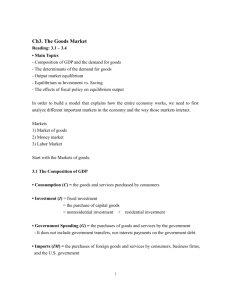

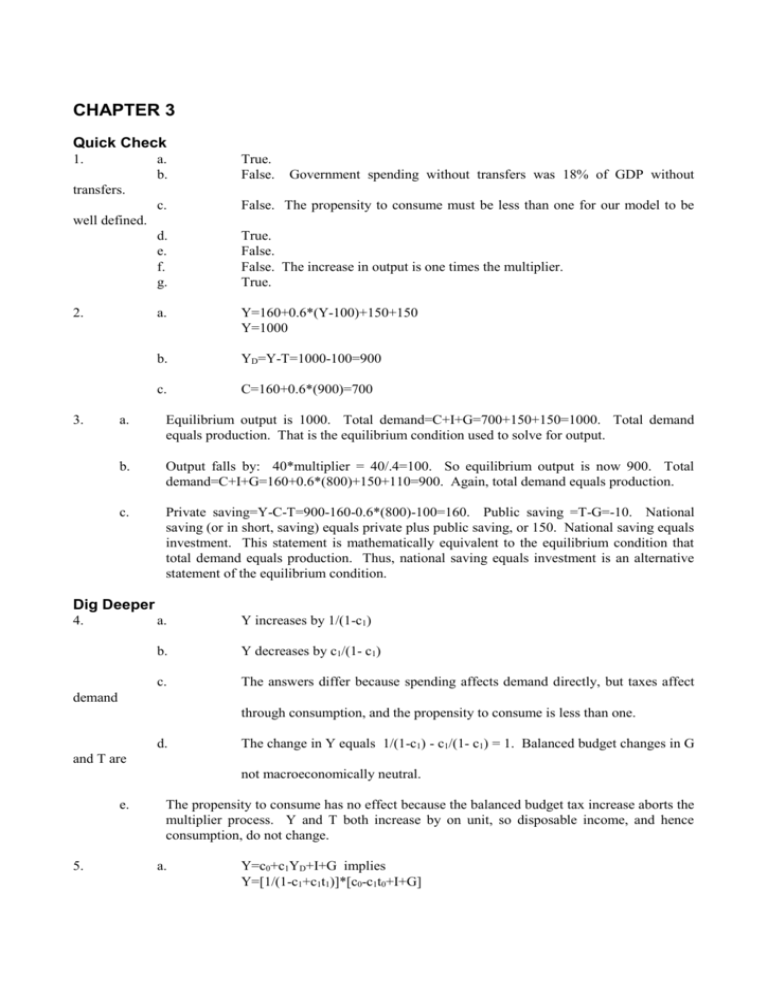

Chapter 3

advertisement

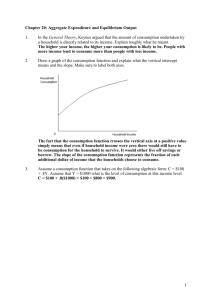

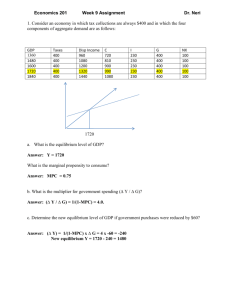

CHAPTER 3 Quick Check 1. a. b. True. False. c. False. The propensity to consume must be less than one for our model to be d. e. f. g. True. False. False. The increase in output is one times the multiplier. True. a. Y=160+0.6*(Y-100)+150+150 Y=1000 b. YD=Y-T=1000-100=900 c. C=160+0.6*(900)=700 Government spending without transfers was 18% of GDP without transfers. well defined. 2. 3. a. Equilibrium output is 1000. Total demand=C+I+G=700+150+150=1000. Total demand equals production. That is the equilibrium condition used to solve for output. b. Output falls by: 40*multiplier = 40/.4=100. So equilibrium output is now 900. Total demand=C+I+G=160+0.6*(800)+150+110=900. Again, total demand equals production. c. Private saving=Y-C-T=900-160-0.6*(800)-100=160. Public saving =T-G=-10. National saving (or in short, saving) equals private plus public saving, or 150. National saving equals investment. This statement is mathematically equivalent to the equilibrium condition that total demand equals production. Thus, national saving equals investment is an alternative statement of the equilibrium condition. Dig Deeper 4. a. Y increases by 1/(1-c1) b. Y decreases by c1/(1- c1) c. The answers differ because spending affects demand directly, but taxes affect demand through consumption, and the propensity to consume is less than one. d. The change in Y equals 1/(1-c1) - c1/(1- c1) = 1. Balanced budget changes in G and T are not macroeconomically neutral. e. 5. The propensity to consume has no effect because the balanced budget tax increase aborts the multiplier process. Y and T both increase by on unit, so disposable income, and hence consumption, do not change. a. Y=c0+c1YD+I+G implies Y=[1/(1-c1+c1t1)]*[c0-c1t0+I+G] b. The multiplier = 1/(1-c1+c1t1) <1/(1- c1), so the economy responds less to changes in autonomous spending when t1 is positive. After a positive change in autonomous spending, the increase in total taxes (because of the increase in income) tends to lessen the increase in output. After a negative change in autonomous spending, the fall in total taxes tends to lessen the decrease in output. c. Because of the automatic effect of taxes on the economy, the economy responds less to changes in autonomous spending than in the case where taxes are independent of income. So output tends to vary less, and fiscal policy is called an automatic stabilizer. 6. a. Y=[1/(1-c1+c1t1)]*[c0-c1t0+I+G] b. T = c1t0 + t1*[1/(1-c1+c1t1)]*[c0-c1t0+I+G] c. Both Y and T decrease. d. If G is cut, Y decreases even more.