CHAPTER 2

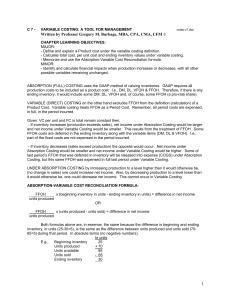

advertisement