Old Exam Packet – Acct 284

advertisement

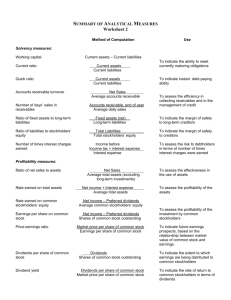

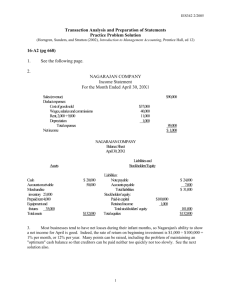

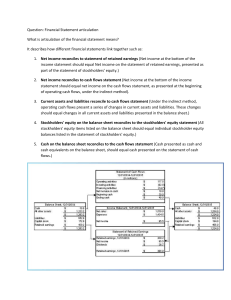

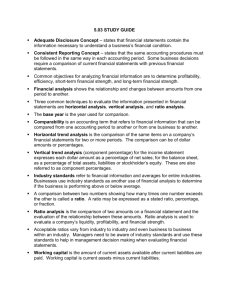

Old Exam Packet – Acct 284 Fall 2009 Exam 1 – Fall 2008 Investing activities: a. involve day to day events like selling goods and services, which occur when running a business. b. involve the buying or selling of land, buildings, equipment, and other longer-term investments. c. only involve financial exchanges. d. All of these. Accumulated depreciation: a. is an expense account. b. is a liability account. c. is a regular asset account. d. is an asset contra-account. At the end of last year, the company's assets totaled $860,000 and its liabilities totaled $740,000. During the current year, the company's total assets increased by $58,000 and its total liabilities increased by $24,000. At the end of the current year, stockholders' equity was a. $154,000. b. $120,000. c. $34,000. d. $178,000. In the U.S., generally accepted accounting principles are established: a. directly by the 1933 Securities Act. b. by the Public Company Accounting Oversight Board. c. by the Financial Accounting Standards Board. d. by the Association of Certified Public Accountants. On March 1, 2006, the premium on a two-year insurance policy on equipment was paid amounting to $1,800. At the end of 2006 (end of the accounting period), the financial statements for 2006, would report a. Insurance expense, $750; Prepaid insurance $1,050. b. Insurance expense, $900; Prepaid insurance $900. c. Insurance expense, $1,800; Prepaid insurance $0. d. Insurance expense, $0; Prepaid insurance $1,800. Which of the following would be listed as a current liability? a. Cash in the bank. b. Notes payable due in two years. c. Supplies. d. Accounts payable. Which of the following describes the classification and normal balance of the retained earnings account? a. Asset, debit b. Stockholders' equity, credit c. Liability, credit d. Stockholders' equity, debit 1. A company buys equipment for $500,000 and signs a promissory note for the full amount. How does this transaction affect the accounting equation? a. Assets: Property and equipment, Cash; Liabilities: no change; Stockholders' Equity: no change. b. Assets: Property and equipment; Liabilities: Notes payable; Stockholders' Equity; no change. c. Assets: Property and equipment; Liabilities: no change; Stockholders' Equity: Retained earnings. d. Assets: Property and equipment; Liabilities: no change; Stockholders' Equity: Contributed capital. At the end of the month, the adjusting journal entry to record the use of supplies would include: a. An increase to supplies and an increase to expenses. b. A decrease to supplies and an increase to expenses. c. An increase to supplies and an increase to revenue. d. A decrease to supplies and a decrease to cash. 2. According to the principle of conservatism, when faced with uncertainty about the value of an item, a company should use the measure that avoids: a. overstating assets and liabilities. b. overstating assets and understating liabilities. c. understating assets and overstating liabilities. d. understating assets and liabilities. Which of the following is not considered to be a liability? a. accounts payable b. unearned revenue c. wages payable d. cost of goods sold Cy’s Bar and Grill has $10,000 in utilities expense during the year. At the beginning of the year, Cy’s had utilities payable amounting to $520. At the end of the year, utilities payable totaled $470. What amount of cash did Cy’s pay for utilities during the year? (Hint: use a T-account of utilities payable) a. $9,950 b. $10,000 c. $10,050 d. $10,990 During 2007, Sensa Corporation incurred operating expenses amounting to $100,000 of which $75,000 was paid in cash; the balance will be paid in January 2008. Transaction analysis of operating expenses for 2007, should reflect only the following a. decrease stockholders' equity, $75,000; decrease assets, $75,000. b. decrease assets, $100,000; decrease stockholders' equity, $100,000. c. decrease assets, $100,000; increase liabilities, $25,000; decrease stockholders' equity, $100,000. d. decrease stockholders' equity, $100,000; decrease assets, $75,000; increase liabilities, $25,000. The primary objective of financial reporting is to: a. provide accurate historical information. b. provide useful information to external decision makers. c. provide operating information to managers. d. meet legal requirements. Adjusting entries: a. always affect one balance sheet account and one income statement account. b. never involve cash. c. are necessary to get revenues and expenses into the proper time periods. d. all of the above. Primary responsibility for the information in a corporation's financial statements rests with a. the shareholders of the corporation. b. the managers of the corporation. c. the Securities and Exchange Commission. d. the certified public accountant who audited the financial statements. Failure to make an adjusting entry to recognize accrued salaries payable would cause an a. b. c. d. understatement of expenses and liabilities and an overstatement of stockholders' equity. overstatement of expenses and liabilities. understatement of expenses, liabilities and stockholders' equity. understatement of assets and stockholders' equity. One of the disadvantages of a corporation when compared to a partnership is that a. the stockholders have limited liability. b. the stockholders are treated as a separate legal entity from the corporation. c. the corporation and its stockholders are subject to double taxation of dividends. d. the corporation provides continuity of life. Brown Corporation reported the following amounts at the end of the first year of operations: contributed capital $20,000; total revenue $95,000; total assets $85,000, no dividends, and total liabilities $35,000. Stockholders’ equity and total expenses would be: a. b. c. d. Stockholders’ equity $60,000 $80,000 $50,000 $70,000 Total expenses $75,000 $40,000 $65,000 $85,000 Which of the following characteristics of accounting allows users to examine the financial results of one company over an extended period of time? a. relevance b. reliability c. comparability d. consistency Exam 2 – Fall 2008 1. Cyclone Corporation reports the following on its most recent income statement: Cost of goods sold……..$800,000 Operating expenses…… 150,000 Pretax income…………. 250,000 Assuming there are no “other revenues and expenses” and that the company faces a 30% tax rate, what is the amount of net sales and net income reported for the year? Net Sales Net Income A. $1,200,000 $175,000 B. $ 950,000 $550,000 C. $1,150,000 $350,000 D. $1,050,000 $ 75,000 2. Maxell Company uses the periodic FIFO method to assign costs to inventory and cost of goods sold. Given the following information, what would be reported as the cost of goods sold and ending inventory balances for the period? A. B. C. D. Date Transaction # of units January 1 January 2 January 5 January 6 Beg balance Purchase Sale Sale 100 75 75 50 COGS $625 $575 $550 $600 Cost per unit $5 $4 Ending Inventory $175 $225 $250 $200 3. The group that uses accounting information to evaluate companies' past performance, predict future results, and make recommendations about the companies to current and potential investors is known as: A. auditors. B. managers. C. creditors. D. analysts. 4. A company has an asset turnover ratio of 1.15. Which of the following statements is true? (Hint: Asset turnover = Net sales ÷ Average total assets) A. The company generates $1.15 of net income for every $1 in reported assets. B. The company buys assets more frequently than it sells them. C. The company generates $1.15 of sales revenue for every $1 in reported assets. D. This is an improvement over the previous period when the asset turnover rate was 1.7. 5. The Tuck Shop began the current month with inventory costing $10,000, then purchased inventory at a cost of $35,000. The perpetual inventory system indicates that inventory costing $30,000 was sold during the month for $40,000. If an inventory count shows that inventory costing $14,500 is actually on hand at month-end, what amount of shrinkage occurred during the month? A. $500. B. $5,000. C. $14,495. D. $15,000. 6. The name for comparing across companies that compete in the same section of an industry at the same point in time is: A. ratio analysis B. cross-sectional analysis C. time-series analysis D. financial analysis 7. The conditions required for an employee to commit fraud include all of the following EXCEPT: A. opportunity B. lack of character C. job security D. incentive 8. Which of the following statements is false? A. A perpetual inventory system can detect inventory shrinkage. B. A perpetual inventory system updates the inventory account for each purchase and sale. C. A perpetual inventory system uses a purchases account. D. A periodic inventory system uses the physical count of inventory to infer cost of goods sold. 9. A company files a Form 10-K with the SEC to submit its: A. quarterly report. B. annual report. C. press releases. D. report of current events of financial importance. 10. If costs are rising, which of the following will be true? A. Cost of goods sold will be smaller if LIFO is used rather than FIFO. B. Ending inventory will be smaller if LIFO is used rather than FIFO. C. Net income will be greater if LIFO is used rather than FIFO. D. Tax expense will be greater if LIFO is used rather than FIFO. 11. Before reconciling to its bank statement, Lauren Cosmetics Corporation's general ledger had a month-end balance in the cash account of $5,250. The bank reconciliation for the month contained the following items: Deposits in transit $750 Outstanding checks $465 Interest earned $ 20 NSF check returned to bank $100 Bank service charge $ 10 Given the above information, what adjusted cash balance should Lauren report at month-end? A. $4,500. B. $4,820. C. $5,160. D. $5,590. 12. Central Company sold goods for $5,000 to Western Company on March 12 on credit. Terms of the sale were 2/10, n/30. At the time of the sale, Central recorded the transaction by increasing accounts receivable for $5,000 and increasing sales revenue for $5,000. Western paid the balance due, less the discount, on March 21. To record the March 21 transaction, Central would increase: A. Cash for $4,900. B. Accounts Receivable for $4,900. C. Cash for $5,000. D. Accounts Receivable for $5,000. 13. At the beginning of the quarter Purrfect Pets has $30,000 in inventory. During the quarter the company purchases $7,900 of new inventory. At the end of the quarter the balance in the Inventory account is $26,500. What is the cost of goods sold? A. $10,500 B. $11,400 C. $3,500 D. $11,900 14. Your company has 500 units in inventory that had been purchased for $12 each and that would currently cost $15 to replace. Your supplier has just announced the cost of these goods is rising to $16.50. A. Your company should make no adjustments to the inventory account. B. Your company should adjust the inventory account using the lower of the recent market values, which is $15. C. Your company should adjust the inventory account using the higher of the recent market values, which is $16.50. D. Your company should adjust the inventory account using the average of the recent market values, which is $14.50. 15. Coca-Cola reported cost of goods sold of $19.8 billion and gross profit for $6.0 billion. Its reported net sales was: A. $25.8 billion B. $19.8 billion C. $13.8 billion D. $ 6.0 billion 16. Which of the following is not a type of inventory held by a manufacturer? A. manufacturing inventory B. work in process inventory C. raw materials inventory D. finished goods inventory 17. A company has net sales of $612,850 and cost of goods sold of $441,252. The company's gross profit percentage is: (Hint: Gross profit percentage = Gross profit ÷ Net sales) A. 72.1%. B. 3.57%. C. 38.9%. D. 28.0%. 18. The Acme Corporation buys 300 units of merchandise in January at $5 each. Acme buys 500 units at $4 each in February and 200 units at $6 each in March. Acme sells 300 units during this quarter. Acme uses the periodic LIFO method. What is its cost of goods sold for the quarter? A. $1,600 B. $1,400 C. $1,500 D. $1,800 19. Increasing inventory turnover ratio indicates: (Hint: Inventory turnover ratio = Net sales ÷ average inventory) A. longer time span between the ordering and receiving of inventory. B. shorter time span between the ordering and receiving of inventory. C. shorter time span between the purchase and sale of inventory. D. longer time span between the purchase and sale of inventory. 20. The Knot, Inc. includes in its year-end inventory, goods that were in transit to a customer, Winston Wedding Consultants. The Knot must use ________________ to determine ownership of goods in transit. A. FOB consignment B. FOB shipping point C. FOB destination D. FOB inventory Exam 3 – Fall 2008 1. Which of the following statements about the effective interest amortization method is false? A) We must compute interest expense before computing the amortized discount or premium. B) The difference between interest expense and cash interest is the portion of premium or discount amortized. C) Interest expense is computed by multiplying the stated interest rate times the book value of the bonds payable. D) None of the above are false. 2. Schager Company purchased a computer system on January 1, 2006, at a cash cost of $25,000. The estimated useful life is 10 years, and the estimated residual value is $3,000. The company will use the double-declining balance method. Depreciation expense for the second year will be A) $5,000. B) $4,000. C) $3,800. D) $2,200. 3. If a bond is sold (issued) above its face value(par), the stated rate of interest was A) higher than market rate. B) lower than market rate. C) equal to market rate. D) not related to market rate. 4. During 2006, Avalon Company recorded bad debt expense of $10,000 and wrote off an uncollectible account receivable amounting to $15,000. Assuming a January 1, 2006, balance in the allowance for doubtful accounts of $18,000, the December 31, 2006, balance in the allowance account would be A) $23,000. B) $15,000. C) $13,000. D) $ 5,000. 5. Newton Corporation sold its $1,000,000, 7%, ten-year bonds to the public on January 1, 2006. The bonds pay interest annually, beginning on December 31, 2006. Newton received $1,153,420 in cash at the issuance of the bonds. The market rate of interest when the bonds were sold was 5%. Compute the amount of the premium that Newton Corporation should amortize on December 31, 2006, assuming the “effective-interest” method is used. A) $15,342 B) $14,865 C) $12,329 D) $10,276 6. What is the effect of writing off an account receivable on total assets? A) total assets increase B) total assets decrease C) total assets don’t change D) can not be determined without additional information 7. Boone Industries purchased a truck for $35,000 on January 1, 2009. The truck had an estimated useful life of 80,000 miles and an estimated residual value of $8,000. In the third year of ownership (2010), the car was driven 25,000 miles. Using the units of production method, the amount of depreciation expense for 2010 was A) $10,938. B) $ 8,438. C) $ 9,538. D) $11,238. 8. On December 31, 2010, Hamilton Inc. sold a used industrial crane for $600,000 cash. The original cost of the crane was $5,000,000 and its accumulated depreciation equaled $4,200,000 on December 31, 2010; they had been using the straight-line depreciation method. The estimated residual value was zero and its useful life was 25 years. What is the gain or loss on the equipment on December 31, 2010? A) $250,000 loss B) $400,000 gain C) $200,000 loss D) $200,000 gain 9. Which of the following is a typical example of a current liability? A) Revenue collected in advance. B) Accrued interest payable. C) The current portion of a long-term debt. D) All of the above are correct. 10. Assume Thomas Trucks Corporation uses the allowance method. During the year, Thomas made cash sales of $1,000,000 and credit sales of $3,000,000. At the end of the year, $500,000 still remained to be collected on the credit sales and the allowance for doubtful accounts had a balance of $15,000. If Thomas estimates 3% of all credit sales will be uncollectible, what amount of bad debt expense should Thomas recognize for the year? A) $15,000 B) $75,000 C) $90,000 D) $120,000 11. Straight-line depreciation A) results in higher net income numbers in early years than accelerated methods. B) results in higher expense in early years than accelerated methods. C) results in less total depreciation during the entire life of an asset than accelerated methods. D) results in a lower tax burden in early years. 12. Nell Computers, Inc. purchased a new machine which cost $25,000. In addition, Nell had to pay shipping charges related to the computer of $500. Training costs for employees related to using the machine totaled $1,500. Finally, Nell paid an additional $250 per year to insure the machine. At what amount should the machine be recorded? A) $25,000 B) $25,500 C) $27,000 D) $27,250 13. In 2003, Starbucks reported a current ratio of 1.52 and Krispy Kreme reported a ratio of 1.94. Which of the following is false? (Current Ratio = Current assets / Current liabilities) A) Starbucks has a higher level of liquidity. B) Krispy Kreme has more in current assets than current liabilities for the year. C) Starbucks lower current ratio could indicate an aggressive cash management strategy. D) Krispy Kreme is doing a better job of having cash available for payment of current liabilities. 14. Miranda Company lent $100,000 cash on September 1, 2007, and received a one-year 6%, interest-bearing note receivable. The required adjusting entry at the end of the accounting period, December 31, 2007, would be A) Interest receivable +2,000 Interest revenue +2,000 B) Interest receivable +6,000 Interest revenue +6,000 C) Notes receivable -100,000 Interest receivable +6,000 Cash -106,000 D) Interest revenue -2,000 Interest receivable -2,000 15. On January 1, 2009, Dorley Corporation issued $1 million of bonds for $1,073,613 when the market rate of interest was 6%. They are 10-year bonds paying 8% interest annually. If Dorley is using the effective interest amortization method, interest expense on December 31, 2009 will be A) $60,000 B) $64,417 C) $65,361 D) $67,361 16. The unadjusted balance of the allowance for doubtful accounts of Johnstone Supplies, Inc., is a credit balance in the amount of $28,947 on July 31, 2005. Based on the accounts receivable aging report, bad debt expense will be: Johnstone Supplies, Inc. Accounts Receivable Aging Report, July 31, 2005 Accounts receivable by due Account Total date Note yet due $126,500 1-30 days past due $89,200 31-60 pays past due $53,600 Over 60 days past due $31,800 A) B) C) D) Estimated % uncollectible 2% 12% 18% 35% $34,012. $5,065. $62,959. $50,434. 17. A high accounts receivable turnover ratio indicates: (Hint: Accounts receivable turnover = Net Sales / Average net accounts receivable) A) the company's sales are increasing. B) a large proportion of the company's sales are on credit. C) customers are making payments very quickly. D) the company is taking longer to sell inventory. 18. When the amount of a contingent liability can be estimated and its likelihood is possible but not probable, the company should: A) include a description in the footnotes to the financial statements. B) record the amount of the liability times the probability of its occurrence. C) record the amount of the liability as a long-term liability. D) omit the information about the contingent liability from its financial statements and footnotes. 19. A company expects to use equipment that cost $48,000 for 10 years and then sell it for $6,000. Using the straight-line method, the company would report depreciation for the equipment of: A) $4,200 per year. B) $8,400 per year. C) $4,800 per year. D) $9,600 per year. 20. The fixed asset turnover ratio measures the: (Hint: Fixed asset turnover ratio = Net sales / Average net fixed assets) A) useful life of long-lived assets. B) the average difference between book value and disposal value of fixed assets. C) useful life of intangible assets. D) efficiency with which the investment in fixed assets produces revenue. Final Exam – Fall 2009 1. At the end of last year, the company's assets totaled $860,000 and its liabilities totaled $740,000. During the current year, the company's total assets increased by $58,000 and its total liabilities increased by $24,000. At the end of the current year, stockholders' equity was A. $154,000. B. $120,000. C. $34,000. D. $178,000. 2. During March, the Long Life Consulting Company provides $23,000 in consulting services of which $12,000 is immediately paid for and $11,000 is on account. A.Cash increases $12,000, revenue increases $11,000, and stockholders' equity increases $23,000. B. Cash increases $12,000, Accounts Receivable increases $11,000, and revenues increase $23,000. C. Accounts Receivable increases $11,000, liabilities decrease $12,000, and stockholders' equity decreases $1,000. D.Revenues increase $12,000, liabilities decrease $12,000, and stockholders' equity is unchanged. 3. Which of the following direct effects on the fundamental accounting model is not possible as a result of transaction analysis? A. Increase a liability and increase an asset. B. Decrease stockholders' equity and increase an asset. C. Increase an asset and decrease an asset. D. Decrease stockholders' equity and decrease an asset. 4. Which of the following are policies and procedures of good internal control of cash? Segregation of duties Preparation of a bank reconciliation monthly Approval of all disbursements by check All of the above are good internal control policies and procedures A. B. C. D. 5. The Acme Corporation buys 300 units of merchandise in January at $5 each. In February, Acme buys 500 units at $6 each and in March it buys 200 units at $7 each. Acme sells 350 units during this quarter. What is the cost of goods sold under the LIFO method? A. $2,100 B. $2,300 C. $2,375 D. $2,450 6. Bateman Company reported total stockholders' equity of $58,000 on its balance sheet dated December 31, 2008. During 2008, it reported a net income of $4,000, declared and paid a cash dividend of $2,000, and issued additional capital stock of $20,000. Therefore, total stockholders' equity at January 1, 2008, was A. $38,000. B. $36,000. C. $34,000. D. $16,000. 7. During 2005, Shockglass Company recorded inventory purchases of $45,000 and cost of goods sold of $50,000. If inventory at the beginning of the year was $15,000, the ending inventory balance must have been: A. $10,000. B. $25,000. C. $26,000. D. $27,000. 8. On average, 5% of credit sales has been uncollectible in the past. At the end of the year, the balance of accounts receivable is $100,000 and the allowance for doubtful accounts has a credit balance of $500 net credit sales during the year were $150,000. Using the percentage of credit sales method, the estimated bad debt expense would be: A. $5,000. B. $7,000. C. $7,500. D. indeterminable; the percent of credit sales method cannot be used, because, based on this information, the aging of accounts receivable method should be used. 9. The amount of uncollectible accounts at the end of the year is estimated to be $25,000 using the aging of accounts receivable method. The balance in the Allowance of Doubtful Accounts account is an $8,000 credit before adjustment. Assuming no accounts are written off during the period, what will be the amount of bad debts expense for the period? A. $8,000. B. $17,000. C. $25,000. D. $33,000. 10. A piece of equipment was acquired on January 1, 2004, at a cost of $22,000, with an estimated residual value of $2,000 and an estimated useful life of four years. The company uses the double-declining-balance method. What is its book value at December 31, 2005? A. $5,500 B. $10,000 C. $11,000 D. $12,000 11. An asset is purchased on January 1 for $40,000. It is expected to have a useful life of five years after which it will have an expected salvage value of $5,000. The company uses the straight-line method. If it is sold for $30,000 exactly two years after its purchase, the company will record a: A. gain of $6,000. B. gain of $4,000. C. loss of $4,000. D. loss of $6,000. 12. On October 1, 2005, you borrow $200,000 at 6% interest and record the promissory note. In April and again in October of the following year, you are required to pay half the annual interest to your creditors. On December 31, 2005, your journal entry for the quarter should: A. Increase Interest Expense for $3,000 and increase Interest Payable for $3,000. B. Increase Cash for $3,000 and increase Accrued Interest for $3,000. C. Increase Interest Expense for $6,000 and decrease Cash for $6,000. D. Increase Interest Expense for $6,000 and increase Notes Payable for $6,000. 13. If the market rate of interest is 6%, a $10,000, 10-year bond with a stated annual interest rate of 8% would issue at an amount: A. less than face value. B. equal to the face value. C. greater than face value. D. that cannot be determined. 14. On January 1, your company issues a 5-year bond with a face value of $10,000 and a stated interest rate of 7%. The market interest rate is 5%. The issue price of the bond was $10,866. Using the effective interest method of amortization and rounding to the nearest dollar, the interest expense in the first year ended December 31 would be: A. $700. B. $543. C. $667. D. $759. 15. A company sells 1 million shares of common stock with a par value of $0.02 for $15 a share. To record the transaction, the company would: A. Increase Cash for $20,000 and increase Common Stock for $20,000. B. Increase Cash for $15 million and increase Common Stock for $15 million. C. Increase Cash for $15 million, increase Common Stock for $20,000 and increase additional paid-in Capital for $14,980,000. D. Increase Cash for $20,000, increase Capital Receivable for $14,980,000, increase Common Stock for $20,000 and increase additional paid-in capital for $14,980,000. 16. GE buys back 300,000 shares of its stock from investors at $45 a share. Two years later it reissues this stock for $65 a share. The stock reissue would be recorded as: A. An increase to Cash of $19.5 million and a decrease to Treasury Stock of $19.5 million. B. An increase to Cash of $13.5 million, an increase to Additional Paid-in Capital of $6 million, a decrease to Treasury Stock of $13.5 million, and an increase to Stockholders' Equity of $6 million. C. An increase to Cash of $19.5 million, a decrease to Treasury Stock of $13.5 million, and an increase to Additional Paid-in Capital of $6 million D. An increase to Cash of $13.5 million, and a decrease to Stockholders' Equity of $6 million, a decrease to Treasury Stock of $13.5 million, and an increase to Gain on Sale of $6 million. 17. On April 1, 2007, the premium on a one-year insurance policy on a building was paid amounting to $6,000. At the end of 2007 (end of the accounting period), the financial statements for 2006, would report A. Insurance expense, $6,000; Prepaid insurance $0. B. Insurance expense, $0; Prepaid insurance $6,000. C. Insurance expense, $1,500; Prepaid insurance $4,500. D. Insurance expense, $4,500; Prepaid insurance $1,500. 18. Amortization Inc. issued $10,000, 10%, 10-year bonds for an issue price of $10,777 . Amortization uses the effective interest method to amortize any premium or discount on issued bonds. Assuming a market rate of interest of 8%, what amount of premium should be amortized for the first year of the bond’s life? A. $ 78 B. $ 138 C. $ 862 D. $1,000 19. What of the following is not consistent with the primary purpose of financial accounting? A. To provide the SEC audited financial statements on a quarterly and annual basis. B. To provide investors with relevant information to use in decision making. C. To provide financial institutions with information relevant to lending decisions. D. All of the above are consistent with the purpose of financial accounting. 20. The principle which holds that all of the expenses incurred in earning revenue should be identified with the revenue recognized and reported for the same period is the A. revenue principle. B. liability principle. C. cost principle. D. matching principle. 21. A company has outstanding 10 million shares of $2 par common stock and 1 million shares of $4 par preferred stock. The preferred stock has an 8% dividend rate. The company declares $300,000 in total dividends for the year. Which of the following is true if the preferred stockholders have a current and cumulative dividend preference? A. Preferred stockholders will receive the entire $300,000, and they must also be paid $20,000 before the end of the current accounting period. Common stockholders will receive nothing. B. Preferred stockholders will receive $24,000 (8% of the total dividends). Common stockholders will receive the remaining $276,000. C. Preferred stockholders will receive the entire $300,000, and they must also be paid $20,000 sometime in the future before common stockholders will receive anything. D. Preferred stockholders will receive the entire $300,000, but will receive nothing more relating to this dividend declaration. Common stockholders will receive nothing. 22. Which of the following would be included in the calculation of net cash flows from financing activities? A. Cash proceeds from sales. B. Cash received from a sale of land. C. Dividends paid to stockholders. D. Cash used to purchases of equipment. 23. When the indirect method is used, if prepaid expenses fall during the accounting period, the change in prepaid expenses is: A. added to the change in the cash account. B. subtracted from net income. C. added to net income. D. subtracted from the change in the cash account. 24. Depreciation is added back to net income in a statement of cash flows prepared using the indirect method because it: A. reduces income but not cash. B. is a cash inflow. C. is a revenue. D. is a valuation concept. 25. Consider the following information: The company would report a net cash inflow from operating activities of: A. $17,500. B. $18,500. C. $21,500. D. $23,300. Use the 2005 financial statements of Pier 1 Imports, Inc. found in your attachment packet to answer the following 25 questions: 26. What is the return on equity (ROE) for the most recent year? A. 4.5% B. 5.8% C. 9.0% D. 10.6% 27. Assuming a market price of $25, what is the price/earnings ratio for the most recent year? (Hint: Use basic EPS) A. 18.4 B. 25.8 C. 36.2 D. 42.6 28. What is the net profit margin the most recent year? A. 3.2% B. 5.6% C. 7.9% D. 9.1% 29. Has the current ratio improved or declined since last year? A. the current ratio has increased B. the current ratio has decreased C. the current ratio has stayed the same D. can not be determined 30. What is the gross profit ratio for the most recent year? A. 28.3% B. 38.3% C. 42.1% D. 47.3% 31. Assuming all sales are on credit, what is the receivable turnover for the most recent year? (Hint: use other accounts receivable, net for net receivables) A. 25 times per year B. 81 times per year C. 128 times per year D. 146 times per year 32. What is the inventory turnover the most recent year? A. 3.1 times per year B. 5.7 times per year C. 6.9 times per year D. 8.1 times per year 33. What is the debt-to-assets ratio at the end of the most recent year? A. 0.26 B. 0.38 C. 0.42 D. 0.54 34. What amount of dividends were paid per share during the most recent year? A. $0 B. $0.30 C. $0.40 D. $1.10 35. What is the net cash flow from operating activities for the most recent year? A. $189,081,000 inflow B. $176,688,000 outflow C. $142,201,000 inflow D. $ 97,553,000 outflow 36. By what percentage did net sales increase last year? A. 1.6% B. 2.3% C. 3.1% D. 3.9% 37. What is the asset turnover for the most recent year? A. 2.4 B. 2.0 C. 1.8 D. 1.4 38. What is the effective tax rate for the most recent year? A. B. C. D. 36.5% 37.6% 38.9% 40.3% 39. What is the quality of income ratio for the most recent year? A. 1.6 B. 1.9 C. 2.1 D. 2.4 40. What is the largest source of cash (i.e., inflow) from financing activities? A. cash dividends B. purchases of treasury stock C. proceeds from stock options exercised D. beneficial interest in securitized receivables 41. What is the net value of property, plant, and equipment at the end of the most recent year? A. $ 3,852,000 B. $ 99,239,000 C. $159,040,000 D. $337,630,000 42. What did the company report as cash proceeds from the disposition of properties for the most recent year? A. $ 3,852,000 B. $ 99,239,000 C. $159,040,000 D. $337,630,000 43. What is the par value of the common stock? A. $ 0.01 B. $ 0.10 C. $ 1.00 D. $10.00 44. What is the balance in retained earnings at the end of the most recent year? A. $ 60,457,000 B. $630,997,000 C. $656,692,000 D. $664,369,000 45. What is the largest expense reported on the income statement for the most recent year? A. income tax expense B. selling, general, and administrative expenses C. interest expense D. cost of sales 46. How many shares of common stock are held in treasury at the end of the most recent year? A. 12,473,000 shares B. 14,459,000 shares C. 16,429,000 shares D. 93,389,000 shares 47. By what amount did cash change during the most recent year? A. $36,020,000 decrease B. $36,020,000 increase C. $178,289,000 increase D. $178,289,000 decrease 48. What amount of accounts payable are reported at the end of the most recent year? A. $ 14,116,000 B. $ 21,572,000 C. $ 102,294,000 D. $ 113,502,000 49. On what day does the company’s fiscal year end in 2005? A. December 31 B. February 26 C. February 28 D. March 1 50. What is the cash coverage ratio for the most recent year? A. 107.8 B. 167.3 C. 217.4 D. 256.3 FINAL EXAM ATTACHMENT PACKET RATIO/ITEM BASIC COMPUTATION PROFITABILITY RATIOS: Net Income 1. Net Profit margin 2. Gross Profit Ratio 3. Asset turnover ratio 4. Fixed asset turnover ratio 5. Return on equity (ROE) 6. Earnings per share 7. Quality of income 8. Price/earnings ratio Net sales revenue Net Sales Revenue – Cost of Goods Sold Net Sales Revenue Net sales revenue Average total assets Net sales revenue Average net fixed assets Net Income Average stockholders’ equity Net income Average number of common shares Net cash from operations Net income Stock price per share Earnings per share LIQUIDITY RATIOS: Net sales revenue 9. Receivable turnover 10. Days to collect Average net receivables 365 Receivables turnover ratio Cost of sales 11. Inventory turnover 12. Days to sell 13. Current ratio Average inventory 365 Inventory turnover ratio Current assets Current liabilities SOLVENCY RATIOS: Total liabilities 14. Debt-to-assets ratio Total assets RATIO/ITEM BASIC COMPUTATION Net income + interest expense + income tax expense 15. Times interest earned Interest expense Net cash from operations + Interest paid + income taxes paid 16. Cash coverage 17. Interest paid Net cash from operations Capital acquisitions ratio Cash paid for PPE Insert pages 30 – 33 of pdf file of Pier 1 Report (numbered 28 – 31 on actual report)…4 financial statement tables. KEYS Question 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 Exam 1 B D A C A D B B B B D C D B D B A C C D Exam 2 A D any C A B C C B B C A B A A A D A C C Exam 3 C B A C C C B C D C A C A A B B C A A D Final Exam A B B D B B A C B A B A C B C C D B D D C C C A D C C A B B D A B C C A C B D C D A C C D B A D B C