NIKE, INC - Stock Valuation Analysis

advertisement

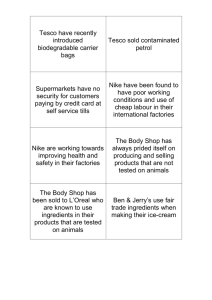

NIKE, INC. Ticker Symbol: NKE (NYSE) Sector: Consumer Cyclical Industry: Footwear FUNCTION: NIKE, Inc. is engaged in the design, development and worldwide marketing of footwear, apparel, equipment and accessory products. It sells its products to approximately 18,000 retail accounts in the United States and through a mix of independent distributors, licensees and subsidiaries in nearly 200 countries. NIKE's athletic footwear products are designed for specific athletic use, although some of its products are worn for casual or leisure purposes. The Company creates designs for men, women and children. Running, basketball, children's, cross-training and women's shoes are the Company's top-selling product categories. NIKE also markets shoes designed for outdoor activities, tennis, golf, soccer, baseball, football, bicycling, volleyball, wrestling, cheerleading, aquatic activities, hiking and other athletic and recreational uses. NIKE sells active sports apparel that covers most of these categories, athletically inspired lifestyle apparel and others. FINANCIAL SNAPSHOT Sales/Revenue: $10,697,000,000 (TTM) Market Capitalization: $16,613,750,000 Industry Ranked: Number One (Market Capitalization) Number One (Sales) Fundamental Analysis: A- Equity Valuation Ratio DDM Company $6.621 Industry Sector Market P/E 21.55 20.33 19.16 24.79 PEG 7.81 7.08 3.07 3.73 PSR 1.55 1.37 1.15 3.43 P/B 3.94 3.56 3.39 4.28 Beta 0.72 0.75 1.03 1.00 Comparison Based on the DDM, NIKE’s stock intrinsic value is $6.62. NIKE’s stock is presently trading at $63.90. This would suggest that the price of NIKE’s stock is significantly overvalued compared to its intrinsic value. P/Eco>P/EInd and P/ESec NIKE’s P/E Ratio is slightly higher than the industry and the sector indicating that the company is slightly overvalued. PEGco > PEGInd and PEGSec. NIKE is overvalued. PRSco > PSRInd and PSRSec NIKE’s PSR is less than 3, indicating the company is undervalued. PBco>1 which indicates that the company is overvalued. Betaco < 1. This stock is less risky compared to stocks in this industry and sector. Conclusion of Equity Valuations: NIKE’s P/E, PSR and P/B of 21.55, 1.55, and 3.94 are quite similar to the averages of its industry and sector. Hence, NIKE can be considered to be fairly valued. However, based on the DDM model, NIKE’s stock price of $63.90 is significantly overvalued compared to its intrinsic value of $6.62. 1 Do = 0.56 Growth (5 year) = 0.0874 Ks = 12% V = $6.62 B- Financial Strength Analysis Category 1GROWTH RATE Ratio 5 years Growth of Sales Company 2.29% Industry 4.19% Sector 8.14% Market 9.72% 5 years Growth of EPS 15.34% 14.80% 6.01% 10.38% Comparison The sales growth of NIKE is lower compared to the industry and sector averages. The EPS growth of NIKE is higher compared to the industry and sector averages. Growth of Sales 5 Year Sales Growth 3 Year Trend Analysis 15.0% 10.0% Nike Industry 5.0% 0.0% 2000 2001 2002 Year Interpretation: NIKE’s 5 year sales growth has declined substantially from 2000 to 2002. In 2002, its 5 year sales growth was lower than its industry average. Growth of EPS 5 Year Growth of EPS 3 Year Trend Analysis 20.0% 15.0% 10.0% Nike 5.0% Industry 0.0% -5.0% 2000 2001 Year 2002 Interpretation: NIKE’s 5 year EPS growth has been on a downward trend, and its 2002 figure was in negative territory. Moreover, its industry average was much higher than NIKE’s 5 year EPS growth in 2002. Category Ratio Company 2Operating 13.81% PROFITABILITY Margin Net Profit Margin 7.18% Industry 12.52% Sector 11.03% Market 18.91% 6.64% 4.79% 11.73% Comparison The Operating Profit margin of NIKE is higher than the industry and sector averages. The Net Profit margin of NIKE is higher than the industry and sector averages. Operating Margin Operating Margin 3 Year Trend Analysis 11.0% 10.8% 10.6% 10.4% 10.2% 10.0% 9.8% Nike Industry 2000 2001 2002 Year Interpretation: This chart shows NIKE’s operating margin was higher than the industry average in 2002. In 2002, NIKE’s operating margin rebounded from a decline it experienced in 2001. Net Profit Margin Net Margin 3 Year Trend Analysis 6.8% 6.6% 6.4% 6.2% 6.0% 5.8% Nike Industry 2000 2001 2002 Year Interpretation: After a decline in net margin for NIKE in 2001, its net margin increased substantially in 2002, and is close to its industry average. Category Ratio 3ROI MANAGEMENT EFFECTIVENESS ROE Company 16.71% Industry 16.12% Sector 8.49% Market 9.64% 20.12% 19.15% 16.12% 17.86% Return on Equity ROE 3 Year Trend Analysis 19.5% 19.0% 18.5% 18.0% 17.5% 17.0% Nike Industry 2000 2001 Year 2002 Comparison The return on investment of NIKE is slightly higher than the industry average but almost twice its sector average. The return on equity of NIKE is higher than the industry and sector averages. Interpretation: NIKE’s ROE has been stagnant from 2000 to 2002, and its ROE was lower than the industry average in 2002. Category Ratio 4Inventory EFFICIENCY Turnover RATIO Asset Turnover Company Industry 4.37x 4.41x Sector 9.25x Market 9.96x 1.67x 1.19x 0.93x 1.76x Comparison The inventory turnover of NIKE is lower than the industry and sector averages. This indicates that NIKE inventory turnover is slower compared to those in its industry and sector. The asset turnover of NIKE is lower than the industry average but higher than the sector average. This indicates that the company does not utilize its assets as well as those in its industry but they do utilize its assets better if compared to the sector. Inventory Turnover Inventory Turnover 3 Year Trend Analysis 4.4 4.3 4.2 4.1 4.0 3.9 3.8 Nike Industry 2000 2001 2002 Year Interpretation: After declining slightly in 2001, there was a sharp upturn in NIKE’s inventory turnover in 2002. Asset Turnover Asset Turnover 3 Year Trend Analysis 1.8 1.8 1.7 1.7 1.6 1.6 1.5 Nike Industry 2000 2001 2002 Year Interpretation: NIKE’s asset turnover was very flat from 2000 to 2002. Moreover, its asset turnover was lower than its industry average in 2002. Category 5DEBT RATIO Ratio Company 0.23x Total Debt/Equity Interest Coverage 28.54x Industry 0.22x Sector 4.03x Market 0.98x 25.33x 8.68x 12.96x Comparison The debt/equity ratio of NIKE is comparable to its industry average. This indicates that NIKE is as leveraged as those in its industry. However, the debt/equity ratio of NIKE is lower than its sector average, indicating that NIKE is not as leveraged as those in its industry. The interest coverage ratio of NIKE is higher than the industry and sector averages. This indicates that NIKE can meet its fixed obligations much better than those in its industry and sector. Debt/Equity Total Debt/Total Equity 3 Year Trend Analysis 0.25 0.20 Nike 0.15 0.10 Industry 0.05 0.00 2000 2001 2002 Year Interpretation: NIKE’s debt to equity ratio has increased in 2002, after a decline in 2001. However, NIKE is still below its industry average as far as its leverage is concerned. Category Ratio 6Quick LIQUIDITY Ratio RATIO Current Ratio Company 1.52x Industry 1.76x Sector 1.26x Market 1.26x 2.48x 2.94x 2.16x 1.76x Comparison The quick ratio of NIKE is lower than the industry average, but higher than its sector average. This indicates that NIKE is less liquid than those in its industry, but it is more liquid than those in its sector. The current ratio of NIKE is higher than the sector averages, but lower than the industry average. This indicates that NIKE is more liquid than those in its sector, but it is less liquid than those in its industry. Quick Ratio Quick Ratio 3 Year Trend Analysis 2.00 1.50 Nike 1.00 Industry 0.50 0.00 2000 2001 2002 Year Interpretation: NIKE’s quick ratio has been increasing steadily from 2000 to 2002 although its figure in 2002 was still lower than its industry average. Current Ratio Current Ratio 3 Year Trend Analysis 4.00 3.00 Nike 2.00 Industry 1.00 0.00 2000 2001 Year 2002 Interpretation: The current ratio of NIKE has been slowly increasing from 2000 to 2002. However, its current ratio in 2002 was slightly lower than its industry average. Conclusion of Financial Strength Analysis: NIKE scores better than the industry and sector averages in the following factors (twelve trailing months): 5 year EPS growth (15.34%), operating margin (13.81%), ROI (16.71%), ROE (20.12%), and interest coverage (28.54%) ratios. NIKE is a world leader in footwear and proves to be very competitive within its industry and its sector posting results that are slightly higher than its industry and sector averages in several areas. Technical Analysis: 1-Relative Strength Index: The Relative Strength Index ("RSI") is a popular oscillator. The name "Relative Strength Index" is slightly misleading as the RSI does not compare the relative strength of two securities, but rather the internal strength of a single security. The RSI is a pricefollowing oscillator that ranges between 0 and 100. A popular method of analyzing the RSI is to look for a divergence in which the security is making a new high, but the RSI is failing to surpass its previous high. This divergence is an indication of an impending reversal. When the RSI then turns down and falls below its most recent trough, it is said to have completed a "failure swing." The failure swing is considered a confirmation of the impending reversal. Movements above 70 are considered overbought, while an oversold condition would be a move under 30. Figure 1: Nike _1year price chart Interpretation: NIKE’s RSI is at the 60 level. This would indicate a HOLD position for NIKE. Figure 2: Nike compared to the Market _1year price chart Interpretation: In figure 2, NIKE’s price movement has quite similarly followed the trend of the market the last 12 months. However, they are currently outperforming the market. Although the market trend seems to be taking an upward turn, NIKE stock seems to be overbought. This verifies that it is not a good time to buy. Figure 3: Nike compared to Puma 1year price chart Interpretation: Figure 3 illustrates that PUMA has outperformed NIKE for the last 12 months. I will still maintain a HOLD position on NIKE. 2-Bollinger Bands: Bollinger Bands are similar to moving average envelopes. The difference between Bollinger Bands and envelopes is envelopes are plotted at a fixed percentage above and below a moving average, whereas Bollinger Bands are plotted at standard deviation levels above and below a moving average. Since standard deviation is a measure of volatility, the bands are self-adjusting: widening during volatile markets and contracting during calmer periods.Bollinger Bands are usually displayed on top of security prices, but they can be displayed on an indicator. These comments refer to bands displayed on prices. As with moving average envelopes, the basic interpretation of Bollinger Bands is that prices tend to stay within the upper- and lower-band. The distinctive characteristic of Bollinger Bands is that the spacing between the bands varies based on the volatility of the prices. During periods of extreme price changes (i.e., high volatility), the bands widen to become more forgiving. During periods of stagnant pricing (i.e., low volatility), the bands narrow to contain prices. Figure 1: Nike _1year price chart Interpretation: NIKE currently falls within the Bollinger Band. This indicates that the stock is neither positively nor negatively extended. Since the Bollinger Band widths are not very wide, this indicates that there is not much volatility in the price of the stock. However, since NIKE falls within the Bollinger Band, this indicates a time to HOLD the stock since there is great potential for price growth. Figure 2: Nike compared to the Market 1year price chart _ Interpretation: NIKE and the market seem to have a close historical trend. Recent performance indicates that the market is heading upwards. This indicates that it is opportune time to BUY NIKE. However, I will still maintain a HOLD on the NIKE stock. Figure 3: Nike compared to Puma _1year price chart Interpretation: Figure 3 shows that NIKE’s stock is not as volatile as PUMA’s stock. Due to the fact that NIKE’s stock presently falls within the Bollinger Band, this indicates a time to HOLD the stock since there is great potential for price growth. 3- Simple Moving Average: A Moving Average is an indicator that shows the average value of a security's price over a period of time. When calculating a moving average, a mathematical analysis of the security's average value over a predetermined time period is made. As the security's price changes, its average price moves up or down. There are five popular types of moving averages: simple (also referred to as arithmetic), exponential, triangular, variable, and weighted. Moving averages can be calculated on any data series including a security's open, high, low, close, volume, or another indicator. A moving average of another moving average is also common. The only significant difference between the various types of moving averages is the weight assigned to the most recent data. Simple moving averages apply equal weight to the prices. Exponential and weighted averages apply more weight to recent prices. Triangular averages apply more weight to prices in the middle of the time period. And variable moving averages change the weighting based on the volatility of prices. The most popular method of interpreting a moving average is to compare the relationship between a moving average of the security's price with the security's price itself. A buy signal is generated when the security's price rises above its moving average and a sell signal is generated when the security's price falls below its moving average. Figure 1: Nike _1year price chart Interpretation: Since the closing prices of NIKE in the last few days are slightly above the SMA line, there is an indication to BUY at this time. Figure 2: Nike compared to the Market _1year price chart Interpretation: A BUY signal was triggered when the market average was heading upwards. Moreover, NIKE’s stock has been hovering above the SMA line in the last few trading sessions. Figure 3: Nike compared to Puma _1year price chart Interpretation: It is an opportune time to BUY NIKE’s stock because its stock is trading above the SMA line, and its stock has not appreciated much compared to PUMA’s stock. 4-Volume Analysis: The Cumulative Volume Index ("CVI") is a market momentum indicator that shows whether money is flowing into or out of the stock market. It is calculated by subtracting the volume of declining stocks from the volume of advancing stocks, and then adding this value to a running total. The CVI and OBV (On Balance Volume) are quite similar. Many computer programs and investors incorrectly call the OBV the CVI. OBV, like the CVI, was designed to show if volume is flowing into or out of the market. But, because up-volume and down-volume are not available for individual stocks, OBV assumes that all volume is up-volume when the stock closes higher and that all volume is down-volume when the stock closes lower. The CVI does not have to make this large assumption, because it can use the actual upand down-volume for the New York Stock Exchange. One useful method of interpreting the CVI is to look at its overall trend. The CVI shows whether there has been more up-volume or down-volume and how long the current volume trend has been in place. Also, look for divergences that develop between the CVI and a market index. For example, is the market index making a new high while the CVI fails to reach new highs? If so, it is probable that the market will correct to confirm the underlying story told by the CVI. Figure 1: NIKE _1year price chart Interpretation: There was heavy trading on NIKE’s stock in the months of July and September. The volume has since decreased substantially. Place a HOLD on NIKE. Figure 2: NIKE compared to the market _1year price chart Interpretation: In figure 2, NIKE stock seems to be overbought in relation to the market index. As a contrarian, it is better to HOLD on to NIKE stock since it is a bit overvalued at this point. The volume index of NIKE is not rising in relation to the Market index. This indicates that the number of investors of the stock is decreasing. This verifies that it is not the best time to buy the stock because the demand for the stock is not strong. Place a HOLD on the stock. Figure 3: NIKE compared to PUMA _1year price chart Interpretation: The price movement of NIKE’s stock in the last six months suggests that they have underperformed in comparison to PUMA’s stock. There seems to be a strong resistance in the upward momentum of NIKE’s stock. NIKE’s volume has been quite inconsistent in the last 6 months. There was a huge spike in volume at the end of June and in the middle of September. Unless there is a substantial increase in volume, I would place a HOLD on NIKE. Conclusion of the Technical Analysis: Out of the four technical indicators, 3 have indicated a HOLD on NIKE and 1 has indicated a BUY on NIKE. Final technical analysis: Place a HOLD on NIKE. Leading Economic Indicator Analysis Gross Domestic Product (% change) 8 6 2002 4 2003 2 0 1Q 2Q 3Q 4Q Interpretation The US economy seems to be recovering from its slowdown. The 3rd Quarter GDP expanded at a 7.2% rate. Earnings Growth Rate 30 20 10 0 -10 -20 -30 2001 2002 2003 1Q 2Q 3Q 4Q Interpretation The forecast for the stock market in the next few months is good because companies have reported 7 consecutive earnings growth quarters. In third quarter of this year, companies on average reported a whopping earnings growth rate of 21.8%. Job Growth (in thousands) 200 100 0 -100 J F M A M J J A S O N D -200 -300 -400 Job Growth, 2001 Job Growth, 2002 Job Growth, 2003 -500 Interpretation Job growth in 2003 is very poor. However, there is an indication that the job market is slowly improving. Job growth is extremely important for the economy and subsequently the stock market because two thirds of the United States GDP comprised of consumers expenditure. Consumer Confidence Consumer Confidence, 2001 140 120 100 80 60 40 20 0 Consumer Confidence, 2002 J F M A M J J A S O N D Consumer Confidence, 2003 Interpretation Consumer confidence is important to the US economy because it accounts for about 66% of its economic activity. Consumer confidence in 2003 is still weak. Based on the graph above, consumer confidence will likely remain weak unless job growth improves significantly. 2 1.5 1 PPI, 2002 (% change) 0.5 0 -0.5 J F M A M J J A S O N D PPI, 2003 (% change) -1 -1.5 -2 Interpretation The PPI for 2001 and 2003 has been very low. Based on the graph above, the PPI is likely to be in the range of 0 and 1 in the near future. 0.8 0.6 0.4 CPI, 2002 (% change) 0.2 CPI, 2003 (% change) 0 -0.2 J F M A M J J A S O N D -0.4 Interpretation The CPI for 2002 and 2003 has been very low. It is projected that the CPI will remain low for the next 6 months. The Federal Reserve will not raise the interest rate if the level of inflation is low. A higher interest rate will have a negative effect on the stock market. Conclusion of economic indicator analysis: Based on the six graphs above, the US economy has showed signs of growth and the stock market might experience a mild rally due to these factors. Companies are beginning to report positive earnings, and profits continue to improve. Another positive side is the low inflation rate judging by the PPI and CPI numbers. The US economy is anticipated to improve in the coming months. Industry Analysis 10 Best Performing Industries Industry % Change One Month Packaging & Containers 14.6% Sporting Goods Stores 14.4% Semiconductor Equipment & Materials 14.3% Textile - Apparel Clothing 13.9% Processing Systems & Products 13.9% Diagnostic Substances 13.7% Jewelry Stores 13.6% Computer Based Systems 13.1% Copper 12.5% Air Services, Other 12.0% 10 Worst Performing Industries Industry % Change One Month Drugs - Generic -13.1% Sporting Activities -13.1% Drug Delivery -11.0% General Entertainment -7.8% Long Distance Carriers -6.7% REIT - Hotel/Motel -6.0% Oil & Gas Equipment & Services -5.4% Healthcare Information Services -5.3% Grocery Stores -4.9% Appliances -4.7% Conclusion of industry analysis: With the general improvement in the economy, the footwear industry is projected to benefit from the upside in the economy because people will have more disposable income to spend on non durable goods which is basically the footwear industry. RECOMMENDATION: Based on NIKE’s fundamental analysis, it is not a good to buy this stock aggressively. Based on a long term investment strategy, it is better to ACCUMULATE NIKE stock because of its potential for further growth and expansion, and also due to its cyclical nature. The technical analysis indicates that it is a good time to HOLD the stock at this point of time. I would recommend a “HOLD / ACCUMULATE” on NIKE stock.