Dollar Weakens Against Euro But Off Lows

advertisement

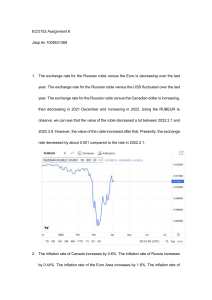

Russia Central Bank Under Pressure as Rate-Increase Bets Surge By Vladimir Kuznetsov 2014-12-05T14:26:29Z Wagers for Russian interest-rate increases soared to a six-year high and government bonds headed for the worst week since 2009 as the ruble’s decline prompted the central bank to step up currency interventions. Policy makers may be preparing to raise interest rates by 364 basis points in the next three months, according to forward-rate agreements tracked by Bloomberg. The ruble rose 1% to 53.75 RUB/USD by closing time in Moscow, paring its weekly decline to 6.2%. Yields on 10-year bonds jumped 77 basis points to cross 12% for the first time since 2009. The euro closed at 64.74 RUB/EUR. (RUB=Russian Ruble.) Pressure is mounting on central bank Governor Elvira Nabiullina to increase rates at a Dec. 11 policy meeting as oil’s slide and sanctions over the conflict in Ukraine put the ruble on course for its biggest annual drop since Russia’s 1998 default. Capital flight has quickened as the Russian economy heads for recession, with data today showing bond mutual funds lost a third of their assets this year, while OAO Alfa Bank said its clients are increasing the pace of withdrawals. “The central bank has to come in with a massive rate hike, FX interventions alone might not be able to stabilize the situation,” Bernd Berg, London-based strategist at Societe Generale SA, said by e-mail. The market is seeking a rate increase “of a couple of hundred basis points,” he said. The Bank of Russia said it sold USD 1.9 billion on Dec. 3, its biggest intervention since Oct. 30. Policy makers may also be selling currency today, according to traders surveyed by Bloomberg. Shaken Confidence Nabiullina drained about USD 74 billion of Russia’s foreign-exchange reserves this year to support the ruble and raised rates by 400 basis points after President Vladimir Putin’s annexation of Crimea in March led the U.S. and European Union to impose sanctions and oil tumbled into a bear market. Putin pledged to punish speculators attacking the ruble with “harsh” steps in an address to parliament yesterday, asking the government and central bank to work together to defend the ruble. The currency’s plunge beyond 50 RUB/USD has shaken confidence of Russians. Clients of OAO Alfa-Bank are withdrawing USD 1 million to USD 3 million a day, its chief managing director Alexey Marey told reporters today, adding there wasn’t a frenzy to take out funds. The tumbling value of Russian bonds has contributed to a 33% drop in mutual bond funds’ net assets to RUB 40.2 billion (USD 750 million), according to Investfunds.ru data today. Yields on 10-year government ruble bonds jumped 143 basis points this week, the most in five years. Rate Bets For a “sustained and durable recovery” in the ruble, “the underlying drivers” of the oil price and sanctions risks must abate, Morgan Stanley economists wrote in a note yesterday. They predict the Bank of Russia will raise borrowing costs by 200 basis points this month. The premium on three-month forward-rate agreements has surged 264 basis points this week to 3.64 above the MosPrime interbank rate as bets on higher borrowing costs increased, data compiled by Bloomberg show. Five-year credit default swaps protecting Russian debt against non-payment rose 14 basis points to 383, also a five-year peak. The RTS stock index fell 0.7% to 912.45 as Brent crude lost 0.7% to USD 69.18, set for a 27% drop this quarter. More Interventions Nabiullina is weighing policy options as she seeks to keep lending flowing in an economy verging on recession, while avoiding a deeper currency slump that could spark a rush among citizens to switch their ruble savings into dollars. Policy makers are using one-off ruble purchases to slow the currency’s drop. The Bank of Russia said yesterday the ruble had “substantially” deviated from its fundamental value, while Finance Minister Anton Siluanov appealed to state-controlled exporters to convert more of their foreign revenue into rubles. The central bank may have sold more than USD 800 million today, according to Aram Kazaryan, FX and rates sales trader at MDM Bank in Moscow. “We’re most likely seeing central bank interventions to support the exchange rate in line with announced currency policy,” Denis Korshilov, the head of fixed income, currencies and commodities at ZAO Citibank in Moscow, said by e-mail. “It’s possible currency is also sold by exporters, with whom the Finance Ministry planned to hold consultations.”