Denmark In a Page - Food

advertisement

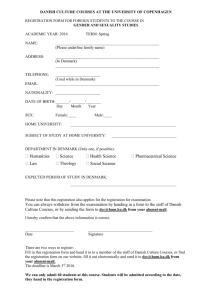

Country Report Denmark (All monetary values are in Euro) Country Report - Denmark Table of Contents DENMARK IN A PAGE ....................................................................................................................................................... 3 DASHBOARD................................................................................................................................................................................ 4 KEY CHARACTERISTICS ............................................................................................................................................................ 11 ECONOMY AND DEMOGRAPHY ................................................................................................................................................. 12 RETAIL SALES & FORECAST ..................................................................................................................................................... 14 RETAIL CHANNELS .................................................................................................................................................................... 16 TOP 5 COMPANIES.................................................................................................................................................................... 19 REGULATORY FRAMEWORK ..................................................................................................................................................... 21 BUYING AND PRIVATE LABEL STRATEGY ................................................................................................................................. 22 INTERNATIONALISATION ............................................................................................................................................................ 23 06 March 2016 www.planetretail.net - Planet Retail 2016 2 Denmark In a Page Inhabitants (mn) GDP (EUR mn) GDP / Real Growth % CPI % 2013:6 2013:251,641 2013:1.2 2013:2.0 2012:6 2012:244,524 2012:0.511 2012:2.6 GDP / capita (EUR) Consumer spending / capita (EUR) 2013:45,008 2013:22,481 2012:43,853 2012:21,907 Summary Retail sales have declined since the start of the global economic crisis. In 2011, however, retail sales recovered, but with Danish economy showing signs of slowing in 2012 retail sales decreased as a result. This year retail sales are expected to increase. Dashboard Macroeconomics Country Report - Denmark 06 March 2016 www.planetretail.net - Planet Retail 2016 5 Consumer Spending Top Companies Country Report - Denmark 06 March 2016 www.planetretail.net - Planet Retail 2016 8 Channel Leaders Hypermarkets & Superstore Leaders Supermarkets & Neighbourhood Stores Leaders Country Report - Denmark Discount Stores Leaders 06 March 2016 www.planetretail.net - Planet Retail 2016 10 Key Characteristics Economy in context Denmark’s economy has shown robust growth during the years prior to the crisis. However, the economy was hit by the collapse of the US sub-prime mortgage market in 2009 and the subsequent global credit crisis. The Danish economy has grown moderately over the last couple of years and it did not show considerable improvement during 2012 partly due to ongoing crisis in Europe. The growth rate is expected to be around 1% this year. Market concentration The Danish retail sector is highly concentrated, with the top five retailers capturing around 65% of grocery retail market. The top three companies are Coop Danmark (FDB), Dansk Supermarked and Dagrofa, all of them domestic retailers. Food market facts The Danish food retail market is driven by quality over price. Danish people have a deep sense of appreciation for their traditional foods. Opening hours of stores are extensive. Wholesaling to independent retailers and integrated trading are features of Danish retailers. Legal aspects There are no major legal restrictions on trading. Shop opening hours are fairly relaxed, Sunday trading times are determined by local authorities depending on yearly sales. Small stores are allowed to trade on Sunday. All stores have a number of "free" Sundays every year when they can trade. Planning regulations have been severely tightened regarding the opening of larger stores in an effort to protect town centres, the environment and independent retailers. Economy and Demography Population With population being 5.5 million, women make up slightly more than half of the Danish population (51%). This is because of higher mortality rates among men. Men are the majority in age groups of up to 58 years, however women take over in all successive ag e groups. The 95 and over age group comprises almost four times as many women as men. Of the population, 95% are of Evangelical Lutheran belief, 3% are Protestant and Roman Catholic, and Muslim make up 2%. Languages spoken are Danish, and Faroese. A smaller ethnic group speaks Greenlandic (an Inuit dialect), and there is also a s mall minority of German speakers. Denmark is geographically split into several islands and its mainland, Jutland, which is the largest landmass within Denmark. The capital of Copenhagen is on the island of Zealand, the second largest of Denmark’s home territories, which is als o a bridgehead into Sweden. Denmark also has administrative control of the Faroer Islands and Greenland. Economic Background The Danish economy has shown robust growth throughout the last several years, rising from a low after the start of the new millennium. An increase in domestic consumption and improving exports have resulted in higher growth rates over the past years. However, this prosperous situation has come to an end. Denmark has become the first European economy to enter recession following the collapse of the US sub-prime mortgage market in 2009 and the subsequent global credit crisis. The Danish economy has grown moderately over the last couple of years and it grew by 0.5% last year partly due to ongoing debt crisis in Europe. In 2013 the real GDP is expected to grow by around 1%. Consumer price inflation Over the past years, inflation in Denmark has been at stable levels, around the 2% mark. However, in 2008, consumer prices saw the highest increase in 24 years. This was mainly due to the rise in international food prices. The financial crisis has led to a decline in inflation, however in 2010 inflation grew to 2.3%. Although economy and consumer confidence slowed in 2011, the inflation rat e jumped to 2.8%. In 2012, the inflation rate was 2.6% and this year it is expected to be around 2%. Consumer spending Consumer spending has been rising until 2008 but declined at the same rate as the GDP in the following two years and throughout 2010. This was due to falling consumer confidence. In 2011, consumer spending grew for the first time in three years, however, uncertain economic environment partly due to European debt crisis dented consumer spending again in 2012; however, it is expected to recover and show growth throughout 2013. Economic Indicators 2013 (EUR) Inhabitants GDP GDP per capita GDP % nominal growth Consumer Spending Consumer spending per capita 5,591,000 251,641,201,724 45,008 2.83 125,691,335,081 22,481 Retail Sales & Forecast Total Retail Format sales Retail sales have declined since the start of the global economic crisis. In 2011, however, retail sales recovered, but with Danish economy showing signs of slowing in 2012 retail sales decreased as a result. This year retail sales are expected to increase. Food Retail Format sales The population is in general categorical on food consumption, likely to compromise on other goods, rather than food. After two years of decline, grocery retail sales recovered in 2011. Last year, however, was the year for negative growth again due to uncertain economic environment. In 2013 food retail format sales are expected to grow marginally. Growth & forecast Growth forecast figures for both the Danish economy in general and retail sales suffered from the recession until late 2010 and 2011 showed moderate growth. However, during 2012 retail sales decreased again with gradual recovery expected this year. Although Denmark's sovereignty in monetary politics resulting from its non-inclusion in the euro also shields it from common problems in other European countries, it has led to substantial losses on interest rate differences having adverse effects on the economy. Retail Market Sizes 2013 (EUR) Total Retail Format Sales Total Retail Format Sales per capita Food Retail Format Sales Food Retail Format Sales per capita Total consumer spending Total consumer spending per capita Total Grocery Spending Total Grocery Spending per capita Non Grocery Spending Non Grocery Spending per capita 46,791,274,401 8,369 23,385,458,018 4,183 125,691,335,081 22,481 27,081,396,903 4,844 61,991,522,650 11,088 Retail Channels Hypermarkets & superstores Hypermarkets and superstores are popular formats operated by market leaders Dansk Supermarked and Coop Danmark (FDB). Both have relatively large networks considering the size of the country and its small population. However, growth of these formats has been minimal over the last years as planning restrictions have been imposed by local authorities on outlets larger that 3,000 square metres. Supermarkets & neighbourhood stores Supermarkets are the most domineering format on the Danish market. They service the many smaller communities scattered across the Danish mainland and islands. Danish supermarkets are modern and focus on quality foods rather than price and offer broad services to their customers. Country Report - Denmark Discount stores The discount sector is very important in the Danish market, as the pricing factor is an effective way for the discounters to distinguish themselves. The sector has grown by 45% in terms of sales over the last five years. Domestic retailer Netto is the market leader, followed by Norway-based Reitan owned Rema 100 stores and Coop Danmark (FDB) owned Fakta stores. German Aldi and Schwarz Group-owned Lidl are the only true hard discounters on the scene. 06 March 2016 www.planetretail.net - Planet Retail 2016 17 Country Report - Denmark Convenience & forecourt stores Traditionally independent kiosks have filled the niche of inner-city convenience retailing. However, modern convenience stores such as 7-Eleven are expected to move forward in the coming years. Reitan has been operating 7-Eleven stores as their franchise holder in Denmark for several years and is continuing to expand the format. It entered a joint venture with Shell in August 2007. 06 March 2016 www.planetretail.net - Planet Retail 2016 18 Top 5 Companies Retail environment The Danish retail market is highly mature and is largely dominated by chains of multiples operating a variety of modern retail formats from hypermarkets to convenience stores. The majority of the leading players are domestic companies. Independent stores have been falling in numbers lately as market concentration and consolidation is increasing among the top players. All major players operate a national network stretching out across the Danish mainland and its several islands. Top Grocery Retailers In Context Four of the top five retailers in Denmark's very highly concentrated market are domestic companies, with Reitan featuring as the only foreign player. Leading retailer Coop Danmark (FDB) has a strong co-operative based structure. The top players compete on similar grounds, mainly in the supermarket and neighbourhood sectors. Dansk Supermarked and Coop Danmark (FDB) are the only retailers operating hypermarkets and supermarkets. Dagrofa has been traditionally serving independent chains as a wholesaler, while also operating the SPAR chain in the country. Top Grocery Retailers 2013 Company Number of Outlets Total Sales Area SQM Average Sales Area SQM Grocery Banner Sales (EUR) Grocery Spending Market Share 1,285 1,037,600 807 6,205,907,391 22.92 Dansk Supermarked 566 650,970 1,150 4,626,151,497 17.08 Dagrofa 777 433,633 558 2,942,801,421 8.72 Reitan 732 249,510 341 2,757,159,706 10.18 SuperBest amba 194 170,720 880 1,268,140,600 4.68 Coop Danmark (FDB) Regulatory Framework Property regulations The Danish parliament restricts authorisation of stores larger than 3,000 square meters in out-of-town locations. Consequently, new large stores are authorised only in exceptional cases. Local authorities decide the approval of building applications. The ai m of the planning law is to protect town centres, smaller and independent retailers and encourage a more environmentally friendly retail structure, with shorter journey times for both shoppers and suppliers. Opening hours From October 1 2012, all retailers in Denmark extend opening hours and stay open on Sunday, after Danish authorities passed the new law. Pricing Prices in general are higher than in other European countries because of the high food VAT of 25%. Prices for alcohol are ver y high compared to other European countries, similar to Sweden and Norway. In general, pricing is a way of distinguishing one's stores from others. Most supermarket chains operate on a quality-based policy, so discounters attract consumers considerate of prices. The entry of Lidl to the market has led to a greater price-led competition. Buying and Private Label Strategy Wholesale The wholesale sector in Denmark is very important to retailers, some delivering to their own stores via their wholesale operations. Dagrofa is an important player in delivering to independent stores via its wholesale division. Manufacturers There is a large number of companies on the Danish food manufacturing sector. Nevertheless, the sector is highly concentrated. For example, Danish Crown achieves a market share of more than 50% in the meat and poultry sector, while MD Food captures more than 90% of the milk and dairy products market. Private labels All major Danish retailers run broad private label ranges, from premium-priced organic lines to standard to economy lines. Market leader Coop Danmark (FDB) has its grocery product brand range of around 800 items at standard prices across all grocery banners. Danks Supermarked has a wide private label offer aimed at different customer groups due to its portfolio of hypermarkets, superstores and discount stores. In collaboration with suppliers and manufacturers top retailers have developed a series of articles and series which either carries the Nordic Swan or the European Ecolabel EU Flower. Internationalisation Inward investment The majority of foreign companies investing into Denmark are German retailers. Leading retailers Schwarz Group-owned Lidl, Metro and Aldi all have long-standing businesses in the country. Of these, hard discounters Aldi and Lidl are relatively small players in the discount market. Metro is concentrating on its Cash & Carry operation. Scandinavian retailer Reitan is also active in the country, however with smaller operations than its German competitors. Reitan operates its franchised 7-Eleven convenience stores and its Rema 1000 discount stores in the country. Outward investment Majority of Danish retailers confine themselves to the domestic market. This is mainly due to their co-operative or wholesale based structure, which tightly links them to their retail environment. Dansk Supermarked is active in three foreign markets with its Netto discount formula. In 2013 another retailer Coop Danmark plans to open two discount banner Fakta stores in Germany.