ais 100 – introductory financial accounting

advertisement

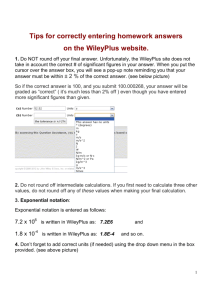

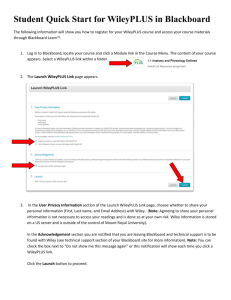

AIS 100 – INTRODUCTORY FINANCIAL ACCOUNTING Syllabus and Instructions Spring 2014 – MW Sections Section Number: _________________________ Classroom: ____________________________ Instructor: ______________________________ Email: ________________________________ Time & Days: ____________________________ Office Hours (Grainger 1204):_____________ Course Website (WileyPLUS) URL: _____________________________________________________ COURSE ADMINISTRATION Faculty Coordinator: Professor Terry Warfield Office: Grainger 4117 Email: twarfield@bus.wisc.edu Ph.D. Coordinator: Matt Kaufman Office: Grainger 4171 Email: mbkaufman@wisc.edu OBJECTIVES This course is designed to provide a basic understanding of financial accounting, including introductory accounting theory, concepts, principles and procedures. Specific attention will be devoted to the preparation, understanding, and analysis of financial data and financial statements. Students will also be exposed to current events in accounting and application of business ethics. Students will be expected to interpret current events in terms of accounting measurements and communication. Upon successful completion of this course, students should be able to: Read, understand, and analyze basic financial statements; Apply basic accounting concepts to determine the appropriate accounting treatment for transactions or events; Determine and prepare the appropriate journal entries to record accounting events; Understand and evaluate alternative approaches to account for various transactions or changes in the value of assets or liabilities; Analyze the economic ramifications of various current events and political issues, including the development of emerging international accounting standards. NOTE: In order to perform well in this class, extensive preparation is required prior to each class meeting. In addition, over the course of the semester, every attempt will be made to follow the daily schedule listed in the syllabus. However, depending on overall class progress, the syllabus may be adjusted. Any departures from the syllabus will be announced in class. YOUR RESPONSIBILITIES The objective of the course is to help prepare you to succeed in your career – whether it be in accounting, business, or in a non-business career where you need to be able to analyze how well you are doing. You, and you alone, are accountable for the grade you receive in the course. In order to facilitate your success in this course in building a foundation for other courses in the school, we suggest the following: Page 1 1. Plan on spending a minimum of 3 hours of uninterrupted time preparing for each class (and possibly more for the first day of a new topic area). 2. Let your instructor know, in advance, if you will miss a class and the reason for missing the class. 3. Come prepared each day with questions. You will do better in the class if you are prepared each day and come with questions about things you do not understand. 4. Read current business articles that may have an accounting implication or issue and bring them to class. 5. Do your own work – including the automated homework. 6. Be prepared for, and assume, an unannounced quiz every day except the day before an exam. 7. Adhere to the University and Business School Code of Conduct regarding your responsibilities – including not cheating and referring others who cheat to your TA, the course coordinator, or department chair. TEXT The required text is Kimmel, Weygandt & Kieso’s Financial Accounting – Tools for Business Decision Making, Seventh Edition [John Wiley & Sons, Inc., 2013]. You are required to complete and submit assignments (graded) online through WileyPlus. Purchase options for the text and access to WileyPlus are: 1. Purchase new hard-copy text with a WileyPlus code through the University Bookstore (ISBN: 978-1-118-57029-6). If purchased new at the bookstore, a WileyPlus code is automatically included with the text. This option is expected to have a retail price of around $272. Be careful if you purchase the text elsewhere (e.g. amazon.com), as a WileyPlus code is not typically included with the text. 2. Purchase new binder-ready text with a WileyPLUS code through the University Bookstore (ISBN: 978-1-118-57015-9). The binder-ready text delivers the text pages unbound but can be inserted into a binder of the student’s choice. This option is expected to have a retail price of around $180. 3. Purchase new “All-Access Pass” with an e-book text and WileyPLUS code through the University Bookstore (ISBN: 978-1-118-62032-8). The e-book text is available for download and accessible from either a desktop or tablet computer. This option is expected to have a retail price of around $99. Be sure to retain the WileyPLUS code that comes with your book; instructions for accessing WileyPLUS will be provided by the instructor for your section. If you do not have a WileyPLUS registration code (i.e. because you purchased a used sixth edition of the text), you will need to purchase a WileyPLUS registration code to have uninterrupted access to the course. COURSE WEBSITE You may access the course website on WileyPLUS through the URL provided by your instructor. This site requires a password which is either included in the textbook or purchased directly from the publisher’s website for access. The WileyPLUS website includes the assignments (graded activity and non-graded), tutorials, PowerPoint slides, and other supplementary materials. Page 2 In addition, on this website you will find the general syllabus followed by each section and exam dates/times/locations (under “Announcements”). Please note that the University of Wisconsin-Madison is not responsible for technical problems with WileyPLUS. It is advised that you allow yourself adequate time to complete your assignments prior to the deadline as exceptions will not be made for any circumstance. Useful links: Login: LIVE CHAT! Technical Support: Additional Resources: www.wileyplus.com www.wileyplus.com/support www.wileyplus.com/studentfdoc INSTRUCTOR’S OFFICE HOURS During office hours, students may check homework solutions, ask questions, and discuss any other aspect of the course with the instructor. Please take advantage of this resource. If these hours conflict with your schedule, arrange to meet with the instructor at a time that is mutually convenient. Location for instructors’ office hours: Grainger Room 1293. ATTENDANCE AND CLASS PARTICIPATION Regular attendance and class participation are expected of all students. Because the course covers a great deal of material, attending every class session is very important to good performance. Group discussions of the course material are an important part of the learning process in this course. Students are expected to make a meaningful contribution to the class, whether by asking questions, responding to questions, or contributing in other ways to class discussion. COURSE GRADES In addition to the relative weighting of exams, quizzes, and class participation, there are two items particularly noteworthy about the grading policy for this class: 1. Your Instructor, under the supervision of Professor Warfield, will be the individual who makes the primary determination of your grade. In other words, your Instructor will be responsible for assessing your class participation, your quizzes, attendance, and other factors that reflect your overall performance in the class. Thus, it is important to note that grades on exams are important, but only count for approximately two-thirds of your grade. 2. Your grade will depend on your overall performance against a standard of excellence that we have held in the accounting department for a number of years. We will not curve the course just for the purpose of creating a curve. The determination of the cut-off grades is dependent on the difficulty of each exam, your performance on the exams, and your performance in class. NOTE: Attending office hours held by your Instructor may be important, but is not a substitute for class participation, and will not be a factor in determining your grade for class participation. Page 3 Final course grades will be based on the following four components: Exam 1 (Thursday, February 27) Exam 2 (Thursday, April 10) Final Exam (Tuesday, May 13) Exam Subtotal Individual Section Component Total Exam and Individual Section Points 125 points 125 points 150 points 400 points 285 points 685 points It should be noted that even though letter grades are given following each midterm examination, the letter grade received is not necessarily reflective of what the student will receive as a grade for the course (in other words, the final class grade is not an average of individual component letter grades). Midterm letter grades are only given to let the student know how he/she performed on that specific exam, relative to everyone else enrolled in AIS 100. Final grades for the classes are determined by each Instructor under grading guidelines prepared for the class, and will be based on total accumulated points using the criteria identified above. The individual section component (285 maximum points) will be based on in-class quizzes, graded homework, classroom participation, and current events. This component consists of the following items: In-Class Quizzes WileyPLUS Questions (Graded) Participation Current Events Total Individual Section Component 80 points 80 points 50 points 75 points 285 points The following factors are considered in the class participation points assigned by your instructor: 1. 2. 3. 4. Attendance. Volunteering answers to questions or asking good questions. Responses to cold-calling. Responses to discussion questions. For example, attending every day, but with no responses on items 2, 3, and 4 above, would result in a maximum score of 25 out of 50. Non-attendance and poor responses in categories 2, 3, and 4 will lead to an even lower score. Also, note that participation is based solely on in-class participation; therefore attending office hours will have no effect on your participation grade. EXAMINATIONS There will be three exams during the semester, including the final exam. Each exam will run for two hours. Please note that the midterm exams will be given from 7:15 to 9:15 p.m. The midterm examinations are composed with a mix of multiple-choice questions, short answer questions, essay questions, problems, and the preparation of financial statements or other financial data. Sample exam questions will be posted on WileyPLUS. The self-study questions at the end of each chapter, homework assignments, discussion questions, and notes taken during class discussion provide an excellent resource for studying for exams. The final exam will be cumulative, covering all of the material considered in this course, but will emphasize material since the last exam (about 50% of the final). Page 4 You must sit for the first two exams on the dates and times scheduled. It is your responsibility to check the dates and times of exams in other courses for which you are registered. If you do not notify your instructor during the first two weeks of class of any conflict, it will be assumed that you have no conflicts with these two exams. If conflicts arise over the timing of the final examination due to conflicting block exam times set by the registrar’s office, accommodations for an alternative final exam will be made. You will not be permitted to miss any examination in this course because of travel plans. EXAMINATION SCHEDULE Exam Date Exam 1 Thursday, February 27 Exam 2 Thursday, April 10 Final Exam Tuesday, May 13 Time 7:15 – 9:15 p.m. 7:15 – 9:15 p.m. 7:45 – 9:45 a.m. Material Included Chapter 1 – Chapter 6 Chapter 7 – Chapter 10, App. D Cumulative QUIZZES Each individual instructor will develop a minimum of four quizzes during the semester. The value of each quiz may vary, and the total value of all quizzes will be 80 points. The quizzes are used to provide you with timely and effective feedback on your mastery of the material. Quizzes may or may not be announced in advance. Some quizzes may be given prior to discussion of the material to encourage students to read the material prior to coming to class. Quizzes will test your knowledge of both concepts and the application of those concepts, as well as knowledge of current accounting events discussed in class. HOMEWORK ASSIGNMENTS 1. Homework assignments are the basis for class discussion. Homework is an important part of the learning process. If you do not attempt to complete the assignments before class, it is likely that your performance in the course will suffer. 2. You are allowed and encouraged to help each other with the daily homework and class preparation. Additional help with homework is available from (1) the instructor during office hours, (2) the Learning Center in Grainger Hall, (3) weekly Beta Alpha Psi tutoring sessions, and (4) private tutors (A tutor list will be available from your instructor). 3. It is expected that homework assignments will be completed prior to the start of class. Homework assignments are taken from the questions (Q), brief exercises (BE), Do it! Review (DIR), exercises (E), problem set A (P-A), problem set B (P-B), the “Broadening Your Perspective” (BYP) questions at the end of each chapter, and the “IFRS: A Look at IFRS” (IFRS) questions at the end of each chapter. 4. There are three types of activities designed to help you understand the material: 1.) WileyPLUS Questions (Graded), 2.) WileyPLUS Questions (Non-Graded), and 3.) Discussion Questions. A schedule of these activities and the respective due dates are listed in the course calendar at the end of this syllabus. 1) WileyPLUS Questions (Graded): Homework assignments in the form of WileyPLUS Questions (Graded) must be completed in WileyPLUS at least one hour before the start of the class in which they are due, as listed on the syllabus. You may wish to bring a printed copy of your completed assignments in WileyPLUS to class to facilitate discussion and help with your class participation. These problems will be identified in WileyPLUS as “GRADEDX” where “X” designates the WileyPLUS Identification Number noted on the Page 5 class schedule. As an example, GRADED5 includes problems E4-3, E4-5, and E4-8 and is due on Monday, February 10. Students will receive two attempts to complete each WileyPLUS Question (Graded). Answers to WileyPLUS Questions (Graded) will be made available in WileyPLUS after the due date for all sections of AIS 100. No exceptions will be made for late homework. If a student does not complete the homework in WileyPLUS by the assigned due date, zero points will be given to the student for that assignment. Note that no exceptions will be made for technical difficulties experienced with the Wiley website. Homework assignments are posted in advance so that you can plan accordingly. One suggestion is that you consider printing out the WileyPLUS question and record the answers to the question prior to entering the answer on WileyPLUS. This will decrease the likelihood of errors and timing out on WileyPLUS. No additional attempts will be provided to students who incorrectly entered the answers or if answers were lost or not completed by the due date because WileyPLUS timed out. WileyPLUS Questions make up 80 points in the Individual Section Component of your grade. Your final homework grade will be scored based on 95% of the total points available on Graded questions during the term. This adjustment is meant to compensate for any difficulties or misunderstandings during the term. The adjustment could also be used to compensate for approximately one missed assignment (depending on points available), but will be most beneficially used to correct for small errors or misunderstandings throughout the term. 2) WileyPLUS Questions (Non-Graded): The second type of question, WileyPLUS Questions (Non-Graded) will also be available on WileyPLUS for each chapter. These WileyPLUS questions are NOT GRADED. They may be used by your instructor to facilitate class discussion. Solutions to these problems will be made available in WileyPLUS after the student has correctly completed the question or attempted to correctly complete the question in two attempts. These problems will be identified in WileyPLUS as “NONGRADEDX” where “X” designates the WileyPLUS Identification Number noted on the class schedule. Please note that (when possible) these problems will be algorithmic problems in WileyPLUS – every time you begin a new attempt, the numbers in the problem will change. This is done to allow students the maximum amount of practice questions. 3) Discussion Questions: The third type of question, Discussion Question, should be prepared prior to the start of class as these questions will be discussed in class and factored into the Participation component of your grade. Note that these questions should NOT be completed in WileyPLUS or turned in to your instructor. Page 6 CURRENT EVENTS As noted on the schedule below, current events and associated questions will be discussed in class. Prior to coming to class, students are expected to prepare written responses to the current events to be turned in. There are a total of 3 current events averaging 25 points per current event. These are graded as follows: Clarity and correctness of your answer. Quality of writing, i.e. clear, concise, direct and to the point, etc. Demonstration of logical thinking and application of accounting concepts to the project. Useful Websites and Gadgets for Business News We recommend you to keep yourself updated with latest business news. Some useful websites for business news include: Wall Street Journal: http://www.wsj.com CNBC: http://www.cnbc.com/ BusinessWeek: http://www.businessweek.com/ Fortune: http://money.cnn.com/magazines/fortune/ Yahoo! Finance: http://finance.yahoo.com/ In addition, we recommend you to create an iGoogle account and put gadgets for business news on your iGoogle webpage. Useful gadgets includes: Google News - Business, Latest Financial News CNNMoney.com, Reuters: Business News, etc. International Financial Reporting Standards (IFRS) Implementation Project The accounting environment in the United States is rapidly changing. Efforts are currently being made to converge U.S. Accounting Standards with International Accounting Standards. To educate students on this matter, we will incorporate IFRS into the current curriculum. The objectives are the following: To provide students with a basic understanding of what IFRS is, the status of IFRS in the U.S., and reasons for and against globalization of accounting standards. Introduce students to similarities and differences between International and U.S. accounting standards and the implications of such for businesses and users of financial information. To have students apply basic accounting principles and concepts to in-depth case studies highlighting the similarities and differences between International and U.S. accounting standards. To understand various factors considered in the standard setting process, particularly related to determining the best way to value an economic event, complex factors considered in valuation, and the impact of varying cultural and individual behaviors. To provide students with enough background on the current convergence process so students are able to develop their own viewpoints on convergence and its costs/benefits. As shown on the schedule on the following page, IFRS and current events related to IFRS will be discussed throughout the semester. At the end of each chapter, there is a section entitled “IFRS: A Look at IFRS”. Students are required to read the text in this section and complete the IFRS Concepts and Applications identified on the schedule under “Discussion Questions”. Written responses to these questions will NOT be collected by your TA. Please note that points allocated to IFRS are incorporated within the current events and participation points. Students will be responsible for this material on the exams. We encourage students to read every chapter’s “IFRS: A Look at IFRS”, but will only be held responsible for those identified on the schedule below. Page 7 ACCOUNTING 100 – Spring 2014 MW – Course Calendar (Page 1 of 3) Homework Assignments Date Jan 22 27 29 Feb Day Chapter W Course Introduction 1. Introduction to Financial Statements 1. Introduction to Financial Statements 2. A Further Look at Financial Statements M W WileyPLUS Identification Number 2. A Further Look at Financial Statements WileyPLUS Questions (Graded) # 1 E1-9 , E1-11 2 E2-12#, P2-3A#, P2-7A# # WileyPLUS Questions (Non-Graded) # # P2-5A, E2-8 Q9, Q13, Q15 BYP1-3, BYP1-6 BE2-8, IFRS 1-1 to IFRS 1-4, IFRS 2-1 to IFRS 2-2 E3-3 Q12, Q13, Q18 E1-2, P1-2A, P1-5A 3 M 3. The Accounting Information System 3 E3-2 , E3-6 5 W 4 10 M 3. The Accounting Information System 4. Accrual Accounting Concepts (skip Appendix) 5 P3-8A E4-3, E4-5, E4-8 E3-4, P3-6A E4-1, E4-7, P4-1A 12 W 6 P4-8A E4-18 17 M 19 W 24 M 4. Accrual Accounting Concepts (skip Appendix) 5. Merchandising Operations (including Appendix) 5. Merchandising Operations (including Appendix) 6. Reporting and Analyzing Inventory (including Appendix 6A & 6B) 7 8 9 Page 8 P5-2A, P5-9A E5-8 (a & b), P5-8A E6-7 (a – c), P6-1A, P6-2A Discussion Questions E5-4, E5-13 E5-9 E6-9, P6-4A BYP 3-4, BYP3-5 Q14 Q33, Q34, IFRS4-1 to IFRS 4-2 Current Events 1, Q10 BYP5-9 IFRS 6-1 to IFRS 6-2 ACCOUNTING 100 – Spring 2014 MW – Course Calendar (Page 2 of 3) 6. Reporting and Analyzing Inventory 26 W (including Appendix 6A & 6B) 10 Mar E6-12, P6-7A (a – c) P6-9A BYP6-6, BYP6-9 11 E7-3, E7-4 P7-2A Q5, BYP7-1, BYP7-7 27 R Exam 1 - 7:15-9:15 p.m. 7. Internal Control and Cash 3 M (skip Appendix) 5 W (skip Appendix) 12 E7-12, P7-4A E7-11, P7-8A 10 M 8. Reporting and Analyzing Receivables 13 E8-3, P8-3A P8-1A, P8-8A BYP7-5 Q8, Q18, BYP8-6 12 W 8. Reporting and Analyzing Receivables 14 P8-6A, P8-7A E8-12 BYP8-4 24 M SPRING BREAK 9. Long-Lived Assets (including Appendix) 15 E9-6, P9-1A, P9-3A E9-3, E9-4 26 W 9. Long-Lived Assets (including Appendix) 16 P9-4A (a-c), P9-7A E9-13, P9-8A 31 M Q3, Q4, Q12 Q19, Q20, Q23, BYP9-6, IFRS9-1 to IFRS 9-3 Current Events 2, Q18, Q24 2 W 7 M 9 W 10. Continue Liabilities (including App 10B & 10C; skip App 10A) In-Class Office Hours – No New Material Covered 10 R Exam 2 – 7:15-9:15 p.m. 14 M 11. Stockholders’ Equity (including Appendix) 7. Internal Control and Cash Apr 10. Liabilities (including App 10B & 10C; skip App 10A) Appendix D: Time Value of Money (pp. D7-D13) 17 19 E10-2, P10-1A BED-7, BED-16 E10-14, P10-4A, P10-10A 20 E11-4, P11-8A 18 Page 9 E10-3, E10-10, E10-17 BED-13 P10-5A, P10-11A BYP10-10 E11-2, E11-6 Q9, Q22 ACCOUNTING 100 – Spring 2014 MW – Course Calendar (Page 3 of 3) 11. Stockholders’ Equity 16 W (including Appendix) 21 21 M 23 W 28 May M 30 W 5 M 7 W Appendix E: Investments 12. Statement of Cash Flows (skip Appendices) 12. Statement of Cash Flows (skip Appendices) 13. Financial Analysis (including Appendix) 13. Financial Analysis (including Appendix), IFRS discussion, Review (1-13) In-Class Office Hours – No New Material Covered 22 E11-14, P11-2A PE-2, PE-4, PE-5 23 E12-3, P12-1A 24 E12-8, P12-5A 25 P12-7A, P12-9A, P12-12A BE13-2, E13-1 26 P13-4A P13-5A E11-16, P11-6 EE-1, EE-2, EE-5 BE12-8, E12-2, P12-3A E13-2 Q24, BYP11-5 Q1, Q9, Q19 Q13, BE12-3 Current Events 3, IFRS12-1 to IFRS12-3 Q1, Q2, Q3, Q22 Q14, Q15, Q18, BYP13-7 NOTE: Activities identified with a numeric symbol (#) will not be due in WileyPLUS until Monday, February 3 at 5:30 p.m. This is done to allow all individuals who add the course after the first day of class enough time to complete the designated assignments. Solutions to these activities will be available on Tuesday, February 4 for all sections. Final Exam: Tuesday, May 13 – 7:45 a.m. – 9:45 a.m. Page 10