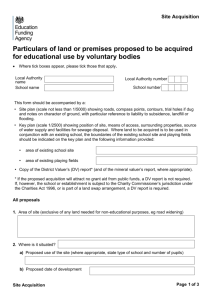

File - Nordson corporation Integration information

advertisement

Acquisition Integration Playbook Outline I. II. Overview a. Guiding Principles b. Summary of Process c. Phases & Timelines Structure a. Organizational Structure i. Org Chart ii. Steering Committee 1. Objective 2. Members 3. Responsibilities iii. Acquisition Integration Team 1. Commercial Integration Lead a. Objective b. Selection Guidelines c. Responsibilities 2. M&A Integration Manager a. Objective b. Selection Guidelines c. Responsibilities 3. Functional Teams a. Functional Team Leads i. Objective ii. Selection Guidelines iii. Responsibilities b. Preliminaries, Areas of Focus 4. Cross-Functional Sub-Teams b. Governance III. Process a. Planning i. Who ii. What iii. When iv. How b. Executing i. Day-to-day Workflows ii. Collaboration Tools iii. Measuring & Tracking / Reporting Tools 1. Integration progress 2. Synergy capture iv. Budget and Expense Management 1. Integration team expenses (travel, etc) 2. Integration execution expenses (consultants, Infrastructure costs, etc.) c. Communicating IV. Feedback and Process Improvement V. Appendix a. Sample integration plan outline b. Sample communication plan documents c. Tools and templates Overview Integration Playbook – Nordson Corporation Draft 3 This integration playbook is the first attempt at creating a formal documented corporate integration process at Nordson Corporation. It is now, and should continue to be a dynamic set of documents and tools. Every acquisition is different, as are the people who will be using the data, and the environment in which it is operating. Use this tool as a guide and a roadmap. Add to it, simplify it, and adapt the tools and methods for the specific acquisition integration. A. Guiding Principles: We will adhere to the following principles: Guiding Principle – #1 Simplicity/Alignment Mergers and Acquisitions integrations are complex business activities. At Nordson Corporation, we understand that every acquisition is different, some more complicated than others, but we do not want to add complexity to the process. This is the reason that we focus on alignment. If we set common standards, all of our internal departments and integration activities will align to achieve the business goals of the acquisition. We strive for simplicity in data capture, check lists, and reporting devices, especially in the first 100 days after closing. Finding ways to use new technology to move along the integration is encouraged and this playbook will change as we improve upon our processes. The Corporate Development group will continually update our playbook and incorporate improvements as we gain experience. Guiding Principle - #2 Communication Communication refers to the messages that are shared with all of the stakeholders in the corporate integration process. Stakeholders include internal entities such as the Nordson Board of Directors, the senior management team, and employees of Nordson and the acquired entity. External stakeholders include the two companies’ shareholders and customers. Consistent and coordinated messages and themes of communications will add clarity and confidence as the integration activities progress. “Be assured that whenever there is an information vacuum or partial information vacuum, the human species can be counted on to fill that vacuum with its own fantasies about what is ‘probably’ going on,” states Mark Brenner, PhD, chairman of the Global Consulting Partnership. “Most employees are constantly talking about all the ‘worst-case scenarios,’ in terms of who will be retained, who will be released, and how the everyday rules of the game will change, once the dominant culture shifts into ascendancy.”For all of these reasons, a clear vision and consistent communication are vital. Guiding Principle - #3 Operational Effectiveness Strive for an efficient and effective integration process and continuously improve integration capabilities by: Promoting consistent, repeatable processes that reduce integration project setup time and assist with resource and capacity planning. Adapting standards to accommodate different business models as Nordson acquires large or small companies, and those offering different types of products and services. Incorporating the lessons learned after each acquisition and associated integration. Guiding Principle - #4 Measurement and Feedback Actively measuring our performance during an integration process is crucial to driving performance excellence in our acquisition process. In addition to integration progress and synergy tracking measurement tools and we will also identify measures that focus on identifying and tracking the people issues as well. For example, effective communicating with employees throughout the integration process can be measured by employee surveys. The following metrics are commonly tracked by companies to measure deal success: Employee engagement Revenue growth Talent Acquisition/retention Operational continuity Employee productivity Margin gain We will build in feedback loops to track our progress, and continually measure performance against expectations, while documenting and rewarding our successes. Validating improvements and judging success is not something done at the end of the integration process, accompanied by a declaration of success; rather, it requires an ongoing process designed to provide the integration team members with real-time feedback. Feedback can be used to enhance and strengthen strategies that prove to be successful in creating a shared corporate culture. We can also use feedback and measurements to modify or replace strategies that are not gaining traction. Our goal is to be flexible enough in our operations during integration, to make changes when necessary and alter the playbook as we learn through experience. Summary of Acquisition/Integration Process Business Case, Valuation, & Analysis PreApproval & Terms Due Diligence Draft Plan of Intent GTM Strategy High Level Project /Scope Plan Cost and Synergies Product Strategy Org Structure Announce to close Integration/ Stabilization 100 days Integration Optimization 100+ days Plan of Record Day 1 Plan Discovery and Due Diligence Business Strategy High Level Day 1 Plan Final Approval & signage End State Definition Opportunity Evaluation Detailed Project Plan Cost and Synergies Work stream Work stream Work stream Org Structure Work stream Work stream Estab. Team & Gov. Integration Management Project Management Work stream Integration Process begins at Due Diligence Final Approval & signage Due Diligence Draft Plan of Intent Cost and Synergies Org Structure Integration Optimization 100+ days Day 1 Plan End State Definition High Level Project /Scope Plan Integration/ Stabilization 100 days Plan of Record High Level Day 1 Plan Discovery and Due Diligence Business Strategy Announce to close Detailed Project Plan Cost and Synergies HR Work stream BO Work stream Work stream Work stream Org Structure Work stream Work stream Estab. Team & Gov. Integration Management Project Management II. Structure: i. Organization Structure: Acquisition Integration at Nordson Corporation will use a specific organizational structure to drive the accomplishment of the project objectives. See Exhibit A: (Exhibit A) Steering Committee (Business Group Executive + Corp Dev + CI + HR) Commercial Integration Leader Acquisition Integration Team Operations Commercial Human Resources M&A Integration Manager Supply Chain Back Office / Finance Pricing Marketing Communication s IS / IT The Steering Committee: ii. Objective: to oversea and guide the Integration Process Members: BU Executive, CFO, HR Executive, Continuous Improvement Executive, Corporate Development, others as appropriate Responsibilities: Provide overall vision and direction and assist with resources allocation Monitor integration progress and adherence to the integration plan Assist in problem areas – removing barriers, prioritization, change management Review and approve monthly integration status report to CEO Acquisition Integration Team: iii. 1. Commercial Integration Lead: a. Objective: Dedicated leader of the integration team. Drive the integration process, providing leadership to the integration team and the newly acquired entity. b. Selection Guidelines: Senior-level manager with skills necessary to lead the company through the integration process. Since every integration process is different from the next, the selection criteria will differ by the complexity involved in the specific acquisition strategy. See Complexity Matrix c. Responsibilities: Lead the development of the integration plan and process Assure project objectives and milestones are achieved Deliver the integration and synergy commitments, in conjunction with the Business Group Executive Identify and resolve issues including resource allocation Develop and communicate regular status reports and dashboards to the steering committee and senior executives Provide a report-out at the “end” of the integration, on all members of respective functional teams, for inclusion on annual performance reviews 2. M&A Integration Manager: a. Objective: Project Manager for the integration team. Manage the day-to-day integration process and activities. b. Selection Guidelines: Currently staffed by the permanent M&A Integration Manager within Corporate Development c. Responsibilities: Participate in the creation of the integration plan and process Coordinate, plan and track the integration effort Provide day-to-day support, tracking and coordination of the integration project in support of the Commercial Integration Lead Coordinate, guide and train the functional team leads and functional team members Monitor functional team progress and identify, to the Commercial Integration Lead, potential issues/problems Indentify and document process improvements, and lessons learned for future integrations 3. Functional Integration Team a. Functional Team Leads i. Objective: To carry out the integration process Selection Guidelines: The Functional Integration Team leads will be dedicated or partially dedicated to the integration team depending on function and complexity of the integration. They may also be the functional due diligence resource, insuring a seamless transition from transaction to integration. Functional teams may change based on the particular integration; however, the standard functions to be represented on the Acquisition Integration Team include: Supply Chain Human Resources Back Office / Finance / Legal Marketing Communications Pricing IS/IT Operations – efficiency, footprint optimization Commercial – channel/revenue optimization ii. Responsibilities: Development of functional charter, strategies, and tactics Creating and managing a detailed Project Plan for their functional team responsibilities, including functional team identification and resource allocation Verify and further develop synergy opportunities and capture plans Delivering the functional integration project plan and synergy capture plan Weekly report their team’s project status to the Integration Project Manager via Smartsheet and additional reporting mechanisms as developed, as well as face to face or teleconference meetings. Bring conflicts or irreconcilable issues to the attention of the Integration leadership for resolution Provide a report-out at the “end” of the integration, on all members of respective functional teams, for inclusion on annual performance reviews 4. Cross-Functional Sub-Teams There may be a need to create a cross-functional horizontal sub-team, for working on a task that has inter-dependencies between functional areas. Sub-team responsibilities mirror the functional team responsibilities identified above. An example of a project for a horizontal team is order management – pricing/finance/IT and commercial may all be involved in creating a workable process. It may take additional resources to solve a complicated process flow, therefore a cross-functional sub-team or task force will be created to do a deeper dive into solving a business challenge. The cross functional team will report the solution to the functional leader identified in the original integration plan. b. Governance: A formal governance structure is essential during the creation of the Project Plan and determining the structure and priorities during an integration. It is a function of best management practices to have established structure for decision management. The Integration Governance Matrix as detailed in Exhibit [ ] provides the governance and decision-making hierarchy of the Nordson Integration Process. Integration Governance Matrix Business Segment VP Integration Steering Committee Commercial Integration Lead M&A Integration Manager Integration Functional Lead Functional Team and/or participants A/P A P P C C Integration Project Plan Baseline A A P P P/C C Integration Project Plan Baseline Changes A A A/P P A/P C Communications Plan A A A/P P P C P P Initial Plan or Changes to Plan Integration Scope Charter Synergy Capture Plan A/P A A/P (program level) (synergy initiative level) C Synergy Baseline Changes A/P A A/P P P C Issue Resolution A A/P A/P P P C Governance Decision Authorities: P=Plan, A= Approve, C=Consult Escalation path – Business Segment VP has final approval authority III. Process – Integration Strategy and Planning Overview Each acquisition should have an individual and specific integration strategy that identifies the level of integration required to deliver value from the acquisition and driven off of the acquisition strategy rationale. The importance of an integration strategy goes beyond the fact that the benefits from the acquisition are not created simply through the joint ownership of assets, but dependant on how well the target can be integrated and synergies can be realized. This, in turn, will guide the entire integration planning process and will underpin the Integration Project Plan. There are a few things to keep in mind as planning for the integration commences: 1. Be mindful of integration complexity - just because a company is small, doesn’t mean the integration will be simple. The Integration Complexity Matrix is a good tool for understanding the complexity that will be encountered during the integration. 2. Clearly identify the appropriate level of integration There is no “one size fits all” solution when it comes to the degree of integration. Identification of the level of integration must occur early in the planning phase, as it is a key input into other planning phases. Tools: Standardizing Deal Types Chart Integration Planning: Overview: The integration plan is an action plan with a set timeframe that works out the mechanics of how the acquired entity will be integrated, synergies will be attained, growth will be achieved and therefore how the businesses will be combined to realize the value from the acquisition. The development of the plan begins during Due Diligence and the key priorities and organizational goals, along with the expectation of synergy capture will be developed, defined and agreed upon before the close of the deal. The functional workstreams will then be staffed and assigned to carry out the activities that will achieve the integration goals and result in a unified organization. Beginning the Integration Process: (Exhibit) 1. Begin early by Defining the Scope of the Integration Regardless of the type or scale of acquisition planning the integration activity must start early. The Nordson integration process begins at Due Diligence with the development of documentation that will enable us to create a blueprint, or scope for the integration. Defining the Scope of the Integration: The M&A Integration Manager, in collaboration with the business segment project sponsor and the due diligence team begins the integration process by creating scope documentation that outlines the basic facts relevant to the integration plan. For each functional area, the team identifies the critical processes/activities that must be achieved during the integration period. The data set is unique for each target for acquisition, but will include most or all of the following: The strategic rationale for the acquisition Pertinent information on the acquisition impacting o o o o Business unit strategy Project Description Key Financials Value impact o Key risks o Implementation strategy o Critical dates Identification of the Commercial Integration Lead and the Functional Team Leads o Tool – (see Integration Complexity Grid) Organizational Structure – a review of the target company’s structure and a preliminary outline and/or recommendations on how the company might “fit” into the Nordson organization. Will it be a simple merger of functions is a more complex structural realignment (example: a rationalization of sales/support services) Market activities that may impact activities over first 100 days o Major trade shows, customer events, o IT/IS activities o Contracts/Commitments Tools utilized to capture this information include: o High Level Planning – Scoping Matrix Template o Project Template – 4 blocker o Checklists for Identifying key integration issues From the scoping documents created and the results of the due diligence, we have a foundation for the integration, essentially the blue print on which to build the details of the integration plan. We are able to better understand the complexity of the integration, identified the key business goals, and the expected synergies. The output of the scoping document provides: Identification of the key functions and processes involved What specific areas and priorities need to be addressed in the first 100 days The Commercial Integration Lead is identified The initial view of the “end state” goals that will signify the end of the integration process and beginning of integration optimization or business as usual. 2. Resourcing Early identification of the resources required for success is essential to ensure a smooth transition execution to the integration process. Using the scoping documents as guidance, we can adjust and calibrate for lack of resources in our timelines, and/or assist in building the business case for adding third party resources, when necessary. The Integration Planning Process Once the Commercial Integration Lead is identified, this person, with the assistance of the M&A Integration Manager, will lead the process of drafting an initial integration plan, reviewing the plan with the Integration Steering Committee and receiving approval to move forward. The integration plan will include the following: o The Charter for the new combined company o Organization structure defined o Functional workstream leaders identified along with each of their functional teams. o Integration Timetable with key milestones o Calendar for integration activities o Key dates and deliverables o Meeting schedules o The 100 Day Plan with specific tasks o This plan will be in the form of a Gantt Chart o Communication Plan o The Marketing Communication team will be managing the output of the plan, however the content and deliverables are the responsibility of the integration team o End State Goals for moving from integration to business as usual The 100-Day Plan It is the intention of the integration process that functional integration will be completed within 100 days of closing. This does not mean that the integration is over, but it does mark the time when the key business processes identified in the integration plan are completed, and the companies are functionally working as one. During the integration planning, the “end state” will have been identified, and at the end of the 100 days, success will be measured on the achievement of the stated goal. Beyond the 100 days, there may be many additional projects to complete, and it will be left to the Steering Committee to decide on how much of the integration team will remain on task, or handed off to functional areas as “normal” workflow. The 100-Day Plan is the structure on which the functional work streams function. Each functional lead will be responsible for identifying and achieving their “end-state” within the 100 day timeframe. At Day 1, each functional lead will be Opportunity Risk End State Complexity Function/Process Headcount Req. Integration Scope/Planning Matrix Worksheet Target Benefit Target integration date Functional Integration Strategy Template Integration Process Charter Functional Group ### Integration Projected Timing Business Need/ Problem Statement Insert project “elevator speech here Project goal/ end state: Drivers, Interdependencies: list business , drivers, trade shows, major sales, launches, etc. Core Team for Project Cost/Benefit Analysis (budget needs, expected outcome – can it be dollarized?) Champion: Functional resources: IT leader: Team members: Performance Metrics (how can we measure, do we track performance on scorecard?) Integration Complexity: Assessing the complexity of the integration assists Nordson in identifying the best candidate for the Commercial Integration Manager, which is a key appointment for the success of the integration project. We can identify the best candidate in several ways: Using the Integration Complexity Grid, nine attributes of the integration are reviewed with the Business Unit VP, who is the sponsor of the acquisition. Each attribute is mapped against a standard list of integration management skills The result of the analysis gives us a customized integration management “job description”. Integration Complexity Grid Characteristic of Complexity Category Low (1) 1. Size of Transaction Dollar value/ purchase price Number of employees/size of acquiring BU 2. Target Location Proximity to 3. acquiring BU Number of locations Number of international locations Level of Cost Reduction 4. Type of Acquisition 6. Perceived 7. enthusiasm to be acquired Level of Process/Systems Sophistication 8. Market Space 9. Comments High (5) >$550M Up to $10 M 0 employees >2500 employees < 50 miles >1000 miles < 2 locations >10 locations Zero >3 0% of sales 10% of sales 5. Talent to Retain Score 1-5 Standalone Product bolt-on Merger of equals Few, replicable skills Many critical skills, technology expertise Agreeable Hostile Low High near adjacency far adjacency (core vs. step out) Core Step out Cultural Compatibility High Low Total Score: Score will range from 9 – 45, with a scores 9 – 22 indicating a low complexity integration, 23 – 32 I moderate integration, and scores over 33 as higher in complexity. The higher the complexity, the higher the level of skill required when selecting the integration lead Integration Manager Selection Criteria Level Required Comments H/L_______________________________________________________________ Nordson Experience ____________________ Ability to communicate (includes foreign language) ____________________ ____________________ Leadership competence, expertise/credibility ___________________ (ready access to sr. leadership) ____________________ Sense of urgency and action orientation, entrepreneurial ____________________ ____________________ Ability to be an agent of change ____________________ Group facilitation and process skills ____________________ People and interpersonal relationship skills ____________________ Project Management skills ____________________ Conceptual and analytical abilities ____________________ Organized and process oriented ____________________ Integration Management Skills Index: Project Management skills: While there will be an integration project manager assigned to the integration, the more complex projects will require a leader who is actively involved in the project management process, and can actively monitor functional workstream activities without the assistance of the project manager. Change Management skills: Complex integrations are stressful for all participants. The ability to be effective while working under difficult circumstances, while being able to command the respect and admiration of both workers and leadership. Risk Management skills: Ability to identify constraining factors that are unspoken and unseen. Proactively identify possible corrective action when needed and diplomatically engage those who need to act. Social Skills: Interpersonal skills, negotiation skills and the ability to make decisions. Must be able to build trusting relationships that will assist in completing tasks and identify potential issues. Leadership Skills: Ability to make key decisions on the spot and keep things moving swiftly, which demonstrates the commitment to making the integration a success. Financial Focus: Ability to ensure the financial benefits are delivered. Solid understanding of synergy capture and financial reporting requirements. Cross Cultural Skills: Understand, anticipate and manage cultural, market and regulatory differences across geographies and market segments. Comfortable and effective working and leading global teams. III. Process a. Executing i. Day-to-Day Workflows: Integration Functional teams: Functional teams are responsible for the specific area of the Integration plan for their workstream. The major functional areas that are necessary in any integration are: o Back-office/Finance o IT/IS o Human Resources These functional workstreams are responsible for developing action plans and tracking synergies. Synergy opportunities and capture plans will be developed and assigned to the identified initiatives during integration planning. Once the integration team is identified, the entire group will be trained on project management and the use of the collaboration tool, Smartsheet. Within this tool, each functional workstream can manage their project and communicate with team members proactively. The following check list should be used by each Functional Team leader to assign responsibility and establish a time frame for the completion of each task. ii. Collaboration Tools We will be utilizing a Cloud-based collaborative project management tool Smartsheet. www.smartsheet.com as our collaborative project management tool. All functional checklists and action plans will be managed via Smartsheet which enables real-time updating of all project activities and more. Within Smartsheet: Reporting templates Functional Checklists / Action Plans Action Plan Dashboards will be real time Master Action Plans Calendars Gantt Charts for all functional projects Gantt Charts showing interdependencies for entire integration Data warehouse for all documentation And more….. Smartsheet streamlines all integration workloads and makes data “real-time”. Project Managers can make assignments, track activities, and status charts are real time, all the time. Eliminates the need to email updates, upload information to Sharepoint, and send updates to team members. Everyone on the team has access to the data. Smartsheet also has an app available for smart phones and tablets, whether IOS or Android, with language capabilities, and global reach. Full training on how to use Smartsheet, and support via video training and experts “on call” will be provided. iii. Budget and Expense Management Initial estimates of integration costs should be identified during the transaction/purchase phase and at due diligence. The Integration Leadership team will review and refine these estimates. Cost elements budgeted and tracked proactively include: Retention Agreements Incremental IS/IT (hardware plus infrastructure costs) Consultants (Financial, legal, others) At a minimum, we will track the following expenses: Basic IT/IS infrastructure changes and associated costs Legal and other costs to ensure compliance with local laws and to meet Nordson standards Costs to introduce risk management / insurance policies Costs related to management changes (outsourcing, redundancy costs) Advisor/Consultant costs Travel/Accommodation for the Team during integration Any significant project – specific items required Recurring costs are incremental costs to the Corporation to make the acquired business in line with Nordson standards. These costs could include IS/IT, HR, Pension, Benefits, Trade compliance or other Corporate like groups. These expenses will typically start off slow at the beginning of the acquisition but then ramp up to higher levels depending on whether additional headcount is required in these functional areas to support the acquisition. Types of incremental costs to consider: HR Personnel Support Additional headcount in HR organization needed to specifically support this acquisition Pension Additional costs to cover the acquired entity under Nordson's pension plan. This would just represent the incremental costs - not the full cost for pension that might be borne by the entity PTO / Holiday Time If there is a significant deviation in the PTO policy between the acquired entity and Nordson, then consider the impact on the direct labor production pool and whether or not incremental costs need to be factored into the model Based on the revenue model in model, consider whether additional manufacturing overhead headcount might be needed to support the incremental revenue. If the model assumes gross margins will be flat, then to some extent these are already factored into the model. However, consider additional in costs if there have been changes in the mfg. process (i.e., loss of a quality check) or if additional headcount is needed to be in line with Nordson's plan Additional headcount in IS-IT organization needed to specifically support this acquisition. Or, incremental IT costs to bring organization in line with Nordson standards. Typically modeled at 1/3% of sales Additional headcount in CI organization needed to specifically support this acquisition Additional headcount in finance organization needed to specifically support this acquisition Additional headcount in legal organization or incremental legal fees needed to specifically support this acquisition Additional Trade compliance headcount needed to specifically support this acquisition or software costs to add this acquisition to the Nordson platform Mfg. Overhead IS/IT Continuous improvement Finance Support Legal Patent Trade Compliance ACQUISITION INTEGRATION FRAMEWORK Types of Mergers & Acquisitions: When it comes to mergers and acquisitions, there’s no magical method to making them successful. Each deal is unique and has its’ own strategy or logic, but there are some general categories that we can identify, that are used as strategic rationale for an acquisition that creates value. These types of mergers/acquisitions include those shown below: DD Consulting 2013 Historically, the acquisitions at Nordson Corporation have primarily fallen into the Type 5 – 7 categories. Type 5: Purchase customers for our products (similar geographies) Smaller companies with innovative products have difficulty reaching the entire potential market for their products. Bigger companies in a space may purchase smaller companies and use their own larger scale sales force to accelerate the sales of the smaller companies’ products. Or, the target can also help accelerate the acquirer’s revenue growth. For example, in Procter & Gamble’s acquisition of Gillette, the combined company benefited because P&G had better sales in some emerging markets, where Gillette was stronger in others. Working together, they were able to successfully introduce products into new markets much faster. Type 6: Purchase new technology or product, to put through our sales channels This is a fairly simple and common type of merger/acquisition, and is used to obtain skills or technologies faster or at a lower cost than they can be built. This is often used in the high tech market space, to speed growth. A good example is Cisco Systems, as they grew very quickly from a single product line into a major player in the Internet equipment space. From 1993 to 2001, Cisco acquired 71 companies. Cisco’s sales increased from $650 million in 1993 to $22 billion in 2001, with nearly 40% of revenue coming directly from new acquisitions. Type 7: Conglomerate & Diversification. Acquire R&D, technology, people, markets At Nordson, congeneric mergers are attractive. This is where companies are related by markets, technology or production processes. The target firm is valued due to an extension of a product line or a similar technology market space. A product extension is when a new product line from the acquired company is added to an existing product line – gap filling with current customer markets. A market extension is when a new or adjacent market is added to the existing market, bringing new customers or deepening current customer relationships. Clearly understanding the type of acquisition in play is the first step in developing an integration plan that will be successful over the long term, fulfilling the goals of value creation. As we become more efficient in our integration processes, we will gain the discipline and rigor for each type of acquisition, with more defined checklists and tools. These will develop over time, and with more experience and process management. Communication Overview A Communication Plan will assist in developing and organizing the communications strategy needed to keep the key stakeholders, customers, and acquisition/integration team informed as we move through the phases of the integration process. Good communication is the lifeblood of a successful acquisition. In order to be effective, the integration leadership must identify what needs to be communicated, what the communications should contain, who is responsible for generating the communication, what format or medium the communication should be delivered in, what frequency is needed to keep the target audience up to date on integration actions and finally, who is the target audience for the communications. Effective communications will comfort employees, interest investors, improve decisionmaking, improve productivity and reduce waste and expense. Conversely, poor communication during an integration project can lead to misapplication of resources, employee dissatisfaction and attrition, and poor business performance. Strategic Drivers that should be considered when creating a communication plan include: Type of merger/acquisition – e.g., merger of equals, a voluntary acquisition Whether the acquired/merged institution will remain a stand-alone and retain its identity, or be fully integrated and rebranded Timing – whether immediate, or in stages Markets served – e.g., distinct separate geographic markets, contiguous or overlapping markets Surviving (or new) vision, value proposition and brand promise System capabilities and/or limitations, including core processors and other system applications – integration plans and timing of changes Anticipated community and/or employee impacts (plant closures) Competitive opportunities and/or threats Alignment of product and service offerings Assessment An assessment should be undertaken to guide the development of a comprehensive integration communication and marketing plan to support the integration objectives, including the following: Employee Communication Customer Communications Media and Public Relations Community Communications & Customer Relations Other Marketing Support Product Offerings and Service Support Staff Training Employee Communications Employee communications should include all employees of both organizations and may include most or all of the following: Executive/Sr. Mgmt/Key Employee Communications: Need to know employees will be kept informed as determined by integration leads and Legal counsel Announcement: All employees meeting immediately following agreement, with a hand out or intranet posted “packet” of information including: Media contacts and procedures Press release FAQs and talking points Timetable (initial plan) General employee impact if any Ongoing Updates: Special email employee newsletter distributed frequently throughout the process to keep employees informed of progress, developments, impacts, etc. This info could also be kept current on an intranet site. Staff Meetings – all employee or functional groups (great place to gather employee feedback) Copies of all customer/member communications – with background info (if appropriate) Customer Communications Potential customer communications include the following, determined based on specific situation (may include: personalized mailings, emails, targeted phone calls, web site, and newsletter updates, social media, and more). Possibly develop a special acquisition web site section available to customers as a portal of information. Initial Announcement: Develop and send an announcement communication to newly acquired company strategic customers. Welcome or introduction to Nordson Corporation: Develop a welcome letter informational “packet” to impacted customers for distribution via sales managers that informs of key changes and emphasizing advantages and benefits, providing information on corporate facts, contacts, and other changes. Product & Service Change Notification: As applicable, develop and send communications to customers impacted by changes, to include description of changes, impacts and options; supporting collateral; applicable disclosures/terms & conditions; etc. Depending on scope of changes. Customer Feedback: Develop process for addressing customer concerns and questions with feedback loop to FAQs Ongoing Communications: Develop targeted, multi-channel customer “onboarding”, retention and potential cross-selling. Media Communications and Public Relations A media and public relations plan can be the best way to gain support for acquisitions, and should include some or all of the following: Media Plan: Develop list of media contacts for press release distribution and other Communications – including “friendly” publications/reporters that can be helpful supporters Identify spokesperson who will represent both companies with the media, and community organizations or other interested groups Develop key messages and talking points – including responses to sensitive or challenging questions Press Releases, Interviews: Issue press release announcing definitive agreement (approved by Commercial lead and legal) Reach out to identified publications/reporters for interviews and coverage of the acquisition (if appropriate) Determine and develop follow-up press releases, interviews, social media Social Media: Need to better understand the policy at Nordson on Facebook, LinkedIn, Twitter and any others…..messages via these networks need to be identical. General Communication & Community Relations Depending on the circumstances of the acquisition, a visible reconnection with the community may be needed, and could include one or more of the following: Community outreach: Identify meetings or events with community leaders to demonstrate Nordson’s commitment to the community and send a positive strategic message Community Sponsorships, Board Memberships & Community Involvement: Develop a strategy to integrate the community relations involvement and support and previous commitments made by the acquired organization as long as they are consistent with Nordson’s brand, vision and value proposition Additional Marketing Support to consider in Communication Planning: Branding: Execute the branding plan as described in the process (see Exhibit XXX). Also see marketing communications functional checklist. Depending on scope, standardized graphic guidelines must be communicated internally and externally Marketing Plan and Calendar: New acquisition needs must be built into and follow the annual calendar and budget specific to Nordson’s Marketing Plan. The overall marketing plan includes: Collateral Media Direct Marketing Marketing campaigns and promotions Promotional items Events (trade shows, receptions, etc) See functional checklist for Marketing in the Appendix Branding – Exhibit XXX Reporting and Results Management: Each team leader is required to keep their project plan document current at least weekly. Project files are required to be updated via Smartsheet. Collaborative software enables realtime updates within shared files. Working within these tools is required, and will improve efficiency, as accountability is built into the work flow. By using the collaborative software, we eliminate the fire drills for reporting progress to plan. Each team leader is required to keep their project plan document current, ideally, updated daily. Project files are kept current on the “collaborative tool website” at all times. Since all data is real time, if you haven’t been updating the action plan, it will be obvious to the Integration Project Manager. The Project Manager will prepare a report of the major project achievements/issues for the Commercial Integration Leader who will present or report to the Business Unit VP. Each week, the Integration Leader will present the weekly overall project summary to the Integration Steering Committee for review, comment, decisions, and directional adjustment and resource commitments. The process of continuous status review will reveal performance failures and allow the opportunity for correction prior to development of critical issues. Status Reporting Process Summary Weekly Monthly Board Updates (as required) • Update Action Plans Functional Integration Team Leaders • Lead Team Meetings/Calls •Update Action Plan Dashboard incl. Comments Accounting/ Controlling Integration Project Manager Business Segment VP • Update Gantt Chart and FY Forecast • Lead Team Meetings/Calls • Update Value Driver Dashboard incl. Comments • Update P&L Summary •Review/Finalize Master Action Plan Dashboard • FYI only •Compile Monthly Report •Lead Monthly Management Integration Status Meeting •Add Comments to Monthly Report and Send to CEO • Submit Board Report (Summary Sheet from Monthly Report)