L-CMI

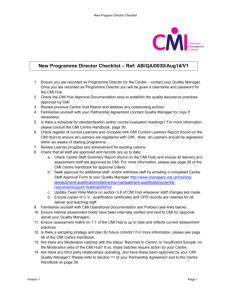

advertisement

Cummins Inc. (CMI:US) Memo Name: Beichen Wang College/School: Arts and Sciences Year: 3rd Year Important Company Financial Data (Cited from Bloomberg) Closing price: $87.49(Oct 5th) Market Cap: 17.43B P/B(mrq): 9.12304 52 Wk Summary: High: $129.51; Low: $79.53; Return 14.90% Thesis / Key Points The machinery industry is highly correlated to macroeconomic performance, therefore we apply top down approach to analyze CMI. Macroeconomic situations: Good news: The Institute for Supply Management’s (ISM) factory index rose to 51.5 last month from 49.6 in August. The consumer confidence of September jumped to the highest level in 7 months. U.S. unemployment rate of September decreases to 7.8%, the lowest reading from January 2009. Bad news: The 2nd quarter GDP is disappointing, only 1.3%. PMI index dropped to 51.1 in September from 51.4 in August. Globally, China and Brazil have slowdown in manufacturing. QE3: the Federal Reserve is printing money to purchase mortgage backed securities (MBS). This action will cause two effects. First of all, it will lower mortgage rates, stimulate American housing markets and boom American economics. Second, it will drive interest rates to about zero in the future. Given the fact that most buyers of construction machinery finance through buyer’s credit, lower interest rates will increase demand. Economic recovery usually starts from downstream industries (housing markets, automobile industries) to middle stream industries (construction machinery, components and steel) and finally to upstream industries (raw materials). We have already seen the evidences showing that housing market and automobile markets are under recovering. There is inventory shortage in second-hand housing market. And September auto sales jumped to years high (Chrysler, one of CMI’s principle customers, recorded a 12% increase from a year ago, the best reading in 5 years). Then now we are expecting to see middle stream industries, such as construction machinery, to recover from downturn. Industrial analysis: The P/E ratio of the machinery industry is below 10. It was about 20 in 2010. Caterpillar (CAT) and Deere (DE) are two major competitors of Cummins in the industry. Now we are going to compare financial data of these companies to illustrate industry features. Basic: Average P/E(ttm) for these companies are around 10. Beta is high, larger than 1.5. For cyclical industry, P/B is a relative indecisive factor. CMI’s P/B is 2.85, the lowest among three companies. Operating Ability: Net income growth rates of three companies are very attractive, more than 50%. Companies can generate enough cash by operating. As we can see from operation cash flow/net income ratio. Inventory and receivable take major part of current asset. Capital Structure: Machinery engineering is a capital-intensive industry. Companies in this industry usually have a high debt to equity ratio. But debt/equity ratio for CMI is pretty remarkable, only 10.74%, compared with CAT’s 246.07% and DE’s 423.26%. CMI’s quick ratio and current ratio is in the middle of three companies. Profitability: Operating margin is around 12 % and profit margin is about 9 %. CMI has the smallest difference between operating margin and profit margin, which demonstrates that its effective management. CMI’s ROE is about 5 percent less than that of CAT and DE, but 35.58% is an attractive number under CMI’s 10.74% debt/equity ratio. Company fundamentals: CMI is an engines and engine-related component producer. CMI has four major operating segments: engine, components, power generation and distribution. Among them, engine segment generates more than half of the total earnings (picture 1). Different from other companies in the industry which manufacture engines for their own products, CMI focuses on producing engines to other manufacturers of construction, agricultural equipment. The principal customers of CMI are PACCAR, Volvo AB, Komatsu, Hyundai, Belaz, Liugong, Hitachi and Chrysler. CMI focuses on innovations and product improvements. R&D expenses were $621 million, $402 million and $362 Cummins Inc. (CMI:US) Memo million respectively in 2011, 2010 and 2009. Income Statement: Sales Q2-12 decreased by -4% than Q1-11. Sales declined due to weaker demand in China, Brazil and Europe. Revenue is 18,045 million dollars in 2011, increased by 36.44%. Net income is 1,848 million dollars in 2011, increased by 77.69% Statement of Cash Flow: Net cash flow increased by 154% in 2011, compared with -31.49% in 2010. Increased dividend by 52 percent and paid 255 million dividends. Repurchasing 6.3 million shares in 2011. Misperception There are still a lot of uncertainties in the whole economy. CMI as a company in the high cyclical industry, its stock price still have big room to decrease because of economic performance. It is true that there are a lot of uncertainties in the global economy. Europe and China are now in the downturn. There is still a long way to settle down European debt crisis. China’s GDP growth rate will drop to 7%, which is still very high, but not as high as years before. But if we look at companies’ fundamentals, the P/E ratios are really lower in this period. The P/E ratios were about 20 two years ago, but now it is below 10. There is not big room to drop, and the industry will recover and stock prices will increase. Heavy equipment manufacturers are always high leveraged and therefore having high long-term debt to asset ratios, which would potentially harm companies debt paying ability. It is true that machinery industry as a whole is a capital intensive industry, but it is not the case for Cummins. The long-term to asset ratio of Cummins is 5.88%, compared with 31.00% of Caterpillar and 35.18% of Deere. Moreover, Cummins is generating a favorable cash flow. Its operation cash flow is greater than it net income. Low leverage ratio may influence company’s return on equity. The return on equity of Cummins is 35.58%, compared with 40.41% of Caterpillar and 40.85% of Deere. Meanwhile, only 5.88% long-term debt to asset ratio also indicts that Cummins’ ROE has big room to grow if it uses leverage in the future. VAR Operating Segments: Source:Q212 CMI Earning Teleconference Competitors Analysis: Mkt Cap Closing Pring (Oct 9th) CMI CAT DE 17.15B 55.46B 2.01B 90.84 85.44 8.73 P/E(ttm) 9.02 9.48 10.91 P/B 2.85 3.5 4.39 10.19 8.94 7.49 1.77 1.79 1.44 Diluted EPS(ttm) Beta Cummins Inc. (CMI:US) Memo Capital Structure quick ratio 1.32 0.83 1.82 current ratio(mrq) 2.02 1.42 2.24 10.74% 246.07% 423.26% 5.88% 31.00% 35.18% 77.69% 82.52% 50.13% 7.57 3.46 1.23 112.18.% 142.25% 83.07% 30.19% 38.15% 12.04% 31.66% 47.09% 9.82% operating margin(ttm) 11.92% 13.41% 13.20% profit margin(ttm) 10.50% 9.01% 8.71% return on assets(ttm) 12.17% 6.71% 5.75% return on equilty(ttm) 35.58% 40.41% 40.85% total debt/equity (mrq) long-term debt/asset Operating Ability net income growth rate receivable turnover operating cash flow/net income inventory/ current assets receviable/ current assts Profitability Personal Experience: In the summer of 2011, I had an internship in an investment bank. I was working to assist to IPO program of a construction machinery company. By talking with the company representatives, I got to know that many construction machinery companies in China choice Cummins’s engines and other components because they are reliable. How It Plays Out In the coming one or two months, the stock price would probably shock in a narrow range, since earning reports of Q1 and Q2 are not as attractive as annual report of 2011, and the Q3 earning report is not expected to be optimistic. However, if we see two-year returns of CMI and S&P 500, CMI’s return has highly deviated from that of S&P 500, it will reverse to mean value and exceed S&P 500’s return in a foreseable future. Given the fact that it is always impossible to catch the bottom of a stock, it is not a bad choice to initial a long position in the coming weeks. Risks / What Signs Would Indicate We Are Wrong? CMI is exposing to exchange rate risk by selling its products in more than 190 countries and territories. Moreover, since company’s financial statements are denominate in U.S. dollars, changes of exchange rate may impact company’s operation results. Inventory risk. Inventory to current assets ratio is 30.19%, therefor CMI has risk of inventor impairment. Account receivable risk. Receivable to current assets is 31.66%, therefore CMI may have relatively high risk of account receivable risk. About 9 percent of Cummins earnings come from European markets. Another downturn in European automotive industry or infrastructure development could materially impact CMI’s operation. The challenge of increasing capacity and ramping up production at the appropriate pace due to the high cyclical nature of the industry. Signposts / Follow-Up Q3 2012 Cummins Inc. Earnings Release on Tuesday, October 30th. Q3 reports of other construction machinery companies, such as CAT, DE and Volvo AB, since stock prices of these companies are always high correlated. Global economic performances, both of emerged and emerging markets. (Page of Exhibit/s) Company Description (cited from 2011 Form 10K) CMI is a global power leader that designs, manufactures, distributes and services diesel and natural gas engines and engine-related component products. CMI has four complementary operating segments: engine, components, power generation and distribution. CMI sells its products to original equipment manufacturers, distributors and other customer worldwide, through a network of more than 600 company-owned and independent distributor locations and more that 6500 dealer locations in more than 190 countries and territories. Cummins Inc. (CMI:US) Memo Selected financial data from 2011 Form 10k 2011 2010 2009 Sales 18.05B 13.23B 10.8B gross income 4.57B 3.15B 2.17B net income 1.85B 1.04B 428M total assets 11.67B 10.4B 8.82B account receivable 2.53B 2.24B 2B Inventories 2.14B 1.98B 1.34B current assets 7.09B 6.29B 5B total liabilities 5.84B 5.41B 4.8B account payable 1.55B 1.36B 957M long term debt 561M 657M 607M current liabilities 3.75B 3.31B 2.46B stockholder's equity 5.49B 4.67B 3.77B retained earnings 6.04B 4.45B 3.58B net cash flow 1.2B 470M 686M repurchases of stk (629M) (241M) (20M) common dividends (255M) (172M) (141M) Cummins Stock return compared with S&P 500 return in a two-year scale. Source: Yahoo MarketDash