Heading D

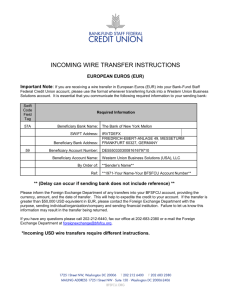

advertisement