Managerial Economics Simulation

advertisement

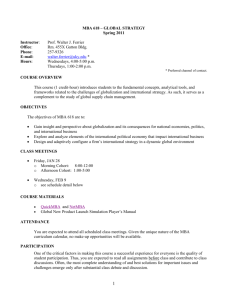

Managerial Economics Simulation (http://asdsim.buz.net/EN_LoginManecSim.html) In this simulation your group will manage a simulated firm in which the main decisions are related to pricing and setting of promotional and customer service expenditures for three products. Each product has different cost structures which allows for the treatment of operating leverage. In addition to making decisions, your group must forecast sales at the market and firm levels. Your group will be developing your operations in a competitive environment. The demand of each product manufactured by the firm is subject to macroeconomics variables, besides the demand variables under firm control (price, promotion, and customer service). I will be receiving a summary report of each firm. This simulation, besides giving you the opportunity to observe the interrelationship between marketing and production will allow you to experience competition in three different markets and with three different sets of elasticities (price, income, promotion, etc.). Throughout the twelve week simulation market conditions may change. For instance, a supply shock may cause input prices to dramatically rise or conditions that cause a price war may appear. Make sure to pay close attention to the market as well as your competitors. You will be grouped in teams of four or five members (twelve teams total). The simulation will last ten weeks with each week simulating three months of operations. A manual and weekly instructions are provided in Web site. After each round of decisions reports and financial statements in Excel format will be made available. Each week you will choose a firm manager. This manager will be responsible for making the changes (decided by all) for the team that week. They will also be responsible for writing a reflective 500 word memo describing: 1. The decisions that were made 2. Why those decisions were made 3. The conditions of the market 4. The outcome of the decisions to the firm. 5. Whether or not a different decision could have been beneficial and why This memo will be written by one firm member, but will be shared as one grade for the ENTIRE firm. Thus, all members should contribute to the editing and reviewing of the memos before the memo is turned in. Reflective memos will be due at the beginning of class on WEDNESDAY following the decision week. Only hardcopies of the memo will be accepted. For each class session that the memo is late the final grade of the memo will be reduced by 10%. At the end of the simulation the group will be responsible for writing an ANNUAL REPORT for their firm. This report will include all of the information presented in the weekly reflective essays. Graphs and charts should be used to show the progress that your firm made throughout the 30 months in business. Information about your competitors can be included to help support positive or negative events that your firm experienced. This annual report should be presented in a professional format and written for those both with and without economic knowledge. It should be written using 12 pt Times New Roman format, 1 inch margins, and MLA paper formatting. Final papers should not exceed 10 pages in length. Final papers will be due on Wednesday April 25th at the beginning of class. For each class session that the annual report is late the final grade of the memo will be reduced by 10%. Semester assignment of firms: 11:00 Class 1:30 Class Brundage, Matthew Kelley, Terrence Dorflinger, Ariel Stolle, William Baumeister, Jordan Hoffman, Morgan Scheinfield, Robert Govern, Matthew Stratton, Melissa George, Anthony Price, Daniel Hampson, Brian Gallagher, Katherine Im, Joo Yamazaki, Daisuke Martingano, Francis Hirose, Nozomu Park, So Ra Deegan, Elizabeth Sakowski, Leah Montefiore, Paul Turnbach, Heather Gilbert, Britiany Downs, Daryl Sullivan-Rivera, Steven D'Arcangelo, Rocco Manton, Christina Hanby, Brett George, John Rembert, Eric Merrill, Melissa Harley, Jacqueline Pierce, Robin Young, Dustin Kargman, David McShane, Ann Tyrrell, Gregory Conant, Brian Smith, Walter Suzuki, Issei Coellner, Danielle Kabacinski, Adam Haag, Hillary Borden, Weston Jones, Douglas Shaw, Daniel Maguire, Robert