Course Outline

advertisement

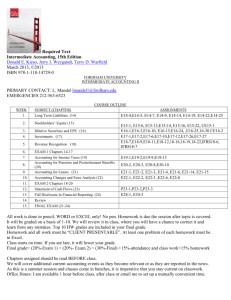

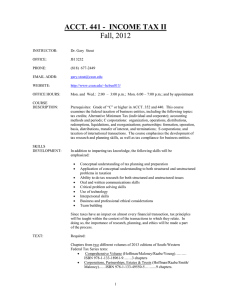

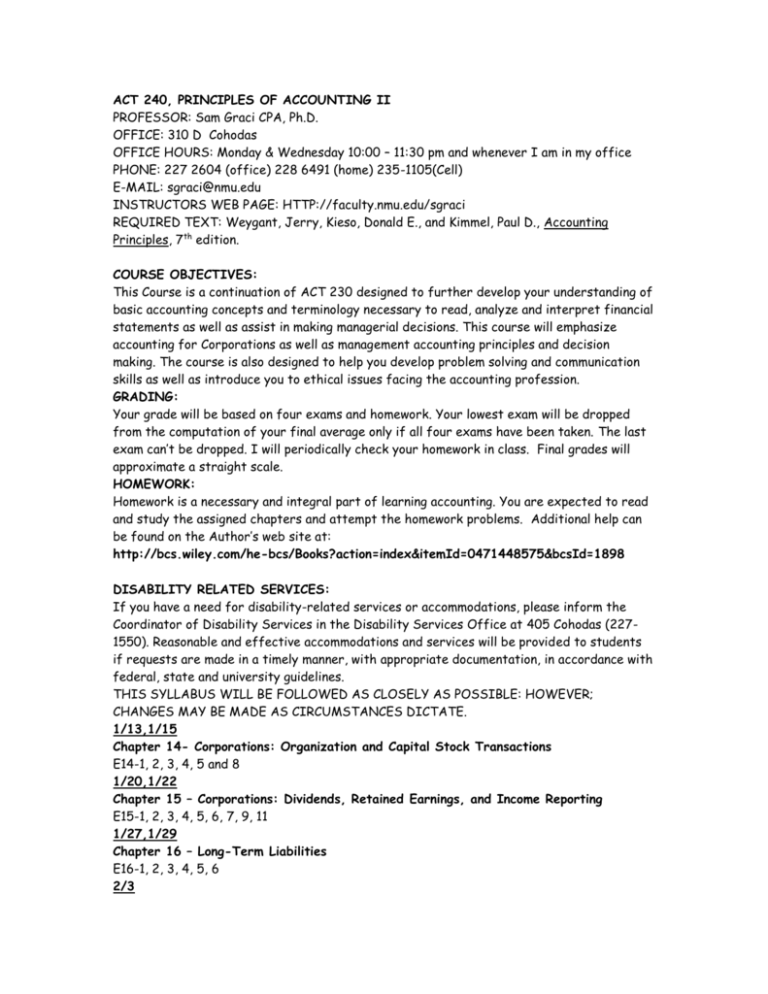

ACT 240, PRINCIPLES OF ACCOUNTING II PROFESSOR: Sam Graci CPA, Ph.D. OFFICE: 310 D Cohodas OFFICE HOURS: Monday & Wednesday 10:00 – 11:30 pm and whenever I am in my office PHONE: 227 2604 (office) 228 6491 (home) 235-1105(Cell) E-MAIL: sgraci@nmu.edu INSTRUCTORS WEB PAGE: HTTP://faculty.nmu.edu/sgraci REQUIRED TEXT: Weygant, Jerry, Kieso, Donald E., and Kimmel, Paul D., Accounting Principles, 7th edition. COURSE OBJECTIVES: This Course is a continuation of ACT 230 designed to further develop your understanding of basic accounting concepts and terminology necessary to read, analyze and interpret financial statements as well as assist in making managerial decisions. This course will emphasize accounting for Corporations as well as management accounting principles and decision making. The course is also designed to help you develop problem solving and communication skills as well as introduce you to ethical issues facing the accounting profession. GRADING: Your grade will be based on four exams and homework. Your lowest exam will be dropped from the computation of your final average only if all four exams have been taken. The last exam can’t be dropped. I will periodically check your homework in class. Final grades will approximate a straight scale. HOMEWORK: Homework is a necessary and integral part of learning accounting. You are expected to read and study the assigned chapters and attempt the homework problems. Additional help can be found on the Author’s web site at: http://bcs.wiley.com/he-bcs/Books?action=index&itemId=0471448575&bcsId=1898 DISABILITY RELATED SERVICES: If you have a need for disability-related services or accommodations, please inform the Coordinator of Disability Services in the Disability Services Office at 405 Cohodas (2271550). Reasonable and effective accommodations and services will be provided to students if requests are made in a timely manner, with appropriate documentation, in accordance with federal, state and university guidelines. THIS SYLLABUS WILL BE FOLLOWED AS CLOSELY AS POSSIBLE: HOWEVER; CHANGES MAY BE MADE AS CIRCUMSTANCES DICTATE. 1/13,1/15 Chapter 14- Corporations: Organization and Capital Stock Transactions E14-1, 2, 3, 4, 5 and 8 1/20,1/22 Chapter 15 – Corporations: Dividends, Retained Earnings, and Income Reporting E15-1, 2, 3, 4, 5, 6, 7, 9, 11 1/27,1/29 Chapter 16 – Long-Term Liabilities E16-1, 2, 3, 4, 5, 6 2/3 Test 1 Chapters 14,15,16 2/5,2/10 Chapter 17 – Investments E17-1, 2, 3, 4, 6, 7, 8 2/12,2/17 Chapter 18 (Read only to page 726)– The Statement of Cash Flows E18-1, 2, 3, 4, 5 P18-1A 2/19,2/24 Chapter 19 – Financial Statement Analysis E19-1, 2, 5, 7, 8, 9 2/26 Test 2 Chapters 17, 18 and 19 3/10 Chapter 20 – Managerial Accounting E20-1, 2, 4, 5, 7, 9, 10, P20-3A 3/12,3/17 Chapter 21 – Job Order Cost Accounting E21-3, 4, 5, 7, P21-1A 3/19,3/24 Chapter 22 – Process Cost Accounting E22-2, 3, 4, 5, 7, 8, 10 3/26,3/31 Chapter 23 – Cost-Profit-Volume Relationships E23-2, 3, 4, 5, 6, 7, 8, P23-3A 4/2 Test 3 Chapters 20, 21, 22 and 23 4/7 Chapter 24 – Budgetary Planning E24-1, 2, 3, 4, 5, 6, 7, 8 4/9,4/14 Chapter 25 – Budgetary Control and Responsibility Accounting E25-1, 2, 5, 6, 10 4/16 4/21,4/23 Chapter 27 – Incremental Analysis and Capital Budgeting E27-1, 2, 3, 4, FINAL DATE TO BE ANNOUNCED Test 4 Chapters 24,25,27