III. Economies of Scale

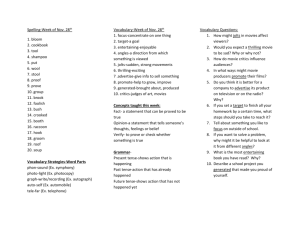

advertisement

Topic 3A: Extremely Competitive Closed Markets LECTURE NOTES I. Price in Extremely Competitive Markets: Firms in extremely competitive markets are price takers. They take price as given and choose to produce output Q such that at Q, their marginal cost of producing Q = market price P, i.e. MC(Q) = P. This is the profit maximizing price for a firm in this type of market. II. Overview of Various Measures of Cost: 1. Fixed cost F: cost that does not vary with the level of output, i.e. does not depend on Q. 2. Sunk cost: portion of fixed cost that is not recoverable, that is cannot be recovered if the firm stops operating. Examples: incorporation fee, legal expenses associated with setting up a business, commission paid to real estate agent. Sunk cost is like spilt milk: once it is sunk there is no use worrying about it (pour yourself another glass) and it should not affect subsequent decisions. 3. Variable cost VC(Q): cost that varies or changes with changes in output. Example: labor, cost of inputs, operations and maintenance costs. 4. Total cost TC(Q): Fixed cost + variable cost = F + VC(Q) 5. Average fixed cost AFC(Q): F/Q 6. Average variable cost AVC(Q): VC(Q)/Q 7. Average total cost ATC(Q): TC(Q)/Q. Note: ATC(Q) is also = AFC(Q) + AVC(Q) = F/Q + VC(Q)/Q 8. Marginal cost MC(Q): change in total cost associated with a small change in the level of output. MC(Q) = TC(Q)/Q III. Economies of Scale Scale economies exist if the average cost of production ATC(Q) falls as output Q increases, i.e.: TC(Q+n)/(Q+n) < TC(Q)/Q, n = 1,2,3….. ATC : the cost function exhibits economies of scale, i.e. the average cost per unit of output decreases as the level of output increases. ATC is constant: the cost function exhibits constant returns to scale ATC: the cost function exhibits diseconomies of scale. Causes for Economies of Scale: Increase in capacity with less than proportional rise in equipment cost. Many examples of this in plant engineering and manufacturing processes. Fixed costs spread over a larger level of output: if fixed costs are a very large part of the production cost, since they do not vary with the level of output, when the level of output increases, the fixed costs will be spread over a larger output and the AC will decline (as long as the variable costs do not increase drastically or the plant reaches a point where output cannot be increased because the fixed plant has reached its full productive capacity.) Economies of massed reserves: Manufacturing plants as well as most other production facilities are configured to have extra capacity (or reserve capacity) in case of breakdown. The larger the level of output or services produced the less reserve capacity may be needed as a proportion of the total output. For example, the number of repairmen a company must employ to maintain a certain level of service in the case of a breakdown usually rises proportionately less than the increase in the number of machines employed in the production process. Attract managers of higher ability Work force specialization: With a larger level of output, the production process can be divided into specialized tasks and workers can be trained in those tasks. Example: automobile assembly line. It’s the concept behind Adam Smith’s “division of labor”: workers specialize in a certain type of labor and become very proficient at it. (But, there may be drawbacks. See Charlie Chaplin in “Modern Times”) Checks on Economies of Scale: Minimum efficient scale of technology Managerial diseconomies and higher monitoring costs when production increases beyond a certain level. IV. Economies of Scope Definition: Are present if it is cheaper to produce 2 or more different products together than separately. Contributing Factors: Use of common inputs. For example, for a car manufacturer there may be substantial economies of scope in producing small and large cars in the same division. The manufacture of small and large cars uses many same inputs, including the skills required to build the cars. On the other hand, manufacturing of trucks is often handled in a separate division. An important common input is knowledge (information about one product is relevant for the production of another closely-related product), using same marketing and distribution skills, same accounting dept., etc. Suppose: Cost of producing 2 goods y1 and y2 together = C(y1,y2) Cost of producing y1 alone = C(y1) Cost of producing y2 alone = C(y2) The measure or degree of economies of scope from producing both goods together is: [C(y1) + C(y2)] – C(y1,y2) C(y1,y2) This is a measure of the relative increase in cost that would result if the products were produced separately. V. Choice of Plant Size and Type of Technology What do costs depend on? The type and size of equipment and staff, technology adopted, managerial skill, etc. How do the managers/owners decide how large a plant to build and what type of technology to adopt? - Their assessment of present and future demand for their product; - The cost of different size plants and technologies; - The time and cost associated with training or hiring new people if a new technology is adopted; - What they expect their competitors to do; - The firm’s objective; - The time horizon Individual Plant-Size ATC: This figure shows the ATC curve for 3 different plant sizes. For low levels of output the smallest plant size is the cheapest. For larger sizes of output the largest plant size is the cheapest. Which size plant the firm decides to build will depend on all the things we mentioned above. Decisions regarding capital investments are made in the short-term with expectations about the long term. Those expectations may be correct or not. If they are correct the investment decisions will be appropriate. If they are not the firm will find itself with obsolete equipment, too much inventory, too little productive capacity or of the wrong kind, etc. and it will be at a disadvantage relative to its competitors unless its competitors have made the same or other mistakes and consumers don’t have other alternatives. READINGS 1. Google, Facebook, Amazon, Ebay: Is the Internet Driving Competition or Market Monopolization? International Economics and Economic Policy, February 2014, Vol.11, Issue 1-2, pp. 49-61. http://www.biblio.liuc.it:2383/ehost/pdfviewer/pdfviewer?vid=5&sid=4d926e25-3be64230-8a91-9f8ef772c2f1%40sessionmgr4002&hid=4109 2. (Optional Reading) Overemphasis on Perfectly Competitive Markets in Microeconomics Textbooks, Journal of Economics Education, Volume 38, Issue 1, Winter 2007, pp. 58-77 http://www.biblio.liuc.it:2383/ehost/pdfviewer/pdfviewer?vid=11&sid=4d926e25-3be64230-8a91-9f8ef772c2f1%40sessionmgr4002&hid=4109 SAMPLE PROBLEMS Castellanza Movies is a movie theatre geared primarily to LIUC students. It has two evening shows with ticket price of $10/movie. Since some students have free time during the day, Castellanza Movies also offers one matinee show at 2pm for a reduced rate of $6/movie. The total fixed costs of running the movie theatre are $500/day. The variable costs associated with showing a movie is $300/movie. Ticket sales average 120 total tickets/evening and 40 tickets/matinee. a. Using the cost estimates and movie attendance figures, determine whether or not the owner should continue its two evening shows and its matinee show. b. What is the minimum ticket price that must be charged for matinee movies so that the theatre will not lose money on these showings? (Assume that a small increase in the matinee ticket price (less than 30%) will not affect matinee attendance.) Answer: a. In order to determine if the theatre should continue showing movies in the evening or during the day (in the short run), compare the variable costs incurred for these movies with the revenues they generate. Fixed costs are already considered sunk costs and should not be factored into Castellanza Movies management’s decision. Evening movies Variable Cost of one movie = $300 Total Variable Cost for one evening (2 evening movies) = 2 x $300 = $600 Revenues generated from evening movies = tickets purchased x price/ticket = 120 x $10 = $1200 $1200 > $600, revenues exceed variable costs, therefore evening movies should continue. Matinees Total Variable Cost for matinee = $300 Revenues generated from matinee movie = tickets purchased x price/ticket = 40 x $6 = $240 $240 < $300, variable costs exceed matinee revenues. Therefore, matinee movies should be discontinued. b. In order to continue the matinee showings, the theatre must charge enough per ticket so that the revenues for a matinee are at least equal to the variable costs associated with showing that movie. Variable Cost for matinee = $300 So revenues generated from a matinee movie must at least equal $300. So minimum matinee ticket price = $300/40 = $7.50.