IM 03 READY

advertisement

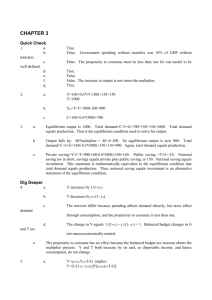

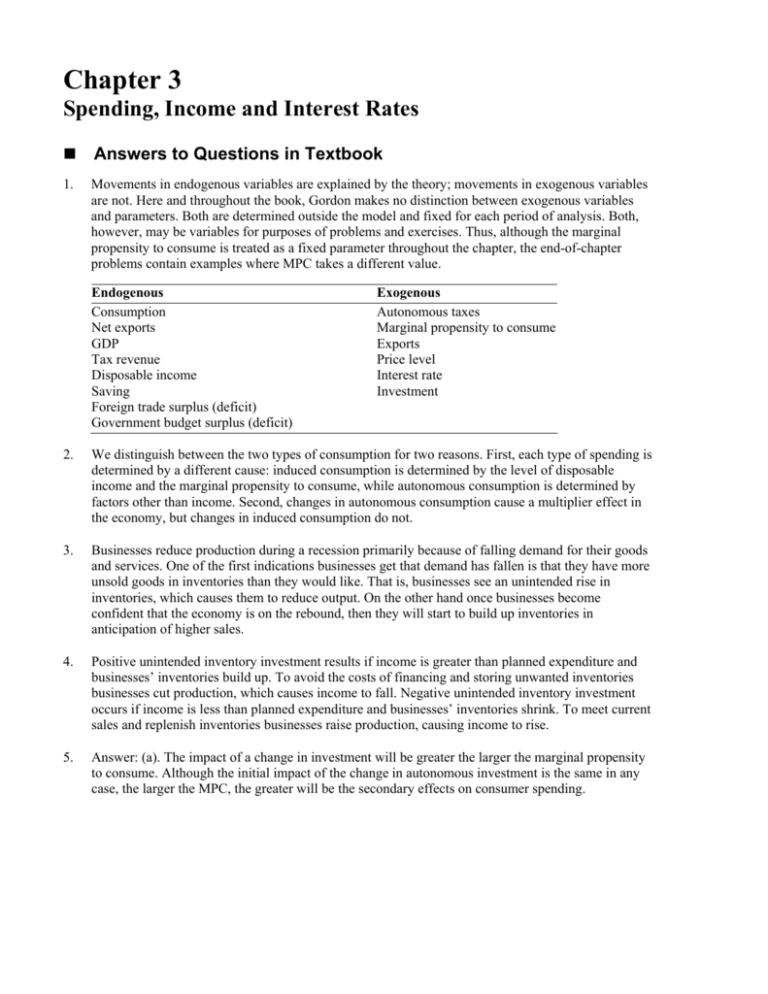

Chapter 3 Spending, Income and Interest Rates Answers to Questions in Textbook 1. Movements in endogenous variables are explained by the theory; movements in exogenous variables are not. Here and throughout the book, Gordon makes no distinction between exogenous variables and parameters. Both are determined outside the model and fixed for each period of analysis. Both, however, may be variables for purposes of problems and exercises. Thus, although the marginal propensity to consume is treated as a fixed parameter throughout the chapter, the end-of-chapter problems contain examples where MPC takes a different value. Endogenous Consumption Net exports GDP Tax revenue Disposable income Saving Foreign trade surplus (deficit) Government budget surplus (deficit) Exogenous Autonomous taxes Marginal propensity to consume Exports Price level Interest rate Investment 2. We distinguish between the two types of consumption for two reasons. First, each type of spending is determined by a different cause: induced consumption is determined by the level of disposable income and the marginal propensity to consume, while autonomous consumption is determined by factors other than income. Second, changes in autonomous consumption cause a multiplier effect in the economy, but changes in induced consumption do not. 3. Businesses reduce production during a recession primarily because of falling demand for their goods and services. One of the first indications businesses get that demand has fallen is that they have more unsold goods in inventories than they would like. That is, businesses see an unintended rise in inventories, which causes them to reduce output. On the other hand once businesses become confident that the economy is on the rebound, then they will start to build up inventories in anticipation of higher sales. 4. Positive unintended inventory investment results if income is greater than planned expenditure and businesses’ inventories build up. To avoid the costs of financing and storing unwanted inventories businesses cut production, which causes income to fall. Negative unintended inventory investment occurs if income is less than planned expenditure and businesses’ inventories shrink. To meet current sales and replenish inventories businesses raise production, causing income to rise. 5. Answer: (a). The impact of a change in investment will be greater the larger the marginal propensity to consume. Although the initial impact of the change in autonomous investment is the same in any case, the larger the MPC, the greater will be the secondary effects on consumer spending. Chapter 3 Spending, Income and Interest Rates 17 6. Expansionary fiscal policy would include increasing government spending or decreasing taxes. In each case, the size of the deficit would increase. If the budget were initially in surplus, however, the same policy choice would decrease the surplus. 7. The IS curve is downward sloping because a fall in the interest rate results in a rise in consumption and planned investment, the two interest rate sensitive components of autonomous planned spending. That increase in planned spending results in a rise in income as businesses increase output in response to the greater demand for goods and services. Income continues to rise until the commodity market is once again in equilibrium. Note that the higher level of income takes place at a lower interest rate, which is shown graphically as a movement down the IS curve. A shift of the IS curve takes place when autonomous planned spending changes due to something other than a change in the interest rate. For example, suppose that there is a change in fiscal policy which reduces autonomous planned spending. That decrease causes a fall in income as business firms cut output in response to the lower demand for goods and services. Income continues to fall until the commodity market is once again in equilibrium. Note that the lower level of income takes place at the same interest rate, which is shown graphically as a shift left of the IS curve. 8. (a) The decline in sales of American agricultural exports reduces net exports. Therefore autonomous planned spending decreases at a given interest rate. The reduction results in a fall in equilibrium income at a given interest rate, which is shown graphically as a shift left of the IS curve. (b) The collapse in consumer confidence reduces consumption. Therefore autonomous planned spending decreases at a given interest rate. The reduction results in a fall in equilibrium income at a given interest rate, which is shown graphically as a shift left of the IS curve. (c) The decline in the personal savings rate is accompanied by a rise in consumption. Therefore autonomous planned spending increases at a given interest rate. The increase leads to a rise in equilibrium income at a given interest rate, which is shown graphically as a shift right of the IS curve. (d) The collapse in business confidence reduces planned investment. Therefore autonomous planned spending decreases at a given interest rate. The reduction results in a fall in equilibrium income at a given interest rate, which is shown graphically as a shift left of the IS curve. 9. Since a demand shock is a significant change in desired spending by consumers, business firms, the government, or foreigners, a demand sock causes a change in autonomous planned spending at a given interest rate. That change in autonomous planned spending results in a change in equilibrium income, given the interest rate, and is shown graphically as a shift in the IS curve. Thus the hypothesis that the increased stability of the U.S. economy since 1985 is due to smaller and less important demand shocks can be interpreted to mean that shifts of the IS curve have become smaller. 10. C = a + c(Y − T) = a + cY − c(Ta + tY) = a − cTa + c(1 − t)Y. S = −a + s(Y − T) = −a + sY − s(Ta + tY) = −a − sTa + s(1 − t)Y. 11. Answer: (b). The greater the MPC, the smaller is the marginal leakage rate. Therefore, the impact of a change in investment will be greater the smaller the marginal leakage rate. It will take more rounds of spending and saving to generate the necessary increase in leakages to match the initial change in autonomous spending. 12. The multiplier decreases when induced taxes are included, because a greater fraction of each dollar of income now leaks out of the spending stream as taxes. Another way of saying the same thing is that when induced taxes are included, the size of the marginal leakage rate increases. 18 Gordon • Macroeconomics, Tenth Edition 13. The marginal leakage rate in this case is s + nx, so that the balanced budget multiplier is s/(s + nx), which is less than one. Answers to Problems in Textbook 1. (a) Consumption equals 1,400 + 0.6(10,000 – 1,750) = 1,400 + 4,950 = 6,350. (b) Saving equals disposable income minus consumption, which equals 8,250 – 6,350 = 1,900. (c) The level of planned investment equals 1,800. To compute the level of actual investment, I, remember that income and expenditures (E) are always equal, and since net exports equal zero in this problem, E = C + I + G, so that I = Y – C – G or I = 10,000 – 6,350 – 1950 = 1,700. Since unintended inventory investment, Iu = I – IP, Iu = 1,700 – 1,800 = –100. (d) Leakages equal saving plus taxes = 1,900 + 1,750 = 3,650. Injections equal investment plus government = 1,700 + 1,950 = 3,650. So both leakages and injections equal 3,650. (e) Since planned expenditure exceeds income, the economy is not in equilibrium. In this economy, the equilibrium level of income equals Ap/s, where s is the marginal propensity to save. Autonomous planned spending, Ap, equals Ca – cT + Ip + G = 1,400 – 0.6(1,700) + 1,800 + 1,950 = 4,100. The marginal propensity to save equals 1 – c = 1 – 0.6 = 0.4. Therefore the equilibrium level of income equals 4,100/0.4 = 10,250. 2. (a) The equilibrium level of income equals Ap/s, where s is the marginal propensity to save. Autonomous planned spending, Ap, equals Ca – cT + Ip + G + NX = 2,200 – 0.5(1,900) + 2,400 + 1,850 – 100 = 5,400. The marginal propensity to save equals 1 – c = 1 – 0.5 = 0.5. Therefore the equilibrium level of income equals 5,400/0.5 = 10,800. The equilibrium level of consumption equals 2,200 + 0.5(10,800 – 1,900) = 6,650. The equilibrium level of saving equals (Y – T) – C = (10,800 – 1,900) – 6,650 = 2,250. The equilibrium level of taxes equal 1,900. (b) The marginal propensity to save equals 1 – c = 1 – 0.5 = 0.5. (c) There is a government surplus of 50 billion since taxes equal 1,900 and government spending on goods and services equals 1,850. (d) Leakages equal saving plus taxes = 2,250 + 1,900 = 4,150. Injections equal investment plus government plus net exports = 2,400 + 1,850 + (–100) = 4,150. So both leakages and injections equal 4,150. (e) The increase in equilibrium income equals Ap/s = G/s = 140/0.5 = 280. 3. (a) The marginal propensity to save equals 1 – c = 1 – 0.85 = 0.15. The marginal leakage rate equals s(1 – t) + t + nx = 0.15(1 – 0.2) + 0.2 + 0.08 = 0.4. The multiplier, k, equals the inverse of the marginal leakage rate = 1/0.4 = 2.5. (b) The marginal propensity to save equals 1 – 0.75 = 0.25. The marginal leakage rate equals 0.25(1 – 0.2) + 0.2 + 0.08 = 0.48. The multiplier equals 1/0.48 = 2.083. (c) The marginal leakage rate equals 0.25(1 – 0.2) + 0.2 + 0.1 = 0.5. The multiplier equals 1/0.5 = 2. (d) The marginal leakage rate equals 0.25(1 – 0.25) + 0.25 + 0.1 = 0.5375. The multiplier equals 1/0.5375 = 1.86. (e) The marginal leakage rate increases and the multiplier decreases as the marginal propensity to consume decreases. The marginal leakage rate increases and the multiplier decreases as the tax rate or the share of GDP in imports increase. Chapter 3 4. Spending, Income and Interest Rates 19 (a) Ap = 660 − 0.8(200) + 500 + 500 + 300 = 1800. Multiplier = 0.1/(0.2(1 − 0.2) + 0.2 + 0.04) = 2.5. Y = 1800 × 2.5 = 4500. T − G = [200 + 0.2(4500)] − 500 = 600 (surplus); NX = 300 − 0.04(4500) = 120 (surplus). Leakages = S + T = 20 + 1100 = 1120. Injections = I + G + NX = 500 + 500 + 120 = 1120. Since the multiplier is 2.5, the decline in Ap of 150 means a decline in Ep. Y now exceeds Ep and there is unintended inventory accumulation. Firms lay off workers and Y declines. Ep declines as well but at a slower rate. Eventually, equilibrium is re-attained at a lower Y. (g) Equilibrium income decreases by 375 from 4500 to 4125. (b) (c) (d) (e) (f) 5. (a) The marginal propensity to save equals 1 – c = 1 – 0.5 = 0.5. The multiplier, k, equals the inverse of the marginal propensity to save = 1/0.5 = 2. (b) The equation for autonomous planned spending, Ap, equals Ca – cT + Ip + G + NX = 1,400 – 15r – 0.5(1,600) + 2,350 – 35r + 1,940 – 200 = 4,690 – 50r. (c) The equation for the IS curve equals 2(4,690 – 50r) = 9,380 – 100r. (d) At an interest rate of zero, the equilibrium level of income equals 9,380. At an interest rate of two, the equilibrium level of income equals 9,380 – 100(2) = 9,180. At an interest rate of four, the equilibrium level of income equals 9,380 – 100(4) = 8,980. (e) The slope of the IS curve, r/Y, equals (2 – 0)/(9,180 – 9,380) = (4 – 2)/(9,180 – 8,980) = 2/ (–200) = –0.01. (f) A rise in consumer confidence causes a rise in consumption expenditures. The new equation for autonomous planned spending equals 1,440 – 15r – 0.5(1,600) + 2,350 – 35r + 1,940 – 200 = 4,730 – 50r. The new equation for the IS curve equals 2(4,730 – 60r) = 9,460 – 100r. (g) At an interest rate of zero, the equilibrium level of income equals 9,460. At an interest rate of two, the equilibrium level of income equals 9,460 – 100(2) = 9,260. At an interest rate of four, the equilibrium level of income equals 9,460 – 100(4) = 9,060. (h) Since equilibrium income increases at each of the three interest rates, the IS curve shifted to the right when autonomous consumption rises. The horizontal shift of the IS curve equals the change in equilibrium income at a given interest rate (80), and since the change in equilibrium income equals the multiplier times the change in autonomous planned spending, the horizontal shift of the IS curve equals the multiplier times the change in autonomous planned spending (2 times 40). 6. (a) The new value of marginal propensity to save equals 1 – 0.6 = 0.4. The new multiplier, k, equals the inverse of the new marginal propensity to save = 1/0.4 = 2.5. (b) The equation for the new autonomous planned spending equals 1,400 – 15r – 0.6(1,600) + 2,350 – 35r + 1,940 – 200 = 4,530 – 50r. (c) The equation for the new IS curve equals 2.5(4,530 – 50r) = 11,325 – 125r. (d) At an interest rate of zero, the equilibrium level of income equals 11,325. At an interest rate of two, the equilibrium level of income equals 11,325 – 125(2) = 11,075. At an interest rate of four, the equilibrium level of income equals 11,325 – 125(4) = 10,825. (e) The slope of the new IS curve equals (2 – 0)/(11,075 – 11.325) = (4 – 2)/(10,825 – 11,075) = 2/ (–250) = –0.008. (f) The equation for the new autonomous planned spending equals, 1,400 – 15r – 0.6(1,600) + 2,350 – 45r + 1,940 – 200 = 4,530 – 60r. 20 Gordon • Macroeconomics, Tenth Edition (g) The equation for the new IS curve equals 2.5(4,530 – 60r) = 11,325 – 150r. (h) At an interest rate of zero, the equilibrium level of income equals 11,325. At an interest rate of two, the equilibrium level of income equals 11,325 – 150(2) = 11,025. At an interest rate of four, the equilibrium level of income equals 11,325 – 150(4) = 10,725. (i) The slope of the new IS curve equals (2 – 0)/(11,025 – 11,325) = (4 – 2)/(10,725 – 11,025) = 2/ (–300) = –0.0067. (j) As the multiplier increases from 2 to 2.5, the IS curve becomes flatter as the slopes decreases from –0.01 to –0.008 and the decrease in income for a two percentage point rise in the interest rate increases from 200 billion to 250 billion. Similarly, the IS curve becomes flatter as the responsiveness of planned spending to the interest rate increases from a 50 billion to a 60 billion dollar decrease in autonomous planned spending for every one percentage point rise in the interest rate. 7. (a) The marginal propensity to save equals 1 – 0.85 = 0.15. The marginal leakage rate equals 0.15(1 – 0.2) + 0.2 + 0.08 = 0.4. The multiplier, k, equals the inverse of the marginal leakage rate = 1/0.4 = 2.5. (b) The equation for autonomous planned spending, Ap, equals Ca – cTa + Ip + G + NXa = 225 – 10r – 0.85(100) + 1,610 – 30r + 1,650 + 700 = 4,100 – 40r. (c) The equation for the IS curve equals 2.5(4,100 – 40r) = 10,250 – 100r. (d) At an interest rate of three, the equilibrium level of income equals 9,950. (e) Taxes at the equilibrium level of income equal 100 + 0.2(9,950) = 2,090, Consumption at the equilibrium level of income, given r = 3, equals 225 – 10(3) + 0.85(9,950 – 2,090) = 6,876. So saving equals 9,950 – 2,090 – 6,876 = 984. So leakages equal 984 + 2,090 = 3,074. Injections equal investment plus government plus net exports = 1,610 – 30(3) + 1,650 + 700 – 0.08(9,950) = 3,074. So both leakages and injections equal 3,074.