4P: Price

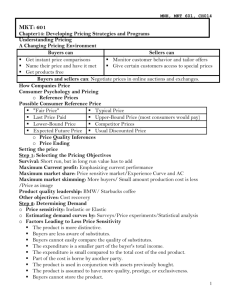

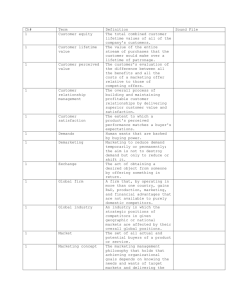

advertisement

MARKETING PRICIPLES AND CONCEPTS THE MARKETING MIX (4P) PRICE Price is all around us. You pay rent for your apartment, tuition for your education, and a fee to your physician or dentist. The airline, railway, taxi, and bus companies charge you a fare; the local utilities call their price a rate; and the local bank charges you interest for the money you borrow. The price for driving your car on Florida's Sunshine Parkway is a toll, and the company that insures your car charges you a premium. The guest lecturer charges an honorarium to tell you about a government official who took a bribe to help a shady character steal dues collected by a trade association. Clubs or societies may make a special assessment to pay unusual expenses. Your regular lawyer may ask for a retainer to cover her services. The “price” of an executive is a salary, the price of a salesperson may be a commission, and the price of a worker is a wage. Finally, although economists would disagree, many of us feel that income taxes are the price we pay for the privilege of making money. Is price the major determinant of the buyer’s choice? <discussion>. Commodity vs. exclusive good. Single product vs. product line. Old vs. new. Strong brand vs. weak. … The importance of pricing for profitability was demonstrated in a 1992 study by McKinsey & Company. Examining 2,400 companies, McKinsey concluded that a 1 percent improvement in price created an improvement in operating profit of 11.1 percent. By contrast, 1 percent improvements in variable cost, volume, and fixed cost produced profit improvements, respectively, of only 7.8 percent, 3.3 percent, and 2.3 percent. Lower price threshold may signal inferior or unacceptable quality, an upper price threshold is prohibitive and seen as not worth the money. Reference prices (which consumers may consciously evaluate). "Fair Price" (what the product should cost) Typical Price Last Price Paid Upper-Bound Price (reservation price or what most consumers would pay) Lower-Bound Price (lower threshold price or the least consumers would pay) Competitor Prices Expected Future Price Usual Discounted Price Price-quality inferences. Many consumers use price as an indicator of quality <discussion>. Scarcity —1— SETTING THE PRICE 8 price points. (e.g. automobile market). Segment Example Ultimate.......................... Rolls-Royce Gold Standard................ Mercedes-Benz Luxury ............................ Audi Special Needs................ Volvo Middle ............................ Buick Ease/Convenience ......... Ford Escort Me Too, but Cheaper ..... Hyundai Price Alone .................... Kia Consumers often rank brands according to price tiers in a category. The six-step procedure (see other sources): (1) selecting the pricing objective; (2) determining demand; (3) estimating costs; (4) analyzing competitors' costs, prices, and offers; (5) selecting a pricing method; and (6) selecting the final price. Price sensitivity <discussion> Factors leading to less price sensitivity. The product is more distinctive. Buyers are less aware of substitutes. Buyers cannot easily compare the quality of substitutes. The expenditure is a smaller part of the buyer's total income. The expenditure is small compared to the total cost of the end product. Part of the cost is borne by another party. The product is used in conjunction with assets previously bought. The product is assumed to have more quality, prestige, or exclusiveness. Buyers cannot store the product. Estimating demand curve <discussion: past experience, experiments, surveys, etc>. Price elasticity of demand. Demand is likely to be less elastic under the following conditions: (1) There are few or no substitutes or competitors; (2) buyers do not readily notice the higher price; (3) buyers are slow to change their buying habits; (4) buyers think the higher prices are justified. A McKinsey pricing study estimated that the price indifference band can range as large as 17 percent for mouthwash, 13 percent for batteries, 9 percent for small appliances, and 2 percent for certificates of deposit. Note: long-run price elasticity may differ from short-run elasticity. —2— ESTIMATING COSTS Demand sets a ceiling on the price the company can charge for its product. Costs set the floor. Total cost. Average cost (short-run and long-run). Experience curve (decreasing cost per unit with increasing [e.g. doubling] production). Activity-based cost (ABC accounting). Target costing (starting from the price, profit is subtracted and all activities are limited to the reminder cost). Adapting the price Geographical pricing. Countertrade. <Pepsi-Cola in Soviet Union offset by Russian vodka back to the US> Discounts. Cash Discount. (A price reduction to buyers who pay bills promptly. A typical example is "2/10, net 30," which means that payment is due within 30 days and that the buyer can deduct 2 percent by paying the bill within 10 days.) Quantity Discount. (A price reduction to those who buy large volumes. A typical example is "$10 per unit for less than 100 units; $9 per unit for 100 or more units."). Functional Discount. (Discount (also called trade discount) offered by a manufacturer to trade-channel members if they will perform certain functions, such as selling, storing, and recordkeeping.) Seasonal Discount. (A price reduction to those who buy merchandise or services out of season. Hotels, motels, and airlines offer seasonal discounts in slow selling periods.) Allowance. (An extra payment designed to gain reseller participation in special programs. Trade-in allowances are granted for turning in an old item when buying a new one. Promotional allowances reward dealers for participating in advertising and sales support programs.). Price discrimination. Customer-segment pricing. (Museums often charge a lower admission fee to students and senior citizens). Product-form pricing. (Different versions of the product are priced differently but not proportionately to their respective costs). Image pricing. (Some companies price the same product at two different levels based on image differences; e.g. perfumes). Channel pricing. (Coca-Cola carries a different price depending on whether it is purchased in a fine restaurant, a fast-food restaurant, or a vending machine). Location pricing. (The same product is priced differently at different locations even though the cost of offering at each location is the same. A theater varies its seat prices according to audience preferences for different locations). Time pricing. (Prices are varied by season, day, or hour. Public utilities vary energy rates to commercial users by time of day and weekend versus weekday. Restaurants charge less to "early bird" customers. Hotels charge less on weekends). —3— Price cutting traps. Low-quality trap. Consumers will assume that the quality is low. Fragile-market-share trap. A low price buys market share but not market loyalty. The same customers will shift to any lower-priced firm that comes along. Shallow-pockets trap. The higher-priced competitors may cut their prices and may have longer staying power because of deeper cash reserves. Price increase (due to cost inflation, overdemand, or else). Reactions of customers and competitors on price change. <discussion>. Basic responses to competitor’s price changes <discussion>. Maintain price. Maintain price and add value. Reduce price. Increase price and improve quality. Launch a low-price fighter line. —4—