Day #2

advertisement

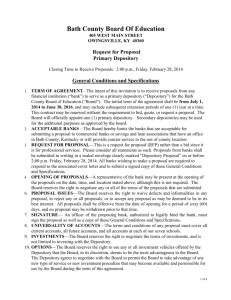

Day 2 Introduction to Depository Institutions Presented by Introductions • Rachel Martini – Customer Relations Specialist • Lindsey Bamba – Westside Branch Manager Review of Yesterday’s Lesson • Types of depository institutions • Deposit Insurance • Factors to consider when choosing a depository institution • Types of accounts Overview of Today’s Lesson • Features of depository institutions • Other services & how to use them • Safety (online, ID theft, fraud, etc) • Fees • Quiz (use Note Taking Guide) Features of Depository Institutions Services offered by depository institutions may offer many different features Online banking Mobile banking Debit cards ATMs Electronic payment Other Services Financial advice Information, advice, and assistance with a wide range of financial topics Safe-deposit box Special needs payment instruments Store valuable personal items Secure types of payments such as traveler’s checks, certified checks, cashier’s checks, and money orders Using depository institution services Call, visit, email or search the website Determine what steps are needed to use the service Do you have an account? Having an account may be a requirement to use certain services Under 18? Most require a parent/guardian signature to open an account Online Banking What is it? Complete certain transactions from a secured Internet site Use a username and password What can you do? Access account information anywhere Transfer money Pay bills/set up recurring bill payment Apply for credit Online Banking Options View all accounts & balances Make transfers between accounts View Electronic Statements Change password, security questions, email, etc. Help topics to answer general online banking questions Log out of online banking View current and available balance for an account View recent transactions Access online bill pay Make immediate transfers or schedule a transfer Reorder checks (duplicate or wallet) Make a stop payment on a check Mobile Banking What is it? Apps that many depository institutions have developed that allow online banking access from devices such as smartphones, tablets, and other mobile devices What can you do? Usually offers the same services as online banking Mobile Banking Easy access to your bank accounts • • • • • • • Access from an App on your smartphone View accounts and balances View recent transactions Make transfers between available accounts Access bill pay Find branch locations Mobile Deposits It’s Fast, Safe, and Simple! Olympia Federal protects your personal information using a multi-level security system including encryption, authentication and much more. If your phone is ever lost or stolen, you can instantly deactivate your mobile banking access by logging onto your online banking at olyfed.com Debit Cards What is it? A plastic card that is electronically connected to the cardholder’s depository institution account What can you do? Function in the same manner as checks but faster and more portable Other Information Use a Personal Identification Number (PIN) or signature to authorize transactions Automated Teller Machines (ATMs) What is it? A machine that allows individuals to complete certain transactions from the machine without human assistance What can you do? • Withdraw and deposit money • Transfer money • Check account balance Other information Accessed via an ATM card (usually the debit card) and PIN Electronic Payments What is it? Transactions completed with no physical connection between the payment device and the Point of Sale (POS) device or store clerk What can you do? Other information Make transactions using account information or using an ATM or debit card Might also be known as contactless, ACH, online or phone payments. Which feature would you find the most appealing? Cast your vote! Online banking Mobile banking Debit cards ATMs Electronic payments Online Safety Before you enter sensitive data on a Web page, ensure that: The site uses encryption, a security measure that helps protect your data as it traverses the Internet. Signs of encryption include a Web address with https ("s" stands for secure) and a closed padlock beside it. (The lock might also be in the lower right corner of the window.) Save financial transactions for your home computer Never pay bills, bank, shop, or do other financial business on a public or shared computer or on devices such as laptops or mobile phones that are on public wireless networks. The security is unreliable. Protect Yourself from Identity Theft • • • Safe Keeping (Debit card, ATM card, checkbook, Social Security Card, etc.) Don’t give out personal information Check your credit report each year (www.annualcreditreport.com) – FREE and NO subscriptions to purchase • • • • Shred financial papers before throwing them away (6% of Identity Theft is from stolen paper documents.) Do not respond to suspicious emails or text messages Maintain good financial records Never carry your Social Security card with you and give out this number sparingly Debit Card Fraud • Protect your debit card number and your Personal Identification Number (PIN) • Be aware of your surroundings when at an ATM • Use caution at night or in the dark • Check the ATM for tampering or additions that do not seem part of the machine – these are warning signs that something might be wrong • Don’t leave your receipt behind • Check your debit card account regularly and contact your bank if you see any discrepancies Account Fees • • • Different types of fees may be charged Fees will vary between institutions and within different services at the same institution One of the most important factors to consider when choosing a depository institution Overdraft fee Charged if you withdraw more money from your account than is available ATM fee Minimum balance fee Charge for using an ATM that belongs to another depository institution Some accounts have a minimum account balance; fee charged if you go below that balance How do you manage fees? Research Manage responsibly • Research fees when choosing a depository institution • When opening an account, ask for a list of fees • Most are avoidable • Keep track of your transactions and use a budget How do you choose one depository institution over another? Choose one that meets your goals! Analyze the following factors: Type of depository institution Location Interest rates offered Insurance Features offered Services offered Fees charged Which checking account should Josie choose? Let’s discuss the homework – Josie’s Depository Institution What did you learn about Josie? Will be traveling often to neighboring states Make sure she can avoid all fees with proper account management Owns a smartphone Has over drafted her account in the past Has several bills to pay every month Would prefer no minimum balance requirements Would like to earn interest on her deposits Would like a quick way to check her account balances Which checking account would you recommend Josie choose - option 1 or 2? Why? Summary Depository institutions offer many benefits: A safe place to store money A way to manage cash The opportunity to earn interest Services/features offered and fees charged vary between and within every depository institution Research different depository institutions and choose one that will help you reach your goals