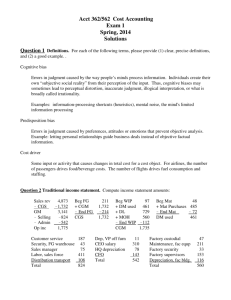

Chapter M5

advertisement

M5 Business Decisions Using Cost Behavior Discussion Questions 5-1. This question will ask your students to apply the concepts learned in previous chapters concerning cost behavior. Many of your students may be overwhelmed by this question if they have not read ahead. Since the selling price of each shirt was $12 each, the total sales will be $12 x 5,000 shirts. Cost of goods sold, a variable cost, is given at $7.20 per shirt. Students must determine the variable cost per unit for selling and administrative expenses. Total selling expenses consist of both fixed ($5,700) and variable ($3,800) portions. The variable cost per unit of selling expenses is $1.27 ($5,700/3,000). Next, variable cost per unit of administrative expenses must be determined. Variable administrative expenses are $1,600. The administrative variable cost per unit is $0.53 ($1,600/3,000). Variable cost per unit of selling expenses: Variable selling expense Cost per unit at 3,000 units sold 3,800 $ 1.27 Variable cost per unit of administrative expenses: Variable selling expense 1,600 Cost per unit at 3,000 units sold $ 0.53 The contribution margin income statement will segregate variable costs from fixed costs. Total variable costs per unit are $1.27 plus $0.53 plus $7.20, for a total of $9.00 per unit. The income statement presented below calculates each of the variable cost separately. Fixed selling Chapter M5 – Business Decisions Using Cost Behavior M5-1 costs are $5,700. Fixed administrative costs are $6,300. The net income is based on sales of 5,000 units. Sales (5,000 x $12) Variable cost: Cost of goods sold (5,000 x $36,000 $7.20) Variable selling expense (5,000 x 6,350 $1.27) Variable admin. expense (5,000 x 2,650 $0.53) Contribution margin Fixed selling expense 5,700 Fixed administrative expense 6,300 Net income $ 60,000 45,000 $ 15,000 12,000 $ 3,000 The contribution margin per unit is determined by subtracting the total variable costs of $9.00 from the unit selling price of $12.00 per unit, for a net of $3.00 per unit. 5-2. This question encourages students to think about the difference between the functional income statement and the contribution margin income statement. Gross margin is determined by subtracting cost of goods sold from sales revenue. Cost of goods sold includes both a fixed and a variable portion. Contribution margin is sales revenue minus total variable costs. Total variable costs consist of three components: cost of goods sold, variable selling cost, and administrative variable cost. No fixed costs are deducted to arrive at contribution margin. M5-2 Chapter M5 – Business Decisions Using Cost Behavior 5-3. Net income or net loss will be exactly the same regardless of the format of the statement because both statements use identical costs. The operating loss computation on both statements is calculated by subtracting total fixed and total variable costs to obtain the bottom line. The difference in the statements is the arrangement of the fixed and variable costs within each statement. 5-4. This question provides an opportunity for your students to practice using what they have learned thus far about contribution margin. Using the formula for contribution margin ratio, we can plug in the contribution margin ratio and plug the increase in sales and solve for the increase in profit. X / $20, 000 = 25% If sales increases by $20,000, profits will increase by $5,000. 5-5. To prove that 13,000 T-shirts must be sold to earn $27,000 total profit, we can use the income statement format. Sales revenue (13,000 x $12) Less variable costs (13,000 x $9) Less fixed costs Net income $156,000 117,000 12,000 $ 27,000 As an alternative, CVP formula 3 may be used as follows: ($12,000 + $27,000) / $3 = 13,000 5-6. As shown in Discussion Question 5-5, a condensed income statement can be created to prove the profit of $27,000. As an alternative, CVP formula 4 may be used as follows: ($12,000 + $27,000) / 25% = x Selling for x, sales must be $156,000. Chapter M5 – Business Decisions Using Cost Behavior M5-3 5-7. This question demonstrates how a CVP graph can be used as a management tool. Caution your students that graphs often make data appear more useful, but should not be used in place of calculations. This is also an opportunity to tie in the concept of relevant range. a. Based on Exhibit 5-8, profit is equal to $10,500 when fixed costs equal $12,000 and sales equal $90,000. First, the sales level must be identified horizontally on the graph. At the point where $90,000 crosses the sales line, a vertical line can be drawn to identify the number of units that must be sold at this sales level, which is 7,500 shirts. b. From CVP formula 4, we know that a profit of $27,000 requires $156,000 in sales. Once the sales level is identified on the sales line, a vertical line can be drawn to intersect the x-axis at the number of units needed to produce this amount of sales—13,000 units. This amount can be verified by dividing the unit price of $13 into total sales of $156,000. 5-8. This question requires students to use analytical skills in applying sensitivity analysis. Those students who have read ahead will have an idea of how this question might be solved. The reduction in price to $11 reduces the contribution margin from $3 to $2 per unit. Using CVP Formula 3 we know that: Required Unit Sales = 13,000 = Fixed Cost + Target Profit Contribution Margin per Unit $12,000 + $2.00 Solving for (target profit), gives us $14,000. The profit will drop to $14,000 if the sales price is dropped to $11 per unit. M5-4 Chapter M5 – Business Decisions Using Cost Behavior 5-9. This Discussion Question helps students associate the contribution margin statement with contribution margin analysis. The best way to prove the amount of profit is to create a condensed contribution income statement. Sales (19,500 x $11) $214,500 Variable cost (19,500 x $9) 175,500 Contribution margin 39,000 Fixed costs 12,000 Net income $ 27,000 The computation can also be approved by substituting back into CVP Formula 4. 5-10. The first step is to calculate a new contribution margin ratio. If selling price is reduced to $11 per unit and the variable cost remains at $9 per unit, the new contribution margin per unit is $2. The new contribution margin ratio is $2/$11 or 18.18%. Next, the new contribution margin ratio is substituted into CVP formula 4: ($12,000 + $27,000) / .1818 = $214,500 rounded 5-11. A new contribution margin ratio must be calculated when the selling price changes because the change in selling price reduces or increases the contribution margin per unit. For each additional unit sold, a different amount equal to the change in selling price is available to cover fixed cost and go towards profit. 5-12. A new contribution margin ratio will be calculated when either component of contribution margin changes—selling price or variable cost. Chapter M5 – Business Decisions Using Cost Behavior M5-5 5-13. This question asks students to consider alternatives possible when the number of units cannot be increased. Some students may wonder why it may be impossible to increase the number of units sold. Ask them to play the role of a store manager with 200 cases of Tickle Me Elmo dolls for sale. These stuffed toys were so popular during 1998 that some people were willing to pay up to $300 to buy one. How many of these toys could be sold today, even if the store manager really wanted to sell all of them? Chances are customers would only buy one if the selling price were reduced even further. Unless the merchandiser wants to incur a loss, sometimes increasing volume is not possible. Some alternatives that Claudia might consider to retain the desired profit include reducing the variable cost, reducing the fixed cost, or reducing the selling price even lower than $11. 5-14. CVP formula 4 can be used to prove that sales must total $123,750. First, the contribution margin ratio must be calculated. If the selling price is $11 per unit and the variable cost is $7.80, the contribution margin per unit is $3.20. The contribution margin ratio is calculated by dividing the contribution margin per unit by selling price per unit, $3.20/$11, for a ratio of 29.1%. Substituting this ratio into CVP formula 4, we get: ($9,000 + $27,000) / 29.1% = $123,750 (rounded) 5-15. This question can be used to complete your discussion of changes in variable and fixed costs as they are affected by changes in selling price and volume. Answer this question by creating a contribution margin income statement as follows: Sales (13,000 x $11) Variable cost (13,000 x $7.80) Contribution margin Fixed costs Net income M5-6 $ 143,000 101,400 41,600 9,000 $ 32,600 Chapter M5 – Business Decisions Using Cost Behavior Profits will increase to $32,600 if 13,000 shirts are sold during 2010. 5-16. This question encourages your students to think about factors that may make CVP analysis unreliable. Some factors are: Some cost may be considered mixed that can be separated into fixed and variable components. The volume of activity may go outside the relevant range. Fixed cost may predictably vary within the relevant range. Some customers may be offered volume discounts while others are not. Some merchandise is marked down for sale. The average contribution margin ratio varies throughout the relevant range 5-17. The contribution margin income statement that follows proves that sales must equal $602,703 in order to obtain a net income of $80,000. Sales Variable cost Contribution margin Fixed costs Net income $602,703 379,703 223,000 143,000 $ 80,000 Review the Facts A. A contribution income statement classifies costs by their behavior fixed, variable, or mixed. A functional income statement classifies costs by their function product or period. Chapter M5 – Business Decisions Using Cost Behavior M5-7 B. C. The contribution margin is the difference between sales and total variable costs. The contribution margin is the difference between operating revenues and variable costs which measures the amount of revenues remaining after variable costs to contribute towards fixed costs and profits. The contribution margin is effective in helping to determine an entity’s breakeven point or desired profit. D. The total contribution margin is the difference between total sales and total variable costs. The contribution margin per unit is the difference between the sales price per unit and the unit variable costs. E. The contribution margin ratio is the contribution margin expressed as a percentage of sales as opposed to a dollar amount for the contribution margin. F. Cost-volume-profit analysis is the analysis of the relationships between cost and volume, and the effect on profit of those relationships. For planning and analysis, it helps managers find the break-even point, determine the dollar volume or sales volume required for a desired profit level, and create data for operating budgets. G. The break-even point is the volume of sales dollars or units required for an entity to achieve breakeven, or the point at which the company achieves neither a net income or loss. H. The break-even point in units divides fixed costs by the unit contribution margin, whereas the break-even point in sales dollars divides fixed costs by the contribution margin ratio. I. To calculate the required sales in units to attain a target profit, add the target profit to the fixed costs and divide by the unit contribution margin. M5-8 Chapter M5 – Business Decisions Using Cost Behavior J. To calculate the required sales in dollars to attain a target profit, add the target profit to the fixed costs and divide by the contribution margin ratio. K. Sensitivity analysis is a technique used to determine the effect of changes on the CVP relationship. Sensitivity analysis attempts to answer “what if” questions. An example is the analysis of what would happen to profit if a manager were to raise or lower the selling price of product, or obtain quantity discounts on purchases. L. The average contribution margin ratio for a company with multiple products is the total contribution margin divided by total sales. M. The two CVP formulas used to compute target profits for a multiproduct company use the contribution margin ratio. N. CVP formulas that require per unit information are useless in a multiproduct situation because there is a separate contribution margin for each product. Chapter M5 – Business Decisions Using Cost Behavior M5-9 Apply What You Have Learned 5-18. Fresh Baked Cookie Company Contribution Income Statement For the Year Ended December 31, 2007 Sales Variable Cost: Cost of Goods Sold Variable Selling Expense Variable Administrative Expense Total Variable Cost Contribution Margin Fixed Cost: Fixed Selling Expense Fixed Administrative Expense Total Fixed Cost Operating Income $36,000 $ 4,000 3,600 500 8,100 $27,900 $14,400 9,500 23,900 $ 4,000 5-19. Stieferman's Bait Shop Contribution Income Statement For the Year Ended December 31, 2007 Sales Variable Cost: Cost of Goods Sold Variable Selling Expense Variable Administrative Expense Total Variable Cost Contribution Margin Fixed Cost: Fixed Selling Expense Fixed Administrative Expense Total Fixed Cost Operating Income M5-10 $98,000 $22,000 8,100 3,600 33,700 $64,300 $18,900 32,400 51,300 $13,000 Chapter M5 – Business Decisions Using Cost Behavior 5-20. Quality Fishing Gear Company Contribution Income Statement For the Year Ended December 31, 2007 Sales Variable Cost: Cost of Goods Sold Variable Selling Expense Variable Administrative Expense Total Variable Cost Contribution Margin Fixed Cost: Fixed Selling Expense Fixed Administrative Expense Total Fixed Cost Operating Income Chapter M5 – Business Decisions Using Cost Behavior $540,000 $360,000 57,200 18,000 435,200 $104,800 $ 30,800 54,000 84,800 $ 20,000 M5-11 5-21. a. Shannon Davis Projected Contribution Income Statement For the Month of November, 2007 Sales (3000 x $2) $6,000 Variable Cost: Cost of Goods Sold (3000 x $.50) $1,500 Miscellaneous Variable Cost (3000 x $.10) 300 Total Variable Cost 1,800 Contribution Margin $4,200 Fixed Cost: Salaries $1,200 Rent 550 Electricity 200 Telephone 95 Miscellaneous Fixed Cost 150 Total Fixed Cost 2,195 Operating Income $2,005 b. Contribution margin per unit = $4,200 / 3,000 = $1.40 Break-even point = $2,195 / $1.40 = 1,568 units 11 hours per day for 24 days = 264 hours 1,568 cards / 264 hours = 6 cards per hour c. Contribution Margin Ratio = $4,200 / $6,000 = 70% Break-even Point in Sales = d. FC = $2,195 CMR .70 = $3,136 Target Profit = FC + DP = $2,195 + $40,000 = $60,279 CMR .70 312 days per year x 11 hours = 3,432 hours per year $60,279 / $2 = 30,140 card sales required per year 30,140 / 3,432 = 8.78 cards per hour This is a feasible number of card sales per hour. M5-12 Chapter M5 – Business Decisions Using Cost Behavior 5-22. a. Jon's Pretzel Stand Contribution Income Statement For the Year Ended December 31, 2007 Sales (8,000 x $2) Variable Cost: Cost of Goods Sold (8,000 x $.25) Wages (8000 x $.20) Total Variable Cost Contribution Margin Fixed Cost: Rent Total Fixed Cost Operating Income $16,000 $ 2,000 1,600 3,600 $12,400 $12,000 12,000 $ 400 b. If Jon were to invest his rent money each year in a certificate of deposit and could make five percent interest, he would earn $720 per year. The $720 represents his opportunity cost. If Jon were to work the stand himself, he would increase his profits to $2,000. c. John could increase his profits by: increasing his selling price, limited to the amount the market will bear. adding additional products such as cheese dip or drinks. reduce the costs of the product, rent, or labor. Chapter M5 – Business Decisions Using Cost Behavior M5-13 5-23. Janet's Snow Cone Stand Contribution Income Statement For the Year Ended December 31, 2007 Sales (6,000 x $2.00) Variable Cost: Cost of Goods Sold (6,000 x $.30) Wages (6,000 x $.40) Total Variable Cost Contribution Margin Fixed Cost: Rent Total Fixed Cost Operating Income $12,000 $1,800 2,400 4,200 $ 7,800 $2,400 2,400 $ 5,400 b. Janet could invest her fixed cost of $2,400 per year in a certificate of deposit earning 5% and make $120 per year. In this case, she makes much more than her opportunity costs at the snow cone stand. c. Janet might increase her profits by: increasing her sales price to what the market will bear. adding additional products to sell such as candy, ice cream, or drinks. doing the work herself instead of hiring others to increase her profits to $7,800. M5-14 Chapter M5 – Business Decisions Using Cost Behavior 5-24. The Bevens Company Contribution Income Statement For the Year Ended December 31, 2008 Sales Variable Cost Contribution Margin Fixed Cost Operating Income $800,000 528,000 $272,000 181,000 $ 91,000 5-25. The Bevens Company Income Statement For the Year Ended December 31, 2008 Sales Cost of Goods Sold Gross Profit Operating Expenses: Selling Expenses Administrative Expenses Operating Income $800,000 420,000 $380,000 $203,000 86,000 289,000 $ 91,000 5-26. The Heidi Company Contribution Income Statement For the Year Ended December 31, 2008 Sales Variable Cost Contribution Margin Fixed Cost Operating Income Chapter M5 – Business Decisions Using Cost Behavior $4,800,000 3,069,000 $1,731,000 1,621,000 $ 110,000 M5-15 5-27. The Heidi Company Income Statement For the Year Ended December 31, 2008 Sales Cost of Goods Sold Gross Profit Operating Expenses: Selling Expenses Administrative Expenses Operating Income $4,800,000 2,320,000 $2,480,000 $ 913,000 1,457,000 2,370,000 $ 110,000 5-28. Carl's Athletic Shop Contribution Income Statement For the Year Ended December 31, 2008 Sales Variable Cost Contribution Margin Fixed Cost Operating Income $422,000 282,000 $140,000 109,000 $ 31,000 5-29. Carl's Athletic Shop Income Statement For the Year Ended December 31, 2008 Sales Cost of Goods Sold Gross Profit Operating Expenses: Selling Expenses Administrative Expenses Operating Income M5-16 $422,000 205,000 $217,000 $130,000 56,000 186,000 $ 31,000 Chapter M5 – Business Decisions Using Cost Behavior 5-30. Paradise Manufacturing Contribution Income Statement For the Year Ended December 31, 2007 Sales Variable Cost: Direct Material Direct Labor Variable Manufacturing Overhead Variable Selling Cost Variable Administrative Cost Total Variable Cost Contribution Margin Fixed Cost: Fixed Manufacturing Overhead Fixed Selling Cost Fixed Administrative Cost Total Fixed Cost Operating Income Chapter M5 – Business Decisions Using Cost Behavior $2,780,000 $680,000 420,000 130,000 240,000 198,000 1,668,000 $1,112,000 $900,000 60,000 22,000 982,000 $ 130,000 M5-17 5-31. Nicole’s Toy Manufacturing Company Contribution Income Statement For the Year Ended December 31, 2007 Sales $3,164,000 Variable Cost: Direct Material $440,000 Direct Labor 90,000 Variable Manufacturing Overhead 70,000 Variable Selling Cost 522,500 Variable Administrative Cost 85,500 Total Variable Cost 1,208,000 Contribution Margin $1,956,000 Fixed Cost: Fixed Manufacturing Overhead $800,000 Fixed Selling Cost 427,500 Fixed Administrative Cost 484,500 Total Fixed Cost 1,712,000 Operating Income $ 244,000 M5-18 Chapter M5 – Business Decisions Using Cost Behavior 5-32. Rick’s Watch Company Contribution Income Statement For the Year Ended December 31, 2007 Sales Variable Cost: Direct Material Direct Labor Variable Manufacturing Overhead Variable Selling Cost Variable Administrative Cost Total Variable Cost Contribution Margin Fixed Cost: Fixed Manufacturing Overhead Fixed Selling Cost Fixed Administrative Cost Total Fixed Cost Operating Income Chapter M5 – Business Decisions Using Cost Behavior $2,745,000 $534,000 129,000 397,000 131,320 53,460 1,244,780 $1,500,220 $998,000 64,680 189,540 1,252,220 $ 248,000 M5-19 5-33. Alumacraft Manufacturing Contribution Income Statement For the Year Ended December 31, 2008 Sales Variable Cost: Direct Material Direct Labor Variable Manufacturing Overhead Variable Selling Cost Variable Administrative Cost Total Variable Cost Contribution Margin Fixed Cost: Fixed Manufacturing Overhead Fixed Selling Cost Fixed Administrative Cost Total Fixed Cost Operating Income M5-20 $7,900,000 $2,600,000 1,820,000 540,000 323,000 218,500 5,501,500 $2,398,500 $1,900,000 57,000 11,500 1,968,500 $ 430,000 Chapter M5 – Business Decisions Using Cost Behavior 5-34. a. Total Fixed Cost_____ = Breakeven Point in Units Contribution Margin per Unit $200,000 = $200,000 = 3,077 units $90 – $25 $65 b. Total Fixed Cost + Target Profit = Required Unit Sales Contribution Margin per Unit $200,000 + $25,000 = $225,000 = 3,462 units $65 $65 c. 3,462 / 2080 hours in a year = 1.67 per hour d. 4 tests per hour x 2,000 hours x $65 CM = $520,000 minus fixed costs of 200,000 Potential profit $320,000 e. Most students will come to the following potential customers: insurance companies doctors and clinics sports teams and schools employers When they think about it, these organizations are the sources of the business. To promote the business, the owner must make contacts with these organizations to attract the business. Chapter M5 – Business Decisions Using Cost Behavior M5-21 5-35. a. Total Fixed Cost __ = Breakeven Point in Units Contribution Margin per Unit $385,000 = $385,000 = 500,000 units $.99 – $.22 $.77 b. Total Fixed Cost + Target Profit = Required Unit Sales Contribution Margin per Unit $385,000 + $35,000 = $420,000 = 545,455 units $.99 – $.22 $.77 5-36. a. Total Fixed Cost___ = Breakeven Point in Units Contribution Margin per Unit $3,000 = 1,000 units $5 – $2 b. Total Fixed Cost + Target Profit = Required Unit Sales Contribution Margin per Unit $3,000 + $5,000 = 2,667 units $5 – $2 M5-22 Chapter M5 – Business Decisions Using Cost Behavior 5-37. a. Total Fixed Cost_____ = Breakeven Point in Units Contribution Margin per Unit $4,558___ = $4,558 = 5,300 units $3.97 – $3.11 $.86 b. Total Fixed Cost + Target Profit = Required Unit Sales Contribution Margin per Unit $4,558 + $2,580 $3.97 – $3.11 = $7,138 = 8,300 units $.86 5-38. a. Contribution Margin = Contribution Margin Ratio Sales $200,000 – $130,000 = .35 $200,000 ___Total Fixed Cost __ = Breakeven Sales in Dollars Contribution Margin Ratio $48,000 + (12x300) = $51,600 = $147,429 .35 .35 b. Total Fixed Cost + Target Profit = Required Sales Contribution Margin Ratio $51,600 + $20,000 = $204,571 .35 Chapter M5 – Business Decisions Using Cost Behavior M5-23 5-39. a. Contribution Margin = Contribution Margin Ratio Sales $1,250,000 – $600,000 = .52 $1,250,000 ___Total Fixed Cost __ = Breakeven Sales in Dollars Contribution Margin Ratio $420,000 + $75,000 = $495,000 = $951,923 .52 .52 b. Total Fixed Cost + Target Profit = Required Sales Contribution Margin Ratio $495,000 + $120,000 = $1,182,692 .52 5-40. a. Contribution Margin = Contribution Margin Ratio Sales $3,650,000 – $1,387,000 = .62 $3,650,000 ___Total Fixed Cost __ = Breakeven Sales in Dollars Contribution Margin Ratio $225,000 = $362,903 .62 b. Total Fixed Cost + Target Profit = Required Sales Contribution Margin Ratio $225,000 + $125,000 = $564,516 .62 M5-24 Chapter M5 – Business Decisions Using Cost Behavior 5-41. a. Fixed Costs: Rent $125 b. Variable Costs: Cost of Goods Sold ($3/12) $.25 per unit c. Unit Selling Price – Unit Cost = Unit Contribution Margin $0.75 – $0.25 = $0.50 per unit d. (1) ____Total Fixed Cost_____= Breakeven Point in Units Contribution Margin per Unit $125 = 250 units $0.50 e. (2) Sales ($0.75 x 250) Variable Cost ($0.25 x 250) Contribution Margin Fixed Cost Operating Income $187.50 _62.50 $125.00 125.00 $ 0 (1) Total Fixed Cost + Target Profit = Required Unit Sales Contribution Margin per Unit $125 + $50 = 350 units $0.50 (2) Sales ($0.75 x 350) Variable Cost ($0.25 x 350) Contribution Margin Fixed Cost Operating Income Chapter M5 – Business Decisions Using Cost Behavior $262.50 _87.50 $175.00 125.00 $ 50.00 M5-25 5-42. a. Fixed Costs: Rent $90.00 b. Variable Costs: Cost of Goods Sold ($1.00/8) $.125 per unit c. Unit Selling Price – Unit Cost = Unit Contribution Margin $0.35 – $0.125 = $0.225 per unit d. (1) _____Total Fixed Cost_____= Breakeven Point in Units Contribution Margin per Unit $90_ = 400 units $0.225 e. (2) Sales ($0.35 x 400) Variable Cost ($0.125 x 400) Contribution Margin Fixed Cost Operating Income $140.00 _50.00 $ 90.00 90.00 $ 0 (1) Total Fixed Cost + Target Profit = Required Unit Sales Contribution Margin per Unit $90 + $180 = 1,200 units $0.225 (2) M5-26 Sales ($0.35 x 1,200) Variable Cost ($0.125 x 1,200) Contribution Margin Fixed Cost Operating Income $420.00 150.00 $270.00 90.00 $180.00 Chapter M5 – Business Decisions Using Cost Behavior 5-43. a. Fixed Costs: Rent $48.88 b. Variable Costs: Cost of Goods Sold $.40 per unit c. Unit Selling Price – Unit Cost = Unit Contribution Margin $3.00 – $0.40 = $2.60 per unit d. (1) _____Total Fixed Cost____ = Breakeven Point in Units Contribution Margin per Unit $48.88_ = 18.8 units => 19 units $ 2.60 e. (2) Sales ($3.00 x 19) Variable Cost ($0.40 x 19) Contribution Margin Fixed Cost Operating Income $57.00 _7.60 $49.40 48.88 $ .62 (1) Total Fixed Cost + Target Profit = Required Unit Sales Contribution Margin per Unit $48.88 + $200 = 95.7 units => 96 units $2.60 (2) Sales ($3.00 x 96) Variable Cost ($0.12 x 80) Contribution Margin Fixed Cost Operating Income Chapter M5 – Business Decisions Using Cost Behavior $288.00 38.40 $249.60 48.88 $200.72 M5-27 5-44. a. Cost per year = Total Cost / Life = $200 / 4 = $50 b. Fixed Cost = $50 + $300 = $350 c. Variable Cost per Unit = $0.15 + $0.20 = $0.35 d. (1) ___Total Fixed Cost___ = Breakeven Point in Units Unit Contribution Margin _ $350 __ = 212 units $2.00 – $0.35 (2) Unit Contribution Margin = Contribution Margin Ratio Unit Selling Price $2.00 – $0.35 = .825 $2.00 ____Total Fixed Cost __ = Breakeven = $350 = $424 Contribution Margin Ratio Sales .825 OR Unit Selling Price x Breakeven Units = Breakeven Sales $2.00 x 212 = $424 e. Total Fixed Cost + Target Profit = Required Unit Sales Contribution Margin per Unit $350 + $800 = 697 units $1.65 f. Total Fixed Cost + Target Profit = Required Sales Contribution Margin Ratio $350 + $800 = $1,394 .825 OR Unit Selling Price x Required Units = Breakeven Sales $2.00 x 697 = $1,394 M5-28 Chapter M5 – Business Decisions Using Cost Behavior 5-45. a. Cost per year = Total Cost / Life = $250 / 4 = $62.50 b. Fixed Cost = $62.50 + $500 = $562.50 c. Variable Cost per Unit = $0.75 + $0.50 = $1.25 d. (1) ___Total Fixed Cost___ = Breakeven Point in Units Unit Contribution Margin _ $562.50___ = 322 units $3.00 – $1.25 (2) Unit Contribution Margin = Contribution Margin Ratio Unit Selling Price $3.00 – $1.25 = .5833 $3.00 ____Total Fixed Cost_ = Breakeven = $562.50 = $965 Contribution Margin Ratio Sales .5833 OR Unit Selling Price x Breakeven Units = Breakeven Sales $3.00 x 322 = $966 e. Total Fixed Cost + Target Profit = Required Unit Sales Contribution Margin per Unit $562.50 + $2,000 = $2,562.50 = 1,465 units $3.00 – $1.25 $1.75 f. Total Fixed Cost + Target Profit = Required Sales Contribution Margin Ratio $2,562.50 = $4,393 .5833 OR Unit Selling Price x Required Units = Breakeven Sales $3.00 x 1,465 = $4,395 Chapter M5 – Business Decisions Using Cost Behavior M5-29 5-46. a. Cost per year = Total Cost / Life = $800 / 4 = $200 b. Fixed Cost = $200 + $600 = $800 c. Variable Cost per Unit = $0.65 + $0.25 = $0.90 d. (1) ___Total Fixed Cost___ = Breakeven Point in Units Unit Contribution Margin _ $800__ _ = 1,334 units $1.50 – $0.90 (2) Unit Contribution Margin = Contribution Margin Ratio Unit Selling Price $1.50 – $0.90 = .40 $1.50 ____Total Fixed Cost___ = Breakeven = $800 = $2,000 Contribution Margin Ratio Sales .40 OR Unit Selling Price x Breakeven Units = Breakeven Sales $1.50 x 1,334 = $2,001 e. Total Fixed Cost + Target Profit = Required Unit Sales Contribution Margin per Unit $800 + $3,000 = $3,800 = 6,334 units $1.50 – $0.90 $0.60 f. Total Fixed Cost + Target Profit = Required Sales Contribution Margin Ratio $800 + $3,000 = $9,500 .4 OR Unit Selling Price x Required Units = Breakeven Sales $1.50 x 6,334 = $9,501 M5-30 Chapter M5 – Business Decisions Using Cost Behavior 5-46. (Continued) g. Contribution Margin – Fixed Cost = Profit (.4 x 8,000) – $800 = $2,400 5-47. a. (1) Contribution Margin = Contribution Margin Ratio Sales 1.00 –0.40 –0.05 = 0.55 1.00 ____Total Fixed Cost____ = Breakeven Sales Contribution Margin Ratio $2,800 + $1,200 = $7,273 .55 (2) Total Fixed Cost + Target Profit = Required Sales Contribution Margin Ratio $4,000 + $2,000 = $10,909 .55 (3) ____Total Fixed Cost____ = Breakeven Sales Contribution Margin Ratio $2,600 + $1,200 = $6,909 .55 b. (1) Contribution Margin = Contribution Margin Ratio Sales 1.00 – 0.40 + (.10 x.40) –.05 = .59 1.00 (2) ___Total Fixed Cost___= Breakeven = $4,000 = $6,780 Contribution Margin Ratio Sales .59 Chapter M5 – Business Decisions Using Cost Behavior M5-31 5-48. a. (1) Contribution Margin = Contribution Margin Ratio Sales 1.00 –.30 –.10 = .60 1.00 ____Total Fixed Cost____ = Breakeven Sales Contribution Margin Ratio $3,286 + $4,200 = $7,486 = $12,477 .6 .6 (2) Total Fixed Cost + Target Profit = Required Sales Contribution Margin Ratio $7,486 + $1,500 = $14,977 .6 (3) ____Total Fixed Cost____ = Breakeven Sales Contribution Margin Ratio $2,986 + $4,200 = $7,186 = $11,977 .6 .6 b. (1) Contribution Margin = Contribution Margin Ratio Sales 1.00 –.30 + (.05 x.30) –.10 = .615 1.00 (2) ____Total Fixed Cost____ = Breakeven Sales Contribution Margin Ratio $7,486 = $12,172 .615 M5-32 Chapter M5 – Business Decisions Using Cost Behavior 5-49. a. No variable cost b. c. Fixed cost per month: Purchase payments Store rent Other Total $2,900 2,000 1,200 $6,100 Unit Selling Price – Unit Variable Cost = Unit Contribution Margin $2.00 – $0 = $2.00 ___Total Fixed Cost___ = Breakeven Point in Units Unit Contribution Margin $6,100 = 3,050 units $2.00 d. Total Fixed Cost + Target Profit = Required Unit Sales Contribution Margin per Unit $6,100 + $1,000 = 3,550 units $2.00 Chapter M5 – Business Decisions Using Cost Behavior M5-33 5-50. a. Annual rent = $1,800 x 12 = $21,600 b. Annual sales salaries = $1,200 x 12 = $14,400 c. Unit Contribution Margin = Contribution Margin Ratio Unit Selling Price $1.00 – $0.55 = .45 $1.00 d. ___Total Fixed Cost___ = Breakeven Point in Units Unit Contribution Margin $21,600 + $14,400 = $36,000 = $80,000 .45 .45 e. Total Fixed Cost + Target Profit = Required Sales Contribution Margin Ratio $36,000 + $12,000 = $106,667 .45 M5-34 Chapter M5 – Business Decisions Using Cost Behavior 5-51. a. Annual rent = $600 x 12 = $7,200 b. Annual sales salaries = $1,100 x 12 = $13,200 c. Unit Contribution Margin = Contribution Margin Ratio Unit Selling Price $1.00 – $0.45 = .55 $1.00 d. ___Total Fixed Cost___ = Breakeven Point in Units Unit Contribution Margin $7,200 + $13,200 = $20,400 = $37,091 .55 .55 e. Total Fixed Cost + Target Profit = Required Sales Contribution Margin Ratio $20,400 + $18,000 = $69,818 .55 Chapter M5 – Business Decisions Using Cost Behavior M5-35 5-52. a. Annual rent = $3,400 x 12 = $40,800 b. Annual sales salaries = $2,800 x 12 = $33,600 c. Unit Contribution Margin = Contribution Margin Ratio Unit Selling Price $1.00 – $0.68= .32 $1.00 d. ___Total Fixed Cost___ = Breakeven Point in Units Unit Contribution Margin $40,800 + $33,600 = $74,400 = $232,500 .32 .32 e. Total Fixed Cost + Target Profit = Required Sales Contribution Margin Ratio $74,400 + $36,000 = $69,818 .32 M5-36 Chapter M5 – Business Decisions Using Cost Behavior 5-53. a. Annual rent = $1,400 x 12 = $16,800 b. Annual sales salaries = $1,700 x 12 = $20,400 c. Unit Contribution Margin = Contribution Margin Ratio Unit Selling Price $1.00 – $0.52= .48 $1.00 d. ___Total Fixed Cost___ = Breakeven Point in Units Unit Contribution Margin $16,800 + $20,400 = $37,200 = $77,500 .48 .48 e. Total Fixed Cost + Target Profit = Required Sales Contribution Margin Ratio $37,200 + $36,000 = $152,500 .48 5-54. Students’ responses will vary but the reports might include the following considerations: The sales price increase of $19 per unit will result in an increase of $19 in the unit contribution margin. Operating income will also increase by $19 per unit or $11,400 total (600 x $19). Therefore, the total operating income for the sale of 600 units would be $19,140 (last year's profit of $7,740 + the increase of $11,400). The resulting contribution margin income statement is as follows: Chapter M5 – Business Decisions Using Cost Behavior M5-37 5-54. (Continued) Sales Variable Costs Contribution Margin Fixed Cost Operating Income _Total_ $88,800 (a) 19,660 (b) $69,140 (c) 50,000 $19,140 (d) Per Unit $148.00 32.77 $115.23 (a) 600 x $148 (b) $88,800 – $69,140 (c) $19,140 + $50,000 (d) (600 x $19) + $7,740 The total fixed cost and unit variable cost are assumed to be unaffected by the price increase. Managers are also assuming that a price increase of $19 per unit (about 15%) will have no affect on the unit sales volume. This assumption may be risky because the customers may be unwilling to pay the increased price and may seek competitors’ products. After the price increase: Breakeven sales in units = $50,000 / $115.23 = 434 units Required unit sales for last year's = ($50,000 + $7,740) / $115.23 = 501 profit If, after the price increase, sales fall below 501 units, the company will earn less than they did before the increase. If sales fall below 434 units, the company will incur a loss. The logical recommendation would be to make the price increase only if the risk of sales falling below 501 is considered an acceptable risk by the company’s management. M5-38 Chapter M5 – Business Decisions Using Cost Behavior 5-55. Students’ responses will vary but the reports might include the following considerations: The sales price increase of $18 per unit will result in an increase of $18 in the unit contribution margin. Operating income will also increase by $18 per unit or $18,000 total (1,000 x $18). Therefore, the total operating income for sale of 1,000 units would be $26,000 (last year's profit of $8,000 + the increase of $18,000). The resulting contribution margin income statement is as follows: _Total_ Per Unit Sales $106,000 (1) $106 Variable Costs 40,000 (2) 40_ Contribution Margin $ 66,000 (3) $ 66 Fixed Cost 40,000 Operating Income $ 26,000 (4) (1) 1,000 x $106 (2) $106,000 – $66,000 (3) $40,000 + $26,000 (4) (1,000 x $18) + $8,000 The total fixed cost and unit variable cost are assumed to be unaffected by the price increase. Managers are also assuming that a price increase of $18 per unit (about 20%) will have no affect on the unit sales volume. This assumption may be risky because the customers may be unwilling to pay the higher cost and may seek competitors’ products. After the price increase: Breakeven sales in units = $40,000 / $66 = 606 units Required unit sales for last year's profit = ($40,000 + $8,000) / $66 = 727 units Chapter M5 – Business Decisions Using Cost Behavior M5-39 5-55. (Continued) If, after the price increase, sales fall below 727 units, the company will earn less than they did before the increase. If sales fall below 606 units, the company will incur a loss. The logical recommendation would be to make the price increase only if the risk of sales falling below 727 is considered an acceptable risk by the company’s management. 5-56. Students can provide any reasonable amounts in response to the questions below. The amounts provided in the solution below are examples only. a. b. M5-40 (1) Contact the owner of the parking to inquire about rental costs. (2) Example: $100 per month (3) Example: $7.00 per hour (4) Example: 8 hours per day (11:00 a.m. to 7:00 p.m.) (5) 8 hours x 26 days x $7 = $1,456 (6) Example: $2.00 (1) The variable cost per hot dog will include the cost of ingredients and variable costs of preparation. Example: $0.50 per hot dog (2) Monthly fixed cost = rent ($100) + wages ($1,456) + license cost ($42) = $1,598 (3) Unit sales price Unit variable cost Unit contribution margin $2.00 .50 $1.50 Chapter M5 – Business Decisions Using Cost Behavior 5-56. (Continued) (4) Contribution margin ratio = $1.50 / $2.00 = 75% (5) Variable cost ratio = $0.50 / $2.00 = 25% (6) a. Breakeven units = $1,598 / $1.50 = 1,066 b. Sales (1,066 x $2.00) Variable cost (1,066 x $.50) Contribution margin Fixed cost Operating income a. Units for target profit = ($1,598 + $300) / $1.50 = 1,266 hot dogs b. Sales (1,266 x $2.00) Variable cost (1,266 x $.50) Contribution margin Fixed cost Operating income (7) Chapter M5 – Business Decisions Using Cost Behavior $2,132 533 $1,599 1,598 $ 1 $2,532 633 $1,899 1,598 $ 301 M5-41