2014 PDF

advertisement

TCAT Quick Stats

In 2014, TCAT...

....operated 1,586,902 revenue miles

....operated 120,657 revenue hours

....recorded 4,296,844 rides

....recorded 10,879,160 passenger miles

As of December 2014, TCAT...

....operated 33 routes (including one demand-response

route and one summer-only route)

....had 49 vehicles (48 transit buses, 1 mini-bus)

TCAT recorded 41.5 rides per capita in 2014.

(based on the 2014 population of Tompkins County)

Table of Contents

Executive Summary

Ridership Stats

Service Productivity

Other Ridership Fleet and Operations Metrics

Budget/ Fuel costs

Communications

Human Resources

Conclusion

3

4

11

13

15

23

26

28

29

Prepared by:

Matt Yarrow

TCAT Service Analyst

May 2015

Cover by Jenn Jennings

900

Executive Summary

After seven straight years of ridership increases, 2014 brought a slight dip in ridership with a 2.1%

decrease. This turned out to be a harbinger for other measures of TCAT’s system – it was a difficult

and challenging year for TCAT. This report will illustrate some of the current challenges TCAT faces

as well as some opportunities for improvement in 2015. What is more difficult to show in graphs is

the effort that TCAT employees invest in the success of this organization on a daily basis.

Some challenges that TCAT faced in 2014 (and beyond):

• Decreasing ridership: decreasing gas prices, especially in the second half of 2014, likely contributed to TCAT’s lower ridership.

• A shrinking and aging fleet: TCAT started the year with 53 vehicles and ended it with 49 (having

lost one bus to an accident and 3 to old age (excessive corrosion and skyrocketing repair costs).

Out of the entire fleet, 37% of buses were at or past their replacement age.

• Maintenance challenges: the number of road calls (bus breakdowns) increased in 2014 and at the

same time on-time preventative maintenance performance decreased. These measures underscore

the effect of an aging fleet and insufficient bus spare ratio.

• Missed trips became a thorn in the side of TCAT’s usually impeccable service. The main peak of

missed trips occurred in the late summer to early fall and spurred TCAT to make important changes

in its service at the beginning of 2015.

• Increase in unpreventable accidents: Although the vast majority of accidents TCAT sees are

minor (e.g. mirror clips), 2015 saw the unfortunate increase in non-preventable accidents while

preventable accidents stayed relatively unchanged. This is an indicator of increasing traffic volume

on local streets as well as the effect of several long-term detours.

• TCAT faced increasingly severe budgetary issues in 2014. Falling federal funding levels and flat

state and local funding have impacted TCAT’s operational and capital budgets. Service increases

were put on hold; three staff positions were not filled or canceled altogether. TCAT was unable to

undertake important capital projects in 2014, such as bus replacements, facility upgrades, and the

the ITS (intelligent transportation systems) project that will bring real-time information to TCAT

passengers.

Some positive trends and opportunities:

• A May 2014 TCAT rider survey showed that customers are satisfied with TCAT. Most respondents

agree or strongly agree that TCAT gets them where they need to go (84%), service is dependable

(77%), and staff is professional and courteous (78%).

• Funding eventually came through in 2014 to order 2 large buses and 2 small buses; which went

into service by March 2015.

• After noting that Cornell’s average fare per ride had dropped from close to a dollar in 2010 to

83¢ in 2013, negotiations ensued, ultimately resulting in an increase in Cornell’s bulk fare payment

that will be phased in over 3 years.

• The lower fuel prices meant that TCAT spent less on fuel in 2014 than it has in three years.

• TCAT’s DOT inspection rate stayed over 90% for 2014.

• 2014’s annual employee retention rate was higher than in 2013.

The 2014 yearbook provides an honest look at the current state of TCAT as a transit system and a

non-profit organization providing a critical community service. While the challenges we face going

into 2015 are numerous, TCAT staff bring energy every day to the task of improving service and

molding the local transit system to the needs of the community. Some exciting projects coming

in 2015 and beyond: a technology project will bring real-time information to our passengers and

improve internal efficiency, several new 40-foot and mini-buses will be ordered to help us rejuvenate our fleet, and the “What’s a Bus Stop?” project will optimize and improve our bus stops and

shelters.

Ridership Stats

Prior to 2014, TCAT’s ridership had been growing consistently since 2007; in 2012, TCAT joined the

ranks of mid-sized transit agencies by surpassing 4 million rides annually. 2014 brought a change in

this pattern of consistent growth. Looking at ridership by quarter, it is evident that 2014 started with

positive growth (2.3%) and then fell to zero growth by the second quarter and descending to -4%

growth by the fourth quarter. In the table below, the change in ridership by quarter is compared to

the change in Upstate NY gas prices from the previous quarter and the missed trips by quarter. Both

of these measures correlate well with the decrease in ridership, showing that they are likely factors

in explaining the ridership decrease.

When considering changes in TCAT ridership

over the past dozen years, it is clear from the

graph below, that the overall trend is toward

higher ridership. Even with the decrease in

ridership in 2014, the R-Squared value for the

trend line is 0.94 – indicating a good fit with a

linear model. Over this period, TCAT added, on

average, more than 155,000 rides/year. TCAT

benefits from a local community that rides the

bus in high numbers. The 2009-2013 American

Community Survey showed that 12.4% (±1.9%)

of workers in Ithaca used public transit to get to

work. This compares favorably to Syracuse (8.0%),

Binghamton (7.5%), and Rochester (7.7%).

Ridership, Gas Prices, Missed Trips by Quarter

2014

Measure

Q1

Q2

Q3

Q4

Change in TCAT

ridership from same

quarter 2013

2.3%

0.0%

-3.5%

-4.0%

Change in Upstate

gas prices from

previous quarter

2.0%

3.4%

-2.8%

-13.4%

45.0

66.0

231.0

72.0

Ave Missed

trips/month for

quarter

Annual TCAT Ridership and Percent Growth

5 .0 M

4.39M

6.3%

4 .5 M

3.94M

10.3%

To ta l A n n u a l R id e rsh ip

4 .0 M

4.30M

-2.1%

3.58M

6.7%

3 .5 M

3 .0 M

4.13M

4.7%

3.11M

1.3%

3.09M

12.9%

3.32M

6.8%

3.35M

1.0%

2.79M

7.4%

3.07M

-0.9%

2.74M

-1.7%

2 .5 M

2 .0 M

% ∆ Total Rides

Total Rides

-2.5%

2.0M

4.5M

0.0%

1 .5 M

5.0%

10.0%

13.0%

1 .0 M

2003

2004

2005

2006

2007

2008

2009

Y ear

2010

2011

2012

2013

2014

Ridership by Route Category

A look at the ridership by route category (graph below) shows that all the major categories exhibited

decreasing ridership in 2014. Interestingly, the urban category decreased the least – only 1%. If the

downtown-Cornell circulator (route 10) is removed from the urban category, the remaining urban

routes actually had slightly positive ridership growth in 2014. This suggests that a dip in Cornell

ridership contributed to the overall decline in system-wide ridership. When campus ridership is

split into day vs. night, a clear difference emerges: the daytime ridership decreased significantly by

5.7% while nighttime ridership increased 4.7% for the year. In fact, the campus night category (90,

92, & 93) has increased a whopping 150% since 2007! On the other hand, campus day service (81,

82, & 83) has been relatively stable over the last decade with only a 13% increase since 2005.

The rural “minimum service” routes (20, 22, 36, 37, 40, 53, 65, 74, 75, & 77) have only a few peak

hour trips a day; ridership on these routes declined 3.2% in 2014, but this category is still up 117%

since 2005. The rural “large market” routes (21, 41, 43, 52, & 67) serve the larger outlying villages

and have mid-day trips and peak hour service; this category decreased 3.5% in 2014.

Annual TCAT Ridership by Route Category

Route Category

2005

Urban Total

C am pus

C am pus D ay

C am pus Night

Urban

R ural Total

R ural Large

R ural Min.

2,735,944

1,026,261

912,409

113,852

1,709,683

358,416

260,432

97,984

2006

2,674,183

876,575

777,038

99,537

1,797,609

391,126

276,983

114,143

2007

2,713,008

850,437

752,856

97,581

1,862,571

393,207

270,646

122,561

2008

2,862,428

848,242

743,487

104,755

2,010,748

455,283

300,824

154,459

2009

2,869,689

833,048

718,450

114,598

2,036,641

482,103

311,317

170,786

2010

3,089,507

1,040,386

903,188

137,198

2,049,121

488,072

298,674

189,398

2011

3,407,935

1,154,271

979,944

174,327

2,253,664

536,690

339,617

197,073

2012

3,591,621

1,200,811

995,650

205,161

2,390,810

536,621

334,036

202,585

2013

3,839,443

1,271,435

1,027,417

244,018

2,568,008

549,256

336,086

213,170

2014

3,766,431

1,224,343

968,740

255,603

2,542,088

530,413

324,157

206,256

Total

3,094,360 3,065,309 3,106,215 3,317,711 3,351,792 3,577,579 3,944,625 4,128,242 4,388,699 4,296,844

Percent Change

12.9%

-0.9%

1.3%

6.8%

1.0%

6.7%

10.3%

4.7%

6.3%

-2.1%

Annual TCAT Ridership by Major Route Category

Measure Names

2 ,5 4 2K

2 ,3 9 1K

2 ,0 3 7K

1 ,2 2 4K

1 ,2 7 1K

1 ,2 0 1K

2009

2010

5 3 0K

8 3 3K

8 4 8K

2008

5 4 9K

2007

5 3 7K

2006

5 3 7K

2005

1 ,1 5 4K

1 ,0 4 0K

2004

4 8 8K

3 9 3K

2003

4 8 2K

3 9 1K

2002

4 5 5K

3 5 8K

8 5 0K

8 7 7K

1 ,0 2 6K

3 3 9K

0K

3 7 1K

9 6 9K

1,000K

500K

1 ,8 6 3K

1 ,4 9 8K

9 0 2K

1 ,4 4 6K

9 7 1K

1 ,2 9 2K

1,500K

3 3 5K

Annual Ridership

2,000K

1 ,7 9 8K

1 ,7 1 0K

U rban

2 ,0 1 1K

URrban

ural

2 ,0 4 9K

2 ,2 5 4K

RCural

am p us

2,500K

2 ,5 6 8K

C am p us

Measure Names

2011

2012

2013

2014

Change in Ridership by Route

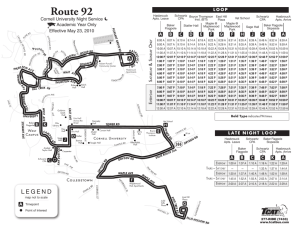

From 2013 to 2014, changes in ridership by route ranged from a high of 8.5% (Rt. 93) to a low of

-15% (Rt. 20). The average change in ridership across all routes was -2.1%. Route 93 and 92 serve

Cornell’s Campus, student housing, Collegetown and East Hill Plaza, with route 93 extending to

Eastern Heights. Demand for these night routes (92 also runs weekend days) increased in 2014, a

trend that continues from 2013. Remarkably, despite an overall decrease in rural ridership, many of

the best performing routes in 2014 were rural routes: 75, 65, 52, 36, and 53. An increase of ridership

on 52 and 53 indicate indicates an increase in bus commuters living in Ellis Hollow, Brooktondale

and Caroline. The two poorest performing routes (20 and 21) serve Enfield and Trumansburg. In

June of 2014, the Enfield Park ‘n’ Ride at the corner of Route 79 and Enfield Main Rd was moved

to Enfield Town Hall due to objections of the property owner. This is likely to have negatively

impacted the travel patterns of people commuting into Tompkins County along Route 79 and, in

turn, the ridership on route 20. On these rural routes especially, the lower gas prices in 2014 may

have changed commuters’ personal calculus in determining whether it is easier or cheaper to drive

versus taking the bus. The campus day routes also had a lackluster performance in 2014. Because

dispatchers often removed buses on routes 81 and 82 when there were bus shortages during peak

times of day, it makes sense that ridership on these routes was negatively affected. Most of the

urban routes clustered around the zero growth line (see below). Absolute ridership numbers by

route are shown on the next page.

Changes in Annual TCAT Ridership by Route (2013-2014)

2014 Ridership

0

8.0%

93

75

65

400,000

600,000

6.0%

Percent Change in Ridership by Route

800,000

52

36

4.0%

53

15

2.0%

0.0%

92

51

40

11

-2.0%

90

72

30

67

32

10

C am p us N ig ht

R ural Larg e M ark et

R ural M in. S erv ic e

77

70

A ve ra g e p e rce n t ch a n g e 2 0 1 3 -2014

43

13

82

74

-6.0%

83

37

22

31

41

-10.0%

-12.0%

Route Category

C am p us D ay

U rb an

14

-4.0%

-8.0%

200,000

81

21

-14.0%

20

-16.0%

labeled

D Datapoints

ata p o in ts areare

labeled

by T Cby

ATTCAT

ro ute route

Ridership by Route: 2013 vs. 2014 (recodes are miscoded trips where the route is unknown)

Rt.

Destination

N/A Rec odes

10

CU - Com m ons

11

IC - Com m ons

13

Norths ide - M all

14

W es t Hill

15

S W S hopping

17

TCA T/F all Creek

20

E nfield

21

Trum ans burg

22

S tate P ark s

30

Com m ons - M all

31

NE Ithac a

32

A irport

36

S outh Lans ing

37

North Lans ing

40

G roton

41

DR F reeville

'13 Rides '14 Rides Change

94

1

-93

479,177 474,938

-4,239

211,803

52,522

122,536

119,338

215,513

3,710

1.7%

52

'13 Rides '14 Rides Change Δ (%)

141,701 138,375

Dry den - TC3

-3,326 -2.4%

E as tern Heights 143,075 146,842

3,767 2.6%

45,327

Newark V alley

47,794

2,467 5.2%

50,324

-2,198

-4.4%

53

E llis Hollow

122,446

-90

-0.1%

65

Danby

2,652

121,990

35,285

48,314

8,896

N/A

43

-0.9%

51

Destination

2.2%

67

Newfield

70

W k end M all

42,019

-6,295 -15.0%

72

W k end A irport

94,662

-10,792 -11.4%

74

W k end G roton

8,288

-608

-7.3%

75

W k end Dry den

764,100

1,242

0.2%

77

W k end W arren

106,056

-8,303

-7.8%

81

C.U. W eek day

278,884

-3,753

-1.3%

82

C.U. W eek day

20,805

1,069

5.1%

83

C.U. W eek day

27,270

-1,582

-5.8%

90

C.U. Night

37,812

808

2.1%

92

C.U. Night

17,463

-1,597

continued at right

-9.1%

93

C.U. Night

TOTAL

762,858

114,359

282,637

19,736

28,852

37,004

19,060

Rt.

-13,677 -63.3%

21,608

105,454

Δ (%)

↗

14,690

20,991

42,849

175,402

62,534

4,339

8,587

433

569,609

411,312

55,395

57,270

129,310

57,950

15,183

493 3.2%

22,726

1,735 7.6%

42,334

-515 -1.2%

172,664

-2,738 -1.6%

62,990

456 0.7%

4,146

-193 -4.7%

9,365

778 8.3%

429

-4 -0.9%

520,012

-49,597 -9.5%

401,279

-10,033 -2.5%

52,451

-2,944 -5.6%

58,270

1,000 1.7%

134,466

5,156 3.8%

63,339

5,389 8.5%

4,388,699 4,296,844 -91,855 -2.1%

Map of TCAT Ridership by Stop 2014

Rides2014

≤ 10

50,000

Route Category

C am p us

R ural

100,000

Suburban

150,000

U rban

≥ 200,000

Ridership by Stop

For 2014, all boarding locations were analyzed and grouped by the closest bus stop. We kept some

stops, such as Greet St. and Seneca St. as distinct; in other cases the easiest approach was to group

paired stops such as Sage Hall and Statler Hall on Cornell’s campus. As in previous years, Green

@ Commons had the highest ridership system-wide with close to 360,000 rides in 2014. Seneca @

Commons, as the paired stop for Green St, also had high ridership. Together, these two stops make

up over 15% of total TCAT ridership in 2014. At just under 275,000 rides in 2014, the two main

Collegetown stops (Schwartz PAC and College @ Dryden) shows the importance of Collegetown as

both an area of student housing and student-oriented services. A series of paired stops on Cornell’s

campus are the next highest ridership stops (see figure below). The Shops at Ithaca Mall stop (with

125,000 rides) shows the importance of the mall as a destination and a terminus to the route 30

(TCAT’s highest ridership route). The TC3 stop and the Dryden Village stops are the highest rural

ridership stops, being served by routes 43 and 75.

Ridership by Stop - 2014 total boardings

K ennedy / C orson &

M udd

155,832

R isley H all/ B alc h @

Thurston

199,984

H asbrouck

A pts.

65,901

V et

S c hool/B TI

58,742

H elen

N ew m an

56,141

U ris H all

218,348

R oy P ark

S c hool

47,453

S tate @

Q uarry

50,011

S hops at Ithac a

Mall @ S ears

124,977

A Lot/ J essup Tennis

C ourts

158,894

Tioga @ C ourt

66,326

Tripham m er

M all

48,073

C ourt @

Linn

49,784

A nabel

Tay lor/C arpenter

H all

93,909

S age/ S tatler H all

266,328

D airy B ar

68,627

B ak er Flagpole

81,752

S c hw artz/ C ollege @ D ry den

274,871

S enec a @ C om m ons

293,672

G oldw in S m ith/ R oc k ef eller

246,784

G reen @ C om m ons

359,740

Ridership by month, day of week, hour of day

TCAT’s annual ridership patterns reflect the collegiate academic year, with ridership peaks in the

spring and autumn while classes are in session. As expected, the majority of ridership occurs on

weekdays with weekends making up a small fraction of total boardings by month (see pie chart

below). As shown in the ridership-by-day graph, weekdays see higher ridership than weekends.

Thursdays have the highest average daily ridership with 14,953 rides/day, followed by Fridays with

14,809 average rides/day. Daytime ridership drops off on Fridays, while Thurs-Sat late night ridership

has grown over the years. Weekends have significantly lower ridership with an average of 6,996 and

4,400 rides on Saturdays and Sundays, respectively. This reflects fewer commute-to-work trips and

a reduced offering of transit service on weekends. The graph below shows that the 8 a.m. - 9 a.m.

hour records the most boardings on weekdays. Interestingly, the p.m. peak is lower overall, but also

spread out more than the a.m. peak. The late-night bump in ridership at 1 a.m. occurs primarily

Thurs-Sat when party-goers are returning home. Weekend ridership has a distinctly different form

than weekday ridership, with one gradual peak occurring mid-afternoon.

Ridership by Month for 2014 (weekday vs. weekend)

Jan.

Feb.

March

April

May

June

July

Aug.

Sept.

Oct.

Nov.

Dec.

Weekday

Ridership

Weekend

Ridership

Size of sphere is propotionate to total monthly ridership

Ridership by Day of Week and Hour of Day

1800

1600

1400

Average Ridership per Hour

1200

Day(s) of the Week

1000

800

M o n -W e d (a ve ra g e )

Th -F ri (a ve ra g e )

S a tu rd ay

S u n day

600

400

200

0

4am 5am 6am 7am 8am 9am 1 0am 11am Noon 1pm 2pm 3pm 4pm 5pm 6pm 7pm 8pm 9pm 10pm 11pm 12am 1am 2 am

H ou r of D ay

3am

Ridership by Fare Type

As a percentage of total boardings, Cornell fare

types remain the most common of all fares,

comprising 71.16% of 2014 ridership. This is a slight

decrease from 2013, when Cornell rides accounted

for 71.42% of TCAT ridership. Cash and TCAT

passes were the second and third most commons

fare types at 11.72% and 10.35% respectively. Cash

fare ridership decreased slightly more in 2014

– at 2.6% compared to TCAT Passes with a 0.9%

decrease. TCAT considers decreases in cash usage

positive due to the staff time involved in handling

cash. The only positive trend in usage by fare

type is the Ithaca College passes, particularly the

student 15-ride pass, which increased a healthy

26.6% in 2014. Tompkins Cortland Community

College (TC3) passes decreased 4.3% after three

years of healthy increases, perhaps indicating

that the TC3 student pass program has reached a

saturation point among the student body. City of

Ithaca employees increased their ridership, while

Tompkins County passes exhibited a drop in

ridership. More details on ridership by fare types

are shown in the table below.

Annual Rides by Fare Type

Fare Type

Cash

Adult

Youth

Half fare

TCAT Passes

Ride Passes

Day Passes

Other Passes

Youth

Cornell

All Zones

Zone 1 Pass

Eve + Weekend Pass

Not Specified

Ithaca College

Faculty/ Staff

Student Semester

Student 15-Ride Pass

Student Month Pass

TC3 Student

Unlimited Pass

Limited Pass

Government

City of Ithaca

Tompkins County

Other

Other

Transfers

Total

Ridership by Pass 2014

TC A T P asses

Transf er/

O ther

C ornell - Zone 1

Faculty & Staff

IC

G

TC3

C ornell E v e/W eek nd

C ornell - A ll Zones

New S tudents

C ash Fares

C ornell - A ll Zones

Faculty & S taf f

C ornell - A ll Zones

Other S tudents

G = Government

IC = Ithaca College

TC3 = Tompkins Cortland

Community College

Ridership by Fare Type 2010-2014

Percentage of Annual Rides by Fare Type Percent Change

2010

2011

2012

2013

2014

2010

2011

2012

2013

2014

10-'14

13-'14

456,010

373,571

32,069

50,370

412,548

113,008

237,837

103,662

19,744

2,528,728

1,924,733

458,384

139,519

6,092

71,570

38,404

33,166

0

0

10,129

7,777

2,352

11,807

4,306

7,502

86,786

0

86,786

3,577,579

520,536

416,422

47,822

56,292

421,411

139,217

233,180

5,439

43,575

2,725,731

2,069,886

498,508

150,274

7,063

114,502

45,698

47,817

15,716

5,271

17,317

13,560

3,757

11,588

2,931

8,657

133,540

23,927

109,613

3,944,625

510,997

408,571

49,050

53,376

430,863

135,700

235,349

4,831

54,983

2,913,855

2,250,289

474,200

169,140

20,226

123,231

45,814

49,471

21,770

6,176

25,356

19,252

6,104

11,722

2,747

8,975

112,218

2,898

109,320

4,128,242

514,408

414,691

47,199

52,518

454,077

134,502

249,326

8,110

62,139

3,134,298

2,435,977

477,574

200,324

20,423

128,614

47,500

44,667

27,861

8,586

23,871

18,630

5,241

11,893

3,235

8,658

121,538

1,370

120,168

4,388,699

500,860

402,658

43,524

54,678

450,064

130,247

249,553

9,090

61,174

3,057,500

2,381,075

446,481

215,797

14,147

133,523

44,148

46,004

35,266

8,105

22,843

18,143

4,700

11,622

3,605

8,017

120,432

1,071

119,361

4,296,844

12.75%

10.4%

0.9%

1.4%

11.53%

3.2%

6.6%

2.9%

0.6%

70.68%

53.8%

12.8%

3.9%

0.2%

2.00%

1.1%

0.9%

0.0%

0.0%

0.28%

0.2%

0.1%

0.33%

0.1%

0.2%

2.43%

0.0%

2.4%

100.0%

13.20%

10.6%

1.2%

1.4%

10.68%

3.5%

5.9%

0.1%

1.1%

69.10%

52.5%

12.6%

3.8%

0.2%

2.90%

1.2%

1.2%

0.4%

0.1%

0.44%

0.3%

0.1%

0.29%

0.1%

0.2%

3.39%

0.6%

2.8%

100.0%

12.38%

9.9%

1.2%

1.3%

10.44%

3.3%

5.7%

0.1%

1.3%

70.58%

54.5%

11.5%

4.1%

0.5%

2.99%

1.1%

1.2%

0.5%

0.1%

0.61%

0.5%

0.1%

0.28%

0.1%

0.2%

2.72%

0.1%

2.6%

100.0%

11.72%

9.4%

1.1%

1.2%

10.35%

3.1%

5.7%

0.2%

1.4%

71.42%

55.5%

10.9%

4.6%

0.5%

2.93%

1.1%

1.0%

0.6%

0.2%

0.54%

0.4%

0.1%

0.27%

0.1%

0.2%

2.77%

0.0%

2.7%

100.0%

11.66%

9.4%

1.0%

1.3%

10.47%

3.0%

5.8%

0.2%

1.4%

71.16%

55.4%

10.4%

5.0%

0.3%

3.11%

1.0%

1.1%

0.8%

0.2%

0.53%

0.4%

0.1%

0.27%

0.1%

0.2%

2.80%

0.0%

2.8%

100.0%

9.8%

7.8%

35.7%

8.6%

9.1%

15.3%

4.9%

-91.2%

209.8%

20.9%

23.7%

-2.6%

54.7%

132.2%

86.6%

15.0%

38.7%

N/A

N/A

125.5%

133.3%

99.8%

-1.6%

-16.3%

6.9%

38.8%

N/A

37.5%

20.1%

-2.6%

-2.9%

-7.8%

4.1%

-0.9%

-3.2%

0.1%

12.1%

-1.6%

-2.5%

-2.3%

-6.5%

7.7%

-30.7%

3.8%

-7.1%

3.0%

26.6%

-5.6%

-4.3%

-2.6%

-10.3%

-2.3%

11.4%

-7.4%

-0.9%

-21.8%

-0.7%

-2.1%

10

Service Productivity

Service productivity measures ridership change per unit of service delivered. The most common units

of measure are riders per revenue mile and riders per revenue hour. In 2013, system-wide averages

were 2.77 riders per revenue mile and 36.4 riders per revenue hour. In 2014, these measures were

2.71 riders per revenue mile and 35.6 riders per revenue hour, representing small decreases of 2.25%

and 2.1% respectively. These decreases in service productivity parallel the small decrease in total

ridership in 2014. However, TCAT’s service continues to have high service productivity measures – the

chart below shows that riders/hour and riders/mile were still higher in 2014 than the period between

2010 and 2012. As we reported last year, given that a high percentage of peak hour buses are full

or close to full - without changes in work hour start and end times to smooth out ridership demand

peaks - there is likely little room for increased efficiency above the current levels. Regardless, TCAT

continues to strive for efficiency in operations and service delivery.

Unsurprisingly, routes that travel through areas of high density during peak hours, namely urban

and campus routes, are the most productive based on these measures. Rural routes seem highly

unproductive, however, rural routes must travel greater distances over longer trips in order to pick

up riders. A better measure of rural route productivity would be the utilization of the capacity of

the bus—i.e. how “full” the bus is. Because TCAT has the technology to count passengers only

as they board, and not as they disembark, there is no easy and standardized way to measure the

“fullness” of buses without actually riding the buses and manually counting passengers. TCAT staff

has documented very full buses on rural routes 43, 40 and 21 during certain trips.

Productivity Measures for 2010 - 2014: Riders/hour and riders/hour are system-wide annual averages; Revenue Hours and Revenue Miles are broken into the three main route categories

40

Ave. Riders/hour

34.5

Riders/hour

31.0

30

26.5

20

31.8K

∫

32.1K

64.5K

69.5K

30.8K

33.5K

29.6K

62.0K

28.0K

29.8K

30.2K

62.5K

3 .0

Ave. Riders/mile

35.6

36.4

28.0K

62.4K

Rev. Hours

28.5K

2.8

2.6

2 .5

2.7

Riders/mile

2.3

2.2

677K

∫

706K

722K

263K

277K

260K

2 .0

666K

730K

268K

680K

637K

636K

264K

Rev. Miles

677K

646K

0.0

2010

2011

2012

Route Category:

C am p us

2013

R ural

U rban

2014

11

Comparison with other transit agencies

In relation to other transit agencies in Upstate New York, TCAT compares favorably. The Federal Transit

Administration (FTA) designates extra funding for Small Transit Intensive Cities (population 50,000200,000). TCAT qualifies for STIC funding because TCAT is above the national average on 4 of the 6

STIC metrics. These metrics can also be useful to compare service among different agencies. In the

table below, TCAT is compared to other upstate transit agencies for 2013, the last year that data were

available. TCAT data for 2014 is also included; although ridership decreased in 2014, a new passenger

mile survey indicated that riders were traveling farther per trip - leading to increases in several metrics.

Examining the metrics in the four right-most columns in the table below, it is clear that TCAT has the

highest levels of transit service provision and consumption per capita of any transit agency in Upstate

New York. The vehicle utilization measures (left two columns in the metrics section of table below)

are lower because commuter-oriented (low ridership in off-peak direction) rural service makes up a

significant proportion of TCAT’s service. Nevertheless, these stats still compare favorably to some of

the larger transit operators in the state and mid-sized cities nationally (see last line of table below).

Principal Upstate New York Transit Agencies - 2013 Stats

Service

Area

Populaon

Unlinked

Passenger

Trips

Small Transit Intensive Cies Performance Metrics 2013

Vehicles Passenger Passenger Vehicle Vehicle

Operated Miles per Miles per Revenue Revenue Passenger Passenger

Maximum Revenue Revenue Miles per Hours per Miles per Trips per

Service

Mile

Hour

Capita

Capita

Capita

Capita

Transit

Agency

Locaon

Broome

Transit Binghamton

165,000

2,251,455

39

CDTA

Albany

618,360 15,062,212

184

Centro

Uca

154,159

1,170,926

23

CNY Centro Syracuse

467,025

9,372,854

123

GGFT

Glens Falls

61,090

331,728

5

NFTA

Buffalo

1,182,165 23,270,057

269

RTS

Rochester

694,394 19,975,013

213

TCAT 2013

Ithaca

102,554

4,388,699

43

TCAT 2014

Ithaca

103,617

4,296,844

43

US Urbanized Areas - populaon 200,000 - 999,999 (Averages)

7.1

6.8

4.1

9.2

3.6

10.3

9.9

6.4

6.9

6.3

78.1

80.9

49.6

102.4

64.1

109.3

128.2

83.5

90.2

104.6

6.8

11.5

6.3

6.3

5.4

7.1

8.4

15.4

15.3

10.6

0.6

1.0

0.5

0.6

0.3

0.7

0.6

1.2

1.2

0.7

48.5

78.0

25.8

58.3

19.5

73.1

82.4

98.3

105.0

82.4

13.6

24.4

7.6

20.1

5.4

19.7

28.8

42.8

41.5

13.2

Missed trips

Every transit agency has missed trips – there are certain factors in transit that cannot be completely

controlled. For TCAT, 2014 was not a good year for missed trips, especially in the summer and fall.

The graph below shows that the vast majority of one-way missed trips were due to bus shortages.

After four buses were retired from the fleet by mid-2014, TCAT’s spare ratio went down. This meant

that at peak times, only 6 buses could be out of service due to major mechanical issues, preventative

maintenance service, and DOT inspections. And two of these six were not full-sized buses! This turned

out to be an untenable situation and was a primary reason why the number of buses needed in peak

service was reduced for the January 2015 service period. Two major factors that contributed to the

missed trips issue were the aging fleet and the difficulty in obtaining capital funding for new buses.

250

Mis s ed trips

200

Reason for Missed Trip

Bus Sh o rtage

D riv er Sh o rtage

Eq uip m en t F ailure

150

O th er

100

50

0

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

12

Paratransit and Vanpool

As required by the Americans with Disabilities Act

of 1990, TCAT contracts with Gadabout to provide

complementary paratransit to people who are unable to take fixed-route transit due to their disability. In addition to TCAT’s paratransit service,

Gadabout also provides transportation for senior

citizens in Tompkins County. Total Gadabout trips

decreased at a higher rate than last year at -6.1%

in 2014, compared to -3.3% in 2013. Gadabout suspects that the transition in Medicaid trip scheduling from the local Department of Social Services to

Medical Answering Services, LLC (MAS) in late 2013

has been a factor in declining ridership. MAS often schedules trips on taxis, leaving paratransit and

small rural transit systems with less ridership and

revenue. Another interesting trend is that non-ADA

trips continued to decrease at a higher rate than

ADA trips. The result is that ADA trips now make

up just less than 50% of total Gadabout rides – up

from 33% in 2009.

The discontinuation of service to Schuyler County

in January 2011 triggered the formation of the first

vanpool group in the region. By the end of 2011, a

second group had formed. Total vanpool ridership

in 2014 was down from 2012 and 2013 due to a

couple of passengers dropping out of the program.

The graph below shows changes in monthly vanpool ridership from 2013 to 2014.

Gadabout ridership and service measures.

Read chart from bottom up.

R id e rsh ip

S e rvice M e a su re s

2014

3 3K

3 0K

2 9K

4 6 3K

2013

3 5K

3 2K

2 8K

4 7 4K

2012

3 7K

3 2K

2 7K

4 6 8K

2011

3 9K

2 7K

2 4K

4 1 8K

2010

4 0K

2 3K

2 3K

3 9 8K

2009

4 1K

2 1K

2 2K

3 9 0K

2008

4 4K

2 0K

2 1K

3 7 8K

2007

3 9K

1 9K

2 2K

3 6 8K

2006

4 2K

1 6K

2 4K

3 2 8K

N on-A D A

ADA

R ev . H rs R ev . M iles

Vanpool Ridership 2013-2014: Ridership change by month

Ja n .

Feb.

M a rch

A p ril

May

M o n th

Ju n e

Ju ly

A u g.

S e p t.

O ct.

N o v.

D e c.

350

300

250

2014

2014

2013

2014

2013

2014

2013

2014

2013

2014

2013

2014

2013

2014

2013

2014

2013

2014

2013

2014

2013

2014

2013

200

2013

R id e s p e r M o n th

400

13

Bicycles and Mobility Devices Boarded on Buses

In 1996, TCAT became the first agency in New York State to install bicycle racks throughout its

fleet. Today, all TCAT vehicles are equipped with bicycle racks mounted on the bus. In 2014, the

number of bikes boarded increased slightly over 2013 to 34,024. Overall the trend (see tan line in the

graph below) is in the upwards direction. The map at the bottom of the page shows that the main

downtown stops have the most bike boardings, while stops on the hills board less buses overall.

This alludes to the advantage of biking with gravity. TCAT’s vehicle fleet is universally accessible

to people who use mobility devices such as wheelchairs. In 2014, TCAT transported approximately

1,250 passengers with their mobility devices. This is a decrease of 25% from 2013 and the overall

trend is in the downwards direction (see light blue line on graph below).

Bikes and mobility devices boarded on TCAT buses 2010-2104

1 ,8 00

4 2K

1 ,7 00

4 0K

1 ,4 00

3 4K

1 ,3 00

3 2K

1 ,2 00

3 0K

1 ,1 00

2 8K

1 ,0 00

2 6K

2 4K

2 2K

2 0K

9 00

Bik es bo ard ed p er y ear

8 00

M o bility d ev ic es bo ard ed per year

7 00

Thin lines show trends for bike and mobility device boardings

2 010

2 011

2 012

Y e ar

6 00

2 013

2 014

Map of bikes boarded by stop 2014

B ike s b o a rd e d p e r ye a r

1 ,5 00

3 6K

M o b ility d e vic e s b o a rd e d p e r ye a r

1 ,6 00

3 8K

14

Fleet Summary and Narrative

As of December 31, 2013, TCAT’s inventory included 49 vehicles with an average age of 8 years. Thanks

to federal stimulus funds, TCAT was able to purchase 15 new buses for delivery in 2011. No new vehicles

were added in 2012 through 2014. In 2014, four buses were retired from the fleet: mini-buses 610 and

611 were retired due to frame corrosion, the trolley (bus 73) was past its useful life and becoming increasingly unreliable, bus 201 was involved in an accident and retired due to structural damage.

As 2014 drew to a close, TCAT had 18 vehicles (the 2001 Nova and 2002 New Flyer series, the 30’ International, “Old 914” and the remaining Ford mini-bus (“T-kitten”) that were past their FTA suggested

retirement age. This represents just over 1/3 of the fleet. By early 2015, two 40-foot buses and two minibuses are scheduled to be delivered; however, TCAT still faces a major hurdle in terms of financing the

replacement of these old buses and potentially restoring the fleet to the 54 buses of 2012. The table at

the bottom of the page shows TCAT’s fleet as of Dec 31, 2014, while the bubble chart below shows the

number of buses in each series and the years remaining to the FTA recommended retirement age.

TCAT Fleet: Number of buses by series and age to retirement

2 0 1 1 G illig

8 B u se s

‘0 7 Int’l

1 Bus

‘0 6 Ford

1 Bus

2 0 0 2 N e w F lye r

7 B u se s

2 0 0 9 G illig

2 B u se s

2 0 1 1 O rio n

7 B u se s

‘9 1 Orion

1 Bus

2 0 0 7 G illig

3 B u se s

2 0 0 6 G illig

1 1 B u se s

2 0 0 1 N o va

8 B u se s

Years to retirement

-12

8

TCAT Bus fleet by series

914

Body

Total # of Bus Age in Replacement

Manufacturer Power

Buses

Years

Year Length (ft.)

1

23

2003

35

O rion

D ies el

101 - 108

N o va

D ies el

8

13

2013

40

37

41

202-204, 206-209

N ew F ly er

D ies el

7

12

2014

40

39

38

601-608

G illig

D ies el

8

8

2018

40

38

28

612

F ord

G as

1

8

2013

23

16

6

613-615

G illig

H y brid

3

8

2018

40

38

28

701-703

G illig

H y brid

3

7

2019

40

38

28

704

In tern ational

D ies el

1

7

2014

30

22

11

901-902

G illig

D ies el

2

5

2021

40

38

28

1102-1103

G illig

H y brid

2

3

2023

40

38

28

1104-1108

G illig

D ies el

6

3

2023

40

38

28

1110-1116

O rion

D ies el

7

3

2023

40

36

41

Bus Numbers

Stands

Seats (# riders)

35

20

15

The table on pages 15-16 has details for each bus on fuel efficiency, parts costs, labor hours and reliability (road calls). While there is quite a lot of variation in each series, it is clear that certain patterns emerge among series. For example, among full-sized buses, the 2011 hybrids and the 2006 and

2009 Gilligs tend to have low parts costs and labor hours and fewer road calls per distance traveled

as compared to other bus series. On the other hand, the table below suggests that the 2001 Nova’s

showed their age in 2014; these vehicles are the most costly to maintain in terms of parts cost, labor time, and road calls/ disruptions to service. The trolley was retired part of the way through

2014, but before it left the fleet, it was one of the poorest performing buses by about any measure.

Principal maintenance metrics for each individual bus, by vehicle series

B u s in f o

M ilea ge

S eries

B u s No.

91 O rion

914

Ford Vans

(2006)

Gillig (2006)

New Flyer (2002)

Nova (2001)

Tro lle y

M iles

Tra veled

2 5 ,0 3 9

Fu el

G a llon s

M iles

of Fu el

per

Us ed

G a llon

6 ,4 7 6

3 .8 7

M a in ten a n c e

L a bor

Hou rs

Cos t of

P a rts

P a rts

Cos t per

M ile

3 1 3 .0 $

7 ,8 5 9

$ 0 .3 1

Other

M a jor

R oa d

Ca lls

M in or

R oa d

Ca lls

R d.

Ca lls /

1 K M i.

8

6

0 .6

73

2 ,0 2 1

643

3 .1 4

9 2 .8 $

1 2 ,3 7 5

$ 6 .1 2

0

1

0 .4 9

101

2 6 ,6 5 3

6 ,4 2 4

4 .1 5

5 7 3 .1 $

2 4 ,4 3 5

$ 0 .9 2

13

8

0 .7 9

102

1 1 ,8 9 3

3 ,4 9 9

3 .4 0

3 9 3 .6 $

3 9 ,8 8 5

$ 3 .3 5

4

6

0 .8 4

103

2 7 ,9 5 2

7 ,3 4 7

3 .8 0

4 1 8 .2 $

3 4 ,1 5 7

$ 1 .2 2

3

5

0 .2 9

104

2 3 ,1 5 2

5 ,7 4 0

4 .0 3

5 4 5 .7 $

3 7 ,4 7 2

$ 1 .6 2

5

14

0 .8 2

105

3 7 ,7 0 6

1 0 ,1 1 7

3 .7 3

2 6 6 .1 $

1 8 ,3 9 8

$ 0 .4 9

4

2

0 .1 6

106

1 3 ,0 6 4

3 ,5 9 6

3 .6 3

3 0 9 .7 $

3 2 ,3 0 7

$ 2 .4 7

5

1

0 .4 6

107

3 5 ,9 8 6

9 ,0 2 4

3 .9 9

3 0 4 .8 $

1 7 ,0 1 4

$ 0 .4 7

8

1

0 .2 5

108

TO TAL

3 7 ,5 4 0

1 0 ,0 4 0

3 .7 4

3 2 9 .3 $

1 4 ,8 9 8

$ 0 .4 0

2 1 3 ,9 4 6

5 5 ,7 8 7

N /A

AVG .

2 6 ,7 4 3

6 ,9 7 3

3 .8 4

3 9 2 .6 $

2 7 ,3 2 1

201

2 1 ,4 1 9

5 ,4 5 0

3 .9 3

3 1 6 .7 $

202

3 5 ,0 2 6

9 ,0 0 3

3 .8 9

3 4 4 .4 $

203

3 6 ,8 5 3

9 ,0 8 8

4 .0 6

204

3 2 ,6 6 1

8 ,6 6 6

3 .7 7

206

2 7 ,0 9 9

7 ,1 7 1

207

3 6 ,8 3 0

208

3 3 ,0 2 1

209

TO TAL

AVG .

3 2 ,5 4 5

601

602

5

2

0 .1 9

47

39

N /A

$ 1 .0 2

5 .8 8

4 .8 8

0 .4 0

1 0 ,4 7 4

$ 0 .4 9

5

12

0 .7 9

1 9 ,0 5 7

$ 0 .5 4

7

5

0 .3 4

3 1 5 .0 $

1 5 ,1 7 8

$ 0 .4 1

6

9

0 .4 1

2 9 5 .6 $

2 1 ,1 3 5

$ 0 .6 5

8

4

0 .3 7

3 .7 8

3 3 5 .8 $

2 2 ,9 4 3

$ 0 .8 5

1

6

0 .2 6

9 ,3 6 5

3 .9 3

2 2 8 .2 $

1 7 ,3 9 1

$ 0 .4 7

4

8

0 .3 3

8 ,5 6 8

3 .8 5

2 6 7 .1 $

3 0 ,5 1 3

$ 0 .9 2

6

9

0 .4 5

3 7 ,4 5 3

9 ,9 3 5

3 .7 7

3 1 1 .3 $

2 0 ,1 7 7

$ 0 .5 4

2 6 0 ,3 6 2

6 7 ,2 4 6

N /A

8 ,4 0 6

3 .8 7

3 0 1 .8 $

1 9 ,6 0 9

3 3 ,5 3 0

8 ,2 7 8

4 .0 5

3 2 8 .9 $

3 9 ,5 3 3

1 0 ,6 1 9

3 .7 2

3 1 9 .0 $

603

4 1 ,4 9 0

1 0 ,4 1 7

3 .9 8

604

4 1 ,9 1 7

1 0 ,3 3 2

605

3 7 ,6 9 3

9 ,8 8 7

606

4 1 ,3 8 7

607

3 9 ,9 7 0

608

TO TAL

AVG .

3 1 4 0 .4

$ 2 1 8 ,5 6 7

N /A

2

5

0 .1 9

39

58

N /A

$ 0 .6 0

4 .8 8

7 .2 5

0 .3 7

1 3 ,6 5 8

$ 0 .4 1

0

4

0 .1 2

2 2 ,2 9 2

$ 0 .5 6

5

12

0 .4 3

2 6 5 .0 $

1 2 ,8 7 6

$ 0 .3 1

0

3

0 .0 7

4 .0 6

2 6 4 .0 $

1 3 ,3 7 0

$ 0 .3 2

2

2

0 .1 0

3 .8 1

3 7 1 .2 $

1 3 ,5 3 0

$ 0 .3 6

4

1

0 .1 3

1 0 ,5 6 8

3 .9 2

3 1 8 .6 $

1 4 ,5 7 6

$ 0 .3 5

3

4

0 .1 7

1 0 ,1 2 7

3 .9 5

2 7 3 .7 $

1 3 ,4 5 7

$ 0 .3 4

0

5

0 .1 3

4 0 ,1 7 3

9 ,9 9 7

4 .0 2

3 3 5 .1 $

1 6 ,1 9 6

$ 0 .4 0

1

6

0 .1 7

3 1 5 ,6 9 3

8 0 ,2 2 4

N /A

15

37

N /A

3 9 ,4 6 2

1 0 ,0 2 8

3 .9 4

3 0 9 .4 $

1 4 ,9 9 4

$ 0 .3 8

1 .8 8

4 .6 3

0 .1 6

610

1 0 ,0 2 3

1 ,5 3 6

6 .5 3

1 7 .7 $

510

$ 0 .0 5

0

0

0 .0 0

612

3 3 ,3 5 2

4 ,8 1 3

6 .9 3

2 1 9 .1 $

1 1 ,3 7 7

$ 0 .3 4

0

8

0 .2 4

TO TAL

4 3 ,3 7 5

6 ,3 4 9

N /A

2 3 6 .8 $

1 1 ,8 8 7

0

8

N /A

AVG .

2 1 ,6 8 8

3 ,1 7 4

6 .7 3

1 1 8 .4 $

5 ,9 4 3

0 .0

4 .0

0 .1 2

2 4 1 4 .1

2 4 7 5 .4

$ 1 5 6 ,8 6 9

$ 1 1 9 ,9 5 3

N /A

N /A

N /A

$ 0 .2 0

16

B u s in f o

Hybrids (2007)

Hybrids (2006)

S eries

Orions (2011)

Gilligs (2011)

Hybrids

(2011)

Gillig (2009)

Int'l

Fleet

Diesel

Hybrid

Ford Vans

M ilea ge

B u s No.

M iles

Tra veled

Fu el

G a llon s

M iles

of Fu el

per

Us ed

G a llon

M a in ten a n c e

L a bor

Hou rs

Cos t of

P a rts

P a rts

Cos t per

M ile

Other

M a jor

R oa d

Ca lls

M in or

R oa d

Ca lls

R d.

Ca lls /

1 K M i.

613

614

28,810

6,297

4.58

263.9 $

8,446

$0.29

3

5

0.28

27,239

5,891

4.62

219.9 $

19,116

$0.70

1

3

0.15

615

24,402

5,516

4.42

325.3 $

20,808

$0.85

4

10

0.57

TOTAL

80,451

17,704

N/A

809.1 $

48,370

8

18

N/A

AVG.

26,817

5,901

4.54

269.7 $

16,123

$0.60

2.67

6.00

0.32

701

27,841

6,241

4.46

298.7 $

9,862

$0.35

1

5

0.22

702

22,776

4,984

4.57

201.5 $

13,394

$0.59

2

3

0.22

703

27,729

6,224

4.46

181.4 $

11,489

$0.41

3

6

0.32

TOTAL

78,346

17,448

N/A

681.7 $

34,746

6

14

N/A

AVG.

26,115

5,816

4.49

227.2 $

11,582

$0.44

2.00

4.67

0.26

704

17,318

2,332

7.43

252.0 $

11,596

$0.67

1

4

0.29

901

38,101

10,048

3.79

233.4 $

9,808

$0.26

3

6

0.24

902

TOTAL

33,252

8,600

3.87

224.4 $

17,172

$0.52

4

3

0.21

71,353

18,648

N/A

457.8 $

26,980

7

9

N/A

AVG.

35,677

9,324

3.83

228.9 $

13,490

$0.38

3.50

4.50

0.22

1102

35,901

7,985

4.50

222.8 $

14,345

$0.40

9

0

0.25

1103

TOTAL

35,732

8,005

4.46

174.7 $

7,682

$0.21

4

3

0.20

71,633

15,990

N/A

397.4 $

22,026

13

3

N/A

AVG.

35,817

7,995

4.48

198.7 $

11,013

$0.31

6.50

1.50

0.22

1104

36,825

9,975

3.69

280.5 $

14,301

$0.39

2

4

0.16

1105

41,524

11,161

3.72

368.9 $

15,826

$0.38

4

13

0.41

1106

45,942

12,707

3.62

233.2 $

14,767

$0.32

11

8

0.41

1107

40,747

11,353

3.59

258.0 $

15,340

$0.38

7

4

0.27

1108

39,481

10,583

3.73

313.6 $

11,315

$0.29

6

7

0.33

1109

39,780

10,315

3.86

270.8 $

12,328

$0.31

6

9

0.38

TOTAL

244,299

66,094

N/A

1725.0 $

83,878

36

45

N/A

AVG.

40,717

11,016

3.70

287.5 $

13,980

$0.34

6.00

7.50

0.33

1110

40,817

11,425

3.57

303.6 $

18,610

$0.46

4

10

0.34

1111

37,993

10,658

3.56

312.7 $

18,307

$0.48

7

13

0.53

1112

41,292

11,558

3.57

212.8 $

10,447

$0.25

2

3

0.12

1113

39,237

10,742

3.65

312.2 $

13,060

$0.33

4

9

0.33

1114

38,519

10,638

3.62

209.4 $

8,682

$0.23

2

8

0.26

1115

41,231

11,596

3.56

248.9 $

9,279

$0.23

5

13

0.44

1116

TOTAL

35,894

10,345

3.47

167.5 $

7,877

$0.22

274,983

76,961

N/A

1767.0 $

86,261

AVG.

39,283

10,994

3.57

252.4 $

12,323

1,698,819

431,901

31,726

8,105

1,425,014

374,411

AVG.

34,334

9,075

3.81

TOTAL

230,430

51,142

N/A

AVG.

28,804

6,393

4.51

236.0 $

TOTAL

43,375

6,349

N/A

AVG.

10,844

1,587

6.83

TOTAL

AVG.

TOTAL

N/A

N/A

N/A

N/A

N/A

0

8

0.22

24

64

N/A

3.43

9.14

0.32

N/A

204

306

N/A

15,656

$0.50

3.83

5.70

0.30

N/A 12,637.6 $ 724,338

N/A

177

263

N/A

17,384

$0.51

4.29

6.32

0.31

1,888.2 $ 105,142

N/A

27

35

N/A

13,143

$0.46

3.38

4.38

0.27

236.8 $

11,887

N/A

0

8

N/A

17

59.2 $

2,972

$0.27

0.00

2.00

0.18

N/A 14,762.6 $ 841,367

3.93

273.8 $

302.1 $

N/A

$0.31

Bus 703

R an k 38

Bus 614

R an k 39

Bus 604

R an k 50

Bus 608

R an k 36

Bus 1109

R an k 34

Bus 612

R an k 48

Bus 902

R an k 32

Bus 607

R an k 47

1105

14

Bus 1114

R an k 40

Bus 207

R an k 33

Bus 1103

R an k 51

Bus 603

R an k 49

208

11

101

104

204

10

Bus 1113

R an k 19

Bus 107

R an k 24

206

13

602

12

Bus 203

R an k 21

Bus 1104

R an k 31

Bus 1107

R an k 23

Bus 108

R an k 22

Bus 209

R an k 20

Bus 610

R an k 52

Bus 701

R an k 35

102 73

201

106

615

Bus 1115

R an k 25

202

15

1111

Bus 601

R an k 37

Bus 1106

R an k 26

1110

16

103

Bus 914

R an k 17

Bus 704

R an k 18

Bus 1108

R an k 27

Bus 105

R an k 28

Bus 605

R an k 30

Bus 613

R an k 41

Bus 702

R an k 29

Bus 1116

R an k 42

Bus 606

R an k 43

Bus 901

R an k 44

Bus 1112

R an k 46

Bus 1102

R an k 45

Bus ranking by bus number - larger circles indicate a higher ranking.

The data on the previous pages were used to create a ranking of each bus in terms of its performance

in 2014. The four factors considered in this ranking are fuel efficiency, labor hours (mechanics) per 1,000

miles driven, parts costs per 1,000 miles driven, and road calls per 1,000 miles driven. The lowest ranked

bus was #102 – a 2001 Nova (see center of graphic above). This bus traveled less than 12,000 miles in

2014, spending several months in Syracuse for dealer repair. The 102 required an engine replacement,

transmission repair, AC system repair, among other things. This combination of high cost of parts, significant labor hours and low miles traveled shows how an old bus such as the 102 can begin to turn into

a financial liability for TCAT. Not only that, but the 102 had the worst road call ranking – as it required

road-side assistance from maintenance staff every ~1,200 miles. One unfortunate pattern that we began to see in the 2013 data is that the 2011 Gilligs and Orions are not as highly ranked as they could be.

This is because that, while the parts costs and labor hours are lower than older buses, the fuel efficiency

is less than stellar and the number of road calls is high for such new buses. TCAT staff looked into this

problem and discovered that many road calls on the 2011 buses are due to problems with check engine

lights. The DEF (Diesel Exhaust Fluid) system, which increases combustion efficiency, triggers the check

engine light and reduces the buses’ power output. This, in turn, requires that the buses be brought back

to the garage. Other agencies have had to deal with such sensitive electronics in their newer buses as

well.

The best bus in the ranking was a “T-kitten”, followed closely by one the two 2011 hybrids. The smaller

T-kittens often rank higher due to better gas mileage; there is also the fact that these Ford Vans use

18

many basic automotive parts that can be acquired very inexpensively directly from a consumer parts

supplier, helping to keep their parts cost down. The 2011 hybrids are about 23% more fuel efficient than

the other full-sized 2011 buses. They also had relatively low parts costs and labor hours in 2014. The

“middle-age” diesel buses (2006 and 2009 Gilligs) seem to be better performing than older generation

hybrids (2006 and 2007). The hybrids have more (electronic) parts than the diesels and replacing these

parts when they fail adds to labor hours. The four metrics and the final ranking of vehicles by series are

displayed in the table below.

Bus metrics and ranking by bus series - green cells indicate better performance.

Miles per

Gallon

Labor Hours/

1,000 Miles

Road Calls/

1,000 Miles

Total Rank

(higher is better)

F ord V ans ('06)

6.7

4.2

$

H y brids ('11)

4.5

5.6

$

196

0.12

50

307

0.22

48

G illig ('06)

3.9

7.9

$

381

0.16

38

G illig ('09)

3.8

6.4

$

387

0.22

38

H y brids ('07)

H y brids ('06)

4.5

8.7

$

452

0.25

34

O rions ('11)

4.5

10.2

$

616

0.33

30

3.6

6.4

$

313

0.32

28

G illigs ('11)

3.7

7.1

$

344

0.33

26

Int'l ('07)

7.4

14.6

$

670

0.29

18

O rion ('91)

3.9

12.5

$

314

0.56

17

N ew F ly er ('02)

3.9

9.7

$

609

0.39

16

N ova ('01)

3.8

17.6

$

1,368

0.47

12

3.1

3.93

45.9

8.7

$

$

6,123

313.70

0.49

0.3

2

mid-point = 26.5

Bus Series

Trolley ('01)

Fleet Average

Parts Cost/

1,000 Miles

The graph below shows the year-to-year patterns in parts costs per mile and road calls per mile.

It shows that road calls dropped off steeply in 2011 as 15 new buses joined the fleet. The influx of

new buses also had a downward impact on the parts cost per mile. 2014 brought a jump in road

calls and parts costs, indicating that the current fleet is aging and becoming more expensive to

maintain. The data from 2014 seem to indicate that as buses (with the exception of 914) pass their

12-year FTA life expectancy, parts and labor costs may not rise in a gradual fashion, but rather

jump up relatively quickly. Clearly, buses in the Nova series will need to be retired as new buses are

gradually delivered in 2015 and 2016 (at which point the Novas will be 15 years old). Bus replacement is a top priority of TCAT management.

Parts costs and road calls per revenue mile for 2009-2014.

0.5

V a lue

0.4

0.3

0.2

0.1

Parts C o s t/ M ile

R o ad C alls / 1K M iles

2009

2010

2011

2012

Y ear

2013

2014

19

Road Calls

While the revenue miles traveled by TCAT

buses stayed essentially unchanged in

2014, the number of road calls per year increased from 382 in 2013 to 510 in 2014.

The number of major road calls in 2014

was the highest since 2010 (512 road calls)

and road calls per revenue mile was the

highest since TCAT began systematically

tracking road calls in 2007 (see chart on

this page). The older buses tended to have

higher road calls – the trolley, the 1991 Orion and the 2001 Novas all had high road

call rates. However, the 2011 buses had

higher than expected rates of road calls.

Month

Year

2008

2009

2010

2011

2012

2013

2014

Jan

24

27

25

37

25

23

27

Feb

25

28

30

44

15

26

26

Mar

30

29

27

25

30

15

23

Apr

21

20

33

32

21

17

27

May

17

24

19

27

32

24

44

Jun

26

24

32

41

25

24

31

Jul

31

15

32

20

25

25

34

Aug

28

41

26

27

30

29

32

The reason that these later models have

higher road calls stems from a push by the

Sep

30

28

41

20

27

42

41

EPA to instate stricter emissions standards

for heavy-duty diesel engines. In order to

Oct

32

33

31

13

14

23

32

meet these standards, engine manufacturers like Cummins added new emissions sysNov

19

28

35

32

25

23

36

tems and sensors to their transit bus line of

products. In addition to a catalytic converter,

37

Dec

34

30

23

19

21

34

the 2011 buses have a Diesel Exhaust Fluid

(DEF) Dosing Valve (which allows a fine mist Average RC/ 27

28

30

28

24

24

32

100k Miles

of fluid to be sprayed into the hot exhaust

stream) and a particulate filter to decrease Total Yearly 135K 144K 143K 143K 131K 132K 132K

Rev. Miles

the fine particulate emissions. Each of these

components has sensors that trigger the check engine light in the driver’s compartment and reduce a

bus’s power output. This in turn triggers a road call. A mechanic may then try to clear the error message

through a process called regeneration, where the particulate filter is heated to oxidize excess particulates. This can solve the issue and allow the bus to continue to operate, but unfortunately leads to missed

trips because it takes about an hour to complete. Often, however, the entire particulate filter needs to be

replaced at a cost of several thousands of dollars. A look into the prevalence of this problem showed that

at least 65 of the 185 road calls in the 2011 buses during 2014 were directly due to emissions systems

problems. As old buses are replaced by newer buses that meet the emissions standards, TCAT hopes that

new generation of emissions technology is less prone to these types of problems that our mechanics

have been grappling with the past couple years.

Road calls and preventative maintenance of buses are connected in an inverse relationship: as fewer

preventative maintenance services are performed on-time, the likelihood of a bus breaking down on the

road increases. And the more mechanics that are required to travel to a road call, the less time is available for keeping up with the preventative maintenance program. A look at the data from 2008 through

2014, shows that, as expected, the number of road calls and the on-time preventative maintenance rate

are negatively correlated.

Bus Series

Road calls per 100,000 revenue mile for 2014 by principal bus series.

Nova ('01)

47.4

New Flyer

Hybrids

('02)

Gillig ('06) ('06)

39.2

16.5

33.3

Hybrids

Hybrids

('07)

Gillig ('09) ('11)

25.3

22.3

22.3

Gilligs

('11)

Orions

('11)

32.7

32.0

20

2014 Preventative maintenance on time performance

Overdue PM Services

2014

Jan

On time PM services

Average Miles Overdue: 528

Feb

1,196

Mar

1,152

Apr

1,266

May

895

Jun

71

Jul

Aug

1,111

Sep

3,506

Oct

3,711

Nov

2,309

Dec

141

0

2

4

6

8

10

12

14

16

18

20

22

24

O n Tim e / O v erdue Preventative Maintenance Services per Month

Preventative Maintenance and Inspections

26

28

30

2014 DOT Inspections of

TCAT Buses

It was a difficult year for TCAT’s maintenance department. With a

large increase in road calls, an aging fleet, and a dwindling spare

ratio toward the end of the year, the preventative maintenance program suffered. As can be seen in the graph above, the rate of on time

services varied quite a bit month-to-month. July was the only month

with a 100% on time preventative maintenance performance. Other

months were more challenging for the maintenance department, especially the Aug-Oct period, which coincided with significant numbers of missed trips. During these three months, the maintenance

department dealt with five buses sent away for warranty/dealer repair, five engine replacements or overhauls, and numerous problems

with emissions systems and performance issues. These constraints

impacted the ability of the maintenance staff to keep up with the

preventative maintenance services. Overall in 2014, 63% of the preventative maintenance measures were done on time and 71% were

done within a 10% buffer. This leaves room for improvement in 2015

and hopefully as TCAT’s spare ratio returns to the 20% goal and

some of the mechanically worst buses are retired, the maintenance

team with be in a better place this time next year.

On the other hand, the maintenance staff was able to maintain an

excellent DOT inspection record – just a hair under a 90% pass rate

for 2014 and an 18-month moving average of close to 92%. It should

be noted that most transit agencies do not have to do NY DOT inspections; the extra burden on DOT inspections is a result of TCAT’s

somewhat unique status as a non-profit.

21

Accidents/incidents

The number of accidents and incidents involving TCAT buses rose in 2014. This is a trend that TCAT supervisors are taking very seriously. The problem has been analyzed extensively in-house and some interesting

patterns have emerged. First, there were only three major accidents/incidents in 2014 - only one of which

was preventable. Although every major accident is a painful event, this is a relatively low number for more

than a million and a half revenue miles traveled in 2014 on local streets and roads. On the other side of the

coin, there were 24 negligible accidents and incidents that resulted in no injuries, no damage to the bus,

and no insurance claims. The rest of the incidents and accidents (a total of 65) could be classified as “minor”, characterized by fender-benders, mirror clips, or other incidents with little overall damage. A second

interesting trend was that while preventable accidents rose by 8% from 2013, unpreventable accidents

rose by 150%. This indicates that TCAT drivers were not the cause of the upward trend in accidents; rather

it was the context in which the drivers operated that seemed to present more unexpected and unavoidable challenges. As an example, the one-way lane on East Avenue during the Klarman Hall construction

was so narrow that there were only inches between a bus’s mirror and the construction fence, and the

traffic gates erected on either end of this stretch of road came down on top of a bus at least twice during

2014. Anecdotally, traffic on Ithaca’s streets has been trending upwards and the winter of 2014 was one

of the coldest and harshest on record. There were also more incidents involving passengers falling while

getting on or off a bus or running up to a bus as it was pulling away from a stop. TCAT dispatchers and

supervisors work to alert drivers to detours, other accidents or areas of difficult passage when they are on

the road. Besides an extensive training when they are hired at TCAT, drivers are given an annual refresher

training that covers all aspects of safety.

The map below shows accident and incident hotspots in 2014. The place with the most accidents is the

TCAT garage where several small incidents occurred due to tight spaces. The “accident/incident” intensity

measure is scaled with the 9 accidents at TCAT as the maximum. Unsurprisingly, heavily traveled /narrow

corridors through Downtown Ithaca, Collegetown and Cornell were the main hot spots in 2014.

22

Fuel Costs and Usage

In 2014, TCAT used close to 432,000 gallons of fuel – 98.5% of which was diesel - at a cost of $1,352,473. In

2014, diesel prices were lower than 2013 and 2012; the fourth quarter of 2014 had the cheapest fuel prices

since 2010. TCAT paid an average of $3.19 per gallon in 2014, a decrease of almost 7% from 2013.

Estimates of the efficacy of transit systems in reducing greenhouse gases (GHG) as compared to the use

of single occupancy vehicles (SOV) require many assumptions and should be taken with a grain of salt.

However, it is instructive to take a quick look at TCAT’s performance in this regard. Using TCAT’s average

fleet MPG for 2014, the number of miles that TCAT buses traveled in revenue service and passenger miles

traveled for 2014, a TCAT bus gets the equivalent of 28.2 miles per gallon (MPG) when compared to a

SOV. The US Department of Transportation estimates that for 2013 the average MPG for light duty, short

wheelbase vehicles (passenger cars) was 23.4 and 17.2 for light duty, long wheel base vehicles (large cars,

pickups and SUVs). If we assume that the fleet of passenger vehicles in Tompkins County is an equal mix

of these two categories, then TCAT is potentially reducing the amount of fuel burned by about 170,900

gallons/year or ~1,520 metric tons of CO2/year. Of course, we know that not all passenger vehicles are

SOVs, but during peak commuting hours when TCAT operates its maximum service, the majority of cars

on the road are SOVs (ITCTC – 2035 LRTP). It is important to note that although transit can contribute to a

reduction in GHG, there are many other benefits to a local community of having a strong transit system.

Average fuel prices and gallons purchased by quarter: 2010-2014

1 2 0K

$ 4 .5 0

1 1 0K

$ 4 .0 0

1 0 0K

8 0K

7 0K

$ 3 .0 0

6 0K

5 0K

G allons Purchased

3 0K

2013 Q4

2013 Q3

2013 Q2

2013 Q1

2012 Q4

2012 Q3

2012 Q2

2012 Q1

2011 Q4

2011 Q3

2011 Q2

2011 Q1

2010 Q4

2010 Q3

2010 Q2

2010 Q1

$ 2 .0 0

2014 Q4

4 0K

2014 Q3

Measure Names

Average Fuel Pric e

2014 Q2

$ 2 .5 0

2014 Q1

Average Fuel Price

$ 3 .5 0

Gallons of Fuel Purchased

9 0K

Operating and Capital budgets

Each year, TCAT staff and board members create an operating and capital budget for the following year

and revise the 5-year budget projections. With rising personnel costs and health insurance premiums, and

shrinking or flat-lined federal, state, and local funding, TCAT continues to face an extremely challenging

budget environment. In the past couple years, TCAT has not been able to keep up with bus replacements

or expand service as much as increasing demand warrants. Transit agencies all over the country have felt

the squeeze, however TCAT’s postition as a non-profit means it does not have some of the financial tools

available to large agencies, such as the ability to levy taxes. The following discussion first looks at TCAT’s

sources of revenue for its operating budget, then at its operational expenditures, and finally at the capital

budget.

23

TCAT’s total operating revenue for 2014 was $13,243,450. As can be seen in the chart below, TCAT depends heavily on the NY Statewide Mass Transportation Operating Assistance (STOA) program. STOA is

administered by NY Department of Transportation and the amount received by each transit provider is

based on the number of rides and revenue miles per year. The Cornell bulk fare program provided $2.6

million in 2014; close to 3.1 million rides were taken in 2014 using Cornell credentials. Non-Cornell passenger fare revenue came in third place at $1.6 million – this represents over 1.2 million rides. This difference between the average price of a CU fare ($0.86/ride) and the average of the other fare groups ($1.30/

ride) led to negotiations between the TCAT Board of Directors and the Cornell administration. In an initial

agreement, Cornell agreed to pay more for its bulk fare payment. Currently, both sides are continuing to

meet to achieve a long-term Memorandum of Understanding about Cornell’s bulk fare payments.

TCAT partner’s (Tompkins County, the City of Ithaca, and Cornell University) each contributed $829,432

in 2014 – representing a total of 18.8% of total revenue. While this local support is critical in allowing

TCAT to provide a high level of service, the graph at the bottom of the page shows that the contribution

has been flat since 2009, while the percent of TCAT’s budgeted revenue each partner share represents

has been declining in recent years. In addition, the Town of Ithaca which had been contributing $50,000

annually to the operating budget, decided in 2014 to cease contributions despite Zone 1 service from

numerous urban and rural routes. On a positive note, in 2014, TCAT received its first revenue from a 0.25%

increase in the County mortgage recording tax (MRT). The revenue from the first year was $245,000 and is

expected to rise in subsequent years. However, TCAT’s budget committee hopes to allocate a large portion (if not all) of the MRT revenue to the capital budget, which needs more funding (see next page).