BUAD 250a - USC Marshall

advertisement

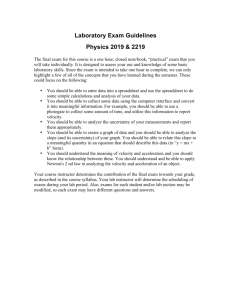

Merle Hopkins, BUAD 250a Syllabus, Page 1 of 10 BUAD 250a: Core Concepts of Accounting Information Dr. Merle Hopkins Spring 2006 Class Meeting Times: Section 14520 MW2 SAL 101 2.00-3.50 pm Professor Office Location: B4a [Basement of ACC] Professor Office Telephone: (213) 740-4857 Instructional Assistant [IA] Office Location: B4 [Basement of ACC] TAs Office Phone: (213) 821-5932 Professor E-Mail Address: mwh@marshall.usc.edu TAs will monitor BUAD250a@marshall.usc.edu when available during office hours. Professor Office Hours: Mondays 8:00 am to 9:45 am Wednesdays Noon to 1:30 pm And by appointment USC Information Line (213) 740-2311 or listen to 91.5 KUSC Radio To report USC Emergencies: (213) 740-4321 USC Emergency Information Hotline (213) 740-9233 Prerequisites: None Co-Requisite: Econ 203 Course Materials Required: 1. Adding Value with Financial Accounting Exercises, Merle W. Hopkins, Thomson Learning, 2005.* 2. Financial Accounting by Stice & Stice, South-Western Publishers, 2006 Edition* (custom bound with paperback cover). *Available in the USC Bookstore in a shrink-wrapped package. Additionally, there is a Study Guide: Study Guide for Core Concepts of Accounting Information, Merle W. Hopkins, 2005. This can be obtained from the instructor as a word document without charge. Students may print this if desired at their own expense, or the instructor can have this printed at a special low university rate of 2.25 cents per page in 2005-06 (about $4.50). Optional materials: Business periodical to stay abreast of current business developments. Merle Hopkins, BUAD 250a Syllabus, Page 2 of 10 Course Objectives Accounting has often been called the ‘language of business’. Core Concepts of Accounting Information should help you to begin to understand and communicate in this language. The course should also help you gain an appreciation for the uses of accounting information and limitations inherent in that accounting information. Very few people achieve serous levels of success in business without a fundamental understanding of accounting principles and concepts. Finally, this course should help you learn about the nature and responsibilities of careers in the accounting profession. Upon completion of Core Concepts of Accounting Information, you should: 1. Have a general understanding of the role of the accounting profession in our economic society, including: (a) an awareness of the process of regulation and self-regulation of the profession (including the accounting standard setting process) in the United States, and (b) the increasing internationalization of accounting. 2. Have a basic understanding of how accounting is used in business, including an appreciation of the role of financial and managerial accounting, systems, tax and auditing. 3. Have an introductory knowledge of how to use the available tools in accounting – including such tools as the professional literature, research literature, – to help clarify accounting concepts and issues, analyze options, and make business decisions or solve problems. 4. Grasp the importance of ethics and values in your career. Course Overview Core Concepts of Accounting Information acknowledges there are five functional areas of accounting: financial accounting, managerial accounting, taxation, systems and auditing. BUAD 250a is a financial accounting course. The other four functional areas of accounting are mentioned when appropriate to establish that accounting extends beyond financial accounting. These functional areas are viewed from the perspectives of managers, preparers and users of accounting information. Following is a brief overview of the course content. I. Financial Accounting: This involves the study of the concepts, standards, and procedures that comprise generally accepted accounting principles [GAAP]. GAAP covers the external reporting process and includes the rules for the preparation of the basic financial statements. These financial statements have a wide audience of users including present and potential investors, management, labor unions, Merle Hopkins, BUAD 250a Syllabus, Page 3 of 10 employees, creditors and governmental entities among others. The financial accounting section will cover these topics. A. B. C. D. E. F. G. H. I. II. An overview of the financial reporting process including the objectives of financial reporting. The underlying concepts, principles and conventions governing the financial reporting process. This will include developing your ability to apply these concepts, principles and conventions in a wide variety of situations. The accounting cycle involves analyzing, recording and summarizing an entity’s transactions in the books and records of an organization in order to prepare financial statements as well as other financial information. The financial statements include classified balance sheets, multiple step income statements and statements of cash flow. Revenue and expense recognition will be developed in some detail because these rules govern revenues and expenses appearing in a particular year’s income statement. Revenue recognition criteria will be examined to better appreciate how and when revenues appear in an income statement. Uncollectible Accounts Receivable will be a part of this coverage as well as related topics. Inventories and Cost of Goods Sold will be explored because of their significance in balance sheets and income statements. Understanding financial statements of many firms will require knowledge of accounting methods for Inventories. Operating assets (property, plant, and equipment) present significant accounting issues because of their size in most enterprises. The variety of acceptable accounting methods for operating assets makes this topic important. Inter-corporate and other investments can pose material accounting issues within the investors’ balance sheets. Managers and other financial statement users need an appreciation for the impacts caused by the variety accounting methods for investments. The accounting and financial statement issues related to capital sources, debt and equity, will be developed appropriately. Management Accounting: This is the primary topical coverage in BUAD 250b [the sister course to BUAD 250a]. In these areas of accounting, students’ skills are developed leading to better business decisions through the use of accounting information. These skills will enhance a student’s capability of progressing into senior management positions [or becoming a better entrepreneur]. Merle Hopkins, BUAD 250a Syllabus, Page 4 of 10 III. Auditing: We will develop an awareness of the need for independent reviews of accounting records and financial statements in order to promote the reliability of the information contained in the published information. Financial statements are the responsibility of the upper management of the firm and are prepared by the firm’s accounting personnel. Independent auditors may review these financial statements to enhance the reliability of the information in the financial statements. Sometimes, these independent audits are required by securities regulations. Additionally, banks and creditors may require independent audits of the financial statements of firms as part of the lender’s decision-making process. IV. Taxation: This will involve an introduction to this functional area within the accounting profession. Taxable income and financial accounting income will be compared in the context of the goals and rules for each area. Recognition of revenues and expenses differs between financial statements and tax returns. These differences pose challenges to users of financial statements and will be examined in this course (current and deferred tax expense). V. Accounting Systems: This is a brief orientation to the value available to management, enterprises, and individuals through an understanding and use of accounting systems. Statement for Students with Disabilities Any student requesting academic accommodations based on a disability is required to register with Disability Services and Programs (DSP) each semester. A letter of verification for approved accommodations can be obtained from DSP. Please be sure the letter is delivered to the instructor as early in the semester as possible. DSP is located in STU 301 and is open 8:30 am – 5:00 pm, Monday through Friday. The phone number for DSP is 213-740-0776. “Blue sheets’ should be given to the instructor for any quiz/exam for which the student intends to utilize the testing services facilities to ensure timely delivery of the quiz/exam to STU 301. DSP has implemented an advance deadline for the submission of paperwork to them to ‘reserve’ a spot for the student to take the exam. Plan ahead. Merle Hopkins, BUAD 250a Syllabus, Page 5 of 10 Course Format The course has two meetings per week each lasting 110 minutes. The class meetings will involve lectures and discussions of class assignments. Your performance over the entire semester will depend on the preparation you have done before class, what you do during the lecture sessions and review/study that you do after the lectures have ended. Review the schedule portion of the syllabus to make sure that you have read the appropriate material for each class session. This will add value to your learning in the lecture and may shorten the total amount of time necessary to perform well in the course. Also, ensure you have appropriate resource materials available for each class meeting. You have enrolled in one of the lab sessions to be held on Fridays. Your attendance at the lab sessions will be optional. Instructional assistants [IAs] will administer the labs. On a space available basis, you may attend lab sessions other than the one for which you are enrolled. The instructor and the IAs will hold office hours each week. These hours are available to you. A schedule of office hours by IAs will be available early in the semester. Make a point to resolve any questions about the course or course content with the instructor or one of the IAs. The instructor and the IAs can be a valuable source of information and you are encouraged to meet with them on a regular basis. Timely resolution of problems/questions should enhance your performance on the quizzes and exams. A typical week’s assignments will include background reading assignments and completion of assigned homework problems. I will utilize many handouts for use in class and/or as homework assignments. These are available to you as part of Adding Value with Financial Accounting Exercises. I may supplement these with additional handouts as needed. These will be important in your learning. Working in Groups You may wish to create informal groups to discuss class topics and/or homework assignments. This can be very helpful for the learning that will need to occur. Grading Final course grades will be assigned depending upon cumulative course points accumulated by you and all of the other students in the mega sections. Grading will be done on a curve that is responsive to the mean and median points accumulated by all the students completing the course. I have no preconception of the number of points needed to earn a particular letter grade. I will attempt to create exams where the mean score will be in the 70%-75% range. The average student completing the course likely will receive a B-/B [2.85/4.0]. Merle Hopkins, BUAD 250a Syllabus, Page 6 of 10 Points will be allocated as follows: Mid-term I Mid-term II Final exam Homework & Quizzes Total Course Points 300 points 300 points 300 points 100 points 1,000 points The exams will be made up of problems/exercises of a computational nature. Some problems may involve matching or true-false responses. There may be some discussion questions included on any of the exams. Announcements will be made in the lecture sessions related to the nature of the questions/problems on a specific exam. Your preparation on a daily basis throughout the semester should enable you to complete the exams in the time allotted. You will be expected to have learned the material thoroughly enough to efficiently adapt to different assumptions or formats. The final exam will not be cumulative over the entire semester. The final exam will generally cover material discussed in class after the second mid-term. A word of caution is appropriate: accounting is cumulative. The ideas and concepts developed early in the course often become the basis for topics introduced later. The nature of the accounting material in this class does not suggest that you pin your hopes for a good grade on a strong ‘second half performance’. Second-half ‘comebacks’ are more common on the football field [and more spectacular]. The course schedule contains homework assignments that are to be ready to be turned in at the start of class on the assigned dates. For example, Session 2 on Wednesday, January 11, the homework listed in the syllabus consists of one exercise [22200] from Adding Value with Financial Accounting Exercises. This exercise is subject to collection at the start of those classes. [These exercises are NOT assigned for the subsequent class.] If collected, the homework assignments will be due at the start of each class session unless otherwise announced by me. Homework collection will potentially depend on two tosses of a coin. I will toss a coin and ask the first volunteer to call ‘heads’ or ‘tails’. If the first volunteer correctly calls the toss, homework will not be collected and the ‘game’ is over for that day. If the first volunteer incorrectly calls the toss, a second volunteer will make a call for the second coin toss. If the second volunteer correctly calls the second toss homework will not be collected. If the second volunteer incorrectly calls the toss, I will immediately collect the homework listed in the syllabus for the day. Advice: your homework assignment should be on a separate sheet of paper other than the handout(s) assigned for that day. You might answer the homework in your workbook and then copy it for handing in or merely record your answers on a separate sheet of paper. Homework, when collected, will be evaluated for apparent effort to obtain an answer. Each homework assignment will count 5 homework points, if collected. Each student is subject to homework collection risk in the mega section for which the student is enrolled. Exceptions are to be discussed in advance with the instructor. Homework will not be reviewed for correct answers. Homework is part of the learning process. To encourage Merle Hopkins, BUAD 250a Syllabus, Page 7 of 10 that your learning occur on a continuous basis, there is homework component in the grade determination process. Quizzes, when given, will count for two homework assignments (10 homework points). Quizzes may be announced or unannounced. [In the past, all quizzes have been previously announced.] The lowest quiz grade will be dropped. I do not offer ‘makeupup’ quizzes. Instead, the missed quiz will become the quiz score that is dropped. The 100 course points assigned for quizzes and homework will be allocated on a proportionate basis. For example, if there are 4 quizzes at 10 points each and 8 homework assignments collected at 5 points each, there would be a maximum of 70 points for the student. [(3 x 10) + (8 x 5) = 70]. If a student has earned 35 of these points out of the maximum 70 points, that student will be awarded 50% of the 100 course points available for homework/quizzes. Exam Schedule Mid-term I Mid-term II Final Exam Friday, February 17, 2006 3-5 pm [Location TBA] Friday, March 31, 2006, 3-5 pm [Location TBA] Wednesday, May 10, 2006, 4.30-6.30pm [Location TBA] Students occasionally have bona fide reasons for not being able to take the midterms on Fridays at the times indicated above. Students wishing to discuss alternate exam times must see the instructor in his office hours prior to the exam dates. Regrading Exams Regrading for partial credit will not be possible. In order to allow you to discover your own mistakes and make the appropriate corrections before turning the exam in, I am planning these steps: 1. The exams will be written with the intention that prepared students can finish in 1.5 hours. This will provide prepared students with sufficient time to review the exam within the two-hour period. This self-review will enable prepared students to correct relatively minor mistakes and avoid significant point loss as a result. 2. Exam questions will be structured to be relatively non-cumulative. This will reduce the likelihood that mistakes made by students and uncorrected will penalize students’ scores repeatedly through a problem. Students will be able to review the exams for the purpose of determining whether mistakes have been made in the grading process. Merle Hopkins, BUAD 250a Syllabus, Page 8 of 10 Exam Reviews Reviews of testable materials prior to exams have been scheduled for Sunday, February 12, from 10am-2pm [Midterm 1] and for Sunday, March 26, from 10am-2pm [Mid-term 2] and for Saturday, May 6, from 10am-2pm for the final exam. Locations will be announced. Additionally, administrative assistants will likely hold a single four-hour review at a time that has not been scheduled yet. Make-Up Exam Policy Mid-term exams should only be missed in extreme situations that, in the opinion of the instructor, constitute a true emergency. Any such situation must be supported by documentation deemed adequate by the instructor. If circumstances permit, the instructor’s prior approval is required. If an exam is missed without prior approval of the instructor and that approval is not obtained subsequently, the student will receive a score of zero for the missed exam. The instructor reserves the right to choose between two options if a student misses a mid-term for an instructor-approved reason: (a) to administer the mid-term on a make-up basis or (b) to have the subsequent mid-term exam and/or the final exam score serve as a relative proxy for the missed exam score. [In option (b), the student’s subsequent exam scores relative to the mean scores, would be used as the student’s score on the missed exam. If a student scored 10% higher than the mean on the subsequent exam(s), the student would get a score on the missed mid-term exam that was 10% higher than the mean had been for the missed mid-term exam.] Final exams must be taken by the student at the designated time and place unless an ‘incomplete’ [IN] contract has been previously approved according to Leventhal School of Accounting regulations or an adequately documented situation necessitates the exam to be completed later in the university’s final exam period. The instructor alone shall decide whether the situation warrants postponing the exam within the final exam period. Advance requests by individuals for exceptions involving the time and/or place of a student’s final within the university’s scheduled finals period will be evaluated by the instructor on a case-by-case basis. Incompletes Please review the Leventhal School of Accounting standards for receiving and clearing an ‘IN’ at the end of this syllabus. Note that only the Dean of the Leventhal School of Accounting, not your instructor, may approve an incomplete [IN] based on these policies. Drops and Adds If any of your friends are thinking of adding this course, please let them now in order that they might adjust their schedules accordingly. If you are thinking about dropping the course, please note the drop dates listed on the last page of this syllabus. If you decide to drop the course, please let your instructor know immediately [email please] because others may be waiting to add. Merle Hopkins, BUAD 250a Syllabus, Page 9 of 10 Academic Integrity Ethics and values are very important in accounting and in the business world. We will consider ethical issues in accounting throughout this course. Ethics and values are also important in education. The instructor will assume that you are an ethical person, unless there is evidence to the contrary. To help you fulfill your ethical responsibilities as a student, the ethical standards for BUAD 250a are listed below. Examinations are to be exclusive work of the individual student. If any class resources are to be used by students there will have been a prior announcement authorizing such use. Absent such authorization, no class resources are to be available to the student during the exam. Students shall not seek to obtain assistance from any other student during the exam nor shall any student provide assistance in any form to a fellow student during the exam. If you know that another student is violating [or has violated] these standards, it is your responsibility to inform the instructor or an IA immediately if the violation is occurring during an exam. Student academic integrity enhances the moral environment of this university. Each of us has an obligation to seek an environment where results are established on the basis of individual efforts and abilities. If you become aware of a violation or a potential violation you have an obligation to take some action. Failure to do anything about a possible violation places you in a situation where you are aiding and abetting the violation [despite the lack of any improvement in your own grade]. Policies Regarding Returned Graded Work Returned paperwork, unclaimed by the student, will be discarded after 4 weeks. After attempting to return grades exams, quizzes and homework in the classrooms, these materials will be available in the IA office for students with picture IDs to establish identities. Policies on Reviewing Returned Exams When mid-term exams are returned to students, an announcement will be made in class regarding the deadline for reviewing the exam with the instructor during scheduled office hours or by appointment. [This announcement will also be made via email.] The student has the responsibility to obtain that deadline information if the student did not hear the announcement in class. Before the expiration of that deadline and if a student has been unable to meet with the instructor during office hours or by appointment, a written extension may be requested by a student before or after class. If granted, the request will be for as many days as the instructor feels are warranted in the circumstances and will apply only to those students whose requests for extension have been granted. Merle Hopkins, BUAD 250a Syllabus, Page 10 of 10 Leventhal School of Accounting Grading and Academic Standards A summary of the most important grading and academic standards of the Leventhal School of Accounting is attached to this syllabus. These pages contain information on grading matters such as the rules for ‘incompletes’ and information about the grade requirements for accounting majors. If you are interested in becoming an accounting major you are required to earn a combined average grade of B [3.0] or better in BUAD 250a and BUAD 250b with no individual grade lower than a B- [2.7]. For a complete discussion see Grade Point Average Prerequisite in the section for the undergraduate degree for the Elaine and Kenneth Leventhal School of Accounting in the USC Catalog. See also the section on Repeat Course Work. Advice for Achieving Success in this Course During this Semester Make plans now to commit the appropriate resources [chiefly your time, attention and energy] to learning accounting well enough to allow you to be successful after your ‘student days’ have ended. An important by-product is a better grade in this course that may be important someday to a recruiter/employer or to a graduate school to which you might be applying. Most of you will discover that you will work harder than you initially expect in this class, that you will learn more than you initially expect, and that you’ll enjoy the class more than you initially expect. There is more enjoyment associated with earning an A [4.0] than with earning a C [2.0]. Success is available to all in this course. Earn it!