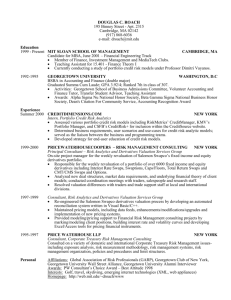

SHENGHUA SI

advertisement

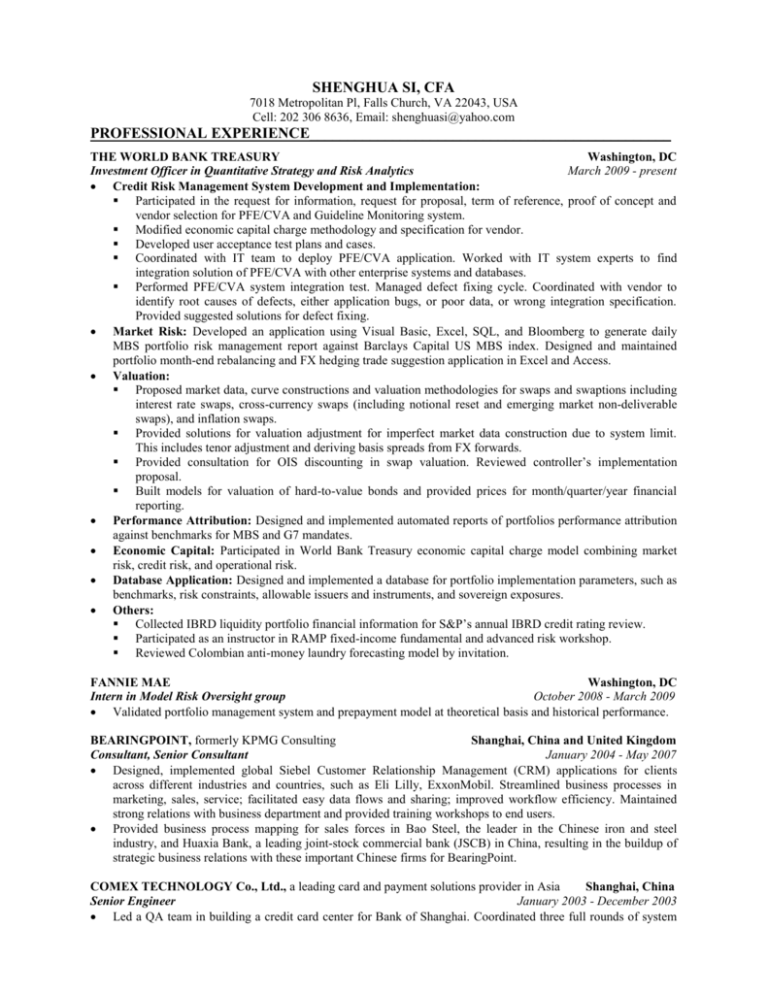

SHENGHUA SI, CFA 7018 Metropolitan Pl, Falls Church, VA 22043, USA Cell: 202 306 8636, Email: shenghuasi@yahoo.com PROFESSIONAL EXPERIENCE________________________________________________ THE WORLD BANK TREASURY Washington, DC Investment Officer in Quantitative Strategy and Risk Analytics March 2009 - present Credit Risk Management System Development and Implementation: Participated in the request for information, request for proposal, term of reference, proof of concept and vendor selection for PFE/CVA and Guideline Monitoring system. Modified economic capital charge methodology and specification for vendor. Developed user acceptance test plans and cases. Coordinated with IT team to deploy PFE/CVA application. Worked with IT system experts to find integration solution of PFE/CVA with other enterprise systems and databases. Performed PFE/CVA system integration test. Managed defect fixing cycle. Coordinated with vendor to identify root causes of defects, either application bugs, or poor data, or wrong integration specification. Provided suggested solutions for defect fixing. Market Risk: Developed an application using Visual Basic, Excel, SQL, and Bloomberg to generate daily MBS portfolio risk management report against Barclays Capital US MBS index. Designed and maintained portfolio month-end rebalancing and FX hedging trade suggestion application in Excel and Access. Valuation: Proposed market data, curve constructions and valuation methodologies for swaps and swaptions including interest rate swaps, cross-currency swaps (including notional reset and emerging market non-deliverable swaps), and inflation swaps. Provided solutions for valuation adjustment for imperfect market data construction due to system limit. This includes tenor adjustment and deriving basis spreads from FX forwards. Provided consultation for OIS discounting in swap valuation. Reviewed controller’s implementation proposal. Built models for valuation of hard-to-value bonds and provided prices for month/quarter/year financial reporting. Performance Attribution: Designed and implemented automated reports of portfolios performance attribution against benchmarks for MBS and G7 mandates. Economic Capital: Participated in World Bank Treasury economic capital charge model combining market risk, credit risk, and operational risk. Database Application: Designed and implemented a database for portfolio implementation parameters, such as benchmarks, risk constraints, allowable issuers and instruments, and sovereign exposures. Others: Collected IBRD liquidity portfolio financial information for S&P’s annual IBRD credit rating review. Participated as an instructor in RAMP fixed-income fundamental and advanced risk workshop. Reviewed Colombian anti-money laundry forecasting model by invitation. FANNIE MAE Washington, DC Intern in Model Risk Oversight group October 2008 - March 2009 Validated portfolio management system and prepayment model at theoretical basis and historical performance. BEARINGPOINT, formerly KPMG Consulting Shanghai, China and United Kingdom Consultant, Senior Consultant January 2004 - May 2007 Designed, implemented global Siebel Customer Relationship Management (CRM) applications for clients across different industries and countries, such as Eli Lilly, ExxonMobil. Streamlined business processes in marketing, sales, service; facilitated easy data flows and sharing; improved workflow efficiency. Maintained strong relations with business department and provided training workshops to end users. Provided business process mapping for sales forces in Bao Steel, the leader in the Chinese iron and steel industry, and Huaxia Bank, a leading joint-stock commercial bank (JSCB) in China, resulting in the buildup of strategic business relations with these important Chinese firms for BearingPoint. COMEX TECHNOLOGY Co., Ltd., a leading card and payment solutions provider in Asia Shanghai, China Senior Engineer January 2003 - December 2003 Led a QA team in building a credit card center for Bank of Shanghai. Coordinated three full rounds of system tests and stress tests focusing on credit card loan interest accumulation model, financial accounting module, transaction authorization with VISA and MasterCard. Achieved 700K issued cards and 20K daily transactions within 3 months after the system became operational. NAVION SOFTWARE DEVELOPMENT Co., a Capital One company Shanghai, China Software Engineer July 2001 - December 2002 Delivered automated testing solutions using Java scripts for Capital One’s call center application in Richmond VA, which shortened the system testing cycle to one fifth of the time for previous manual cycles, reduced testing man-hours by 90 percent, and improved execution precision. EDUCATION_________________________________________________________________ GEORGE WASHINGTON UNIVERSITY, School of Business Master of Science in Finance, GPA: 4.0/4.0 FUDAN UNIVERSITY Bachelor of Science in Electronic Engineering Washington, DC August 2008 Shanghai, China July 2001 SKILLS______________________________________________________________________ Certifications Languages Programming CFA (2008), FRM (2010) Native Mandarin Chinese and Cantonese Advanced Excel, Visual Basic, VBA, SQL, MATLAB, Access, and Bloomberg; basic SAS