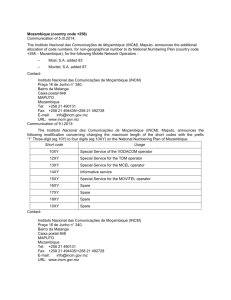

1 - tipmoz

advertisement