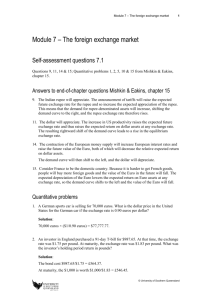

Quantitative Problems Chapter 13

advertisement

Quantitative Problems Chapter 13 1. A German sports car is selling for 70,000 Euros. What is the dollar price in the U.S. for the German car if the exchange rate is 0.90 euros per dollar? Solution: 70,000 Euros ($1/0.90 euros) $77,777.77 2. An investor in England purchased a 91-day T-bill for $987.65. At that time, the exchange rate was $1.75 per pound. At maturity, the exchange rate was $1.83 per pound. What was the investor’s holding period return in pounds? Solution: The bond cost $987.65/$1.75 £564.37. At maturity, the $1,000 is worth $1,000/$1.83 £546.45. The holding period return is (546.45 564.37)/564.37 0.0317. 3. An investor in Canada purchased 100 shares of IBM on January 1st at $93.00/share. IBM paid an annual dividend of $0.72 on December 31st. The stock was sold that day as well for $100.25. The exchange rate is $0.68/Canadian dollar on January 1st and $0.71/Canadian dollar on December 31st. What is the investor’s total return in Canadian dollars? Solution: The price of each share is $93.00/$0.68 136.76 Canadian dollars. The dividend is $0.72/$0.71 1.014 Canadian dollars The sale price is $100.25/$0.71 141.20 Canadian dollars The return (141.20 1.014 136.76)/136.76 0.03988 4. The current exchange rate is 0.93 euros per dollar, but you believe the dollar will decline to 0.85 euros per dollar. If a euro-denominated bond is yielding 2%, what return do you expect in U.S. dollars? Solution: % change in currency (0.85 – 0.93)/0.93 0.086 Total investment return 0.02 (0.086) 10.6% 5. The 6-month forward rate between the British pound and the U.S. dollar is $1.75 per pound. If 6-month rates are 3% in the U.S. and 150 basis points higher in England, what is the current exchange rate? Solution: Spot rate 1.75 (1.045/1.03) $1.775/£ 6. If the Canadian dollar to U.S. dollar exchange rate is 1.28 and the British pound to U.S. dollar exchange rate is 0.62, what must the Canadian dollar to British pound exchange rate be? Solution: Spot rate 1.28 (1/0.62) 2.0645 Canadian dollars/pound 7. The New Zealand dollar to U.S. dollar exchange rate is 1.36 and the British pound to U.S. dollar exchange rate is 0.62. If you find that the British pound to New Zealand dollar is trading at 0.49, what would you do to earn a riskless profit? Solution: Complete the following transactions simultaneously: (1) Exchange $1.00 into 1.36 New Zealand dollars. (2) Exchange the 1.36 New Zealand dollars into 0.6664 British pounds. (3) Exchange the 0.6664 British pounds into $1.0748. This yields a riskless $0.0748. 8. In 1999, the euro was trading at $0.90 per euro. If the euro is now trading at $1.16 per euro, what is the percentage change in the euro’s value? Is this an appreciation or depreciation? Solution: % Change (1.16 – 0.90)/0.90 28.88% The dollar has appreciated by 28.88% 9. The Brazilian real is trading at 0.375 real per U.S. dollar. What is the U.S. dollar per real exchange rate? Solution: Rate 1/0.375 $2.67/real. 10. The Mexican peso is trading at 10 pesos per dollar. If the expected U.S. Inflation rate is 2% while the Mexican inflation rate is 23% over the next year, what is the expected exchange rate in one year? Solution: Expected rate 10 (1.23/1.02) 12.059 pesos per dollar. 11. The current exchange rate between the U.S. and Britan is $1.825 per pound. The 6-month forward rate between the British pound and the U.S. dollar is $1.79 per pound. What is the percentage difference between current 6-month U.S. and British interest rates? Solution: % difference 1.79/1.825 1 So, if current U.S. rates are 5%, the rates in England are 0.05 0.019 0.069 6.9% 12. The current exchange rate between the Japanese yen and the U.S. dollar is ¥120 per dollar. If the dollar is expected to depreciate by 10% relative to the yen, what is the new expected exchange rate? Solution: (X 120)/120 0.10, so X 108 yen per dollar. 13. If the price level recently increased by 20% in England while falling by 5% in the U.S., how much must the exchange rate change if PPP holds? Assume that the current exchange rate is 0.55 pounds per dollar. £0.55/$ 25% £0.1375/$, or £0.6875/$ 14. A one-year CD in Europe is currently paying 5%, and the exchange rate is currently 0.99 euros per dollar. If you believe the exchange rate will be 1.04 euros per dollar one year from now, what is the expected return in terms of dollars? Solution: Expected return 0.05 ((1.04 0.99)/0.99) 5% 5.05% 0.05% 15. Short-term rates are 2% in Japan and 4% in the U.S. The current exchange rates is 120 yen per dollar. What is the expected forward exchange rate? Solution: 0.04 0.02 – (X 120)/120 X 117.6