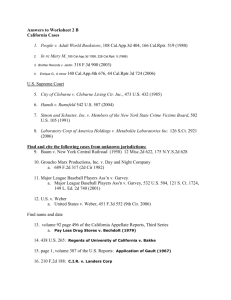

Estillore v Countrywide 2011

advertisement