Company Strategic Analysis Template

advertisement

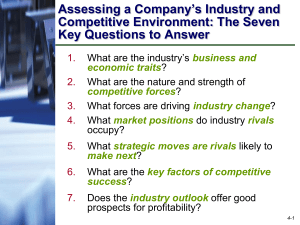

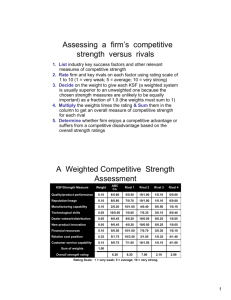

Strategic Analysis Company Name Karl Knapp 03/12/2000 Table of Contents THE STRATEGIC MANAGEMENT PROCESS ....................................................................................................3 THE FIVE TASKS OF STRATEGIC MANAGEMENT .........................................................................................................3 THE FACTORS THAT SHAPE A COMPANY’S STRATEGY ...............................................................................................4 TESTS OF A WINNING STRATEGY ................................................................................................................................4 INDUSTRY AND COMPETITIVE ANALYSIS ......................................................................................................5 QUESTION 1: WHAT ARE THE INDUSTRY’S DOMINANT ECONOMIC FEATURES? .........................................................5 QUESTION 2: WHAT IS COMPETITION LIKE AND HOW STRONG ARE EACH OF THE COMPETITIVE FORCES? ...............6 Competitive Force .................................................................................................................................................6 Analysis..................................................................................................................................................................6 QUESTION 3: WHAT ARE THE DRIVERS OF CHANGE IN THE INDUSTRY AND WHAT IMPACT WILL THEY HAVE? .......8 The Most Common Driving Forces .......................................................................................................................8 QUESTION 4: WHICH COMPANIES ARE IN THE STRONGEST/WEAKEST POSITIONS? ....................................................9 QUESTION 5: WHAT STRATEGIC MOVES ARE RIVALS LIKELY TO MAKE NEXT – OBJECTIVES AND STRATEGIES? ... 10 Evaluating Who the Industry’s Major Players Are Going to Be ......................................................................... 10 Predicting Competitors’ Next Moves ................................................................................................................... 10 QUESTION 6: WHAT ARE THE KEY FACTORS FOR COMPETITIVE SUCCESS? ............................................................. 11 QUESTION 7: IS THE INDUSTRY ATTRACTIVE AND WHAT ARE ITS PROSPECTS FOR ABOVE-AVERAGE PROFITABILITY? ....................................................................................................................................................... 12 EVALUATING COMPANY RESOURCES AND COMPETITIVE CAPABILITIES ...................................... 13 QUESTION 1: HOW WELL IS THE PRESENT STRATEGY WORKING? ........................................................................... 13 QUESTION 2: WHAT ARE THE COMPANY’S RESOURCE STRENGTHS AND WEAKNESSES AND ITS EXTERNAL OPPORTUNITIES AND THREATS? ............................................................................................................................... 14 Identifying Company Competencies and Capabilities ......................................................................................... 16 QUESTION 3: ARE THE COMPANY’S PRICES AND COSTS COMPETITIVE?................................................................... 17 Strategic Cost Analysis and Value Chains........................................................................................................... 17 Strategic Options for Achieving Cost Competitiveness ....................................................................................... 18 QUESTION 4: HOW STRONG IS THE COMPANY’S COMPETITIVE POSITION? ............................................................... 19 The Signs of Strength and Weakness in a Company’s Competitive Position ....................................................... 19 Competitive Strength Assessments ....................................................................................................................... 19 QUESTION 5: WHAT STRATEGIC ISSUES DOES THE COMPANY FACE? ...................................................................... 20 STRATEGY AND COMPETITIVE ADVANTAGE ............................................................................................. 21 THE FIVE GENERIC COMPETITIVE STRENGTHS ......................................................................................................... 21 DISTINCTIVE FEATURES OF GENERIC COMPETITIVE STRATEGIES ............................................................................. 22 EVALUATING THE STRATEGIES OF DIVERSIFIED COMPANIES............................................................ 23 STEP 1: IDENTIFYING THE PRESENT CORPORATE STRATEGY .................................................................................... 23 STEP 2: EVALUATING INDUSTRY ATTRACTIVENESS ................................................................................................. 23 STEP 3: EVALUATING THE COMPETITIVE STRENGTH OF EACH OF THE COMPANY’S BUSINESS UNITS ...................... 23 STEP 4: NINE CELL MATRIX TO SIMULTANEOUSLY PORTRAY INDUSTRY ATTRACTIVENESS & COMPETITIVE STRENGTH ................................................................................................................................................................ 24 STETP 5: STRATEGIC FIT ANALYSIS: CHECKING FOR COMPETITIVE ADVANTAGE POTENTIAL ................................. 25 STEP 6: RESOURCE FIT ANALYSIS: DETERMINING HOW WELL THE FIRM’S RESOURCES MATCH BUSINESS UNIT REQUIREMENTS ........................................................................................................................................................ 26 Checking Financial Resource Fit: Cash Hog and Cash Cow Businesses ........................................................... 26 Checking Competitive and Managerial Resource Fits ........................................................................................ 26 STEP 7: RANKING THE BUSINESS UNITS ON THE BASIS OF PAST PERFORMANCE AND FUTURE PROSPECTS .............. 27 STEP 8: DECIDING ON RESOURCE ALLOCATION PRIORITIES AND A GENERAL STRATEGIC DIRECTION FOR EACH BUSINESS UNIT......................................................................................................................................................... 27 STEP 9: CRAFTING A CORPORATE STRATEGY ........................................................................................................... 27 March 12, 2000 106752145 2 of 28 The Strategic Management Process A company’s strategy is the “game plan” management has for positioning the company in its chosen market arena, competing successfully, pleasing customers, and achieving good business performance. The Five Tasks of Strategic Management 1. Forming a strategic vision of what the company’s future business makeup will be and where the organization is headed – so as to provide long-term direction, delineate what kind of enterprise the company is trying to become, and infuse the organization with a sense of purposeful action. 2. Setting objectives – converting the strategic vision into specific performance outcomes for the company to achieve. 3. Crafting a strategy to achieve the desired outcomes. 4. Implementing and executing the chosen strategy efficiently and effectively. 5. Evaluating performance and initiating corrective adjustments in vision, long-term direction, objectives, strategy, or implementation in light of actual experience, changing conditions, new ideas, and new opportunities. Developing a Strategic Vision and Business Mission Setting Objectives Crafting a Strategy to Achieve the Objectives Implementing and Executing the Strategy Evaluating Performance , Monitoring New Developmen ts and Initiating Corrective Adjustments Revise as Needed Revise as Needed Improve/ Change as Needed Improve/ Change as Needed Recycle to 1,2,3 or 4 as Needed Collaborative partnerships and strategic alliances with others BASIC COMPETITIVE APPROACH Ÿ Low cost/Low price Ÿ Differentiation (what kind?) Ÿ Focus on a specific market niche Manufacturing & Operations TO S LE IE B G A D TE LU N A A A R V S ST LY TH L E G A V N S N TI E IE O TI R IT TI E T L C P S I N M CE AB FU CO UR AP C EY D O K UIL ES B R BUSINESS STRATEGY (The action plan for managing a single line of business.) Marketing, Promotion and Distribution R&D/Technology Moves made to respond to changing industry conditions and other emerging developments in the external environment Moves to secure a competitive advantage (accelerate R&D, improve product design, add new features, introduce new technologies, boost quality or service, outcompete rivals on the basis of superior resources and competitive capabilities) Geographic market coverage and degree of vertical integration (full, partial) Human Resources & Labor Relations Financial Approaches March 12, 2000 106752145 3 of 28 The Factors That Shape a Company’s Strategy External Factors Societal, political, regulatory, and community citizenship consideratio ns Competitive conditions and overall industry attractiveness Company opportunities and threats Conclusions concerning how internal and external factors stack up; their implications for strategy A mix of considerations that determine a company's strategic situation Company resource strengths, weaknesses, competencies and competitive capabilities Personal ambitions, business philosophy and ethical principals of key executives Identification and evaluation of strategy alternatives Crafting a strategy that fits the overall situation Shared values and company culture Internal Factors Tests of a Winning Strategy Three tests can be used to evaluate the merits of one strategy over another and to gauge how good a strategy is: 1. The Goodness of Fit Test: A good strategy is tailored to fit the company’s internal and external situation – without tight situational fit, there’s real question whether a strategy appropriately matches the requirements for market success. 2. The Competitive Advantage Test: A good strategy leads to sustainable competitive advantage. The bigger the competitive edge that a strategy helps build, the more powerful and effective it is. 3. The Performance Test: A good strategy boosts company performance. Two kinds of performance improvements are the most telling fo a strategy’s caliber: gains in profitability and gains in the company’s competitive strength and long-term market position. Strategic options that clearly come up short on one or more of these tests are candidates to be dropped from further consideration. The strategic option that best meets all three tests can be regarded as the best or most attractive strategic alternative. There are of course some additional criteria for judging the merits of a particular strategy: completeness and coverage of all the bases, internal consistency among all the pieces of strategy, clarity, the degree of risk involved, and flexibility. March 12, 2000 106752145 4 of 28 Industry and Competitive Analysis Question 1: What Are the Industry’s Dominant Economic Features? As a working definition, we use the word industry to mean a group of firms whose products have so many of the same attributes that they compete for the same buyers. The factors to consider in profiling an industry’s economic traits are: Economic Feature Strategic Importance Market size Scope of competitive rivalry (local, regional, national, international, or global) Market growth rate and where the industry is in the growth cycle (early development, rapid growth and takeoff, early maturity, mature, saturated and stagnant, declining) Number of rivals and their relative sizes – is the industry fragmented with many small companies or concentrated and dominated by a few large companies? The number of buyers and their relative sizes The prevalence of backward and forward integration The types of distribution channels used to access buyers The pace of technological change in both production process innovation and new product introductions Whether the product(s)/service(s) of rival firms are highly differentiated, weakly differentiated, or essentially identical Whether companies can realize economies of scale in purchasing, manufacturing, transportation, marketing, or advertising Whether certain industry activities are characterized by strong learning and experience effects such that unit costs decline as cumulative output (and thus the experience of “learning by doing”) grows Whether high rates of capacity utilization are crucial to achieving lowcost production efficiency Resource requirements and the ease of entry and exit Whether industry profitability is above/below par March 12, 2000 106752145 5 of 28 Question 2: What Is Competition Like and How Strong Are Each of the Competitive Forces? Competitive Force Rivalry Among Competing Sellers Analysis The strongest of the five competitive forces is usually the jockeying for position and buyer favor that goes on among rivals firms. The intensity of rivalry among competing sellers is a function of how vigorously they employ such tactics as lower prices, snazzier features, expanded customer services, longer warranties, special promotions, and new product introductions. Competitive Force of Potential Entry How serious the competitive threat of entry is in a particular market depends on two classes of factors: barriers to entry and the expected reaction of incumbent firms to new entry. The best test of whether potential entry is a strong or weak competitive forces is to ask if the industry’s growth and profit prospects are attractive enough to induce additional entry. There are several types of entry barriers: Economies of scale Inability to gain access to technology and specialized know-how The existence of learning and experience curve effects Brand preferences and customer loyalty Resource requirements Cost disadvantages independent of size - These can include access to the best and cheapest raw materials, patents and proprietary technology, the benefits of learning and experience curve effects, existing plants built and equipped years earlier at lower costs, favorable locations, and lower borrowing costs. Access to distribution channels Regulatory policies Tariffs and international trade restrictions Competitive Pressures from Substitute Products Just how strong the competitive pressures are from substitute products depends on three factors: Whether attractively priced substitutes are available How satisfactory the substitutes are in terms of quality, performance and other relevant attributes The ease with which buyers can switch to substitutes Another determinant of the strength of competition from substitutes is how difficult or costly it is for the industry’s customers to switch to a substitute. The Power of Suppliers Depends on market conditions in the supplier industry and the significance of the item they supply. Supplier-related competitive pressures tend to be minimal whenever the items supplied are standard commodities available on the open market from a large number of suppliers with ample capability. Suppliers also tend to have less leverage to bargain over price and other terms of sale when the industry they are supplying is a major customer. In such cases, the well-being of suppliers is closely tied to the well-being of their major customers. On the other hand, when the item accounts for a sizable fraction of the costs of an industry’s product, is crucial to the industry’s production process, and/or significantly affects the quality of the industry’s product, suppliers have great influence on the competitive process. Suppliers are also more powerful when they can supply a component more cheaply than industry members can make it themselves. In such situations, the bargaining position of suppliers is strong until the volume of parts a user needs becomes large enough for the user to justify backward integration into self-manufacture of the component. There are a couple of other instances in which the relationship between industry members and suppliers is a competitive force. One is when March 12, 2000 106752145 6 of 28 suppliers, for one reason or another, cannot provide items of high or consistent quality. A second is when one or more industry members form close working relationships with key suppliers in an attempt to secure lower prices, better quality or more innovative components, just-in-time deliveries, and reduced inventory and logistics costs; such benefits can translate into competitive advantage for industry members who do the best job of managing their relationships with key suppliers. The Power of Buyers Buyers have substantial bargaining leverage in a number of situations. The most obvious is when buyers are large and purchase much of the industry’s output. Typically, purchasing in large quantities gives a buyer enough leverage to obtain price concessions and other favorable terms. Retailers often have negotiating leverage in purchasing products because of manufacturers’ need for broad retain exposure and favorable shelf space. “Prestige” buyers have a degree of clout in negotiating with sellers because a seller’s reputation is enhanced by having prestige buyers on its customer list. There are other circumstances where buyers may have some degree of bargaining leverage: If buyers’ costs of switching to competing brands or substitutes are relatively low. If the number of buyers is small. If buyers are well informed about sellers’ products, prices and costs. If buyers pose a credible threat of backward integrating into the business of sellers. If buyers have discretion in whether they purchase the product. One last point: all buyers of an industry’s product are not likely to have equal degrees of bargaining power with sellers, and some may be less sensitive than others to price, quality or service. March 12, 2000 106752145 7 of 28 Question 3: What Are the Drivers of Change in the Industry and What Impact Will They Have? The most dominant forces are called driving forces because they have the biggest influence on what kinds of changes will take place in the industry’s structure and environment. Driving forces analysis has two steps: identifying what the driving forces are and assessing the impact they will have on the industry. The Most Common Driving Forces Changes in the long-term industry growth rate Changes in who buys the product and how they use it Product innovation Technological change Marketing innovation Entry or exit of major firms Diffusion of technical know-how Increasing globalization of the industry Changes in cost and efficiency Emerging buyer preferences for differentiated products instead of a commodity product (or for a more standardized product instead of strongly differentiated products). Regulatory influences and government policy changes Changing societal concerns, attitudes and lifestyles Reductions in uncertainty and business risk While many forces of change may be a work in a given industry, no more than three or four are likely to qualify as driving forces in the sense that they will act as the major determinants of why and how the industry is changing. Thus, strategic analysts must resist the temptation to label everything they see changing as driving forces; the analytical task is to evaluate the forces of industry and competitive change carefully enough to separate major factors from minor ones. March 12, 2000 106752145 8 of 28 Question 4: Which Companies Are in the Strongest/Weakest Positions? A strategic group consists of those rival firms with similar competitive approaches and positions in the market. The procedure is straightforward: 1. 2. 3. 4. Identify the characteristics that differentiate firms in the industry – typical variables are price/quality range (high, medium, low), geographic coverage (local, regional, national, global), degree of vertical integration (none, partial, full), product line breadth (wide, narrow), use of distribution channels (none, some, all), and degree of service offered (no-frills, limited, full service). Plot the firms on a two-variable map using pairs of these differentiating characteristics. Assign firms that fall in about the same strategy space to the same strategic group. Draw circles around each strategic group, making the circles proportional to the size of the group’s respective share of total industry sales revenues. Guidelines for mapping the positions of strategic groups: The two variables selected as axes for the map should not be highly correlated; if they are, the circles on the map will fall along a diagonal and strategy makers will learn nothing. The variables chosen as axes for the map should expose big differences in how rivals position themselves to compete. This means analysts must identify the characteristics that differentiate rival firms and use these differences as variables for the axes and as the basis for deciding which firm belongs in which strategic group. The variables used as axes don’t have to be either quantitative or continuos; rather, they can be discrete variables or defined in terms of distinct classes and combinations. Drawing the sizes of the circles on the map proportional to the combined sales of the firms in each strategic group allows the map to reflect the relative sizes of each strategic group. If more than two good competitive variables can be used as axes for the map, several maps can be drawn to give different exposures to the competitive positioning relationships present in the industry’s structure. High Price/Quality/Image Small Independent Guild Jewelers Medium National, Regional, and Local Guild or "Fine Jewelery" Stores (about 10,000 firms including Tiffany's and Cartier) National Jewelery Chains Carlyle & Co. Gordon's Local Jewelers (about 10,000 stores) Prestige Dept Stores Nordstro m's Upscale Dept Stores Parisian Chains JC Penney Sears Credit Jewlers Kay's Busch's Discou nters Kmart Catalog Showrooms Service Mrch Off-Price Retailers Marshall's Low Specialty Jewelers Full-line Jewlers (gold, diamonds, (gold, diamonds, watches) china and crystal, silver, watches, gifts) Limited-category Merchandise Retailers Broad-category Merchandise Retailers Product Line/Merchandise Mix March 12, 2000 106752145 9 of 28 Question 5: What Strategic Moves Are Rivals Likely to Make Next – Objectives and Strategies? Competitive Strategic Intent Market Share Competitive Strategy Competitive Scope Objective Position / Posture Strategy Situation Local Regional National Multi-country Global Be the dominant leader Overtake the present industry leader Be among the industry leaders (top 5) Move into the top 10 Move up a notch or two in the industry rankings Overtake a particular rival (not necessarily the leader) Maintain position Just survive Aggressive expansion via both acquisition and internal growth Expansion via internal growth (boost market share at the expense of rival firms) Expansion via acquisition Hold on to present share (by growing at a rate equal to the industry average) Give up share if necessary to achieve shortterm profit objectives (stress profitability, not volume) Getting stronger; on the move Well-entrenched; able to maintain its present position Stuck in the middle of the pack Going after a different market position (trying to move from a weaker to a stronger position) Struggling; losing ground Retrenching to a position that can be defended Mostly offensive Mostly defensive A combination of offense and defensive Aggressive risktaker Conservative follower Striving for low cost leadership Mostly focusing on a market niche High end Low end Geographic Buyers with special needs Other Pursuing differentiation based on Quality Service Technological superiority Breadth of product line Image and reputation Move value for the money Other attributes Evaluating Who the Industry’s Major Players Are Going to Be Major players. Predicting Competitors’ Next Moves Next moves. March 12, 2000 106752145 10 of 28 Question 6: What Are the Key Factors for Competitive Success? Key success factors concern what every industry member must be competent at doing or concentrate on achieving in order to be competitively and financially successful. The answers to three questions help identify an industry’s KSFs: On what basis do customers choose between the competing brands of sellers? What must a seller do to be competitively successful – what resources and competitive capabilities does it need? What does it take for sellers to achieve a sustainable competitive advantage? Technology Related KSFs Scientific research expertise (important in such fields as pharmaceuticals, medicine, space exploration, other “high-tech” industries. Technical capability to make innovative improvements in production processes Product innovation capability Expertise in a given technology Capability to use the Internet to disseminate information, take orders, deliver products or services Manufacturing Related KSFs Low-cost production efficiency (achieve scale economies, capture experience curve effects) Quality of manufacturer (fewer defects, less need for repairs) High utilization of fixed assets (important in capital intensive/high fixedcost industries) Low-cost plant locations Access to adequate supplies of skilled labor High labor productivity (important for items with high labor content) Low-cost product design and engineering (reduces manufacturing costs) Flexibility to manufacture a range of models and sizes/take care of custom orders Distribution Related KSFs A strong network of wholesale distributors/dealers (or electronic distribution capability via the Internet) Gaining ample space on retailer shelves Having company owned retail outlets Low distribution costs Fast delivery Marketing Related KSFs Fast, accurate technical assistance Courteous customer service Accurate filling of buyer orders (few back orders or mistakes) Breadth of product line and product selection Merchandising skills Attractive styling/packaging Customer guarantees and warranties (important in mail-order retailing, big-ticket purchases, new product intros) Clever advertising Skills Related KSFs Superior workforce talent (important in professional services like accounting and investment banking) Quality control know how Design expertise (important in fashion and apparel industries and often of the keys to low-cost manufacture) Expertise in a particular technology An ability to develop innovative products and product improvements An ability to get newly conceived products past the R&D phase and out into the market very quickly Organizational Capability Superior information systems (important in airline travel, car rental, credit card and lodging industries) Ability to respond quickly to shifting market conditions (streamlined decision making, short lead times to bring new products to market) Superior ability to employ the Internet and other aspects of electronic commerce to conduct business More experience and managerial know how Other Types of KSFs Favorable image/reputation with buyers Overall low cost (not just in manufacturing) Convenient locations (important in many retailing businesses) Pleasant, courteous employees in all customer contact positions Access to financial capital (important in newly emerging industries with high degrees of business risk and in capital-intensive industries) Patent protection March 12, 2000 106752145 11 of 28 Question 7: Is the Industry Attractive and What Are Its Prospects for Above-Average Profitability? The final step of industry and competitive analysis is to use the answers to the previous six questions to draw conclusions about the relative attractiveness or unattractiveness of the industry, both near term and long term. Important factors for company managers to consider include: The industry’s growth potential Whether competition currently permits adequate profitability and whether competitive forces will become stronger or weaker Whether industry profitability will be favorably or unfavorably impacted by the prevailing driving forces The company’s competitive position in the industry and whether its position is likely to grow stronger or weaker The company’s potential to capitalize on the vulnerabilities of weaker rivals Whether the company is insulated from, or able to defend against, the factors that make the industry unattractive How well the company’s competitive capabilities match the industry’s key success factors The degrees of risk and uncertainty in the industry’s future The severity of problems/issues confronting the industry as a whole Whether continued participation in this industry adds to the firm’s ability to be successful in other industries in which it may have interests As a general proposition, if an industry’s overall profit prospects are above average, the industry can be considered attractive. However, it is a mistake to think of industries as being attractive or unattractive to all industry participants and all potential entrants. Attractiveness is relative, not absolute, and conclusions one way or the other are in the eye of the beholder – industry attractiveness always has to be appraised from the standpoint of a particular company. An assessment that the industry is fundamentally attractive suggests that current industry participants employ strategies that strengthen their long-term competitive positions in the business, expanding sales efforts and investing in additional facilities and capabilities as needed. If the industry and competitive situation is relatively unattractive, more successful industry participants may choose to invest cautiously, look for ways to protect their long-term competitiveness and profitability, and perhaps acquire smaller firms if the price is right; over the longer term, strong companies may consider diversification into more attractive businesses. Weak companies in unattractive industries may consider merging with a rival to bolster market share and profitability or, look for diversification opportunities. March 12, 2000 106752145 12 of 28 Evaluating Company Resources and Competitive Capabilities Question 1: How Well Is the Present Strategy Working? In evaluating how well a company’s present strategy is working, a manager has to start with what the strategy is. The first thing to pin down is the company’s competitive approach – whether it is (1) striving to be a low-cost leader or stressing ways to differentiate its product offering and (2) concentrating its efforts on serving a broad spectrum of customers or a narrow market niche. Another strategy defining consideration is the firm’s competitive scope within the industry – how many stages of the industry’s production-distribution chain it operates in (one, several, or all), what its geographic market coverage is, and the size and makeup of its customer base. The company’s functional strategies in production, marketing, finance, human resources, information technology, new product innovation, and so on further characterize company strategy. The best quantitative evidence of how well a company’s strategy is working comes from studying the company’s recent strategic and financial performance and seeing what story the numbers tell about the results the strategy is producing. The two best empirical indicators of whether a company’s strategy is working well are (1) whether the company is achieving its stated financial and strategic objectives and (2) whether it is an above-average industry performer. It is nearly always feasible to evaluate the performance of a company’s strategy by looking at: Whether the firm’s market share ranking in the industry is rising, stable, or declining Whether the firm’s profit margins are increasing or decreasing and how large they are relative to rival firm’s margins Trends in the firm’s net profits, return on investment, and economic value added and how these compare to the same trends in profitability for other companies in the industry Whether the company’s overall financial strength and credit rating is improving or on the decline Trends in the company’s stock price and whether the company’s strategy is resulting in satisfactory gains in shareholder value (relative to the MVA gains of other companies in the industry) Whether the firm’s sales are growing faster or slower than the market as a whole The firm’s image and reputation with its customers Whether the company is regarded as a leader in technology, product innovation, product quality, customer service, or other relevant factor on which buyers base their choice of brands The stronger a company’s current overall performance, the less likely the need for radical changes in strategy. Weak performance is almost always a sign of weak strategy or weak execution or both. March 12, 2000 106752145 13 of 28 Question 2: What Are the Company’s Resource Strengths and Weaknesses and Its External Opportunities and Threats? Company Strengths & Resource Capabilities A strength is something a company is good at doing or a characteristic that gives it enhanced competitiveness. A strength can take any of several forms: A skill or important expertise – low-cost manufacturing knowhow, technological know-how, a proven track record in defectfree manufacture, expertise in providing consistently good customer service, skills in developing innovative products, excellent mass merchandising skills, or unique advertising and promotional know-how. Valuable physical assets – state of the art plants and equipment, attractive real estate locations, worldwide distribution facilities, natural resource deposits, or cash on hand. Valuable human assets – an experienced and capable workforce, talented employees in key areas, motivated employees, managerial know-how, or the collective learning and know-how embedded in the organization and built up over time. Valuable organizational assets – proven quality control systems, proprietary technology, key patents, mineral rights, a base of loyal customers, a strong balance sheet and credit rating, a company intranet for accessing and exchanging information both internally and with suppliers and key customers, computerassisted design and manufacturing systems, systems for conducting business on the World Wide Web, or e-mail addresses for many or most of the company’s customers. Valuable intangible assets – brand name image, company reputation, buyer goodwill, a high degree of employee loyalty, or a positive work climate and organizational culture. Competitive capabilities – short development times in bringing new products to market, build to order manufacturing capability, a strong dealer network, strong partnerships with key suppliers, an R&D organization with the ability to keep the company’s pipeline full of innovative new products, organizational agility in responding to shifting market conditions and emerging opportunities, or state of the art systems for doing business via the Internet. A achievement or attribute that puts the company in a position of market advantage – low overall costs, market share leadership, having a better product, wider product selection, stronger name recognition, or better customer service. Alliances or cooperative ventures – partnerships with others having expertise or capabilities that enhance the company’s own competitiveness. Company Weaknesses & Resource Deficiencies A weakness is something a company lacks or does poorly (in comparison to others) or a condition that puts it at a disadvantage. A company’s internal weaknesses can relate to: No clear strategic direction Obsolete facilities A weak balance sheet; burdened with too much debt Higher overall unit costs relative to key competitors Missing some key skills or competencies/lack of management depth Subpar profitability because… Plagued with internal operating problems Falling behind in R&D Too narrow a product line relative to rivals Weak brand image or reputation Weaker dealer or distribution network than key rivals Subpar marketing skills relative to rivals Short on financial resources to fund promising initiatives Lots of underutilized plant capacity Behind on product quality March 12, 2000 106752145 14 of 28 Identifying a Company’s Market Opportunities Managers can’t properly tailor strategy to the company’s situation without first identifying each company opportunity, appraising the growth and profit potential each one holds, and crafting strategic initiatives to capture the most promising of the company’s market opportunities. In appraising a company’s market opportunities and ranking their attractiveness, managers have to guard against viewing every industry opportunity as a company opportunity. Wise strategists are alert to when a company’s resource strengths and weaknesses make it better suited to pursuing some market opportunities than others. The market opportunities most relevant to a company are those that offer important avenues for profitable growth, those where a company has the most potential for competitive advantage, and those that match up well with the financial and organizational resource capabilities which the company already possesses or can acquire. Serving additional customer groups or expanding into new geographic markets or product segments Expanding the company’s product line to meet a broader range of customer needs Transferring company skills or technological know how to new products or businesses Integrating backward or forward Falling trade barriers in attractive foreign markets Openings to take market share away from rival firms Ability to grow rapidly because of strong increases in market demand Acquisition of rival firms Alliances or joint ventures that expand the firm’s market coverage and competitive capability Openings to exploit emerging new technologies Market openings to extend the company’s brand name or reputation to new geographic areas Threats to a Company’s Future Profitability Management’s job is to identify the threats to the company’s future well-being and evaluate what strategic actions can be taken to neutralize or lessen their impact. Tailoring strategy to a company’s situation entails (1) pursuing market opportunities well suited to the company’s resource capabilities and (2) building a resource base that helps defend against external threats to the company’s business. STRATEGIC MANAGEMENT PRINCIPLE: Successful strategists aim at capturing a company’s best growth opportunities and creating defenses against external threats to its competitive position and future performance. Likely entry of potent new competitors Loss of sales to substitute products Slowdowns in market growth Adverse shifts in foreign exchange rates and trade policies of foreign governments Costly new regulatory requirements Vulnerability to recession and business cycle Growing bargaining power of customers or suppliers A shift in buyer needs and tastes away from the industry’s product Adverse demographic changes Vulnerability to industry driving forces March 12, 2000 106752145 15 of 28 Identifying Company Competencies and Capabilities Core Competencies: A Valuable Company Resource A competitively important internal activity that a company performs better than other competitively important internal activities is termed a core competence. What distinguishes a core competence from a competence is that a core competence is central to a company’s competitiveness and profitability rather than peripheral. Frequently a core competence is the product of effective collaboration among different parts of the organization, of individual resources teaming together. Typically, core competencies reside in a company’s people, not in its assets on the balance sheet. They tend to be grounded in skills, knowledge and capabilities. Plainly, a core competence gives a company competitive capability and thus qualifies as a genuine company strength and resource. Distinctive Competence: A Competitively Superior Company Resource A distinctive competence is a competitively important activity that a company performs well in comparison to its competitors. Consequently, a core competence becomes a basis for competitive advantage only when it is a distinctive competence. The importance of a distinctive competence to strategy making rests with (1) the competitively valuable capability it gives a company, (2) its potential for being a cornerstone of strategy, and (3) the competitive edge it can potentially product in the marketplace. Determining the Competitive Value of a Company Resource Differences in company resources are an important reason why some companies are more profitable and more competitively successful than others. For a particular company resource – whether it be a distinctive competence, an asset (physical, human, organizational, intangible), an achievement, or a competitive capability – to qualify as the basis for sustainable competitive advantage, it must pass four tests of competitive value: 1. 2. 3. 4. Is the resource hard to copy? How long does the resource last? The longer a resource lasts, the greater its value. Is the resource really competitively superior? Can the resource be trumped by the different resource/capabilities or rivals? A company’s strategy should be tailored to fit its resource capabilities – taking both strengths and weaknesses into account. As a rule, managers should build their strategies around exploiting and leveraging company capabilities – its most valuable resources – and avoid strategies that place heavy demands on areas where the company is weakest or has unproven ability. March 12, 2000 106752145 16 of 28 Question 3: Are the Company’s Prices and Costs Competitive? One of the most telling signs of whether a company’s business position is strong or precarious is whether its prices and costs are competitive with industry rivals. Strategic Cost Analysis and Value Chains Strategic cost analysis focuses on a firm’s cost position relative to its rivals. The task of strategic cost analysis is to compare a company’s costs activity by activity against the costs of key rivals and to learn which internal activities are a source of cost advantage or disadvantage. The Concept of a Value Chain A company’s value chain shows the linked set of activities and functions it performs internally. The value chain includes a profit margin because a markup over the cost of performing the firm’s value-creating activities is customarily part of the price (or total cost) borne by buyers. Disaggregating a company’s operations into strategically relevant activities and business processes exposes the major elements of the company’s cost structure. Purchased Supplies and Inbound Logistics Purchasing fuel, energy, raw materials, parts components, merchandise, and consumable items from vendors; receiving, storing and disseminating inputs from suppliers; inspection; and inventory management Operations Distribution and Outbound Logistics Dealing with Converting inputs physically into final product distributing the form (production, product to buyers assembly, (finished goods packaging, warehousing, equipment order processing, maintenance, order picking and facilities, packing, shipping, operations, quality delivery vehicle assurance, operations, environmental establishing and protection). maintaining a network of dealers and distributors. Sales and Marketing Service Profit Margin Related to sales force efforts, advertising and promotion, market research and planning, and dealer/distributor support. Providing assistance to buyers, such as installation, spare parts delivery, maintenance and repair, technical assistance, buyer inquiries, and complaints. Product R&D, Technology, and Systems Development Product R&D, process R&D, process design improvement, equipment design, computer software development, telecommunications systems, computer-assisted design and engineering, new database capabilities, and development computerized support systems. Human Resources Management The recruitment, hiring, training, development and compensation of all types of personnel; labor relations activities; development of knowledge based skills and core competencies. General Administration General management, accounting and finance, legal and regulatory affairs, safety and security, management informaiton systems, forming strategic alliances and collaborating with strategic partners, and other "overhead" functions. Accurately assessing a company’s competitiveness in end-use markets requires that company managers understand the entire value chain system for delivering a product or service to end-users, not just the company’s own value chain. Anything a company can do to reduce its suppliers’ costs or improve suppliers’ effectiveness can enhance its own competitiveness – a powerful reason for working collaboratively with suppliers. The Value Chain System Upstream Value Chains Company Value Chain Downstream Value Chains Buyer/End User Value Chains Activities, Costs and Margins of Suppliers Internally Performed Activities, Costs, and Margins Activities, Costs, and Margins of Forward Channel Allies and Strategic Partners Buyers and End Users March 12, 2000 106752145 17 of 28 Strategic Options for Achieving Cost Competitiveness When a firm’s cost disadvantage stems from the costs of items purchased from suppliers (the upstream end of the industry chain), company managers can take any of several strategic steps: Negotiate more favorable prices with suppliers Work with suppliers to help them achieve lower costs Integrate backward to gain control over the costs of purchased items Try to use lower-priced substitute inputs Do a better job of managing the linkages between suppliers’ value chains and the company’s own chain Try to make up the difference by cutting costs elsewhere in the chain A company’s strategic options for eliminating cost disadvantages in the forward end of the value chain system include: Pushing distributors and other forward channel allies to reduce their markups Working closely with forward channel allies/customers to identify win-win opportunities to reduce costs. Changing to a more economical distribution strategy, including forward integration Trying to make up the difference by cutting costs earlier in the cost chain When the source of a firm’s cost disadvantage is internal, managers can use any of nine strategic approaches to restore cost parity: Streamline the operation of high cost activities Reengineer business processes and work practices Eliminate some cost producing activities altogether by revamping the value chain system Relocate high cost activities to geographic areas where they can be performed more cheaply See if certain activities can be outsourced from vendors or performed by contractors more cheaply than they can be done internally Invest in cost saving technological improvements Innovate around the troublesome cost components as new investments are made in plant and equipment Simplify the product design so that it can be manufactured more economically Make up the internal cost disadvantage though savings in the backward and forward portions of the value chain system March 12, 2000 106752145 18 of 28 Question 4: How Strong Is the Company’s Competitive Position? The Signs of Strength and Weakness in a Company’s Competitive Position Signs of Competitive Strength Signs of Competitive Weakness Important resource strengths, core competencies, and competitive capabilities A distinctive competence in a competitively important value chain activity Strong market share A pace setting or distinctive strategy Growing customer base and customer loyalty Above average market visibility In a favorably situated strategic group Well positioned in attractive market segments Strongly differentiated products Cost advantages Above average profit margins Above average technological and innovational capability A creative, entrepreneurially alert management In position to capitalize on emerging market opportunities Confronted with competitive disadvantages Losing ground to rival firms Below average growth in revenues Short on financial resources A slipping reputation with customers Trailing in product development and product innovation capability In a strategic group destined to lose ground Weak in areas where there is the most market potential A higher cost producer Too small to be a major factor in the marketplace Not in good position to deal with emerging threats Weak product quality Lacking skills, resources, and competitive capabilities in key areas Weaker distribution capability than rivals Competitive Strength Assessments Key Success Factor KSF 1 KSF 1 KSF 1 KSF 1 KSF 1 KSF 1 KSF 1 Total March 12, 2000 Weight Company Rival 1 Rival 2 Rival 3 30% 20% 10% 10% 10% 10% 10% 100% Score Score Score Score Score Score Score Total Score Score Score Score Score Score Score Total Score Score Score Score Score Score Score Total Score Score Score Score Score Score Score Total 106752145 19 of 28 Question 5: What Strategic Issues Does the Company Face? The final analytical task is to zero in on the issues management needs to address in forming an effective strategic action plan. Consider the following: Does the present strategy offer attractive defenses against the five competitive forces – particularly those that are expected to intensify in strength? Should the present strategy be adjusted to better respond to the driving forces at work in the industry? Is the present strategy closely matched to the industry’s future key success factors? Does the present strategy adequately capitalize on the company’s resource strengths? Which of the company’s opportunities merit top priority? Which should be given lowest priority? Which are best suited to the company’s resource strengths and capabilities? What does the company need to do to correct its resource weaknesses and to protect against external threats? To what extent is the company vulnerable to the competitive efforts of one or more rivals and what can be done to reduce this vulnerability? Does the company possess competitive advantage or must it work to offset competitive disadvantage? Where are the strong spots and weak spots in the present strategy? March 12, 2000 106752145 20 of 28 Strategy and Competitive Advantage The Five Generic Competitive Strengths When one strips away the details to get at the real substance the biggest and most important differences among competitive strategies boil down to (1) whether a company’s market target is broad or narrow and (2) whether it is pursuing a competitive advantage linked to low costs or product differentiation. Five distinct approaches stand out: 1. A low-cost leadership strategy – Appealing to a broad spectrum of customers based on being the overall low cost provider of a product or service. 2. A broad differentiation strategy – Seeking to differentiate the company’s product offering from rivals’ in ways that will appeal to a broad spectrum of buyers. 3. A best-cost provider strategy – Giving customers more value for the money by combining an emphasis on low cost with an emphasis on upscale differentiation; the target is to have the best (lowest) costs and prices relative to producers of products with comparable quality and features. 4. A focused or market niche strategy based on lower cost – Concentrating on a narrow buyer segment and outcompeting rivals by serving niche members at a lower cost than rivals. 5. A focused or market niche strategy based on differentiation – Concentrating on a narrow buyer segment and outcompeting rivals by offering niche members a customized product or service that meets their tastes and requirements better than rivals’ offering. Type of Competitive Advantage Being Pursued March 12, 2000 A Broad CrossSection of Buyers A Narrow Buyer Segment Market Target Lower Cost Differentiation Overall Low-Cost Broad Leadership Differentiation Strategy Strategy Best-Cost Provider Strategy Focused Focused LowDifferentiation Cost Strategy Strategy 106752145 21 of 28 Distinctive Features of Generic Competitive Strategies Type of Feature Low-Cost Leadership Broad Differentiation Best-Cost Provider Focused Low-Cost and Focused Differentiation Strategic Target A broad cross section of the market A broad cross section of the market Value-conscious buyers A narrow market niche where buyer needs and preferences are distinctively different from the rest of the market Basis of Competitive Advantage Lower costs than competitors An ability to offer buyers something different from competitors Give customers more value for the money Lower cost in serving the niche (focused low cost) or an ability to offer nich buyers something customized to their requirements and tastes (focused differentiation) Product Line A good basic product with few frills (acceptable quality and limited selection) Many product variations, wide selection, strong emphasis on the chosen differentiating features Good to excellent attributes, several to many upscale features Customized to fit the specialized needs of the target segment Production Emphasis A continuous search for cost reduction without sacrificing acceptable quality and essential features Invent ways to create values for buyers; strive for product superiority Incorporate upscale features and attributes at low cost Tailor-made for the niche Marketing Emphasis Try to make a virtue out of product features that lead to low cost Build in whatever features buyers are willing to pay for Underprice rival brands with comparable features Communicate the focuser’s unique ability to satisfy the buyer’s specialized requirements Economical prices/good value. Communicate the points of difference in credible ways Unique expertise in managing costs down and product/service caliber up simultaneously Remain totally dedicated to serving the niche better than other competitors; don’t blunt the firm’s image and efforts by entering segments with substantially different buyer requirements or adding other product categories to widen market appeal Sustaining the Strategy All elements of strategy aim at contributing to a sustainable cost advantage – the key is to manage costs down, year after year, in every area of the business March 12, 2000 Charge a premium price to cover the extra costs of differentiating features Stress consistent improvement and innovation to stay ahead of imitative competitors Concentrate on a few key differentiating features; tout them to create a reputation and brand image 106752145 22 of 28 Evaluating the Strategies of Diversified Companies Step 1: Identifying the Present Corporate Strategy One can get a good handle on a diversified company’s corporate strategy by looking at: The extent to which the firm is diversified (as measured by the proportion of total sales and operating profits contributed by each business unit and by whether the diversification base is broad or narrow). Whether the firm is pursuing related or unrelated diversification, or a mixture of both. Whether the scope of the company operations is mostly domestic, increasingly multinational, or global. Any moves to add new businesses to the portfolio and build positions in new industries. Any moves to divest weak or unattractive business units. Recent moves to boost performance of key business units and/or strengthen existing business positions. Management efforts to capture strategic fit benefits and use value chain relationships among its businesses to create competitive advantage. The percentage of total capital expenditures allocated to each business unit in prior years (a strong indicator of the company’s resource allocation priorities). Step 2: Evaluating Industry Attractiveness Industry Attractiveness Factor Weight Rating Weighted Rating Market size and projected growth rate .15 5 0.75 Intensity of competition .30 8 2.40 Emerging industry opportunities and threats .05 2 0.10 Resource requirements .10 6 0.60 Strategic fit with other company businesses .15 4 0.60 Social, political, regulatory and environmental factors .05 7 0.35 Industry Profitability .10 4 0.40 Degree of Risk .10 5 0.50 Industry Attractiveness Rating 1.00 5.70 Step 3: Evaluating the Competitive Strength of Each of the Company’s Business Units Competitive Strength Factor Weight Rating Weighted Rating Relative market share (the ratio of its market share to the market share of the largest rival in the industry, with market share measured in unit volume, not dollars) .15 5 0.75 Costs relative to competitors .30 8 2.40 Ability to match or beat rivals on key product attributes (quality/service) .05 2 0.10 Bargaining leverage with buyers/suppliers .10 6 0.60 Technology and innovation capabilities .15 4 0.60 How well resources are matched to industry key success factors .05 7 0.35 Brand name reputation/image .10 4 0.40 Profitability relative to competitors .10 5 0.50 Competitive Strength Rating March 12, 2000 1.00 106752145 5.70 23 of 28 Step 4: Nine cell Matrix to Simultaneously Portray Industry Attractiveness & Competitive Strength Competitive Strength/ Business Position Weak Medium High Average Low Long-Term Industry Attractiveness Strong High investment priority Medium investment priority Low investment priority March 12, 2000 106752145 24 of 28 Stetp 5: Strategic Fit Analysis: Checking for Competitive Advantage Potential One essential part of evaluating a diversified company’s strategy is to check its business portfolio for competitively valuable value chain matchups among the company’s existing businesses: Which business units have value chain matchups that offer opportunities to combine the performance of related activities and thereby reduce costs? Which business units have value chain matchups that offer opportunities to transfer skills or technology from one business to another? Which business units offer opportunities to use a common brand name? To gain greater leverage with distributors/dealers in winning more favorable shelf space for the company’s products? Which business units have value chain matchups that offer opportunities to create valuable new competitive capabilities or to leverage existing resources? Value Chain Activities Purchased Materials & Inbound Logistics Technology Operations Sales and Marketing Distribution Service Business A Business B Business C Business D Business E Opportunities to combine purchasing activities and gain greater leverage with suppliers Opportunities to share technology, transfer technical skills, combine R&D Opportunities to combine/share sales and marketing activities, utilize common distribution channels, leverage use of a common brand name, and/or combine after sale service activities No strategic fit opportunities A second aspect of strategic fit that bears checking out is whether any businesses in the portfolio do not fit in well with the company’s overall long term direction and strategic vision. In such instances, the business probably needs to be considered for divestiture even though it may be making a positive contribution to company profits and cash flows. The only reasons to retain such businesses are if they are unusually good financial performers or offer superior growth opportunities – that is to say, if they are valuable financially even thought they are not valuable strategically. March 12, 2000 106752145 25 of 28 Step 6: Resource Fit Analysis: Determining How Well the Firm’s Resources Match Business Unit Requirements Checking Financial Resource Fit: Cash Hog and Cash Cow Businesses A “cash hog” business is one whose internal cash flows are inadequate to fully fund its needs for working capital and new capital investment. A “cash cow” business is a valuable part of a diversified company’s business portfolio because it generates cash for financing new acquisitions, funding the capital requirements of cash hog businesses, and paying dividends. Viewing a diversified group of businesses as a collection of cash flows and cash requirements (present and future) is a major step forward in understanding the financial aspects of corporate strategy. Assessing the cash requirements of different businesses in a company’s portfolio and determining with are cash hogs and which are cash cows highlights opportunities for shifting corporate financial resources between business subsidiaries to optimize the performance of the whole corporate portfolio, explains why priorities for corporate resource allocation can differ from business to business, and provides good rationalizations for both invest-and-expand strategies and divestiture. Aside from cash flow considerations, a business has good financial fit when it contributes to the achievement of corporate performance objectives and when it enhances shareholder value. A business exhibits poor financial fit if it soaks up a disproportionate share of the company’s financial resources, if it is a subpar or inconsistent bottom-line contributor, if it is unduly risky and failure would jeopardize the entire enterprise, of if it is too small to make a material earnings contribution even though it performs well. In addition, a diversified company’s business portfolio lacks financial fit if its financial resources are stretched too thinly across too many businesses. Checking Competitive and Managerial Resource Fits A diversified company’s strategy must aim at producing a good fit between its resource capability and the competitive and managerial requirements of its businesses. Checking a diversified company’s business portfolio for competitive and managerial resource fits involves the following: Determining whether: Determining whether the company’s resource strengths (skills, technological expertise, competitive capabilities) are well matched to the key success factors of the businesses it has diversified into. Determining whether the company has adequate managerial depth and expertise to cope with the assortment of managerial and operating problems posed by its present lineup of businesses (plus those it may be contemplating getting into). Determining whether competitive capabilities in one or more businesses can be transferred them to other businesses. Determining whether the company needs to invest in upgrading its resources or capabilities to stay ahead of (or at least abreast of) the effort of rivals to upgrade their resource base. Upgrading resources and competencies often means going beyond just strengthening what the company already is capable of doing – it may involve adding new resource capabilities, building competencies that allow the company to enter another attractive industry, or widening the company’s range of capabilities to match certain competitively valuable capabilities of rivals. Many diversification strategies built around transferring resource capabilities to new businesses never live up to their promise because the transfer process is not as easy as it might seem. A second reason for the failure of a diversification move into a new business with seemingly good resource fit is that the causes of a firm’s success in one business are sometimes quite entangled and the means of recreating them hard to replicate. A third reason for diversification failure, despite apparent resource fit, is misjudging the difficulty of overcoming the resource strengths and capabilities of rivals it will have to face in a new business. March 12, 2000 106752145 26 of 28 Step 7: Ranking the Business Units on the Basis of Past Performance and Future Prospects Once a diversified company’s businesses have been rated on the basis of industry attractiveness, competitive strength, strategic fit, and resource fit, the next step is to evaluate which businesses have the best performance prospects and which the worst. The most important consideration are sales growth, profit growth, contribution to company earnings, and the return on capital invested in the business. Sometimes cash flow generation is a big consideration, especially for cash cow businesses and businesses with potential for harvesting. Step 8: Deciding on Resource Allocation Priorities and a General Strategic Direction for Each Business Unit Using the information and results of the preceding evaluation steps, corporate strategists can decide what the priorities should be for allocating resources to the various business units and settle on a general strategic direction for each business unit. The task here is to draw some conclusions about which business units should have top priority for corporate resource support and new capital investment and which should carry the lowest priority. In doing the ranking, special attention needs to be given to whether and how corporate resources and capabilities can be used to enhance the competitiveness of particular business units. Ranking the businesses from highest to lowest priority process should also clarify management thinking about what the basic strategic approach for each business unit should be – invest and grow (aggressive expansion), fortify-and-defend (protect current position by strengthening and adding resource capabilities in needed areas), overhaul-and-reposition (make major competitive strategy changes to move the business into a different and ultimately stronger industry position), or harvest-divest. Step 9: Crafting a Corporate Strategy Key considerations here are: Does the company have enough businesses in very attractive industries? Is the proportion of mature or declining businesses so great that corporate growth will be sluggish? Are the company’s businesses overly vunerable to seasonal or recessionary influences? Is the firm burdened with too many businesses in average to weak competitive positions? Is there ample strategic fit among the company’s business units? Does the portfolio contain businesses that the company really doesn’t need to be in? Is there ample resource fit among the company’s business units? Does the firm have enough cash cows to finance cash hog businesses with potential to be star performers? Can the company’s principal or core businesses be counted on to generate dependable profits and/or cash flow? Does the makeup of the business portfolio put the company in good position for the future? March 12, 2000 106752145 27 of 28 The Performance Test A good test of the strategic and financial attractiveness of a diversified firm’s business portfolio is whether the company can attain its performance objectives with its current lineup of businesses and resource capabilities. If so, no major corporate strategy changes are indicated. However, if a performance shortfall is probable, corporate strategists can take any of several actions to close the gap: 1. 2. 3. 4. 5. 6. Alter the strategic plans for some (or all) of the businesses in the portfolio. Add new business units to the corporate portfolio. Divest weak performing or money losing businesses. Form strategic alliances and collaborative partnerships to try to alter conditions responsible for subpar performance potentials. Upgrade the company’s resource base. Lower corporate performance objectives. Identifying Additional Diversification Opportunities One of the major corporate strategy making concerns in a diversified company is whether to diversify further and, if so, how to identify the “right” kinds of industries and businesses to get into. With a related diversification strategy, however, the search for new industries to diversify into is aimed at identifying other businesses: Whose value chains have fits with the value chains of one or more businesses in the company’s business portfolio Whose resource requirements are well matched to the firm’s corporate resource capabilities. March 12, 2000 106752145 28 of 28