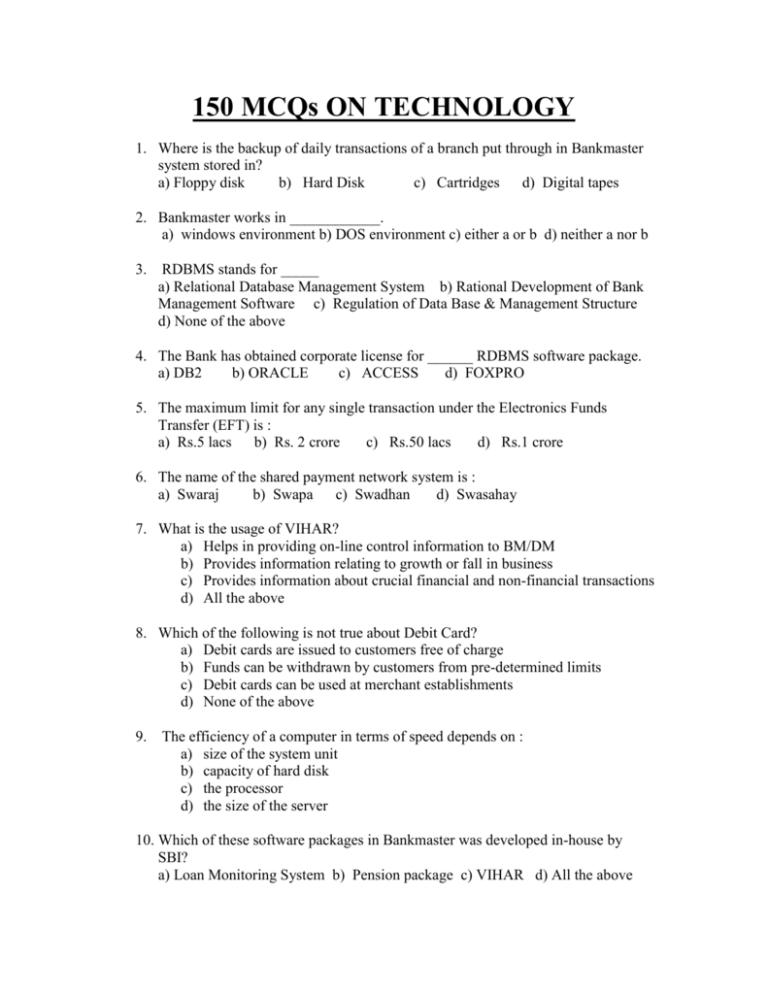

150 MCQs

advertisement

150 MCQs ON TECHNOLOGY 1. Where is the backup of daily transactions of a branch put through in Bankmaster system stored in? a) Floppy disk b) Hard Disk c) Cartridges d) Digital tapes 2. Bankmaster works in ____________. a) windows environment b) DOS environment c) either a or b d) neither a nor b 3. RDBMS stands for _____ a) Relational Database Management System b) Rational Development of Bank Management Software c) Regulation of Data Base & Management Structure d) None of the above 4. The Bank has obtained corporate license for ______ RDBMS software package. a) DB2 b) ORACLE c) ACCESS d) FOXPRO 5. The maximum limit for any single transaction under the Electronics Funds Transfer (EFT) is : a) Rs.5 lacs b) Rs. 2 crore c) Rs.50 lacs d) Rs.1 crore 6. The name of the shared payment network system is : a) Swaraj b) Swapa c) Swadhan d) Swasahay 7. What is the usage of VIHAR? a) Helps in providing on-line control information to BM/DM b) Provides information relating to growth or fall in business c) Provides information about crucial financial and non-financial transactions d) All the above 8. Which of the following is not true about Debit Card? a) Debit cards are issued to customers free of charge b) Funds can be withdrawn by customers from pre-determined limits c) Debit cards can be used at merchant establishments d) None of the above 9. The efficiency of a computer in terms of speed depends on : a) size of the system unit b) capacity of hard disk c) the processor d) the size of the server 10. Which of these software packages in Bankmaster was developed in-house by SBI? a) Loan Monitoring System b) Pension package c) VIHAR d) All the above 11. ROM stands for : a) Random Only Memory b) Readable Only Memory c) Read Only Memory d) Random Other Memory 12. What is the software package used for transmission of financial messages, etc. from one office to another within our Bank known as ? a) SFMS b) SBI Net c) Banknet d) Infinet 13. I Kilobyte equals ____ bytes. a) 1000 b) 1024 c) 100 d) 1008 14. Data transfer rate in computers is measured in _____________. a) Bauds b) MBPS c) Bytes d) bits per seconds 15. Internet banking site of our Bank is certified by _________ for security. a) Verisign b) TCS c) Sify d) Wipro 16. ISP stands for ; a) Internet Service Product b) Internet Service Provider Product d) Internet Source Power c) Internet Source 17. What is the software used for Tele-banking in SBI? a) CRAFT b) Kraft c) Datacraft d) Master Craft 18. SFMS software has been developed by ______. a) Sify b) TCS c) China Systems d) FNS, Australia 19. Which department looks after technology related areas in the Circle? a) Computers & Communications Dept. b) Information Technology Services Dept. c) ATM Dept. d) BPR Implementation Team 20. The name of the software used in our ATMs is _______. a) Bankmaster b) HCL c) Branch Power d) ACI’s Base 24 Software 21. What do you mean by the term “Convergence”? a) bringing together information, communication and entertainment b) arrangement of loans from different banks for a borrower c) conversion of foreign currency into domestic currency and vice versa d) providing different technology enabled services to customers 22. The minimum length of password in Core Banking Solutions is : a) eight b) six c) ten d) five 23. In networked ATMs, the branch database is connected to : a) ATM Switch Centre, Belapur b) Steps Office, Belapur d) all ATMs c) CDC, Belapur 24. The facility of mini-statement in ATMs shows details of the last ___ transactions in a customer’s account. a) 5 b) 10 c) 8 d) 12 25. The facility of mini-statement is available to customers ____ a) 24 x 7, at all times b) only on working days of the branch c) only during working hours of the branch where the customer maintains his account d) at all times when the server is up at the branch maintaining the customer’s account 26. What is the maximum amount of transactions that can take place per day through an ATM-cum-Debit Card at a Merchant Establishment or Point of Sale? a) Rs.5000 b) Rs.15,000 c) Rs.25,000 d) Rs. 50,000 27. The National Financial Switch (NFS) promoted by IDBRT relates to : a) ATM connectivity among banks b) Single financial software for all banks c) internet banking connectivity d) networked foreign exchange facility 28. Cheque truncation refers to the process by which : a) cheques are returned to customers after payment b) entry of stopped cheques into the computer system c) cheques payable at different cities / branches d) physical movement of cheques is curtailed, being replaced by electronic records of their content 29. SBI DATANET has been introduced for : a) Transfer of daily mail to controlling office b) Efficient funds settlement and forex related operations c) To replace transfer of data via internet d) Networking of ATMs 30. Which of the following is an advantage of using a Local Area Network (LAN)? a) Protects against virus infection b) provides central storage and processing to a group of users c) provides programme integrity from unauthorized changes d) protects against improper disclosure of data 31. Audit Trail is : a) a record provided by business or financial software of all the transactions that have taken place during previous amendments of data in order that subsequent checking may take place b) a statement of account copied into a computer system c) a statement of observations made by an Auditor d) None of the above 32. A virus is a : a) a program which causes problems in a computer b) a device introduced in a software package to steal data c) damage caused to components of a computer due to dust, contamination,etc. d) a routine introduced into a computer program, which when activated, produces unwanted results, and spreads infection from one disk to another 33. A password is a : a) a device for using computer software packages b) a method of using computers c) a group of characters required to be input correctly when demanded by a computer package, before it will allow access to the user d) None of the above 34. What does a bug in a computer system mean? a) a virus infection b) problem in booting a computer c) Problems caused by insects getting inside the CPU d) Mistake in a program or error in the working of a computer 35. In CBS, Customer Information File is created for : i) all the joint account holders individually ii) nominee of an account iii) introducer of an account a) i only b) i & ii only c) i & iii only d) i, ii & iii 36. CISLA stands for : a) Credit Information System for Loans & Advances b) Central Information System regarding Liabilities & Assets c) Central Intelligence System for Loans & Advances d) Central Intelligence Scheme for Liabilities & Assets 37. In Core Banking Solutions system, a user’s id is her _____ a) the initials of her name b) the first six letters of her name c) unique number allotted by System Administrator d) PF index number 38. What is the name of the product in SBI which speeds up collection proceeds of high networth clients? a) SBI FAST and CMP b) MOD c) Corporate Liquid Term Deposit d) funds Transfer Scheme 39. In Bankmaster, only ____ will create and maintain Users in Netware. a) Branch Manager b) Cash Officer c) Systems Administrator d) User Control Officer 40. Only _______ will create and maintain Users in Bankmaster. a) Branch Manager b) Cash Officer c) Systems Administrator Control Officer 41. The movement and safe keeping of DATs should be recorded in d) User a) ex-safe custody register b) media back up register c) media movement record register d) storage media record register 42. VIRAT report is generated monthly on a) Last Friday b) Last day of the month d) None of the above c) Last Saturday of the month 43. The EOD operation for CBS branches is done at a) branches concerned b) respective LHOs c) CBD, Belapur the above d) None of 44. The software used for Trade finance transaction for processing transactions under LCs and Bank Guarantees is known as a) China Systems – Exim Bills b) Exim Bills Accounts c) Import Export Bills d) IBS net 45. To maintain General Ledger in Core Banking Solutions, the Bank has procured a product called ________ from __________________, USA. a) Finance One, Comlink b) Finance One, China Systems c) Bancs24, FNS d) China Systems, Exim Bills 46. Through Internet Banking, a customer can avail which of the following services : a) Payment of credit card bills b) invest in SBI Mutual Funds c) Operate his demat account d) Book his train ticket e) a & d f) all the above 47. A user of Internet Banking has to use his profile password to access which of the following : a) third party funds transfer b) give nicknames to his accounts c) define trusted third and fix limits for third party transfer d) transact his PPF account e) a, d & c f) b, c g) all the above 48. Through Internet Banking, a customer can request for which of the following ? a) Opening of a deposit account b) issue of cheque book c) request for cash withdrawal d) all the above e) a & b 49. E-pay Services covers payments to which of these of these ? a) LIC b) Donations to Child Relief & You (CRY) c) Reader’s Digest subscription d) Only a e) all the above f) a & b 50. The purpose of Pre-Printed Kits for Internet Kits is : a) instant delivery of user ID and password b) immediate registration of customers in system and automatic flagging of their accounts c) to ensure safety, as dispatch directly to customers is fraught with risk d) to verify the genuineness of customers before handing over the kits e) all the above f) only a & b 51. Pre-printed kits of Internet Banking are kept in the custody of : a) Branch Manager b) Systems Administrator c) Internet Banking Officer d) Joint custodians of the branch, along with other security forms 52. The different rights available to customers in Internet Banking are : a) Enquiry rights b) Modification rights c) Messaging rights d) Enquiry and Transaction rights 53. In ELRECON, statements of transactions in Branch Clearing General account, Drafts account, Agency Clearing General Account and RTC account have to be sent on _____ basis. a) Daily b) Weekly c) Fortnightly d) Monthly 54. User Locked Out Register is maintained by _____. a) Branch Manager b) User Control Officer c) Systems Administrator d) Dy. Manager (Accounts) 55. In Corporate Internet Banking, customers can make enquiry and put through transactions in __________ type of module only: a) Khata b) Vyapaar & Vistaar c) both a & b d) only Vistaar 56. For using the E-rail facility, a customer should : a) be an INB customer b) register himself online with www.irctc.co.in c) neither a nor b d) be an SBI credit card holder e) both a & b 57. Can a customer cancel online a rail ticket booked through e-rail? a) yes, and the refund will be given online after 4 days b) no, cancellation has to be done at a railway booking office only c) can be done in case of tickets booked from Delhi only d) None of the above 58. In case of rail tickets booked through e-rail, the ticket : a) will be sent by courier to the address given by the customer b) can be printed by the customer himself and produced during the journey c) will have to be collected from the nearest railway booking office d) a or b 59. In e-pay services offered to Internet Banking customers, a customer can : a) add the biller whose bills he wants to pay b) select auto-pay or view & pay options c) pay the bills of his close relatives also d) only a & b e) all the above 60. What is the expansion of VPIS ? a) Valuable Persons In System b) Very Popular Information Software c) Variable Products Information Software d) Valuable Paper Inventory System 61. On receipt of information of loss of ATM card, the Branch should immediately communicate the ATM card number to a) GE Caps b) ATM Switch Centre , Belapur c) GECBPMSL d) AGM (ATM) at Corporate Centre 62. The el-Recon programme is used by branches for a) Sending Inter-Office Transaction statements directly to Corporate Centre b) Sending Inter-office Transaction statements to Controlling Office c) Sending Inter-Office Transaction statements to CBD , Belapur d) Electronic reconciliation of forex transactions 63. Which of the following processes will not be implemented under CBS ? (i) Statement of accounts through delivery channels (ii) Centralised issuance of personalised cheques (iii) Stop payment registers on system (iv) Centralised maintenance of Government accounts (v) Breaking of MOD by ATM transaction (vi) SMS to customers for transactions above threshold limit a) v b) iii & v c) all d) none of these 64. In CBS, BGL accounts begin with ____ and consist of : a) 9 & 9NNNN + 5 Digit branch code + check digit b) 1 & 1NNNN + 4 Digit branch code + check digit c) 9 & 9NNNNN + 5 Digit branch code d) None of the above 65. The main differences between Core Banking System usage and Bankmaster are : a) Extensive use of Mouse with Keyboard b) Use of Internet Explorer c) Multiple Screen Usage d) Works on Windows platform e) All the above 66. What is SMART GOLD? a) SBI Gold Credit Card b) ATM- cum - Debit card c) Co-branded card of SBI, with IOC d) ATM cards issued to farmers under Kisan Gold Card Scheme 67. Which of the facilities are available in SBI Vishwa Yatra Card? a) Balance enquiry facility through SBI/Visa ATMs throughout the world. b) Balance enquiry and view/download details of transactions through www.onlinesbi.com,. c) Balance information after each transaction through SMS d) Only a & b e) All the above 68. A customer can reload his SBI Vishwa Yatra Card in these ways : a) by authorizing his branch to debit his account and top up the card b) remote reload by a person other than the customer himself c) at any Visa or SBI ATM d) all the above e) a & b only 69. MICR system was introduced a) computers could not be effectively used in banks b) there were innumerable frauds in banks and for avoidance of such increasing frauds c) to speed up the clearing operations d) for faster settlement of funds between banks 70. SBI Datanet can be used for : a) reporting currency transfer b) reporting government transactions c) transfer of funds to other Datanet branches d) all the above 71. The Information Technology Act, 2000 does not provide for : a) legal recognition for transactions carried out by electronically b) retention of documents in electronic form c) filing and submission of documents with Government agencies d) purchase of immovable properties online 72. The Information Technology Act, 2000 enables banks to : a) use digital signature on LCs, BGs and other documents b) transfer funds by electronic means c) maintain banking records in electronic form and use the same as evidence in court of law d) file TDS and other returns online e) all the above 73. The first public sector bank in India to use cheque truncation system is : a) Bank of Baroda b) Punjab National Bank c) ICICI Bank d) SBI 74. Which of the following statements about NEFT is false? a) It is a funds settlement system between banks using SFMS backbone b) Settlements take place twice in a day c) Uses end to end Public Key Infrastructure based security d) It is a deferred net funds settlement product unlike RTGS. 75. Real Time Gross Settlement is a payment system which : a) operates on the basis of net settlement of funds between banks b) is only for inter-bank transactions c) is for both inter-bank, customer- to- bank and bank-to-customer transactions d) has replaced the SEFT 76. ______ plans to install low-cost ATMs with biometric recognition technology in rural areas. a) SBI b) ICICI Bank c) Yes Bank d) Stan Chart 77. Disaster Recovery Plan is : a) a plan drawn up to be used when computer systems fail b) a pre-determined blueprint to be used for resuming any critical business function within a defined time frame, minimizing loss in response to any disaster c) the procedure of taking back-up of branch data and storing the same in off-site locations d) prepared to deal with natural disasters only 78. The various types of biometric technology used are ; a) hand geometry system b) voice recognition technology c) fingerprint technology d) all the above e) a & c 79. WAP stands for : a) Wide Area Procedure b) Wireless Application Protocol c) Wireless Access Product d) Web-based Application Protocol 80. The major vendors of cheque truncation solution are ; a) Wipro Ltd. b) Polaris Software c) NCR Corporation d) Diebold 81. What are the facilities available to corporates under Vyapaar of Corporate Internet Banking? a) Funds transfer between accounts b) Draft issue c) Payment to registered suppliers d) all the above f) only a, b 82. The main differences between Vyapaar and Vistaar modules of Corporate Internet Banking are : a) The ceiling on a single transaction in Vyapaar is Rs.5 lacs, while there is no such restriction in Vistaar b) Vistaar has the Bulk uploading facility for making multiple transactions like salaries, vendor payments, etc., which is not available in Vyapaar c) Vistaar can be used for corporates maintaining accounts at multiple branches of SBI, and can allow inter-branch transfer of funds. But Vyapaar is for corporates maintaining accounts at any one branch of SBI d) Both Vyapaar and Vistaar can be used for making online tax payments or excise duty payments e) Only a, b & c 83. Which modules in Corporate Internet Banking can be used for enquiry only? a) Khata b) Khata Plus c) both a & b d) a, b and Vistaar 84. The main difference between Khata and Khata Plus module of Corporate Internet Banking is : a) Khata is for enquiry only whereas Khata Plus can be used for transactions also b) Khata module allows only funds transfer but Khata Plus allows both funds transfer and third party transfers c) Khata Plus can be used for making payments to registered suppliers also d) Khata Plus can be used for enquiry on all accounts at various branches across the country while Khata is used for enquiry on accounts at one branch only 85. The features available on Corporate Internet Banking are : a) single debit with multiple credits b) single credit with multiple debits c) operating instructions for financial powers and mode of operations can be given online d) a & b e) all the above 86. Can a minor be issued an ATM card? a) Yes, if he is over 14 years of age b) No c) Yes, if his guardian signs the request for ATM card, and agrees to take full responsibility for the same d) Yes, if he is over 10 years of age 87. Smart Stream Reconciliation is : a) a software used in Elrecon for reconciling inter-office entries b) a software for on-line enquiry, investigation and reconciliation of forex entries c) a software for Asset Liability Management at Corporate Centre d) None of the above 88. Hot listing of an ATM Card means : a) Information circulated to branches regarding lost or stolen cards b) List of cards which have been de-activated by ATM Switch Centre c) Stopping the operations on a card on the network by ATM Switch Centre, on account of its loss or damage, on notice from the card holder d) Message sent by Switch Centre advising caution to branches regarding the ATM card of a particular customer 89. The software package used for storing and retrieving signatures of customers and officers on our computer system is called a) Signtree b) Shubhtrieve c) Scansign d) Signtrieve 90. Global Link Services is a a) a communications hub for routing forex transactions between our branches and foreign offices b) an agency for routing remittances from USA and Gulf countries to India c) an intra-net connecting our foreign offices with FD, Kolkata d) a software for reconciling our forex transactions on a real-time basis 91. The 24-our toll free helpline number for reporting lost or stolen ATM cards is : a) 1600 – 112211 b) 1600 – 110011 c) 1600 – 221122 d) None of the above 92. What is a Status List in Bankmaster? a) a list showing the closing balances of all accounts in a branch as at the end of a particular day b) a list giving details of limit, drawing power, outstanding , rate of interest, etc. of all accounts in a branch c) a list giving the details of maturity date and interest accrued on all time deposits at a branch d) a list giving particulars of deposits which are due to mature in the month, and loan accounts due to be closed during the month 93. The name of the software package purchased from Infosys for networking of our foreign offices is ______. a) flexicube b) CS-Exim Bills c) Finacle d) 3 G Finance 94. OLTAS is : a) an online tax reporting system for receipt of direct taxes by banks b) an inter-bank funds transfer system c) easy way of paying direct taxes online by customers d) collection of direct taxes by banks through internet 95. E-tax is a facility which : a) enables a Internet Banking customer of our Bank to make payment of his direct taxes or excise & customs duties online b) is offered by SBI and IDBI Bank only, in collaboration with NSDL c) processes the request for tax payment by a customer and issues him a Challan Identification Number (CIN) online d) is available for customers whose PAN/ TAN is available in the database of the IT department e) All the above 96. SBI Express Remit is : a) a web based product for inward remittances to India from the USA b) a web based product for making both inward and outward remittances in forex to USA c) a web based product for making remittances in forex to any country in the world d) a web based product for inward remittances to India from the Middle East 97. SBI Express is : a) a web based product for inward remittances to India from the USA b) a web based product for making both inward and outward remittances in forex to USA c) a web based product for making remittances in forex to any country in the world d) a web based product for inward remittances to India from the Middle East 98. The main features of SBI Express Remit are : a) Direct online money transfer from a local bank account in USA to beneficiary’s account in India with 4000 SBI branches or 30 other banks in India b) Free demand drafts issued and couriered to beneficiaries or their banks in India, payable at over 9000 branches of SBI in India c) Online tracking of remittance be remitter d) Standing instructions facility for periodic remittances e) All the above 99. Under SBI Express Remit, remittances to India can be made : a) by persons having accounts with our branches in USA b) to persons having account with SBI branches only c) up to a ceiling of USD 5000 per day or, USD 15,000 per week with a minimum of USD 50 d) to reach the beneficiary within 15 days 100. SBI has recently tied up with ______ agency for money transfers from abroad to India. a) Western Union b) FedExpress c) Speed Post d) None of the above 101. SBI Connect, the dedicated leased line connectivity, is maintained by : a) TCS b) Financial Network Services, Australia c) Datacraft, Singapore d) HP Systems, USA 102. B@ncs 24 means : a) Bank’s Automatic Networking Connect System for 24 hours b) Bank’s Automation & Networking Control System for 24 hours c) Bank’s Automation & Networking Connection System for 24 hours d) Bank’s Automatic & Networking Control System for 24 hours 103. In networked ATMs, the branch database is connected to : a) ATM Switch Centre, Belapur b) Steps Office, Belapur c) CDC, Belapur d) directly to ATM 104. The software used in telebanking is : a) Datacraft b) Intrasoft c) Softcraft d) Craft 105. The software used in SBI for conduct of governement transactions and electronic reporting has been developed by : a) TCS b) IDBRT c) Infosys d) SBI 106. The turnkey solution provider for implementing National Financial Switch is a) TCS b) HP Systems c) Euronet Worldwide d) China Systems 107. SBI’s share in GE Capital Business Processing & Management Services Pvt. Ltd. is ________. a) 40% b) 50% c) 60% d) 75% 108. The validity period of SBI’s ATM-cum-debit card is : a) 2 years b) 5 years c) valid till 2049 if issued after November, 2002. d) 3 years 109. The charges recovered from a customer for a new ATM Card is Rs.____. a) 100 b) nil, it is given free of cost c) 200 d) 50 p.a. 110. The charges payable by a customer for a duplicate ATM card is Rs.____. a) 100 b) 200 c) 50 d) 100 for SB account-holders and 200 for Current account holders. 111. The procedure of our Bank for dispatch of ATM cards to customer is : a) Cards and PIN mailers sent by courier to the customer directly b) Cards and PIN mailers are sent by separate couriers to customers directly c) Cards and PIN mailers sent to branch and collected by customer there d) Cards sent by Speed Post to customer directly and PIN mailers sent to branch 112. Debit Cards can be used at merchant establishments for purchase of goods or services if they are displaying the ________ logo. a) VISA Electron b) Maestro c) Mastercard d) Sodexho 113. Connectivity of ATMs is maintained by : a) HCL Comnet & Datacraft b) BSNL c) HP Systems d) None of the above 114. Our bank has entered with Bilateral Agreement for ATM sharing with : a) ICICI Bank & UTI Bank b) Bank of India, Punjab National Bank c) UTI Bank, HDFC Bank, Andhra Bank, PNB & Indian Bank d) All the above 115. The charges for using other bank ATMs under Bilateral Agreement are : a) Rs.50 for withdrawal and Rs.18 for enquiry b) Rs. 40 for withdrawal and Rs.20 for enquiry c) Rs. 60 for withdrawal and Rs.20 for enquiry d) Rs.18 for withdrawal and Rs.7 for enquiry 116. The software used for running ATM at ATM Switch Centre, Belapur is : a) Base – 24 b) Craft c) Group Wise d) Oracle 117. Technical support for ATM Switch Centre, Belapur is provided by : a) Financial Software & Systems, Chennai b) Financial Networking Services, Australia c) HCL Comnet d) NCR Corporation 118. Offline transactions in SBI ATMs is made possible through means of a) Opticash b) Positive Balance Files c) GroupWise d) None of the above 119. Through which account is replenishment of ATM cash routed in Bankmaster? a) System Suspense – ATM account b) Steps A/C – ATM Cash c) ATM Switch Centre A/C d) IBIT – ATM Cash Replenishment A/C 120. Opticash is : a) management of ATMs by outside agencies b) management of cash in ATMs by NCR to avoid cash outages c) enabling reading of cash balances in an ATM by Switch Centre d) none of the above 121. RABMN stands for : a) Remote Area Business Message Network b) Remote Area Business Management Network c) Regional Area Bank Management Network d) Regional Area Bank Messenger Network 122. Banknet has been established by : a) IDRBT b) SBI c) Income Tax Department d) RBI 123. In ATM, PIN stands for a) b) c) d) Personal Index Number Permanent Index Number Personal Internet Number Personal Identification Number 124. SBIR is : a) State Bank Internet Remittance b) State Bank Immediate Remittance c) State Bank Instant Remittance d) State Bank Indian Remittance 125. Under State Bank Instant Remittance, credit is given to the beneficiary’s account on : a) 3rd day b) next day c) same day d) 3rd working day 126. In State Bank Rapid Remittance, credit is given on : a) 3rd day b) next day c) same day d) 3rd working day 127. Saraf Committee was set up to study : a) Remittance system b) Electronic transfers c) Clearing systems d) Payment systems 128. The monitoring center for SBI Connect network is : a) ATM Switch Centre b) Datacraft Asia c) Networking Operation Centre d) Data Network 129. Straight Through Processing (STP) is solution used for : a) Loan Management b) Asset Liability Management c) Treasury Management d) NPA Management 130. SBI has drawn up IT plans for the next 5 years in consultation with : a) McKinsey & Co. b) Deloitte & Touche c) KPMG d) Ernst & Young 131. The software solution used for Asset Liability Management in SBI is : a) Oracle Financial Solutions Application Suite b) Oracle Funds Services Application c) Oracle Futures Services Application d) Oracle Financial Services Application 132. Treasury management software solution is provided to our Bank by : a) China Systems b) FNS, Australia c) TCS d) Reuters / Unisys 133. INFINET is used for : a) Electronic Funds Transfer b) SFMS & EFT c) Swift 134. SBI Datanet is used for : a) Product marketing, training and government transactions b) Forex, government transactions, agency clearing, TTs c) Data mining, data warehousing, retrieval d) ATM, Internet Banking and Telebanking d) Single Window 135. SBI Datanet is used for sending messages from : a) administrative offices to branches b) branch to branch c) branch to administrative offices d) branch to branch and branch to administrative offices 136. The functionality of INFINET is : a) e-mail, Electronic Data Interchange, Internet b) Collections, RTGS, EDI, E-mail c) Swift, RDBMS, Elenor, E-recon d) Internet, ATM, e-recon 137. National Informatics Centre (NICNET) network provides service to : a) banks b) government departments c) Govt. departments & banks d) banks & RBI 138. EDI is used for transmission of data between various terminals of : a) SBI and Income Tax Department b) SBI and CBDT c) Air cargo /Airport branches and Customs Offices for crediting Duty Drawbacks d) None of the above 139. The integration of multiple technologies of a depository participant, banks, stock exchange interface is done through : a) e-banking b) e-broking c) e-commerce d) internet banking 140. The common types of Smart Cards are : a) Debit, Credit and Gold Cards b) Chip, Debit and Credit cards c) Storage /Memory, Intelligent and Hybrid cards d) Biometric recognition enabled cards, Intelligent and Storage cards 141. RDRecon stands for : a) Risk Management department Reconciliation b) Rupee Drafts Reconciliation c) Risky Drafts Reconciliation d) Rupee Drawings Reconciliation 142. Group Wise software package is used for Electronic Funds Transfer under the _____ project. a) Steps b) SFMS c) Swift d) SWS 143. SMS alerts to customers regarding credits / debits to their accounts, or when the balance in their accounts exceeds a specified threshold, is available only for : a) customers with ATM card b) customers of Core Banking Branches c) customers who have availed Internet Banking facility d) High Networth individuals 144. Branch Locator on our Bank’s website gives details of a branch such as : a) Name, address, e-mail address and telephone number of the branch b) The kind of business handled by the branch c) The total business, profit and NPA figures of the branch d) The names of the different products offered at the branch e) All the above f) Only a, b & d 145. “Score at Core” is an item which : a) On the website “statebankofindia.com” b) Appears in the NBG news bulletin c) Appears in the quarterly house magazine of ITS Department d) On the Bank’s intranet site “sbitimes.com” 146. Forex rates on a daily basis are : a) displayed in FD-Calcutta’s page on sbitimes.com b) displayed on the Reuter screen c) sent by fax to Overseas branch in each Circle by FD, Calcutta d) obtained by branches dealing in forex through fax/ e-mail from FD, Calcutta 147. SBI has recently tied up with Indian Railways to bring out : a) Shubh Yatra Card b) Railway Pass for suburban travelers in Mumbai c) Railway Card d) Season Tickets for travel during festival season 148. Our Bank’s intranet site “sbitimes.com’ provides links to : a) onlinesbi.com b) mail.sbi.co.in c) RBI Master Circulars e) Indian Railways f) all the above g) a, b, d d) e-circulars 149. e-learning initiative has been started by ______ in NPA, Personal Segment Advances modules for officers. a) SBSC, Hyderabad b) SBA, Gurgaon c) SBIICM d) SBIRD 150. SBI’s toll-free help-line phone number is : a) 1600 112211 b) 1600 425 8002 c) 1600 123 112233 d) None of the above 151. The telephone number of the toll free SBI Contact Centre for ATMs is a) 1600 112211 b) 1600 425 8002 c) 1600 123 112233 d) None of the above 152. Through SBI ATMs, a customer can make donations to : a) Vaishno Devi b) Shirdi Saibaba c) Tirupati Tirumala Devasthanam d) Sabarimala Ayyappa Swamy e) all the above f) a, b & c 153. SBI e-trade is a facility, whereby corporates can : a) trade in shares and debentures on the stock market b) make purchases of their raw materials and sales to their distributors / agents c) request for opening of LCs / BGs online and also authorize payment of their bills, etc. d) Purchase and sell government securities 154. KEY 1 2 3 4 5 6 7 8 9 10 101 102 103 104 105 106 107 108 109 110 C B A B B C D B C D C B A D D C A C B B 11 12 13 14 15 16 17 18 19 20 C A B B A B A B B D 111 112 113 114 115 116 117 118 119 120 21 22 23 24 25 26 27 28 29 30 D C A C D A A B D B A B A B D C A D B B 31 32 33 34 35 36 37 38 39 40 A D C D D A D A C D 121 122 123 124 125 126 127 128 129 130 A D D C B C D C C C 131 132 133 134 135 136 137 138 139 140 41 42 43 44 45 46 47 48 49 50 D D B B D B C C B C D C C A A E F E E F 51 52 53 54 55 56 57 58 59 60 141 142 143 144 145 146 147 148 149 150 D D A C B E A D E D D A C F D A C F B B 61 62 63 64 65 66 67 68 69 70 B C A A E C E E C D 151 A 152 F 153 C 71 72 73 74 75 76 77 78 79 80 D E B B C B A D B C 81 82 83 84 85 86 87 88 89 90 D E C D E A B C D A 91 92 93 94 95 96 97 98 99 100 A A C A e A D E C A