Test 2, Spring 2010 - College of Business Administration

advertisement

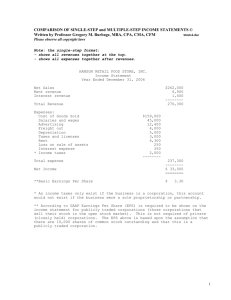

Accounting 303 Exam 2, Chapters 4, 5, 20 Spring 2010 I. Name _______________________ Section _______ Row _______ Multiple Choice Questions. (2 points each, 22 points in total) Read each question carefully and indicate your answer by circling the letter preceding the one best answer. 1. The distinction between operating income and non-operating (other income and expenses) income relates to a. continuity of income. b. principal activities of the reporting entity. c. consistency of income stream. d. reliability of measurements. 2. The single-step income statement emphasizes a. the gross profit figure. b. total revenues and total expenses. c. extraordinary items and accounting changes more than these are emphasized in the multiple-step income statement. d. the various components of income from continuing operations. 3. How should an unusual event not meeting the criteria for an extraordinary item be disclosed in the financial statements? a. Shown as a separate item in operating revenues or expenses if material and supplemented by a footnote if deemed appropriate. b. Shown in operating revenues or expenses if material but not shown as a separate item. c. Shown net of income tax after ordinary net earnings but before extraordinary items. d. Shown net of income tax after extraordinary items but before net earnings. 4. Which of the following is true about intraperiod tax allocation? a. It arises because certain revenue and expense items appear in the income statement either before or after they are included in the tax return. b. It is required for extraordinary items but not for discontinued operations. c. Its purpose is to allocate income tax expense evenly over a number of accounting periods. d. Its purpose is to relate the income tax expense to the items which affect the amount of tax on the income statement. 5. Cole Company, with an applicable income tax rate of 30%, reported net income of $210,000. Included in income for the period was an extraordinary loss from flood damage of $30,000 before deducting the related tax effect. The company's income before income taxes and extraordinary items was a. $240,000. b. $300,000. c. $330,000. d. $231,000. 1 6. For Garret Wolfe Company, the following information is available: Cost of goods sold Dividend revenue Income tax expense Operating expenses Sales revenue $ 60,000 2,500 6,000 23,000 100,000 In Garret Wolfe’s multiple-step income statement, gross profit a. should not be reported b. should be reported at $13,500. c. should be reported at $40,000. d. should be reported at $42,500. 7. Under the realization principle, revenue should not be recognized until the earnings process is deemed virtually complete and a. Revenue is realized. b. Any receivable is collected. c. Collection is reasonably certain. d. Collection is absolutely assured. 8. For a typical manufacturing company, the most common critical point for recognizing revenue is the date a. an order is received. b. production is completed. c. the product is delivered. d. payment is received. 9. Sullivan Software sells packages of a software program and one year's worth of technical support for $500. Their packaging lists the $500 sales price as comprised of a software program at a price of $450 and technical support with a price of $100, with a $50 discount for the package deal. All of Sullivan's sales are for cash, and there are no returns. How should Sullivan recognize revenue for the two parts of the arrangement? a. Recognize the entire $500 when the customer pays cash to buy the package. b. Recognize the portion of the $500 attributable to the software program when the customer pays cash to buy the package, defer the portion attributable to technical support and recognize over the support period. c. Defer the entire $500 and recognize over the support period. d. Recognize the revenue following the installment sales method. 10. An accounting change that is reported by the prospective approach is reflected in the financial statements of a. Prior years only. b. Prior years plus the current year. c. The current year only. d. Current and future years. 2 11. Which of the following accounting changes should be accounted for using the retrospective approach? a. A change in the estimated life of a depreciable asset. b. A change from straight-line to declining balance depreciation. c. Correcting an error in a prior financial statement. d. A change from the completed-contract method of accounting for long-term construction contracts. 3 II. Problems – (78 points in total) Show all work where appropriate! 1. (10 points) Below are listed several types of accounting changes or error corrections. For each one, indicate your answer by using the code letter to indicate the type of change or error correction. Code Letter A B C D Type of change or error correction Change in accounting principle Change in accounting estimate Change in reporting entity Error correction _____ a. Changing the companies included in consolidated financial statements. _____ b. Change from LIFO to FIFO inventory method. _____ c. Change from an unacceptable to an acceptable accounting principle. _____ d. Change in the salvage value of a fixed asset. _____ e. Change in the remaining life of a fixed asset. 4 2. (16 points) ADDI, Inc. had income from continuing operations of $821,000 (after tax) in 2009. In addition, ADDI has the following information to report on their income statement. In early 2009 ADDI experienced an uninsured earthquake loss on one of its warehouses in the amount of $200,000. ADDI considers the earthquake loss as unusual and infrequent. In July 2009 ADDI decided to discontinue its stereo division. The stereo division qualifies as a component of the entity according to SFAS No. 144. Up to the date of closing, the stereo division operated at a loss of $400,000 during 2009. On September 4, 2009, ADDI sold all the assets of the division for a profit of $250,000. Required: Present in proper form the lower portion of ADDI's 2009 income statement starting with "income from continuing operations." Also, prepare the proper earnings per share disclosures required on the income statement. ADDI's tax rate is 30% and they have 1,000,000 shares of common stock outstanding for the entire year. ADDI, Inc. Partial Income Statement For the Year Ended December 31 2009 5 3. (17 points) During 2009, Clapton Company sold a guitar to Beck Company for $21,000. The guitar had a cost to Clapton of $14,910. Beck paid $10,000 in cash in 2009 and paid the remainder in two equal installments, one in 2010 and the final installment in 2011. Ignore any interest Required: Complete each of the two unrelated parts of this problem. a. Assume Clapton Company appropriately used the installment sales method to account for this sale. i. How much gross profit will Clapton report in each of the years? 2009 $____________ 2010 $____________ 2011 $____________ ii. Make all the journal entries Clapton would record in 2009 to properly record this transaction. b. Assume Clapton Company appropriately used the cost recovery method to account for this sale. How much gross profit will Clapton report in each of the years? 2009 $____________ 2010 $____________ 2011 $____________ 6 4. (19 points) In 2008, Nebraska Construction Company began work on a new building for UNO's College of Business. The contract price for the building is $36,000,000 and it will be completed in 2010. Actual and estimated costs for the building are as follows. Item Contract price Actual costs to date Estimated Costs to complete Total actual and est. to complete Progress billings Cash collections a. 2008 2009 2010 $36,000,000 $36,000,000 $36,000,000 $5,900,000 $20,650,000 $29,900,000 $23,600,000 $8,850,000 $29,500,000 $29,500,000 $29,900,000 $7,000,000 $17,000,000 $12,000,000 $6,000,000 $17,500,000 $12,500,000 Prepare the 2008 entries to record this project assuming percentage of completion accounting is used. b. How much gross profit would be recognized each year under the completed contract method? 2008 $______________ 2009 $______________ 2010 $______________ 7 5. (14 points) During 2010 the internal auditors for Alonso Company discovered the following errors were made in last year's financial statements. a. Give the proper entries to correct the errors in 2010. i. Salaries of $12,000 were not accrued at the end of 2009. The salaries were paid in 2010 and charged to salaries expense. ii. 2009 depreciation was overstated by $14,000 because of a computational error. Nothing was recorded in 2010 related to this error. b. Determine the effect each of the above errors had on the 2009 financial statements. Indicate the effect on each of the following by using a "U" to indicate understatement and a "O" to indicate overstatement. Error Assets Liabilities Stockholders' Equity Revenues Expenses Net Income i ii 8 Solutions Multiple Choice Question Number 1 2 3 4 5 6 7 8 9 10 11 Answer b b a d c c c c b d d Problems 1. a. C b. A c. D d. B e. B 2. ADDI, Inc. Partial Income Statement For the Year Ended December 31 2009 Income from continuing operations before tax Income tax expense Income before discontinued operations Discontinued operations: Loss on discontinued operations (net of $250,000 gain on disposal) <150,000> Income tax benefit 45,000 Loss on discontinued operations Extraordinary earthquake loss (net of 60,000 income tax benefit) Net Income Earnings per share: Income before discontinued operations Loss on discontinued operations Extraordinary earthquake loss 1,172,857 351,857 821000 105,000 <140,000> 576,000 .82 <.11> <.14> 9 Net Income .57 3. a. i. 2009 $__2,900______ 2010 $__1,595______ 2011 $__1,595______ ii. Cash A/R 10,000 11,000 Inventory Deferred GP 14,910 6,090 Deferred GP Realized GP 2,900 2,900 b. 2009 $______0______ 2010 $____590______ 2011 $___5,500______ 4. Item Contract price Actual costs to date Estimated Costs to complete Total actual and est. to complete Estimated GP Progress billings Cash collections 2008 $36,000,000 $5,900,000 $23,600,000 $29,500,000 6,500,000 $7,000,000 $6,000,000 2009 $36,000,000 $20,650,000 $8,850,000 $29,500,000 6,500,000 $17,000,000 $17,500,000 2010 $36,000,000 $29,900,000 $29,900,000 6,100,000 $12,000,000 $12,500,000 Percentage completed: 5.9/29.5 = 20% a. Construction in Progress Cash 5,900,000 A/R 7,000,000 Progress Billings 5,900,000 7,000,000 10 Cash A/R 6,000,000 Construction Expense Construction in Progress Revenue 5,900,000 1,300,000 6,000,000 7,200,000 b. 2008 $__________0___ 2009 $__________0___ 2010 $___6,100,000___ 5. a. i. Retained Earnings Salaries Expense 12,000 12,000 ii. Accumulated Depreciation Retained Earnings Error Assets 14,000 Liabilities U i ii 14,000 O Stockholders' Equity Expenses Net Income O U O O U O Revenues 11