shares for the first time is known as floating a company (making a flotation). Companies generally use an investment bank to underwrite the issue, that is to guarantee to purchase all the securities at an agreed price on a certain day, if they can’t be sold to the public. Companies wishing to raise more money for expansion, can sometimes issue new shares, which are normally offered first to existing shareholders at less than their market price. This is known as a rights issue. Companies sometimes also choose to capitalize part of their profit (turn it into capital) by issuing new shares to shareholders rather than paying dividends. This is known as a bonus issue. Buying a share gives its holder part of the ownership of a company. Shares generally entitle their owners to vote at a company’s Annual General Meeting (GB) or Annual Meeting of Stockholders (US) and to receive a proportion of distributed profits in the form of a dividend, or to receive part of the company’s residual value if it goes into liquidation. Shareholders can sell their shares on the secondary market at any time, but the market price of a share – the price quoted at any given time on the stock exchange, which reflects, more or less, how well or badly the company is doing – may differ radically from its nominal value. TASK SHEET 6: Find words or expressions in the previous text, which mean the following: 1. having a responsibility or an obligation to do something (ex. to pay a debt) 2. a person or organization to whom money is owed (for goods or services rendered, or as repayment of a loan) 3. to be insolvent (unable to pay debts) 4. everything of value owned by a business that can be used to produce goods, pay liabilities… 5. to sell all the possessions of a bankrupt business 6. money that a company will have to pay to someone else (bills, taxes, debts, interest and mortgage payments…) 7. to provide money for a company or other project 8. money invested in a possibly risky new business 9. the people who begin a new company 10. the place in which a company does business: an office, shop, workshop, factory, warehouse… 11. to guarantee to buy an entire new share issue, if no one else wants it 12. a proportion of the annual profits of a limited company, paid to shareholders ALTERNATIVE TERMINOLOGY Americans often talk about corporations rather than companies and about an initial public offering rather than a flotation. Another name for stocks and shares is equities because all the stocks or shares of a company – or at least all those of a particular category – have equal value. Two other terms for nominal value are face value and par value. Other names for a bonus issue are a scrip issue (short for “subscription certificate”) and a capitalization issue and in the US a stock dividend or stock split. TASK SHEET 7: Match the following definitions with the words from the box: blue chip defensive stock growth stock insider share-dealing institutional investors mutual fund market-maker portfolio stockbroker 1. 2. 3. 4. 5. 6. 7. 8. 9. a company that spreads investors’ capital over a variety of securities an investor’s selection of securities a person who can advise investors and buy and sell shares from them a stock in a large company or corporation that is considered to be a secure investment a stock – in an industry not much affected by the cyclical trends – that offers a good return but only a limited chance of a rise or decline in price a stock – which usually has a high purchasing price and a low current rate of return – that is expected to appreciate in capital value a wholesaler in stocks and shares who deals with brokers financial organizations such as pension funds and insurance companies which own most of the shares of all leading companies (over 60% and rising) the use of information not known to the public to make a profit out of buying or selling shares TASK SHEET 8: There is a logical connection among three of the four words in each of the following groups. Which is the odd one out and why? 1. 2. 3. 4. 5. 6. 7. 8. 9. annual report – external auditors – financial statements – stockbroker blue chip – defensive stock – growth stock – rights issue bonus issue – dividend – over-the-counter – shareholder creditor – market-maker – shareholder – stockbroker debt – equity – share – stock face value – market value – nominal value – par value float – liquidation – share issue – underwriter institutional investor – insurance company – liabilities – pension fund mutual fund – portfolio – risk – underwriter TASK SHEET 9: Read the following text and answer the following questions: 1. Why do most companies use a mixture of debt and equity financing? 2. Why do governments issue bonds? BONDS Companies finance most of their activities by way of internally generated cash flows. If they need more money they can either sell shares or borrow, usually by issuing bonds. More and more companies now issue their own bonds rather than borrow from banks, because this is often cheaper: the market may be a better judge of the firm’s creditworthiness than a bank (it may lend money at a lower interest rate). This is evidently not a good thing for the banks, which now have to lend large amounts of money to borrowers that are much less secure than blue chip companies. Bond-issuing companies are rated by private ratings companies and given an “investment grade” according to their financial situation and performance, Aaa being the best and C the worst (nearly bankrupt). Obviously, the higher the rating the lower the interest rate at which a company can borrow. Most bonds are bearer certificates, so after being issued (on the primary market), they can be traded on the secondary bond market until they mature. Bonds are therefore liquid, although of course their price on the secondary market fluctuates according to changes in interest rates. Consequently, the majority of bonds on the secondary market are traded either above or below par. A bond’s yield at any particular time is thus its coupon (the amount of interest it pays) expressed as a percentage of its price on the secondary market. For companies, the advantage of debt financing over equity financing is that bond interest is tax deductible. In other words, a company deducts its interest payments from its profits before paying tax, whereas dividends are paid out of already-taxed profits. Apart from this “tax shield”, it is generally considered to be a sign of good health and anticipated higher future profits if a company borrows. On the other hand, increasing debt increases financial risk: bond interest has to be paid, even in a year without any profits from which to deduct it and the principal has to be repaid when the debt matures, whereas companies are obliged to pay dividends or repay share capital. Thus companies have a debt-equity ratio that is determined by balancing tax savings against the risk of being declared bankrupt by creditors. Governments, of course, unlike companies, don’t have the option of issuing equities. Consequently, they issue bonds when public spending exceeds receipts from income tax, VAT and so on. Long-term government bonds are known as gilt-edged securities, or simply gilts (GB) or Treasury Bonds (US). The British and American central banks also sell and buy short-term (three month) Treasury Bills as a way of regulating the money supply. To reduce the money supply, they sell these bills to commercial banks and withdraw the cash received from circulation; to increase the money supply they buy them back, paying with newly created money which is put into circulation in this way. TASK SHEET 10: Match up the words or phrases on the left with the corresponding ones on the right: 1. investors 2. issuing bonds 3. principal 4. maturity 5. pension funds 6. buy-and-hold investors 7. non-payment 8. price appreciation 9. price depreciation 10. capital gains A. the amount of a loan B. borrowing money C. date at which the money will be returned D. fall in interest rates E. keep their bonds till maturity F. default G. profits on the sale of assets H. providers of funds I. retirement money J. rise in interest rates TASK SHEET 11: In each case, which of the three statements is TRUE? 1. Banks’ loan portfolios are now generally less secure than 20 years ago A. because bankers are becoming irresponsible. B. because blue chip companies are becoming irresponsible. C. because blue chip companies issue their own bonds, and banks that receive deposits still have to lend money. 2. Bondholders can A. only get their money back when the bond matures. B. get their money back at any time. C. try to get their money back at any time. 3. If interest rates A. rise above a bond’s coupon, the bond will probably sell at above par. B. fall below a bond’s coupon, the bond will probably sell at above par. C. rise above a bond’s coupon, its yield will normally decrease. 4. The fiscal system in most countries makes it advantageous for companies A. to issue bonds rather than borrow from a bank. B. to issue stocks or shares rather than bonds as long as they don’t make a loss. C. to issue bonds rather than stocks or shares as long as they make a profit. 5. A. Governments systematically issue bonds to finance public spending. B. Governments issue bonds to finance public spending when necessary. C. Governments or central banks regularly issue bonds to increase the money supply. TASK SHEET 12: Match up the expressions on the left with the definitions on the right: 1. equity financing 2. debt financing 3. bearer certificate 4. liquid 5. par 6. coupon 7. yield A. a security whose owner is not registered with the issuer B. easily sold (turned into cash) C. the rate of interest paid by a fixed interest security D. the rate of income an investor receives taking into account a security’s current price E. issuing bonds F. issuing shares G. nominal or face value (100%) TASK SHEET 13: Choose the right word to fill in the gaps: 1) The Board of … is responsible for deciding on and controlling the strategy of a corporation or company. a) workers b) directors c) control 2) Small businesses depend on investors providing … capital. a) venture b) individual c) cooperative 3) Investors are influenced by the projected … on their capital a) market b) return c) rate 4) The capital needed to run a business is provided by... a) gain b) risk c) investment 5) Rent and rates, which do not change as turnover volume changes, make up the … costs of the company. a) fixed b)contribution c) variable 6) Materials and direct labor costs, which change as turnover volume changes, make up the … costs of a company. a) fixed b) contribution c) variable 7) Every company must watch its … carefully if it is to avoid bankruptcy. a) market managers b) cash flow c) production lines 8) The … account shows whether the company is profitable or not. a) profit and loss b) volume c) shareholders 9) Banks require … to guarantee a loan. a) accounts b) shares c) securities 10) Insurance companies may use … to negotiate the amount of insurance to be paid. a) claim forms b) tariff companies c) insurance adjusters SECTION C: BUSSINESS LETTERS AND IDIOMS BUSINESS LETTERS TASK SHEET 1: Fill in the correct prepositions in these sentences. All are expressions which occur frequently in business letters: 1. We are sending samples … separate cover. 2. We allow discounts … up to 7% … larger quantities. 3. We look forward … meeting you … the Trade Fair. 4. We had the pleasure … meeting you … your stand … the trade Fair. 5. We hope this product can compete … both price and quality. 6. I’m afraid Mr. Kelly is away … business … at the moment. 7. Thank you … your cheque … $7648 … complete settlement … your account … date. 8. We regret to inform you that we do not deal … recycled paper. 9. We have taken the liberty … forwarding your enquiry … our agents in India. 10. The form should be completed … duplicate … capitals and signed … you before you forward it to us. 11. We expect all debts to be settled … full … due course. 12. We have a good supply … wood suitable … these desks … stock … the moment. 13. She deals … many enquiries … this sort … the course of her work. 14. Duty has been paid … the goods and they are not liable … VAT. 15. We are writing to inform you … a change of address of our Atlanta branch … effect … May 1st. TASK SHEET 2: Here are a number of standard sentences from business letters. Can you fill in each space with ONE word? In most cases there is only one possibility although sometimes two or three different words are possible for a particular space. 1. We …… you that any …… you …… with us will have …… prompt and careful ……. 2. In …… of the …… that we have now been …… business with you for a year, we …… appreciate quarterly …… of our accounts in the ……. 3. We should be …… if you would …… the …… references when ordering, as your Company is …… to us. 4. Our …… for first orders are …… in advance. Delivery will be not more than three weeks …… receipt …… order. 5. Our …… at the moment are limited and we are …… orders in …… rotation …… as not to …… our regular ……. 6. No …… you will …… your records and let us …… an …… statement in …… course. 7. We …… be …… if you would …… your records and …… us have an amended statement by ……. 8. To …… our dispatch department we …… be …… if you would …… use of the enclosed order-forms, so that your orders …… be …… without delay. 9. We are …… to …… this concession to assist you in extending your exports and in the …… that this will …… to …… orders. 10. We agree …… this price and …… ask you to …… this letter as our official order for the goods in …… . …… ship …… the first …… opportunity. 11. We …… for any …… which …… have been caused …… a result of our oversight. 12. May we …… how …… we are …… …… to collaborating …… you …… this new project. BUSINESS IDIOMS Although there are a lots of ‘standard phrases’ in business English which sometimes make is seem rather formal, one of the most important features of the spoken English used by English bussiness themselves, is that the opposite is true - the use of idioms is a sign of a relaxed atmosphere and that the discussion are friendly. The standard pharases (outside official meetings) often sound cold and unfriendly. Although a foreigner who uses idioms taking a big risk, it can be useful to understand what your English colleague means. Try the following. Match up the expression in list 1 with the meaning in list 2. PRACTICE 1 List 1 1. He’s got a lot on just now. 2. He got carried away. 3. He’s been there donkey’s years. 4. He’s tied up at the moment. 5. He doesn’t miss a trick. 6. He’s got everything going for him. 7. He’s a bit of a lame duck. 8. He’s on the ball. 9. He’s a in a bit of a rut. 10. He’s not easy to get on with. List 2 a. argues a lot b. understands very quickly c. always gets the best from a situation d. is very busy e. needs a change f. is an old employee g. often needs help from the others h. exaggerated what he meant i. can’t speak to you j. ought to succeed PRACTICE 2 These you may hear after a bussiness meeting-perhaps at lunch or dinner. List 1 1. Shall we wet our whistles? 2. Can I top you up? 3. One for the road? 4. Can I square up with you later? 5. Can I just spend a penny? List 2 a. I’m going to the toilet. b. Do you want a drink? c. Do you want another drink? d. Do you want more to drink? e. I’ll pay my share later. PRACTICE 3 Match up the expressions in List 1 with the meaning in List 2. 1. 2. List 1 He got on his high horse. He called a spade a spade. 3. 4. 5. 6. 7. 8. 9. He was given the red carpet treatment He was completely our of his depth. He was stopped in his tracks. He put his head on the block. He put his foot down. He was held his own all right. He was the blue-eyed boy. List 2 a. insisted b. was so popular he couldn’t make a mistake c. was very well cared for d. took the responsibility e. met an enexpected problem f. was rather arogant g. was in serious difficulties h. said exactly what he thought i. wasn’t able to do what he was supposed to do j. was very busy k. didn’t understand at all l. wasn’t able to do what he was supposed to 10. He was up the creek without a paddle. 11. He was up to his eyes. 12. He couldn’t cope. PRACTICE 4 List1 1. He wanted to keep out options open. 2. We were on a wild goose chase. 3. We sat on it for a while. 4. We painted the town red. 5. We didn’t play our cards too well. 6. We hadn’t a leg to stand on. 7. We pulled out all the stops. 8. We were feeling the pinch. 9. We were in rather a tight corner. 10. We were all on our mettle. List 2 a. were short of money b. tried as hard as possible c. waited d. hod no hope of explaining e. tried to show ourselves at out best f. made some mistakes negotiating g. were wasting out time h. didn’t want to decide too early i. were in difficulties j. had rather a wild party/evening PRACTICE 5 1. 2. 3. 4. 5. 6. 7. 8. List 1 There have been a few teething troubles. There’s been a slight hitch. There’s a catch. There was a lot of hot air around. There was a bit of a free-for-all. There’s more in the pipeline. There was a lot of beating about the bush. There’s more in it than meets the eye. a. b. c. d. e. f. g. h. List 2 an unnoticed problem silly, meaningless arguin irrevelant talk confusing argument early problems a problem everything is not as it seems extra bussiness in the future PRACTICE 6 Match up the expressions in List 1 with the explanation in List 2. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. List 1 List 2 Can we count on it? a. Is there a temporary solution? Can you fill me in ? b. Is there a temporary solution? Can we get out of it? c. Is it certain? Can we find some sort of stop-gap? d. Do you think arguing will help? Can we play it by ear? e. Don’t say anything yet. Can we kick up a bit of a fuss? f. Let’s talk about the real problem. Can you tone it down a bit? g. Don’t be so direct! Can you keep an eye on things for us? h. Give me the background, please. Can we get down to brass tacks? i. Will you take care of our interest? Can we keep this under out hats for a while? j. Do we need to be prepared? PRACTICE 7 Choose the correct explanation of the phrase in italics in each case. 1. Then we got down to the nitty gritty. 2. I think they are trying to string us along. 3. It left something to be desired. 4. I’ll put in a word for you. 5. That puts a different complexion on things. 6. They are bendind over backwards for us. 7. He’s up to something. 8. I think they are rather dragging their feet. 9. I think we can take that as read, can’t we? 10. I think we were taken for a ride last time. a. important business b. small details c. tems not on the agenda a. delay things b. lie to us c. make us agree with them a. it was a bit unsatisfactory b. it was very unsatisfactory c. it was not complete a. correct what you have written b. try to help you c. explain what you meant a. things seem better now b. things seem worse now c. things seem different now a. cheating us b. trying to agree with our view c. helping us as much as possible a. doing something good b. doing something bad c. doing something I don’t know about a. going deliberately slowly b. going slowly c. making it extra difficult a. not waste time with a document b. assume I am right c. agree without discussion a. cheated b. not given enough details c. given special treatment (good) PRACTICE 8 Choose the correct alternative in each of the following. All the sentences would sound quite natural if used by a native English-speaking business man to a colleague. 1. I wouldn’t bank on it. a) lend money b) borrow money c) rely d) promise c) pay d) apologize 2. You’ll have to climb down. a) lower you price b) make a concession 3. When do you think they’ll cough up? a) answer b) pay c) deliver the goods d)ring 4. He cried off at the last moment. a) said he couldn’t come b) refused to apologize c) wouldn’t pay d) refused to change his mind 5. You’ll have to knuckle down to it. a) work hard b) accept the bad news c) try harder d) repeat it c) paying interest d) listening c) pay d) relax 6. He’s not letting on at the moment. a) saying what he thinks b) lending money 7. When are you going to let up? a) collect your money b) increase your price 8. I’d like to mull it over. a) discuss it with others b) think about it c) re-read it d) change some of the details 9. The deal is just about sewn up. a) agreed b) signed c) certain to fail d) spoilt by one person c) consider d) prepare a report 10. We need a day or two to size up the situation. a) discuss b) get all the details together PRACTICE 9 Match each sentence a) to j) with a sentence from 1) to 10) which has a similar meaning. a) We have to haggle. b) We have a nice little nest-egg. c) We have high expenditure. d) We get in free. e) We are in debt. f) We are very thrifty. g) We are paid on commission. h) We want a rise. i) We lend money. j) We have a high income. 1) We spend a lot. 2) We don’t waste money. 3) We let people borrow from us. 4) We earn according to what we sell. 5) We argue about the price. 6) We earn a lot. 7) We don’t have to pay. 8) We need higher wages. 9) We owe money. 10) We have some savings. GRAMMAR SECTION: GERUNDS AND INFINITIVES The gerund and the infinitive can function as nouns. - the gerund may stand alone as the subject of a verb; the infinitive is not often used in this way. e.g.: Smoking is bad for your health. To ease credit restrictions at this stage would be unwise. - both may stand alone as the object of a verb e.g.: I have finished working. I want to leave. - both may function as the complement of to be: e.g.: My worst vice is gambling. Her first impulse was to run away. - both may be qualified by adverb: e.g.: A teacher of foreign language must avoid speaking too quickly. He asked me to leave immediately. - both may be followed by a direct or an indirect object: e.g.: Closing the factory leads to social unrest. (direct object) He hates speaking to strangers. (indirect object) To leave the door unlocked means to invite burglars in. (direct object) The manager wants to speak to you. (indirect object) GERUNDS A. Common verbs often followed by gerunds; verbs marked with * can also be followed by that + clause: *appreciate, avoid, contemplate, delay, *deny, detest, dislike, endure, enjoy, escape, excuse, face, *fancy, finish, involve, *mention, mind, miss, postpone, practise, resent, risk, suggest, burst out, it’s no good/ use, feel like, give up, keep on, leave off, put off, can’t stand, spend/ waste time B. Verbs followed by prepositions + gerund (including their adjectival forms): absorbed in smth; be engrossed in smth; specialize in smth; succeed in smth; apologize for smth; blame someone for smth; pay for; accuse someone of smth; remind someone of smth; suspect someone of smth; charge someone with smth; concern with smth; deal with smth; suffer from smth; decide on smth; insist on smth (someone doing smth); insure smth against smth; protest against smth; be concerned about smth; dream about smth; hint at smth; marvel at smth; be used to smth. C. Prepositions following adjectives and nouns + gerund: OF: afraid of, aware of, capable of AT: good at, surprised at, WITH: obsessed with, pleased with ON: keen on, an authority (expert) on, ban on TO: addicted to, grateful to, immune to, prone to, a solution to, a threat to, an alternative to BY: bored by, distressed by, surprised by IN: experienced in, interested in FOR: thankful for, credit for, desire for, responsibility for OVER: be in dispute over smth D. Phrasal verbs + gerunds: break down, break off (stop talking), give up, put off, get round to (find tome to …), end up, feel up to (feel capable of doing smth), put oneself out (take the trouble to help someone) INFINITIVES A. Common verbs often followed by infinitive with to; verbs marked * can also be followed by that + clause: *agree, *appear, *arrange, attempt, ask, choose, dare, *decide, *demand, deserve, *expect, fail, grow, hasten, *happen, *hope, hurry, *learn, long, manage, neglect, offer, pay, *plan, *pledge, *pretend, *promise, refuse, *resolve, seek, *seem, struggle, *swear, *threaten, *vow, want, *wish B. Common verbs often followed by infinitive without to ; verbs marked * can also be followed by that + clause: help, make, let, *feel, *hear, *notice, watch, *observe, *perceive, *se, *sense GERUNDS OR INFINITIVES Verbs followed by either –ing or infinitive with to: 1. Can’t bear, hate, like, love, prefer Like to usually refers to habitual preferences: We like to go out to lunch on Sunday. Not like to means think it wrong to: I don’t like to disturb colleagues at home. 2. Forget, remember With to both verbs refer to an obligation: I had to phone the office but I forgot to do it. With –ing both verbs refer to past events: I don’t remember learning to walk. Both can be followed by that + clause: I remembered that I had to pay the phone bill. 3. Try With to refers to something attempted, which might fail or succeed: I tried to warn him, but it was too late. With –ing this refers to making an experiment, or to a new experience: Have you tried windsurfing? It’s great! Try taking an aspirin. You’ll feel better. 4. Go on With –ing this refers to the continuing of an action: She went on working even though it was late. With to this refers to the continuation of a speech: The Prime Minister went on to praise the Chancellor. This means: The Prime Minister continued his speech by praising the Chancellor. 5. Mean With the meaning intend, this is followed by to: Sorry, I meant to tell you about the party. With –ing and an impersonal subject, this refers to what is involved: If we catch the early train, it will mean getting up at 6.00. That + clause is possible when meaning is being explained: This means that you have to report to the police station. 6. Regret With to this refers to the speaker’s regrets about what is going to be said. It often occurs in formal statements of this kind: We regret to inform you that your application has been unsuccessful. With –ing this refers to a regret about the past: I regret saying that to him. That + clause is also possible: We regret that we didn’t tell her earlier. 7. Stop With to this refers to an intention: Jane stopped to check the oil level in the engine. With –ing this refers to the ending of an activity: The baby stopped waking up during the night now. 8. Hear, see, watch When followed by infinitive without to, the action is complete: We watched all the cars cross the finishing line. With –ing, the action is still in progress: I heard someone coming up the stairs. EXERCISE 1: Put the verbs in brackets into their correct form (Gerund or Infinitive): 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. Have you ever watched people (try) (catch) fish? If you dislike (peel) potatoes, try (hold) them under water while (do) so. There’ll be an opportunity (ask) questions before (leave) the classroom after (hear) the lecture. His plans are well worth (listen to) in spite of (they, sound) so unpractical. I hoped (arrange) (come) early (help) you (put) the room in order before the guests’ (come). I know you will pardon (I, say) so, but you keep (give) us to many difficult words (spell) in English. I’ve had a lot of occasions (complain) of (he, come) late. It’s silly (risk) (get) your feet frost-bitten. Stop (make) a fool of yourself by (keep on) (repeat) the same stupid idea. I remember (allow) them (play) in my garden without first (ask) for permission. I must remember (remind) my mother that the garden needs (water). We mustn’t risk (be) late for the theatre. I put off (go) last week and I don’t want (miss) (see) the play. I appreciate (you, not want) (mention) (he, have) been an alcoholic before (come) to work for us. Is it any use (I, ask) you (insist) on (Tom, be) present without (wait) for any further invitation? He recollects (his uncle, say) that if a job was worth (do) at all is was worth (do) well. She likes (read) detective stories so I can’t understand (she, be) unable to resist (look at) the end of the book first. I don’t mind (your children, play) in the garden, but I won’t have (they, walk) over my roses. Don’t (keep) (I, wait) long before (answer) the phone. I advise you (wait) before (decide) (accept) the offer. Is (boil) or (fry) the best way of (cook) this fish? I should like (watch) these workers (fix) the engine for a few minutes before (go) any further. Did you forget (remind) Tom (ask) his friend (pay back) the money he owes us? Please (begin) (eat) mow without (wait) for the other guests. There’s no (tell) when they’ll manage (get) here. I can see (him, begin) (smile), so it is no use (he, pretend) (be) asleep. Do you remember (I, ask) you (lend) me a dictionary? Try (persuade) Mary (be) more reasonable. If you don’t enjoy (eat) sour lemons, try (put) sugar on them after (peel) them. I’m surprised at (you, have) to work so late. Just imagine (I, do) the same! No, it doesn’t bear (think about). A child can’t learn (spell) without (be) helped. On (hear) my girl-friend Margot (speak), everybody took her (be) a French. I dislike (be) looked at while (attempt) (learn) (swim). They refused (allow)us (go in) without (sign) the paper. Forgive (I, ring) you up so late, but I couldn’t allow your birthday (pass) without (congratulate) you. “Did you remember (post) my letter on your way home?” “I remember (go) into the post-office for some stamps, but even then I’m afraid I forgot (post) it.” EXERCISE 2: Show the differences in meaning between the sentences in pairs: a) Sorry , I meant to tell you about the party. If we catch the early train, it will mean getting up at 6.00. b) I heard someone coming up the stairs. I heard you enter the room. c) I had to phone the office but I forgot to do it. I forgot telling him the news. d) I can’t help to clean the place up. I can’t help falling asleep. e) He said he would like to go to the museum, but he didn’t have enough money. He said he liked going to the museum, but he didn’t have enough money. f) I remember telling him that there was no bus on Sundays. I remembered to tell him that there was no bus on Sundays. g) He couldn’t stop saying thank you for all his brother had done. He couldn’t stop to say thank you for all his brother had done. h) He was used to getting up early. He used to get up early. i) Why don’t you try to hire a car? Why don’t you try hiring a car? j) I regret to say that you’ll be held responsible. I regret saying that you’d be held responsible. EXERCISE 3: Fill in the blanks with a gerund or an infinitive: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. The man was last seen …… (board) a train at Huston. Everyone assumed what he said …… (be) based on facts. The teacher caught the pupil …… (cheat). I vaguely remember …… (tell) him something like that. The new committee member did not venture …… (speak) at his first meeting. He remembered ….. (pass) on most of the information, but omitted …… (mention) one or two of the most important facts. The reporters asked many questions which the freed man declined …… (answer). He left me ….. (sit) in the restaurant alone. The Company saw its market ….. (disappear) and took immediate steps to develop new products. Having mentioned the main problem, he went on …… (talk) of other, less important matters. He dared …… (call) me a fool to my face. Unreliable delivery dates are one of the most important obstacles to…… (increase) our exports. By selling council houses, we are able to devote more money to ….. (build) fresh properties. EXERCISE 4: Complete each sentence using either an infinitive construction or a gerund construction. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. I strongly resent your….. Will the new job involve your ……? The question is whether anyone will volunteer …… Surely you will never consent …… We tried to delay his……., our main concern being to prevent him …… It would be unwise to defer …… I hesitated ……, since I didn’t know him very well. He is the most competent man …… His plans are well worth …… even though they sound so unpractical. How can we be sure of his …..? EXERCISE 5: Rewrite each sentence, beginning as shown, so that the meaning stays the same: 1. I went to the hairdresser; I wanted her to cut and style my hair. I went to the hairdresser ……………………………………… 2. Actually, she succeeded in getting the loan at last. Actually, she ……………………………………. 3. “Never cross the street without looking at the traffic lights”, mother advised her son. Mother advised ………………………………………………………………………. 4. They repaired my gar at the garage. I …………………………………… 5. Don’t try to drive it; the engine is out of order. It’s no use …………………………………… 6. The President is just going to sign the treaty. The President is on ………………………… 7. We couldn’t continue our journey because of the storm. The storm ……………………………………………… 8. I advise you to teach him a lesson. It’s time …………………………. 9. Alice has said that I am responsible for the stain in the carpet. Alice has accused ……………………………………………. 10. The prisoner claimed that he had not murdered the old woman. The prisoner denied …………………………………………… 11. I can hardly wait to get some rest. I’m looking ……………………… 12. Could you manage to make her accept my proposal? Could you succeed …………………………………. 13. She pushed the door ajar so that she might get some fresh air. She pushed the door ajar …………………………………… 14. According to his arrangement , a bonus will be given to each of us. He has arranged …………………………………………………… 15. I’m doing more work than I bargained for. I didn’t expect …………………………… 16. Sally was rude but Anne got her revenge. Anne paid ……………………………… 17. The full truth is only just beginning to sink in. I’m only just beginning ……………………… 18. I bet you wouldn’t ask your father to join the meeting! I dare ………………………………………………… 19. If you work for this company, you have to travel a lot! Working for this company involves ………………….. 20. We haven’t seen one another for a long time. We stopped ……………………………….. EXERCISE 6: Choose the most suitable words underlined; a) b) c) d) e) f) g) h) i) j) You are perfectly capable for/ of making your own bed, I would have thought! I am surprised at/ by your forgetting about our annual meeting. The union and the management are in collaboration/ dispute over working conditions. It seems to be your boss who is under/ at fault in this case. When David started to speak/ speaking everyone fell about in laughter/ laughing. I told her off/ told off her for leaving the office unlocked. It’s time you got/ set about organizing your revision programme. Half the meeting was left/ given over to reading the minutes. Closing the factories means putting/ to put people out of work. Your calling/ call on us just at this time is most inconvenient. EXERCISE 7: Fill in the blanks with one of the phrasal verbs from the box. Choose the most appropriate form for every context: bring up take to 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. get on with cut down go on keep on go through with give up take on shut down She …… riding because she wanted to lose weight. At the last committee meeting, the treasurer …… the question of raising the annual subscription. How are you …… your new project? He …… going for a walk every night before he went to bed. He wanted to talk to me but I …… working and refused to listen. He began by describing the route and …… to tell us what the trip would probably cost. After his fourth attempt he …… trying to pass the examination. You would recover your sense of taste if you …… smoking altogether. Several gambling clubs have been …… recently for breaking the regulations. The Government won’t …… this new legislation if public feeling is against it. EXERCISE 8: Complete the sentences below with a suitable form of the verbs in brackets: 1. My father (remember/ spend) long happy hours on the beach when he was a child. ……………………………………………………………………………………….. 2. We (regret/ say) that you have not won a prize in our competition. …………………………………………………………………….. 3. Your football boots (need/ clean) before the next match. ………………………………………………………….. 4. You (not need/ explain) the situation to me because I understand perfectly. ………………………………………………………………………………. 5. John (try/ remember) his boss’ address, but it had completely gone out of his mind. ……………………………………………………………………………………….. 6. (Try/ not make) elementary grammar mistakes when you are writing a composition. ……………………………………………………………………………………….. 7. Please (remember/ phone) home and tell them I’ll be late. …………………………………………………………… 8. My sister (regret/ not work) harder when she started University. …………………………………………………………………. 9. The technician (try/ fiddle) with knobs, but the machine still wouldn’t work. ……………………………………………………………………………….. 10. The matter (need/ look) into. …………………………….. BASIC VOCABULARY: a buck (fam. US) – un dolar a quid (fam. UK) – o liră sterlină account - cont account for (to) - a reprezenta, a explica accountancy - contabilitate accountant – contabil actuarial - notarial, contabil actuary - notar, contabil agenda – o ordine de zi allotted share capital - capital social autorizat annual report - raport anual de activitate arrears – datorii, restanţe, arierate assets - activ (al unei firme) audit - revizie contabilă auditor - revizor contabil authorised share capital - capital social autorizat authorised share capital - capital social autorizat bad debt – o creanţă neplătită balance - sold balance – un sold balance of account – un sold de cont balance sheet - bilanţ bank - bancă bear – un speculator la bursă (care mizează pe scăderea cursului) bid – o ofertă de cumpărare bill - trată, factură bill of exchange - trată, scrisoare de schimb bill of landing - conosament blank cheque – un cec în alb blue chips – acţiuni ale marilor companii bounded cheque – un cec refuzat building rate – o bancă populară de economii pentru cumpărarea de locuinţe bull – un speculator la bursă (care mizează pe creşterea cursului) called up share capital - capital social atras capital - capital cash point – un aparat distribuitor de bancnote central bank - bancă centrală cheque book - un carnet de cecuri company, corporation (US) – o societate comercială composite rate – o rată compusă concern – o firmă, un concern confirming bank - bancă confirmatoare cost - cost cost - effective - rentabil cost effective – rentabil, care îşi merită preţul cost efficient - rentabil costing - estimare (a preţului) cost-sharing - participare la cheltuieli council tax – impozitele locale credit card – o carte de credit creditor – un creditor current account - cont curent current account deficit – un deficit al balanţei de plăţi curente current assets - active (mijoace) circulante deposit account - cont de depuneri dip – o scădere, o descreştere direct debit – debitare directă direct debit - virament automat dirt cheap - foarte ieftin divident – divident downturn, downswing – un regres draft – o retragere dud/ rubber cheque – un cec fără acoperire equities – acţiuni ordinare expenses – cheltuieli, plăţi extravagant, profligate – cheltuitor, risipitor firm, bussiness – o firmă, o afacere fixed assets - active (mijloace) fixe flat rate – rată uniformă front company – o societate paravan funds - fonduri general meeting – o adunare generală gilt-edged securities – valori/titluri fără risc (obligaţiuni de stat) godsend – o mană cerească hand currency – o valută forte headoffice, headquarters – sediul social holding company – un holding income tax – impozit pe venit inheritance tax – drepturi de succesiune interest – dobândă internal audit - revizie contabilă internă investor - investitor issued share capital - capital social emis issuing bank - bancă emitentă joint stock company – societate pe acţiuni joint venture – o societate pe acţiuni junk bonds – obligaţiuni fără valoare limited partnership – o societate în comandită simplă loan – un împrumut loan shark – un cămătar merchant bank – o bancă comercială monetary - monetar money spinner – o mină de aur money supply – masă monetară mortgage – o ipotecă multinational – o campanie multinaţională operating costs - costuri de exploatare outstanding balance - sold debitor overdue – scadent, întârziat de mult parent company – o companie mamă partner – un asociat, un partener partnership – o societate de persoane pay to - a plăti pay roll - stat de plată PAYE pay as you earn - impozite reţinute la sursă payment – o plată, un vărsământ payment against payment - contra cost phantom profit - profit fantomă portfolio – un portofoliu (de valori) preference dividend - dividend preferenţial pre-paid - plătit în avans private company – o societate cu răspundere limitată profit to - a profita profit making - realizare de profit profitability – rentabilitate profit-sharring - participare la profit public company – o societate anonimă public expenditure – cheltuieli publice redeem (to) - a rambursa, a onora, a amortiza redeemable - rambursabil, amortizal redemption date - dată de rambursare repayment – rambursare retained profit - profit nedistribuit savings - economii set back – o cădere, o involuţie, un regres settlement – o reglare, plată a unui cont share premium account - primă de emisiune sight bill - trată la vedere sister company – o societate din acelaşi grup slump – o scădere masivă spending - cheltuieli spot market - piaţa tranzacţiilor la termen stake, holding – o participare la capital statement of account – un extras de cont stock market – o piaţă bursieră takeover – o preluare tangibile assets - active corporale tax collector – un perceptor tax evasion – evaziune fiscală tax heaven – un paradis fiscal tax relief – o degrevare de impozit taxation – impozitare, taxare taxpayer – un contribuabil the Balance of Payments – balanţa de plăţi the Balance of Trade – balanţa comercială the base rate – rată de bază the discount rate – rată de scont the exchange rate – rată de schimb the Gross Domestic Product – Produsul Intern Brut the Gross National Product – Produsul Naţional Brut the lending date – rată de împrumut the Mercantile Exchange – Bursa de Mărfuri to be in the black - a fi creditor to be in the red – a fi descoperit, în deficit to bid for – a face o ofertă pentru to borrow – a împrumuta de la cineva to break even – a regla conturile to cap taxes – a fixa un plafon pentru impozite to collect – a încasa to default – a nu onora to dip – a scădea, a descreşte to draw money – a retrage, a scoate bani to establish – a fonda, a întemeia to file an account - a depune documentele de constituire a societăţii to file for bankruptcy ,to file – a-şi depune bilanţul, a cere falimentul to flourish – a prospera to go belly up (US) – a da faliment to hedge – a se acoperi (risc) to invest – a investi to lend – a împrumuta cuiva to manage, to run – a conduce, a gestiona to overdraw – a depăşi contul în bancă, a semna un cec fără acoperire to owe money – a datora bani to pay back, to repay – a rambursa to pay money in/into - a vărsa bani în to pay money off - a fi valabil/plătitor, a rambursa o datorie to plummet – a merge foarte prost, a avea greutăţi mari to raise profit - profit to save – a economisi to set up – a organiza, a înfiinţa to settle – a echilibra un cont to shoot up – a creşte vertiginos to slacken, to slow down – a încetini, a frâna to slump – a scădea masiv to squander – a irosi, a risipi, a delapida to take-over – a prelua to take-over bid – o ofertă publică de preluare to tax – a impune taxe, a impozita to undertake – a întreprinde turnover – cifră de afaceri undertaking- o operaţiune întreprinsă upturn, upswing – o redresare, o ascensiune windfall – chilipir