General Conditions and Specifications

advertisement

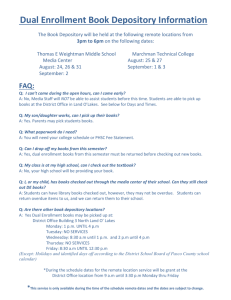

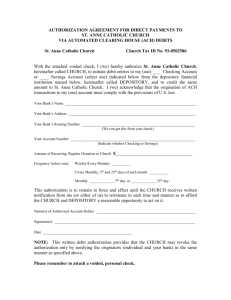

Bath County Board Of Education 405 WEST MAIN STREET OWINGSVILLE, KY 40360 Request for Proposal Primary Depository Closing Time to Receive Proposals: 2:00 p.m., Friday, February 28, 2014 General Conditions and Specifications TERM OF AGREEMENT– The intent of this invitation is to receive proposals from any financial institution (“bank”) to serve as a primary depository (“Depository”) for the Bath County Board of Education (“Board”). The initial term of the agreement shall be from July 1, 2014 to June 30, 2016, and may include subsequent extension periods of one (1) year at a time. This contract may be renewed without the requirement to bid, quote, or request a proposal. The Board will officially appoint one (1) primary depository. Secondary depositories may be used for the additional purposes as approved by the board. 2. ACCEPTABLE BANKS – The Board hereby limits the banks that are acceptable for submitting a proposal to commercial banks or savings and loan associations that have an office in Bath County, Kentucky or will provide courier service to the out of county location. 3. REQUEST FOR PROPOSAL—This is a request for proposal (RFP) rather than a bid since it is for professional services. Please consider all statements as such. Proposals from banks shall be submitted in writing in a sealed envelope clearly marked “Depository Proposal” on or before 2;00 p.m. Friday, February 28, 2014. All banks wishing to make a proposal are required to respond to the associated cover letter and to submit a signed copy of these General Conditions and Specifications. 4. OPENING OF PROPOSALS—A representative of the bank may be present at the opening of the proposals on the date, time, and location stated above, although this is not required. The Board reserves the right to negotiate any or all of the terms of the proposals that are submitted. 6. PROPOSAL ISSUES—The Board reserves the right to waive defects and informalities in any proposal, to reject any or all proposals, or to accept any proposal as may be deemed to be in its best interest. All proposals shall be effective from the date of opening for a period of sixty (60) days, and no proposal may be withdrawn prior to that time. 7. SIGNATURE— An officer of the proposing bank, authorized to legally bind the bank, must sign the proposal as well as a copy of these General Conditions and Specifications. 8. UNIVERSALITY OF ACCOUNTS—The terms and conditions of any proposal must cover all current accounts, all future accounts, and all accounts at each of our seven schools. 9. INVESTMENTS—The Board reserves the right to negotiate the terms of investments, and is not limited to investing with the Depository. 10. OPTIONS—The Board reserves the right to use any or all investment vehicles offered by the Depository that the Board, in its discretion, deems to be the most advantageous to the Board. The Depository agrees to negotiate with the Board to permit the Board to take advantage of any new type of service or new investment procedure that may become available and permissible for use by the Board during the term of this agreement. 1. 1 of 4 11. BORROWING— The Depository will be expected to extend short-term credit as needed on legally drawn notes of the Board for amounts not in excess of the Board’s legal borrowing limit at a rate of interest determined by market conditions. The Board reserves the right to negotiate the terms for such borrowings, and is not limited to borrowing funds from the Depository. The Board did not borrow short-term funds during the last fiscal year and does not expect, nor have plans, to borrow short-term funds in the foreseeable future. 12. CREDIT CARDS / PROCUREMENT CARDS— If requested by a representative of the Board, the Depository must issue credit cards to be used for Board purposes. The credit limit for such cards shall be established at a mutually agreeable amount. There shall be no fee for these cards. 13. STATEMENTS—Monthly statements of all accounts are to be furnished to the Board by the Depository by no later than the third day following the close of each month. The statement period shall be the 1st of each month to the last day of each month. Monthly statements must include such information as the number of deposits and withdrawals in numerical order, copies of all deposit transactions and canceled checks, monthly and year-to-date interest earned, average daily ledger balance, average daily float, cancelled check numbers with any gaps in sequence clearly denoted, and average daily collected balance. 14. CHECKS/SUPPLIES—The Depository is responsible for providing, at no charge to the Board or schools, all reasonable items needed to transact banking business. These items include, but are not limited to, deposit tickets, rolled coin wrappers, bank bags, and checks. 15. TRANSMITTALS—The Depository shall be capable of accepting an electronic data transmission of direct deposit credits made to the Federal Reserve and all other banking institutions. The Depository shall provide the Board with software needed to accomplish the electronic data transmission. This software shall be compatible with the Board’s software and shall permit verification of accuracy of account information. 16. ELECTRONIC BANKING—The depository shall provide free software necessary to allow the district balance reporting, account reconciliation, ACH origination, wire transfers, stop payments, account transfers, and check copies (live banking data). Software should be able to retrieve all activity of the Board’s accounts each business day. 17. DIRECT DEPOSIT—Direct deposit of employee payroll is mandated by the Bath County Board of Education. The Depository shall provide electronic transmissions of direct deposit credits and debits free of charge to the Board. Such transmission capability must be compatible with the Board’s software, known as the Munis Financial System, which generates the data. 18. SWEEP ACCOUNTS—Sweep accounts and associated zero-balance accounts shall be available to the Board at no charge for those accounts it so chooses. 19. COLLECTION OF RETURNED CHECKS—The Depository shall provide assistance to the Board in collecting bad checks by processing the checks a second time after an appropriate waiting period. 20. SERVICE CHARGES—This Depository shall not impose any charges for servicing any and all accounts of the Board or for any other reasonable banking service such as stop payments, cashier’s checks, overdraft charges, interim bank statements, checks returned for insufficient funds, electronic transfers, wire transfers, etc 21. TRAINING—The Depository shall provide training for the Board’s staff in the use of bank products and services. Training should also be available on a remedial basis or in the event of staff turnover. 2 of 4 22. AUDIT ASSISTANCE—The Depository shall provide assistance and cooperation with the district’s auditing firm. 23. EMPLOYEE BANKING PRIVILEGES—The Depository shall implement a “work place banking” policy for the employees of the Board that open accounts at the Depository and are paid by direct deposit. Amenities should include, for example, free checking accounts, reduced fee or free traveler’s checks, cashier checks, money orders, enhanced investment rates, discounted lending rates, free standard checks and ATM or debit cards. 24. SERVICE QUALITY—The Depository is expected to maintain its service level at a high quality. The Board reserves the right to terminate the depository relationship for service issues that are not properly addressed by the Bank. 25. DEPOSITORY BOND—The Depository must be able to provide a depository bond in a size and manner to comply with KRS 160.570 and 702 KAR 3:090, copies of which are attached. If the depository bond is provided by way of a collateral bond, then the Depository must execute the attached Form 2200. The penal sum of the depository bond is calculated by one of the two methods per the Kentucky Department of Education Bond of Depository Instructions, copy attached. Also attached is a spreadsheet showing the average ledger balance for calendar year 2013 for the Board’s current accounts. 26. TRANSITION— In the event the it is not designated by the Board as its primary depository at some point in the future, the Depository shall continue to honor the terms of this agreement (including the interest rate paid and the waiving of any service charges) on any accounts at that bank until all outstanding checks have cleared the bank. In addition, the Depository agrees to assist the Board in its transition to a new depository, should the need arise. The Depository agrees to furnish the Board with such information concerning the activity of all accounts as may be needed to requests future proposals for the Board’s banking needs. 27. NON-DISCRIMINATION—The Bath County Board of Education does not discriminate on the basis of race, color, national origin, age, religion, creed, marital status, sex, or handicap in employment, educational programs, or activities as set forth in Title IX, Title VI, and Section 504. The Depository shall be expected to have these same standards. 28. CONFLICTS OF INTEREST—KRS 45A.455 prohibits conflicts of interest, gratuities or kickbacks to employees of the Board of Education in connection with contracts for supplies or services whether such gratuities or kickbacks are direct or indirect. KRS 45A.990 provides severe penalties for violations of the laws relating to gratuities or kickbacks to employees, which are designed to secure a public contract for supplies or services. If you cannot comply with, or agree to, any of these general terms and conditions, but please identify and explain here or on a continuation page if you want to be considered: 3 of 4 It is understood that, unless otherwise noted, the bank identified below agrees to these general terms and conditions and that they are hereby incorporated into any proposal submitted. Authorized Signature: __________________________________________Date ________________ Typed or Printed Name ________________________________________ Title ________________ Bank Name _____________________________________ Telephone No. ___________________ E-Mail Address: __________________________________________ 4 of 4