Pricing Cards Power Point

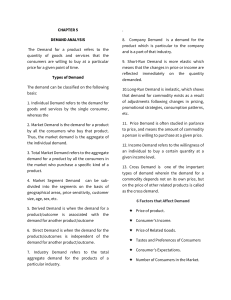

advertisement

• Critical time to price right • Be ready for “fast sale” The Wrong Price Attracts The Wrong Buyers $300,000 Property List Price $360,000 Buyers won’t look. Lookers won’t like! $300,000 buyers won’t look at houses above their ‘price range’. $360,000 buyers won’t like the house nor make an offer. Two (2) Pricing Strategies Price Right Price High - Stay firm! - Be negotiable? Which will likely sell your house - quicker? - for more money? The Risks of Over Pricing Reduces sales associate activity Minimizes advertising response Loses interested buyers Attracts the “wrong” buyers Discourages or eliminates offers Can lead to mortgage rejections Helps sell the competition Property gets a ‘reputation” (stale) Later price reductions tend to cause low or delayed offers Price reductions send the wrong messages! Aspired Price $ _______________ Acceptable Price $ _______________ Walk Away Price $ _______________ What is the highest price you could realistically hope that a prudent buyer would pay for your property? What special features or characteristics does your home have to warrant this price? While hoping for more, what price would still be acceptable? What features or characteristics of your home do you thing buyers will feel are lacking or disappointing? What is your bottom line? What price would be so unacceptable that you would ‘walk away’ from such an offer even if it meant you could not sell your property? The Absorption Rate For Sale Sold - Minimum Competition - Reasonable Demand High Absorption Rate - Extensive Competition - Minimum Demand - Slow Absorption Rate People buy by ‘comparison shopping’! The Pricing Pyramid Range of FMV Fair Market Value Width indicates the number of interested buyers. The Five (5) Fatal Mistakes Most Home Sellers Make When Pricing Their Home 1. Sellers often price their home based on “need” rather than the market. 2. Sellers use the ‘wrong’ properties for comparison when pricing. 3. Sellers build in a ‘negotiating cushion’ and then have no one with which to negotiate. 4. Sellers take advice from ‘well meaning’ but uninformed parties. 5. Sellers allow positive emotions about their property to influence their pricing decisions. Who Controls the Marketplace? Factor: Controlled by: Property Asking Price Seller Property Condition Seller Property Marketing Listing Agent/Agency Property Value Buyer The 7 Factors That Determine How Fast A Property Will Sell High Price 1. Time 2. Location 3. Condition 4. Marketing Low Price 5. Financing 6. Competition 7. Price Fast Sale Slow to Sell The Listing Price Determines Buyer Demand Price as compared to Value + 20% + 10% Market Value - 10% - 20% Percentage of buyers who will view property: 10% 30% 60% 75% 90% Percentages show relationships only, not actual statistics. CMA: Comparative Market Analysis Market Data to Help in Determining the Initial List Price Researching and Reporting: Recent Sales of Similar Properties Competing Properties On Market ‘Expireds’ & ‘Pendings’ - as available Review of Market Conditions Sale Price to List Price Ratio Buyer Tends and Priorities