Mark Everson, IRS Commissioner

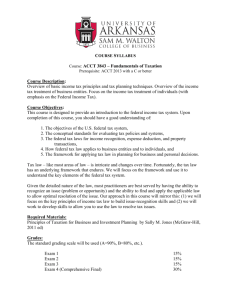

advertisement