Test no 3 fall 15

advertisement

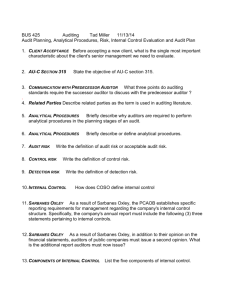

BUS 425 Auditing Tad Miller Nov. 10, 2015 Audit Planning, Materiality & Risk, Internal Control Evaluation and Overall Audit Approach 1. AU-C 315 2. COMMUNICATION WITH PREDECESSOR AUDITOR What three issues do auditing standards require the successor auditor to discuss with the predecessor auditor? 3. 4. Write the objective of AU-C 315 Related Parties Describe related parties as the term is used in auditing literature. SARBANES OXLEY The PCAOB has established reporting requirements for management regarding the company's internal control structure. List the three statements management must include in the company's annual report pertaining to internal controls. 5. ANALYTICAL PROCEDURES Briefly list the two primary reasons auditors are required to perform analytical procedures in the planning stage of an audit. 6. ANALYTICAL PROCEDURES List three commonly used types of analytical procedures that would typically be performed during the planning phase of the audit. 7. MATERIALITY Write the definition of materiality. 8. PERFORMANCE MATERIALITY performance materiality. Describe tolerable error, tolerable misstatement or 9. ESTIMATING MISSTATEMENT Tolerable error for inventory is $5,000. The inventory balance is $50,000 comprised of 1,000 SKU numbers. We sample 150 items with recorded values totaling $7,500. However, the audited value of those 150 items is $6,937.50 with a sample mean of $46.25. Explain why you would with either 1) conclude that inventory is not materially overstated or 2) be unwilling to conclude on inventory. Show your work. You will be graded on you analysis and the use of the appropriate words. 10. CONTROL RISK a timely b Write the definition of control risk. asis by the client’s internal controls. 11. AUDIT RISK MODEL If we assess control risk as high what does that imply about the amount of evidence we will need to obtain from our tests of controls? If planned detection risk is high what does that imply about the amount of evidence we will need to obtain from our substantive tests? (circle the correct answers). Amount of evidence test of controls must provide if CR is High MINIMAL MODERATE EXTENSIVE Amount of evidence substantive tests must provide if PDR is High MINIMAL MODERATE EXTENSIVE 12. INTERNAL CONTROL How does COSO define internal control 13. SARBANES OXLEY As a result of Sarbanes Oxley, auditors must now issue a second attestation report. What two reports do auditors issue for public clients? 14. COMPONENTS OF INTERNAL CONTROL List the five components of internal control. 15. SEGREGATION OF DUTIES what four functional responsibilities need to be performed by different people in order for duties to be adequately segregated? 16. MANAGEMENT ASSERTIONS During the audit, you find an entry in the sales journal for which there is neither an underlying shipping document nor a sales order. To which financial statement assertion does this condition relate? 17. MANAGEMENT ASSERTIONS During the audit, you find prices on invoices which are higher than the official price list. To which financial statement assertion does this condition relate? 18. MANAGEMENT ASSERTIONS During the audit, you find a customer order and a shipping document indicating the goods were shipped to the customer but you are unable to find where the transaction was recorded in the sales journal. To which financial statement assertion does this condition relate? 19. AUDIT OBJECTIVES Write three audit objectives for sales transactions 20. TYPES OF DOCUMENTATION What three types of documentation are typically used to document our understanding of the internal controls? 21. MATERIAL WEAKNESS Write the definition of material weakness. 22. SIGNIFICANT DEFICIENCY / MATERIAL WEAKNESS If an auditor becomes aware of either a significant deficiency or a material weakness in a public company’s internal controls, to whom must it be reported. 23. AUDIT RISK MODEL What is the achieved detection risk (not the planned detection risk but the achieved detection risk) at the beginning of every audit? 24. AUDIT RISK MODEL If we preliminarily assess control risk as high what does that imply about the effectiveness of their internal controls? 25. AUDIT RISK MODEL SEC CLIENT SUBJECT TO SARBANES OXLEY We have evaluated the design of the client’s internal controls and we do not believe the controls would be effective even if properly implemented. We also believe that substantive would cost less to perform than test of controls. 26. AUDIT RISK MODEL PRIVATE CLIENT NOT SUBJECT TO SEC (SARBANES OXLEY) We have evaluated the design of the client’s internal controls and do not believe the controls would be effective even if properly implemented. We do believe that tests of controls would cost less to perform than substantive tests. 27. Which audit approach will you take? How will you preliminarily assess Control Risk? What is the extent of Test of Controls will you perform? What is the extent of Substantive Testing will you perform? Are you required to perform Tests of Controls for private clients? Which audit approach will you take? How will you preliminarily assess Control Risk? What is the extent of Test of Controls will you perform? What is the extent of Substantive Testing will you perform? AUDIT RISK MODEL PRIVATE CLIENT NOT SUBJECT TO SEC (SARBANES OXLEY) We have evaluated the design of the client’s internal controls and we believe the controls would be effective if properly implemented. We do believe that substantive would cost less to perform than test of controls. Which audit approach will you take? How will you preliminarily assess Control Risk? What is the extent of Test of Controls will you perform? What is the extent of Substantive Testing will you perform? 28. UNDERSTANDING THE CLIENT'S ACCOUNTING SYSTEM In order to document our understanding of the client's accounting system (not their internal controls but their accounting system which is an integral part of the control structure). We need to demonstrate that we understand the flow of transactions by documenting: the significant classes of transactions how those transactions are: 29. CLASSES OF SIGNIFICANT TRANSACTIONS List the transaction cycle we have been studying in class and the two significant classes of transactions that comprise this transaction cycle.