Candidates` Performance in the 2010 Examination

advertisement

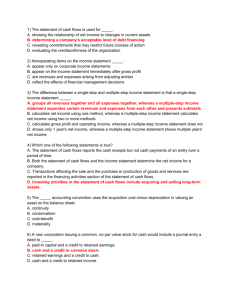

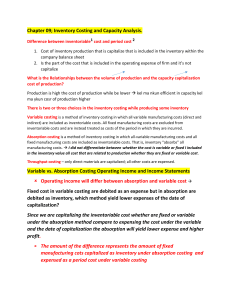

Candidates’ Performance in the 2010 Examination Paper 2 Overall Performance • Fairly well • Should make an effort to get a good understanding of the concepts behind the accounting principles and practices • Should put more efforts in understanding the question requirements 2 Overall Performance Candidates are advised • to read the question carefully • to note the differences between separate parts of a question • to present answers logically step-by-step • to understand the assumptions set in the questions, the timing and details of the transactions and make the answers specific to the situational facts 3 Overall Performance Question No. Popularity Performance in General 1 Well answered / Fair / Poor / Good / Poor 2 Good / Well answered / Good / Fair / Good / Poor / Poor 3 95.7% Satisfactory / Poor / Poor / Poor / Poor 90.3% Good / Good / Poor / Fair / Fair 14.0% Good / Fair / Satisfactory / Poor 4 5 4 Question 1 (a), (b) & (c) Process costing • Not knowing the requirement (i.e. drawing up the process account mechanically without referring to the requirement) • Wrong in calculating the equivalent units of direct materials and transferred-in-costs • Not knowing the result with reduced actual loss (i.e. increased number of units produced decreased per unit fixed cost more units of goods sold higher profit) 5 Question 1 (d) & (e) Activity-based costing method • Not knowing the differences between production and services centers, thus wrongly re-allocated the costs of Process A & B to the pills of Heal and Cure • Not presenting the answer in readable manner • General discussion to support activity-based costing method than giving the reasons of using activity-based costing in the case 6 Question 2 (a) - (f) Standard absorption costing & budgeting • Quantity purchased rather than quantity consumed should be used in calculating the price variance of material • Sales figures were wrongly replaced by the receipts from sales (i.e. candidates just copy the format given in the question to answer) • Only 1 budgeted standard cost per unit should be given (i.e. not correct in columnar form) 7 Question 2 (a) - (f) Standard absorption costing & budgeting (cont’d) • Quarterly income statement rather than monthly income statement was required • Not knowing the calculation of the over/under absorbed production overheads and the uncollectible debts • Failed in understanding the mechanism of absorption of production overheads (both in monthly and yearly basis) 8 Question 2 (g) Lease accounting • Wrongly classify the finance lease to an operating lease • Not deducting the costs borne by the manufacturer from the NPV of the total lease payment • Important factor – the company consumed almost 100% of the machine’s expected useful life 9 Question 3 ~ 95.7% CVP & Budgeting (a) Improper treatment of scrap (1 out of every 11 litres of pre-inspection chemical) (b) Misinterpret the 3000 litres of chemical produced and sold include the sales of scrap. Wrong calculation of variable production cost ( i.e. (TVC-scrap sale proceeds)/3000 ) and thus the contribution. 10 Question 3 (cont’d) CVP & Budgeting (c) Not understanding the changes proposed. Refer to Q3(c). (d) Poor result as wrong variable costs calculated for original budget, proposal 1 and proposal 2. (e) General discussion only, not mentioning the additional fixed cost in proposal 1. 11 Question 4 ~ 90.3% Limiting factor (a) Not using the contribution margin in ranking and not able to identify the direct labour hour as the limiting factor. (b) Some not considering the units made for Carpentry Ltd as a part of the answer. 12 Question 4 (cont’d) Inventory valuation (c) Not understanding the question and not presenting the answer (value of closing inventory and total amount of inventory to be written down) in appropriate manner. Not knowing how closing inventory value should be ascertained (Perpetual inventory system vs. Physical stock taking) Refer to Q4(c). 13 Question 4 (cont’d) Inventory valuation (d) Not able to give valid reasons for adopting the weighted average method (i.e. only mention the value is the average amount). (e) Not knowing the mechanism of specific identification method. Or only mention it is suitable for items with high price. 14 Question 5 ~ 14.0% Accounting concepts, assets / revenue recognition & provision of probable liability • Not realize the importance of general recognition criteria of development cost (i.e. 1 May 2009). Refer to Q5(a)(ii). • Not able to explain the reasons to support the correct accounting treatment . • Down payment should not be recognized as revenue. 15 THANK YOU 16