Remote Capture Resource Generic Final

advertisement

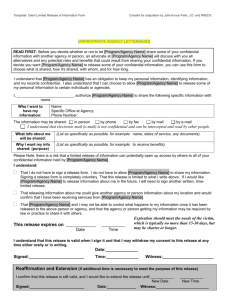

Private and Confidential TABLE OF CONTENTS Introduction: Remote Capture..……………………………………………..….... 3 Network, Security & Reporting..……………………..……………….……………7 Client Hardware & Software…………………………………………………...……11 Scanners & Printer……………………………………………………………..…….14 Image Handling…………..………………………………………………..………….23 Host System Functionality…………………………..…………………………..… 27 Support & Implementation…………………………………………………….……30 System Requirements………………………………………………….…….….…. 33 Remote Capture Work Types………..………………….………………………….35 Private and Confidential 5 INTRODUCTION: REMOTE CAPTURE Private and Confidential 3 REMOTE CAPTURE Introduction Business deposit banking has been significantly improved by the Check21 Act, NACHA Back Office Conversion (BOC) regulations and new technologies. With Remote Capture, business customers can enjoy a modern and amazingly fast deposit service. Your business customers can scan and initiate deposits from their offices and centralized payment centers and a file will be sent to you or your provider for posting directly into their business checking accounts. Best of all, Remote Capture accommodates both types of deposit activity—automatically decisioned with a single system. There is no need for your customers to outsource or be familiar with NACHA (The Electronic Payments Association) rules. Features of Remote Capture Supports capturing either remittance work or standard check deposits. Reduces errors through duplicate inspection and validation. Provides Web access to deposit information for 24 months at no additional charge. Provides up to ten years' worth of check images. Provides daily online deposit summary and detail. Benefits of Remote Capture Remote Capture lets your business customers concentrate on running their businesses, not running to the financial institution. That results in saved time and money, plus: It eliminates your customer’s need to drive to the branch to make check deposits. Deposits can be made sooner and more frequently, which means: Earlier deposits may accelerate funds availability. Reduction in paper handling errors. Notification of returns sooner. Accommodates both Check21 and NACHA BOC activities. Check can be scanned every day of the year, any time, day or night to be deposited into different accounts. Companies maintain a single relationship no matter where their business offices are located. Transportation costs are decreased. Your customer service is enhanced. Private and Confidential 4 How Remote Capture Works: With a low-cost check image scanner and the Remote Capture system to capture images of checks for deposit, the process is as simple as: The Remote Capture application “reads” the dollar amount of each check, the MICR line off the check, and inspects each check to ensure high-quality images. a. Images that are not sufficiently clear or any items with amounts that cannot be read are displayed to the computer operator. b. At that time, the items are either adjusted or rescanned to correct the problem or the operator simply keys in the information for the item. Only errors need to be keyed in. Everything else is read and recorded automatically; with among the highest read rates in the industry. Once all errors are corrected, the application provides a balancing screen to balance the total of the checks to the amount of the deposit. After the deposit is determined to be correct, it is submitted via the Internet or a secure file transfer using the REMOTE CAPTURE File Utility (depending on the solution). CPS completes additional checking and validation of the items and creates x9.37, NACHA and other files as necessary that are transmitted to you, your third party service provider, or directly to the Federal Reserve Bank. Remote Deposit Capture Back-Office Disposition • CPS Central Processing • Source Control Services Check Image Archive • Transaction Completion Services • Transaction WebCapture Remittance Capture IRD Print Balancing Services Image Repository Transaction Database Financial Database Metrics Database ACH Conversion Image Exchange Production Resources Private and Confidential 5 WHY REMOTE CAPTURE? Are you prepared to purchase, inventory, test, configure and ship scanners? We can recommend a solution that manages all of these functions for you. Can you answer technical calls and troubleshoot remote deposit users? Call support options are available that can handle these calls for you, even after hours. Is your provider prepared to promote your offering to your corporate clients? We can assist you with a marketing program designed to attract Remote Capture prospects. Is your financial institution planning to warrant and service hardware? This solution supports multiple brands of scanners. We can recommend a solution that is as in depth or as simple as you need. Are your clients asking for ACH decisioning through Back Office Conversion? Our solution is ARC and BOC compliant and automatically decisions non-eligible items, including them in an IRD print or image file. Plus… We provide the tools necessary to get you up and running quickly, including marketing materials and presentations for your clients. Our system can act as a mini lock box replacement service - your clients can scan and image their own remittance coupons along with their deposit. We offer an accounts receivable file your clients can download to credit their clients’ accounts. Most systems claim to be web capture applications (“thin client”), but many are not! We utilize J2EE technology, eliminating the need for difficult software. This solution is Application Service Provider (ASP) based. You never need to upgrade software, deal with servers, IT support or maintenance. CHECK 21 Background The “Check Clearing for the 21st Century Act,” commonly referred to as “Check 21”, went into effect October 28, 2004. The law was created in response to the events of 9/11 and is designed to improve the efficiency of the nation’s payment system, encouraging electronic check processing. Benefits include conservation of the nation’s resources, reduced fraud, errors, clearing fees and processing times. Check 21 allows banks and retailers to exchange electronic copies of checks and create substitute checks (Image Replacement Document (IRD)) as the legal equivalent of an original check. Financial institutions are required by law to receive substitute checks and are bound by the procedures and timelines in the legislation. Private and Confidential 6 NETWORK, SECURITY & REPORTING Private and Confidential 7 NETWORK Is a web capture solution (thin client) offered? This offering is one of the few true web capture services in the market today. Our Remote Capture solution was developed in J2EE as opposed to .NET, eliminating the need for software other than the scanner drive. Vendors utilizing the .NET technology will be required to download and install the Microsoft framework. Where is the data center located? The CPS data center is located at: Business Resumption/DR Data Center Production Data Center Creative Payment Solution (CPS) 1251 Arrowpine Drive Charlotte, NC 28273 2501 Wooten Blvd Wilson, NC 27893 Describe the Disaster Recovery Plan. A disaster recovery plan is in place and quarterly disaster planning processes are followed. The primary objective of recovery planning is to enable the organization to survive a disaster and to continue normal business operations. In order to survive, it will be assured that critical operations can resume/continue normal processing. Throughout the recovery effort, this plan establishes clear lines of authority and prioritizes work efforts. The key objectives of this contingency plan are to: Provide for the safety and well-being of people on the premises at the time of a disaster; Continue critical business operations; Minimize the duration of a serious disruption to operations and resources (both information processing and other resources); Minimize immediate damage and losses; Establish management succession and emergency powers; Facilitate effective co-ordination of recovery tasks; Reduce the complexity of the recovery effort; Identify critical lines of business and supporting functions; Although statistically the probability of a major disaster is remote, the consequences of an occurrence could be catastrophic; therefore, on-going responsibility for recovery planning has been assigned to an employee dedicated to this essential service. Describe the host system environment. Our Remote Capture solution is an Application Service Provider (ASP) based offering of both the web capture (thin client) and remittance capture (thick client) application. Both are hosted in a multi-tier application behind three layers of firewall protection. SECURITY What are the data security environment and protocols: physical, penetration, encryption, access? Servers and network equipment are located in secure server and network equipment rooms. Access is only granted to users upon request. If access is granted, users are escorted into secure rooms with authorized personnel. Workstations are located within a secure door facility. All areas that contain servers, network equipment, and workstations are situated in locations that require key card access. Access to the facility is limited to employees; all others are escorted into the facility. The facility has security guard monitoring, surveillance cameras, and authorized entry systems. Employees have photographic identification badges that are worn while in the facility. If an employee is terminated, badge access to the facility and network access is revoked. Employees that are Private and Confidential 8 terminated are escorted out of the building by management and subsequent visits require management escort to collect personal belongings. Checkpoint Firewall-1 is the standard firewall used. All firewalls are running on Nokia IP530 or Alteon Switched Firewall hardware. All firewall logs are stored on a dedicated logging system in a forensically sound manner. Both host and network intrusion detection systems are used. Network IDS is the Nortel Threat Protection System which is based on Sourcefire technology. Host IDS is Symantec HIDS. IDS systems are monitored on a 24X7 bases by a MSSP (Managed Security Services Provider) who performs analysis and alerting to a dedicated IDS team. Once an alert is received, it is further analyzed and, if significant or potentially impacting, the event is escalated to the Computer Incident Response Team (CIRT) for containment, eradication and recovery. The CIRT program is based on processes developed by CERT/CC, NIST and SANS and is focused on proactive prevention as well as minimizing the impact a security event has to the organization through containment, eradication and recovery. The CIRT program has leadership from a SANS Certified Incident Handler (GCIH). Admin functions are segregated based on system. Firewall administration is performed by the Information Security Operations team assigned responsibility for firewalls. Each system administrator is assigned two unique logins, one with limited access for daily use and a second administrator level account for system administration functions. All infrastructure servers have a Host Intrusion Detection (HIDS) agent installed and all use of administrator rights are monitored and reported in real time. 24X7 monitoring for malicious actions is in place, also non-malicious HIDS events are reviewed and system administration actions are verified with the appropriate individuals. Finally, weekly reports to management are provided which focus on malicious actions, unconfirmed or suspicious events and escalated items. Describe data transmission protocols and encryption. All interaction is https, so everything is encrypted with 128-bit security. Files (IRD/X9.37i, ACH, AA, posting) are transferred by secure FTP. Passwords are encrypted in SHA-1 algorithm in our DB2 database. What is the average systems availability (%)? Close to 100% up time. Does the hosted solution provide for duplicate item and duplicate deposit prevention? Duplicate item detection occurs at four points during the capture process. 1. Within a captured Unit of Work - Duplicate detection for checks within a deposit. 2. Duplicate Images are detected in the WINCIMS Image Database. If an image file is detected as a duplicate the CIFF file will error and will not be processed. The CIFF file is deposit data and images compressed into a single file. 3. Host code is in place to detect duplicate data. Duplicate checks are verified between back-to-back entries that enter CPCS. 4. There is a final duplicate detection in the process before an X9.37 or ACH file is created. If the following four fields are the same, the item is detected as a duplicate and is not processed. This detection is verified against all clients for 90 days. Routing Number Check Number Amount Account Number Are there batch validation, correction and balancing processes? During the scanning process, items are highlighted if a field in the MICR line, CAR, or LAR is unreadable. These items require correction by the merchant prior to batch submission. In addition, the FI can require a merchant to submit a balanced batch of work. After the file is received, the image quality, CAR, LAR and MICR line are reviewed and a balanced deposit is ensured. The process uses the IBM CPCS mainframe to manage the activity and integrity of the data. Private and Confidential 9 Can security be administered across client locations? The client has the ability to segregate access to the application based on the business need. For example, one location can have limited users with the capability of scanning and correcting deposits only. Review, approve and submit can be performed in a central location. REPORTING What financial institution and client reports are available? The following reports are accessed by the merchant and financial institution: Adjustment Report Transaction Summary Report ACH Returns Report (original check image) Batch Summary Report Reject Report IRD Detail Report (original check image) Accepted Stop Transaction Report ACH Detail Report(original check image) The financial institution will access the above (except Reject Report and Accepted Stop Transaction Report) through a separate web reporting application called FI Administration that will allow the FI to view all of their merchant’s deposit reports. Also, Financial Institutions have access to a duplicate report and message board. How long are reporting data and images retained? Reporting data and images are retained online for 2 years. After that, images can be retrieved from tape for eight additional years. What controls are available for the financial institution? The Remote Capture applications have several control points available. These include, but are not limited to: Duplicate Item Detection Image Quality Usability and Acceptability (IQA) Item Level Dollar Limits Courtesy Amount Recognition (CAR) Aggregate Deposit Amount Monitoring standard in product (Suspicious Activity Suspects) Control Total (Deposit Total) for Balancing Customers Deposit Monitoring Defined Account Number (Credit) in Profile (compared to expectation) Image Based Balancing Private and Confidential 10 CLIENT HARDWARE & SOFTWARE CLIENT HARDWARE Private and Confidential 11 What scanners are supported? The web capture (ASP) product currently supports the Panini MyVision X30 to X90. In addition to the Panini series, the PC-based remittance capture product also supports the MagTek Excella STX scanner. Scanner speeds are as follows: MagTek Excella STX – single-feed Panini MVX30 – 30 IPM Digital Check 230 Panini MVX60 – 60 IPM Panini MVX90 – 90 IPM Do the scanners endorse? Web Capture virtual endorsement capabilities will be available in the future. Do the scanners auto-feed? All scanners offer auto-batch feed except for the MagTek Excella STX which is a single-feed device. What if we acquire another financial institution’s customer who is using an unsupported scanner? Other scanner options may be considered. The only pre-requisite to certifying a scanner is the “Ranger Protocol” interface. Ranger is the scanner software application program interface (API) that connects items processing software with check scanning hardware. What fonts can be captured? HP = Hand Print, MP = Machine Print, HM = Hand or Machine Print Field Types Courtesy Amount Courtesy Amount Compare Code Line Code Line Compare Single Line Single Word Multi-line Supported Fonts CAR HP digits/specials CAR MP digits/specials E13B digits/specials CMC7 digits/specials OCRA digits/specials CAR HP digits/specials CAR MP digits/specials CAR HM digits/specials E13B digits/specials HP digits MP digits HM digits OCRA digits/specials OCRA digits/alphas/specials HM digits / alphas / specials OCRB digits/alphas/specials MP digits/specials HM digits/specials OCRA digits/alphas/specials OCRB digits/alphas/specials HP digits/uppercase/specials MP digits/uppercase/specials HM digits/uppercase/specials HP alphas/specials MP alphas/specials HM alphas/specials HP digits/alphas/specials MP digits/alphas/specials HP uppercase/specials MP uppercase/specials HP digits/specials HM uppercase/specials What are the hardware and software requirements? Private and Confidential 12 There are hardware and software requirements for the Web Capture and PC-based Remittance Capture versions. If needed, the detail requirements are available. Hardware: Merchants are required to purchase an approved scanner. Internet connection of DSL, Broadband or T-1 is supported. Software: Microsoft Windows 2000 Professional or Windows XP Professional. Microsoft Internet Explorer is the supported internet browser. CLIENT SOFTWARE Can the client software be branded? All of your Client’s touch points can be branded with your logo and product name. Can software be downloaded? The web capture application of is a thin-client JAVA application with no software needed at workstations other than the browser and the scanner drivers. The remittance capture PC-based version uses an auto installation program that places software on the workstation. JAVA Runtime is required and can be provided. How are updates provided? Remittance capture sites are provided a CD or Electronic Software Distribution (ESD) for upgrades (depending on the size of the upgrade). Web capture updates are loaded onto servers at the processing center. Is CAR/LAR available? Is this performed in real time? Both CAR & LAR are available. It is performed in real time during the customer capture process. In addition, central processing verifies modified items through an additional CAR/LAR process to provide greater ability to identify out-of-balance situations. Private and Confidential 13 SCANNERS & PRINTERS Private and Confidential 14 23 Private and Confidential 15 Private and Confidential 16 Private and Confidential 17 Private and Confidential 18 Private and Confidential 19 Private and Confidential 20 Private and Confidential 21 Private and Confidential 22 33 IMAGE HANDLING Private and Confidential 23 IMAGE HANDLING Describe the image quality usability and acceptance. Image Quality Usability and Acceptability (IQA) are performed on each item at customer capture. This process is performed in real-time. IQA checks for the presence of key data to allow for successful item processing in the collection process. An unobstructed view of the key check areas is ensured. The description below depicts the web capture component. The IQA utilities work the same on remittance capture, yet reside in the application on the client’s desktop. Where are images stored? In the Web Capture version, all images and MICR line data is stored on servers at the processor so nothing is stored on client workstations. In the remittance capture version, images and MICR line information is on the client’s workstation until an “end of day” action is performed which purges the information. Since all information is available via the processor’s servers over the internet, there is no need to have the information on the users’ workstation. Images are stored on the Viewpointe national archive and made available to clients via the web reporting application. Deposit information is provided down to the individual check level. Images are available online for two years, with availability of up to ten years total. What is Viewpointe? Viewpointe is one of the largest providers of check image exchange and archive services in the United States. Viewpointe has developed the most secure, scaleable, and high-performance national archive and deliver strategic value to many of the nation's top-tier financial institutions. Image storage, retrieval, sharing and exchange services are provided, as well as optional ancillary image services such as images on CD ROM, image statements, imagebased exceptions and return (Day 2), and image viewers to these customers. Private and Confidential 24 What Viewpointe product is used within the Remote Capture application? Image Storage, Viewpointe's national archive, serves as a central repository of data that is protected by state-ofthe-art security. Archived data is backed up at multiple sites and is further supported by Viewpointe's business continuity and disaster recovery expertise. Optional fraud and risk management products are already integrated and managed by Viewpointe, eliminating vendor management and software upgrade costs. Key Technical Facts: o Currently stores nearly 90 Billion images and grows by more than 1.5 Billion items monthly o Accessed more than 3 million times daily by financial institutions for: Online banking applications Internal image viewers Image statement production services CD ROM production service Fraud research o Provides sub-second image retrieval Key Benefits: o Access to a critical mass of image sharing and exchange customers o Opportunity to reduce/eliminate duplicate processing o Speed to market o Disaster recovery services o Operational performance How many user data entry fields are available? Scheduled for Q4 2007, Web Capture will have four optional fields available for data entry of additional information. These fields can be used to capture customer specific posting information. This information can be presented back to your customer in a posting file. What kind of coupon capture functionality is available? Remittance capture supports robust remote lockbox types of processes. The application will allow for multiple coupons to one check or multiple checks to one coupon in a common batch. When available, the web capture product will support this same remittance functionality. Both applications support “coupon not present” with manual capture of posting information. Describe proof logic (i.e. control total entered first). The Remote Capture solution was built on existing financial institution item processing technology and algorithms. The base application requires that the deposit be made to a “known” demand deposit account which is embedded in the customer’s custom profile. This is the first area that we feel is critical in prevention of fraud. The customer is also required to enter a control total (deposit total) for all items to be balanced back to. Code lines are reviewed based on MICR character standards. At the central site (hosted), the same process is performed and all items modified by the customer are reviewed. If an adjustment is required, adjustments will be made according to the SLA (adjust credit, adjust customer (proof correction)). Describe error correction process. At the customer location, after items are scanned , any fields that are incorrect will be highlighted for correction. In the web application, there is a separate tab showing only items in need of correction, which is helpful when the batch is large. In the remittance application, only items that need to be corrected are reviewed by the client. Describe MICR parsing logic. The scanner hardware performs a magnetic read of the MICR characters, which equates to waveform analysis. If the scanner hardware cannot read a field, the application software will attempt to read the field optically. The Private and Confidential 25 software uses Optical Character Recognition (OCR) technology to read the codeline (MICR and coupon OCR lines) of the check/coupon for the remittance application. Confidence levels can be set at the client level to validate read rate of the codeline and if the confidence level is not met, the user is then required to validate the codeline of the check/coupon. How are Canadian and other unconvertible images handled in the system? Since the RT number is an eight digit number, the remittance capture application rejects the item at document correction. The client would then delete the check from the unit of work and take the check to the financial institution for processing. For Web capture, the Canadian item will be rejected since the RT number is only eight digits. An adjustment to the deposit will be inserted and the client will be notified so they can take the check to the financial institution for processing. Does the system provide multiple workflows to select from? (scan & correct item immediately or scan batch & correct only rejects at end.) Multiple workflow options can be offered. The standard is “Scan and Correct” but through rules manipulation items have been processed in a “Scan and Go” operation where only the IQA is utilized. Correction of items early in the process seems to lead to a better overall experience for users. Is there an approval process for the transactions at a supervisory level before being submitted to the host? Web capture supports centralized supervisory review, approval and transmission. Private and Confidential 26 HOST SYSTEM FUNCTIONALITY Private and Confidential 27 HOST SYSTEM FUNCTIONALITY What is the recovery procedure if the merchant loses connection to the host? Web capture application: Items are being written to the servers (transaction database and image) at the time it is originally scanned. If the customer loses connection during this process, the items previously scanned will be available in the deposit. The customer can add to the deposit and submit for processing when connectivity is regained. Remittance capture application: The process is performed on the local system so there is not constant connection to the host. Items are delivered to the central processing site in batch. The batch transfer utility is reviewing the batch to ensure complete receipt of the deposit. If the process is interrupted, a message will be sent back to the customer indicating the process did not complete properly. How are system administration hierarchies set up for the financial institution and end user? The web capture application supports multiple levels of authority. Controlled at the client level, abilities to scan correct and to review and deliver to the financial institution exist. Two rules are used – approver and limited user. Through unique User IDs, roles are defined as to which functions they can access. Limited users can scan and save deposits. Approvers can scan, review, and submit deposits. Can a client establish a master location that can view the batches of the sub locations? In web capture, the master client location (approver security level) has the ability to view the deposit status screen which lists all open and processed deposits. The approvers would submit the deposits for processing. What database protocol is used? Is the database open to SQL queries? The back end database is DB2 version 8.2 and is not open to SQL queries. Describe financial institution and client query capabilities. Check and deposit specific data can be queried for up to 2 years through the web reporting site. Does the system support Accounts Receivable Conversion (ARC and BOC)? Accounts Receivable Conversion and Back Office Conversion are supported. What industry standard image exchange file formats does the system produce? The X9.37i file format is currently supported. Does the system support IRD printing? An IRD print file is available. In addition, arrangements can be made to provide a printer. Does the system produce a deposit ticket in line with the IRDs? A X9.37 file format can be provided that presents credit and offsetting debits (credits in one bundle and debits in another). A settlement credit can be provided to offset associated debits with a posting file to provide the account level deposit detail. What printers does the system support? PDF formats are available for print delivery. Does the system mirror in real time? With high availability disaster recovery (HADR) implemented the system is mirrored real time. Private and Confidential 28 Does the system provide client confirmation? Clients are notified that items have been received at the time of submission and via email once the items are processed. The financial institution is emailed when merchants’ items are processed daily. Notifications are also available through the web reporting site. Can the system be migrated to an in-house platform? Because the product is built around industry leading and available technology, you do have the ability to migrate the product to an in-house solution while maintaining the same user experience. What kind of services and solutions are offered for branch capture? A “behind the counter” branch capture is being piloted utilizing the Web Capture application. Can the financial institution set up new client parameters or is that a host function? Specific client parameters would be set-up us as part of the hosted support. A standard template would be developed for your financial institution, along with SLAs and monitoring, to ensure your customer’s requirements are met on a consistent basis. Private and Confidential 29 SUPPORT & IMPLEMENTATION Private and Confidential 30 SUPPORT Is end-user support provided? Level two support is provided as part of the one-time implementation fee. Your FI call center will be trained to support level one type calls using a list of FAQ and scripted answers. Additional levels of support can be provided for a fee and will be disclosed in the pricing proposal. Is end-user installation and training support provided? Onsite installation and training is not customarily needed for web capture users. Training and support can be provided onsite, via WebEx or by phone. If end-user training is necessary, a cost estimate can be provided. Are install/replacement/repair support to end-users supplied? Any equipment fulfillment vendor you choose can be supported. InStream, LLC will assist with scanner fulfillment, forecasting, inventory allocation, billing and maintenance. InStream supports the Advanced Unit Exchange (AUE) service plan whereby a damaged unit is sent in for repair at the same time a replacement unit is delivered to the client. Clients not using InStream will need to see their maintenance agreement with their respective equipment vendor. Is help provided when writing client contracts? A sample client contract is provided. This sample is meant to provide your legal counsel with a template to work from when creating your custom client contracts. IMPLEMENTATION How do financial institutions charge merchant customers for the service? Financial institutions generally charge a monthly fee and a per item fee above what they are charged by the service provider. Research can be provided to you as you consider your pricing options. Some components of this analysis are market specific (State by State) as well. What are the responsibilities of the financial institution throughout the installation timeline? The timeline for implementation is related to customization required prior to production roll-out. Sample agreements, policies and marketing materials are provided in an effort to accelerate this effort. Depending on the options you choose, you could be offering this product in your market in 60 to 90 days. This assumes that a project owner has been identified at your financial institution and components (contract, testing, product material and operational) are moving according to schedule. Is a single person or team assigned to the financial institution for implementation? You will be assigned an implementation manager who will be the central point of contact during implementation and post implementation. This individual will operate as a project manager throughout the implementation to production. What is the term of the contract the financial institution would be required to sign? Initial term is 2 years. Private and Confidential 31 Remote Capture Technologies and Vendors Function Item data integrity Thin client Remote Capture Thick client Remote Capture Central processing (balancing, codeline inspection, IQA) Data translation Multi-factor Authentication Web Based Reporting ACH decisioning File Movement on Back End Processing Image Archive X9 and IRD creation ACH File creation CAR and LAR Check Scanning API Scanner Hardware Technologies IBM CPCS Carreker Web Capture Carreker Corporate Capture Carreker Source Capture Tibco Middleware Vasco CPS developed and hosted Tibco Middleware Tibco Middleware and Connect Direct Viewpointe Image Storage Carreker IRD Authoring Tibco Middleware Softlock Software Ranger Technologies Panini, Magtek, Digital Check Private and Confidential 32 SYSTEM REQUIREMENTS Private and Confidential 33 3 REMOTE CAPTURE MINIMUM SYSTEM REQUIREMENTS Web Capture (Thin Client) Hardware Intel Pentium(r) 4 Processor, 1.3 GHz or higher 512 MB RAM or greater 1 GB Hard drive CD ROM drive USB2 port (for scanner) Color Monitor with 1024 x 768 resolution or greater High-speed Internet Connection such as DSL or Cable with minimum 256K upload speed (DialUp/DSL-Lite/Satellite are not recommended) Panini® MyVisionX series Scanner Digital Check 230 Scanner Software Microsoft Windows 2000 Professional® with Service Pack 3 or Microsoft Windows XP Professional® with Service Pack 1 Internet Explorer® version 6.x or greater Remittance Capture (Thick Client) Hardware Intel Pentium(r) 4 Processor, 1.3 GHz or higher 512 MB RAM or greater 2 GB Hard drive or more of free space Double speed (2x) CD ROM or DVD/CD drive Color Monitor with 1024 x 768 resolution or greater USB2 port (for scanner) High-speed Internet Connection such as DSL or Cable with minimum 256K upload speed (DialUp/DSL-Lite/Satellite are not recommended) Panini® My VisionX series or MagTek Excella STX Scanner Software Microsoft Windows 2000 Professional® with Service Pack 3 or Microsoft Windows XP Professional® with Service Pack 1 Internet Explorer® version 6.x or greater Note: This information is valid as of 7/25/07. Requirements are subject to change. Private and Confidential 34 47 REMOTE CAPTURE WORK TYPES Private and Confidential 49 35 REMOTE CAPTURE WORK TYPES Remote Capture provides four work types. Two are ACH standard entry class codes: ARC and BOC. The third work type creates a deposit that results in either an X9.37 file or Image Replacement Document (IRD). The fourth work type allows returned items to be redeposited without getting stopped as a duplicate check. ACH Work Types Accounts Receivable Conversion (ARC) applies to billers that receive checks via the mail into a lockbox or dropbox. The ARC application took effect on March 15, 2002. ARC allows for the conversion of checks into ACH debits. The biller captures payment information, including routing number, account number, payee and check serial number, electronically. The payment information is then entered into the ACH Network, and transmitted to the consumer’s account. Settlement is carried out in the same manner as for other ACH transactions. The biller destroys the check within 14 days, and retains a legally permissible copy of the check. Back Office Conversion (BOC) applies to retailers and billers that accept checks at manned locations or at the point of sale. BOC allows for the conversion of checks into ACH debits in a central location, or back office. The BOC application took effect on March 16, 2007. Retailers and billers will be able to collect all consumer checks accepted during the day and convert them later in a single back-office location. BOC requires a posted notice telling customers their checks may be converted and that they may opt out. BOC does not require customer authorization for each transaction, as is the case with Point Of Purchase (POP) sales. Converting checks to ACH debits can result in faster availability, expedited return notification and reduced check handling and clearing cost. The number of NSF and fraudulent checks are reduced as they are processed ahead of paper items. By eliminating paper from the system and consolidating operations, ARC and BOC improve processing efficiency, help avoid the need to physically deposit checks and reduce transportation fees. Items ineligible for ARC and BOC are: Checks or sharedrafts that have not been encoded in magnetic ink. Checks or sharedrafts that contain an Auxiliary On-Us Field in the MICR line. Checks or sharedrafts in an amount greater than $25,000. Third-party checks or sharedrafts. Demand drafts and third-party drafts that do not contain the signature of the Receiver. Credit card issuer checks for accessing credit accounts or checks drawn on home equity lines of credit. Checks drawn on an investment company as defined in the Investment Company Act of 1940. Obligations of a financial institution (e.g., travelers checks, cashier’s checks, official checks, money orders). Checks drawn on the Treasury of the United States, a Federal Reserve Bank, or a Federal Home Loan Bank. Checks drawn on a state or local government that are not payable through or at a participating depository financial institution. Checks or sharedrafts payable in a medium other than U.S. currency. Deposit and Returns Work Types If ACH is not preferred, or for clients that opt out of ACH conversion of their checks, the original check can be replaced with a substitute check known as an Image Replacement Document (IRD). An IRD is a front and back image of the original check. The work type associated with IRDs is known as a Deposit. The IRD file can be in a PDF or PCL format. Once printed, an IRD is processed using existing check clearing channels. An IRD has the same legal status as the original check. This opens up a variety of opportunities for banks, such as reducing their check transportation costs. In addition, overnight borrowing from the Fed is reduced because the time to clear a check is quicker. A paperless alternative to printing an IRD is the creation of an X9.37 file. This allows banks to exchange a check image file without having to print replacement checks. Carreker’s IRD Authoring application is used to create X9.37 Private and Confidential 36 and IRD files. X9.37 files are created according to the ANSI DSTUX9.37 published standards. All required fields in the file are validated prior to creating the file. The X9.37 file is sent to the Fed on behalf of the FI. Lastly, the Return Deposit work type will allow clients to rescan returned items without getting stopped as a duplicate check. This work type will enable your clients to collect the funds from the returned check. Private and Confidential 37