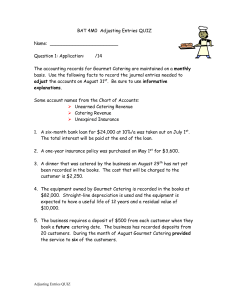

ADJUSTING ENTRIES QUIZ

advertisement

ADJUSTING ENTRIES QUIZ Review: BAF 3MI 1. Date The balance in the Supplies account on January 1, 2013 was $2 018. During the year, an additional $950 of supplies were purchased. A physical count on December 31, 2013 showed that $430 of supplies were still on hand. Give the year-end adjusting entry for Supplies. Include a t-account to show your work. Particulars 2. Debit Credit Paid $12 000 for an insurance policy covering 3 years, starting November 1, 2013. Give the adjusting entries for December 31, 2013 & December 31, 2014. Show all your calculations. Date Particulars Debit Credit Date Particulars Debit Credit 3. The late-invoices were received in January 2014, all of which related to year-end expenses of 2013: Advertising bills (Cambridge Times, $150; Global, $400) Telephone bill, $90 Utilities bill, $242 Give the adjusting entry to record these invoices. (2) Date Particulars Debit Credit 4. Date When examining the sales invoices for December 2012, the senior accountant notices that Preston Company had not yet provided a service to earn any portion of the $4,000. It was a payment in advance. Give the adjusting entry to record this error. (2) Particulars 5. Debit Credit George of the Jungle Delivery has several fixed assets that are depreciated on an annual basis: a. Store Equipment was purchased on May 1, 2012 at a cost of $15 000. It is estimated to have a useful life of 5 years and a salvage value of $1 500. It is depreciated using the straight-line method. Give the adjusting entries that would be required on December 31, 2012 and on December 31, 2013. Show all your calculations and include the formula. (6) Date Particulars Debit Credit Date Particulars Debit Credit a. Date A Delivery Truck was purchased on January 1, 2012 at a cost of $32 600. It is estimated to have a useful life of 8 years and a salvage value of $3 000. It is depreciated using the declining balance method at a fixed rate of 30%. Calculate the depreciation for 2012 and 2013, including a formula. Show all your work. Give the adjusting entry that would be required on December 31, 2012. (5) Particulars Debit Credit