wwwtada.org - Texas Automobile Dealers Association

advertisement

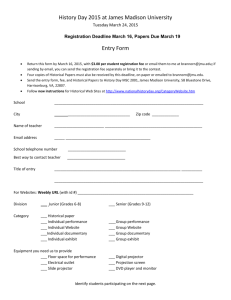

Texas Automobile Dealers Association 1108 Lavaca, SuIte 800 Austin, Texas 78701 -21 81 (512) 476-2686 Fax: (512) 322-0561 wwwtada.org March 1, 2010 Ms. Amanda Crawford Chief, Open Records Division Office of the Attorney General P. 0. Box 12548 Austin, Texas 78711 Via Facsimile 512-463-2092 and U. S. Mail Re: Open Records Request from Mr. Steve Wolfert Requested Information: Maximum Document Fee Submitted by Stated Dealer to OCCC for Review OCCC File No.: OR-10-090 Dear Ms. Crawford: Please accept these public comments as allowed by Texas Government Code § 552.304 on behalf of the members of the Texas Automobile Dealers Association (TADA) as well as the members of the Texas Recreational Vehicle Association (TRVA). Background On February 1, 2010, the Office of Consumer Credit Commissioner (OCCC) received an open records request from Mr. Steve Wolfert, 1 amended on February 11, 2010, that requested a listing of auto dealer document fees reviewed by OCCC since implementation of H.B. 3621 that went into effect 9/1/2009, including: 1. Dealer Name ‘Mr. Wolfert’s first request included a “listing of the auto document fees approved by OCCC since implementation of HB 3621 that went into effect 9/1/2009.” The OCCC explained to Mr. Wolfert that the agency does not approve fees but may only review them. Pagel Serving the franchised new car and truck dealers of Texas since 1916 T A D A 2. Dealer Address 3. Maximum document fee submitted by stated dealer to OCCC for review. According to Ms. Hobbs, Assistant General Counsel for the OCCC, the 1,260 names and addresses of dealers who have submitted a Documentary Fee Request Form to the OCCC have been provided to Mr. Wolfert via first class mail and e-mail, as of February 16, 2010. Notice to the dealers regarding Mr. Wolfert’ s request and the OCCC’ s Open Records Request to your office was subsequently sent to the dealers on February 16, 2010, allowing for a response to th your office no later than the 10 business day after the date the person receives the notice. 2 In accordance with OAG ruling 0R2010-00340, the OCCC withheld the maximum fee documentary amounts from the requestor and referred this information to your office for an Open Records Decision on the potential confidential information regarding the requested information by Mr. Wolfert and whether the maximum document fee submission is excepted from disclosure under the Texas Public Information Act (TPIA). The requested information submitted by a dealer for the OCCC to review is a concern because of its proprietary nature for each franchised motor vehicle dealer and recreational vehicle dealer in Texas, regardless of whether the dealer, to date, has submitted a request to change its documentary fee amount to the OCCC. As such, TADA and TRVA, on behalf of each of its member dealers, request that the open records request from Mr. Wolfert as to the document fee submitted, or to be submitted in the future by a dealer for OCCC review, be denied and the document fee amount remain confidential. Legislative Background The documentary fee 3 is an allowable charge for services rendered for or on behalf of a retail buyer by a dealer for handling and processing documents that relate to a motor vehicle sale. th The fee was enacted by the 66 Legislature and became effective in i979. This legislation amended Art. 7.01, Revised Civil Statutes, and added Section (h-i) to read as follows: (h-i) In addition to the provisions of Section (h) of this article, ‘principal balance’ includes a motor vehicle inspection fee and a documentary fee for services actually rendered to, for, or on T Gov’T CODE ANN. § 552.305(d)(2)(B) (Vernon 2004). 2 TEX. FIN. CODE ANN. § 348.006 (Vernon 2006 and Supp. 2009). 3 i979 Tex. Sess. Law Serv., ch. 450, § 1 at 1016. Page 2 behalf of the retail buyer in preparing, handling, and processing documents relating tot he motor vehicle and the closing of the transaction evidenced by the retail installment contract. If a documentary fee is charged: (i) it must be charged to both cash and credit buyers; (ii) it may not exceed $25; (iii) it shall be disclosed on the retail installment contract as a separate itemized charge; and (iv) all preliminary worksheets which are exhibited to the buyer in which the retail motor vehicle retail seller calculates a sale price for the buyer, the buyer’s order, and the retail installment contract shall include in reasonable proximity to the point in the worksheet, buyer’s order, and retail installment contract where the documentary fee is disclosed the amount of the documentary fee to be charged and the following notice in boldface type: (Emphasis added) In 1993, the legislature increased the maximum allowable documentary fee from $25 to $50. In 2009, the 81 Legislature enacted H.B. 3621, effective September 1,2009. This legislation removed the statutory ceiling on the documentary fee and the Texas Finance Code § 348.006 now requires that: (a) The principal balance under a retail installment contract is computed by: (1) adding: (A) the cash price of the motor vehicle; (B) each amount included in the retail installment contract for an itemized charge; and (c) subject to Subsection (c), a documentary fee for services rendered for or on behalf of the retail buyer in handling and processing documents relating to the motor vehicle sale; and (2) subtracting from the results under Subdivision (1) the amount of the retail buyer’s down payment in money, goods, or both. (b) The computation of the principal balance may include an amount authorized under Section 348.404(b). (c) For a documentary fee to be included in the principal balance of a retail installment contract: (1) the retail seller must charge the documentary fee to cash buyers and credit buyers; 1993 Tex. Sess. Law Serv., ch. 62, §2 at 144. Page 3 (2) the documentary fee may not exceed: (A) for a motor vehicle retail installment contract other than a contract for a commercial vehicle, a reasonable amount agreed to by the retail seller and retail buyer for the documentary services; or (B) for a commercial vehicle retail installment contract, an amount agreed to in writing by the retail seller and retail buyer; and (3) except for a buyer’s order or a retail installment contract for a commercial vehicle, the buyer’s order and the retail installment contract must include: (A) a statement of the amount of the documentary fee; and (B) in reasonable proximity to the place in each where the amount of the documentary fee is disclosed, the following notice in type that is bold-faced, capitalized, underlined, or otherwise conspicuously set Out from surrounding written material: “A DOCUMENTARY FEE IS NOT AN OFFICIAL FEE. A DOCUMENTARY FEE IS NOT REQUIRED BY LAW, BUT MAY BE CHARGED TO BUYERS FOR HANDLING DOCUMENTS RELATING TO THE SALE. A DOCUMENT ARY FEE MAY NOT EXCEED A REASONABLE AMOUNT AGREED TO BY THE PARTiES. THIS NOTICE IS REQUIRED BY LAW.” (Emphasis added) Prior to increasing the documentary fee above $50, the retail seller must provide written notice to the commissioner of the maximum amount that the retail seller intends to charge. The commissioner may review the amount for reasonableness. 6 In reviewing a retail seller’s documentary fee for reasonableness, the commissioner is required to take into account the retail seller’s duties under both state and federal law regarding the processing and handling of documents relating to the sale of a motor vehicle. 7 In general, the State of Texas requires a dealer to apply for the vehicle registration and for TEX. FIN. CoDE ANN. § 348.006(e) (Vernon 2006 and Supp. 2009). 6 1d. 7 Page 4 a certificate of title and to file each document necessary to transfer title or register the vehicle. 8 Requiring a dealer to apply for the registration and title for a vehicle that the dealer sells is not an insignificant requirement as it requires a great deal of time and knowledge. The State of Texas does not reimburse the dealer for this requirement nor for the mandated requirement to remit sales tax. 9 The documentary fee is a means to allow a dealer to be partially compensated for this duty. The following listed documents are a sample of documents used in a vehicle retail sale and show the variance that may occur in a transaction. I am not suggesting that each of the following forms will be used in each retail sale; however, it is instructive to show the different state required forms that may be necessary and on which the dealership must have a working knowledge when performing the necessary service for the State of Texas and on which the documentary fee, in part, is based. 1. Application for Registration Purposes Only (VTR-272); 2. Application for Title Only (VTR-131); 3. Application for a Certified Copy of Title (VTR-34); 4. Odometer Disclosure Statement (VTR-40); 5. Application for Texas Certificate of Title (130-U); 6. County of Title Issuance (VTR-136); Statement of Fact for Tax Collector Hearing/Bonded Title (VTR-130-SOF); 7. Affidavit of Heirship for a Motor Vehicle (VTR-262); 8. Prescribed Form for Release of Lien (VTR-266); 9. 10. Additional Liens Statement (VTR-266); 11. Verification of Ownership (VTR-268); 12. Statement of Physical Inspection (VTR-270); 13. Power of Attorney to Transfer Motor Vehicle (VTR-271); 14. Certification of Vehicle Identification Number for Vehicle Located Out-ofState (VTR-272-B); 15. Request for Texas Motor Vehicle Infonnation (VTR-274); 16. Texas Motor Vehicle Transfer Notification (VTR-346); 17. Authorization for Release of Personal Information (VTR-386); 18. Application for Personalized License Plate (VTR-35-A); 19. Application for Specialty License Plates (VTR-999); 20. Rights of Survivorship Ownership Agreement for a Motor Vehicle (VTR 122). As of October, 2009, the Motor Vehicle Title Manual from the Texas Department of Motor Vehicles (formerly TxDOT) was 580 pages. TEx. TRANsP. CODE ANN. § 501.0234(a)(1) (Vernon 2007). 8 Tix. TRANSP. CODE ANN. 9 § 501.0234(a)(2) (Vernon 2007). Page 5 In addition to the various titling documents, the dealership must also calculate and submit registration fees to the state. Today, there are approximately 1600 different registration fees. ° The 1 truck fees are broken down in 100 lb. increments and also factor in tire type. The Texas Department of Motor Vehicle Registration Manual, revised November 2004, is 693 pages. Other state requirements that a dealer must comply with regarding the handling and processing of documents relating to the motor vehicle sale include the Low Income Repair Assistance, Retrofit, and Retirement Program, or LIRAP, implemented by the Texas Commission on Environmental Quality (TCEQ). This program provides fmancial incentives for a replacement vehicle and mandates additional requirements on a participating dealer with respect to paperwork. ’ 1 Electronic e-tags are mandatory, as of October 6, 2009, and while the process is designed to process a tag faster and easier, oftentimes a dealership dedicates hardware and software to this function. Numerous federal requirements are also placed on the dealership, such as the Gramm-Leach Bliley Act.’ 2 In addition the Federal Trade Commission’s Safeguards Rule and Red Flags and Address Discrepancy Rules are imposed on a dealer) 3 The Office of Foreign Assets Control, OFAC, as administered by the U. S. Department of Treasury, prohibits a financial transaction in which a U.S. person may not engage in unless authorized or expressly exempted by statute. As such, a dealership must check the Specially Designated Nationals and Blocked Persons (SDN) list prior to the sale of a motor vehicle. This SDN check may be done through a credit bureau for a fee, paid by the dealership. The list, frequently updated, was 437 pages as of February 25, 2010. In addition, the Federal Trade Commission’s Buyer’s Guide, placed on each used motor vehicle for retail sale as well as demonstrators, must also be completed by the dealership and is another required document relating to a retail sale. A review of the above shows that there are numerous potential documents “relating to a motor vehicle sale.” No one transaction requires the usage of all of the above and additional documents may also be required in addition to those listed. ‘°The 81st Legislature reduced the 1600 registration fees through H.B. 2533, effective September 1, 2011, and most notably simplifies registration fees for a vehicle with a gross weight of more than 6,000 pounds. TEX. HEALTH & SAFETY CODE ANN. 1 ‘ § 382.209 (Vernon Supp 2009). p L. 106-102 (16 C.F.R. Part 313). 2 ‘16 C.F.R. 681. Page 6 Moreover, the on-going employee costs that attend the completion of the documents requires a great deal of knowledge and understanding as well as time and document cost. The Texas Legislature recognized that the documentation necessary to complete a retail sale is costly as well as ever-changing. In order for the legislature to no longer re-visit the cost issue legislatively, it determined to employ a “reasonableness” standard with an agency review and rule 14 making. On February 19, 2010, the Finance Commission voted to adopt 7 TAC § 84.205. Documentary Fee Reasonableness Standards. These rules, expected to be published and to appear in the March 5, 2010, Texas Register, without amendment, are attached for reference, and discuss the elements considered by the agency for a dealership’s documentary fee as well as excluded costs. In reviewing a written notice for an increased documentary fee over $125, the agency review may include an analysis of the resources required by the seller to perform the seller’s duties (See 7 TAC § 84.205(e)(3)). Open Records Decision 0R2010-00340 In October, 2009, Mr. Richard Bischoff tendered an open records request to the OCCC requesting: “For dealers in El Paso County, Texas, copies of any applications made pursuant to the Document Fee Change Request.. as amended on October 15, 2009, limiting the request: “1 intend to limit my request to new car dealers only.” .“ In summary, OR2O1O-00340 determined that the OCCC is to “withhold the information we have marked pursuant to sections 552.110 and 552.137 of the Government Code. The remaining information must be related to the requestor.” The withheld information included any and all dollar amounts submitted, including the requested documentary fee increase amounts as well as contact email addresses provided by the dealers. Based on 0R2010-00340, the information sought by Mr. Wolfert should not be released under the Texas Public Information Act as the information constitutes fmancial and commercial information under Government Code § 552.110. Requested Information is Confidential In determining an amount to charge for a documentary fee, a dealer uses many factors in TEX. FIN. CODE ANN. 14 § 348.006(h) (Vernon Supp 2009). Page 7 making the calculation. These factors include not only the required documents and regulations and statutes with which the dealership must comply, but also the training and personnel costs that go with the understanding of the documents and regulations and statutes as well as the equipment necessary to perform the necessary functions. The documentary fee number may appear as just an amount; however, behind that numerical amount are numerous calculations which incorporate each dealership’s specific proprietary information. Indirectly or directly, each dealership’s calculations may include the payroll as well as benefit for costs many employees, such as the title clerk, the finance and insurance employees, as well as sales personnel, depending upon the structure and responsibilities of the employees as required by each dealership’s management. Indirectly or directly revealing payroll information as well as benefit information could cause certain dealerships to lose valued employees. In addition, the dealership’s cost for equipment, the facility costs, training expenses, and various taxes, just to name a few costs, may be factored into the resources necessary for processing each customer’s paperwork. Dealership expenditures, either directly or indirectly obtained, should not be available to competitors or to the public at large. In addition, this information should not be able to be captured or gleaned by government entities that have the ability to tax property and equipment. Certain dealerships are also able to obtain vendor services, such as computer hardware and software as well as paper products and training, at a discounted amount which allows those dealerships to obtain services at a different rate than other dealerships. These negotiated discounts are frequently agreed upon on the condition that the information remain confidential. The information regarding these agreements should not indirectly be able to be obtained by the general public or by competitors as the dealership could either lose the discounted price or be in breach of the agreement. If anyone from the public, including a dealership’s competition, could obtain the documentary fee calculation from a centralized repository, which in this instance is the OCCC, then the competitive environment regarding the documentary fee is diminished if not removed. Except in rare instances, the sale of a motor vehicle is a negotiated process. The competitive nature of an automobile sale and the negotiated sales process is the model that has been in effect for approximately one hundred years. Whether a dealer charges a documentary fee as well as the amount of the documentary fee, is information best retained at the dealership level for both the consumer as well as the dealership. Page 8 Texas Government Code § 552.110(b) allows that if disclosed commercial or financial information would cause substantial competitive harm, then that information is excepted from § 552.021. The process involved in arriving at an amount to charge for a documentary fee now includes the regulatory requirements in 7 TAC § 84.205. The amount cannot exceed what is necessary to cover the cost of performing the processing and handling of documents required for the sale and fmancing of a motor vehicle. Three critical tests under these new regulations that must be met in order for the charge to be considered “reasonable” are: 1. Allowable; 2. Allocable; and, 3. Prudent business person. In order to satisfy the “allowable” test, the dealership’s cost must be necessary for the proper and efficient financing of a motor vehicle. How a dealership conducts its business and determines what is “proper and efficient” is commercial and financial information. The “allocable” test means that the cost is logically related to or required in the fmancing of the handling and processing of documents relating to the sale and financing of a motor vehicle. Finally, the “prudent business person” standard is the amount a prudent business person would pay in a competitive marketplace. In order to maintain a competitive marketplace, financial and commercial information must be kept confidential. The amount that a prudent business person pays employees, pays for benefits, pays for equipment, allows for in the time it takes to conduct a particular process, are all elements of commercial and fmancial information that are fluid and required to be maintained as confidential in order for a dealership business to remain competitive. A competitive marketplace is necessary for a consumer to obtain a reasonable price and also requires a business not to remain static but continue to find ways to improve. The documentary fee amount fits squarely into the exception allowed under Texas Government Code § 552.110 because the means to arrive at the number involves a dealership’s commercial or financial information. TADA and TRVA also assert that the requested information is otherwise confidential under Texas Govermnent Code § 552.l01.’ If a document is privileged or confidential under the Texas Rules of Civil Procedure or Texas This provision allows that information is excepted from disclosure if it is information t5 considered to be confidential by law, either constitutional, statutory, or by judicial decision. Page 9 Rules of Evidence, those documents are within a category of information that is confidential by other law, as allowed by § 552.101. Texas Rules of Evidence 507 allows a person to claim a privilege or refuse to disclose to prevent other persons from disclosing a trade secret owned by the person. A trade secret is broadly interpreted to include information that would provide a competitor with tremendous advantage. In Miller Paper Co. v Roberts Paper Co., 901 S.W.2d 593 (Tex. App—Amarillo 1995, no writ), former employees of Roberts Paper Company (Roberts), a janitorial, paper, and chemical company, started a competing business called Miller Paper Company. The newly formed Miller Paper Company solicited their former employers’ customers. Roberts maintained a customer list and document known as “the book,” a 52-year compilation of “customer information.” The “customer information” from Roberts was taken by certain of Roberts’ former employees, n/k/a Miller Paper Company. The “customer information” included customer’s name, address, special billing information, delivery sites, infonnation regarding the need for purchase orders, cash on delivery data, and phone numbers. Other information found in the possession of the Miller employees and taken from Roberts included order pads, computer lists with customer names, addresses, and buying preferences, product lists, manufacturer catalogues, and product costs.’ 6 As the court enjoined as confidential the information in Miller Paper Company, the information and data used to determine a documentary fee should also remain confidential in that it includes product costs and employee costs as well as equipment costs and training expenses. Finally, under Texas Rules of Civil Procedure, the requested information would be subject to a request for a protective order under Tex. R. Civ. Pr. 192.6 as the information sought is highly confidential and proprietary and relates to a retail seller’s confidential business expenses, revenues, and practices and should not be provided. Conclusion A dealer has an expectation of privacy of submitted information regarding the documentary fee to the OCCC. The information obtained by the OCCC with respect to the documentary fee is given for the sole purpose for the agency to determine the reasonableness of the requested fee. There is no private right of action’ 7 regarding the documentary fee and since the ‘ 1 6 d at 601-602. TEX. FIN. CODE ANN. 7 ‘ § 348.006(g)(1) (Vernon Supp. 2009). Page 10 commissioner has exclusive jurisdiction to enforce Section 348.006,18 a dealership’s expectation of privacy regarding the documentary fee is reasonable. The process that a dealership must perform in determining a documentary fee amount and the direct and indirect costs that must be factored into the final number, including that fmal numerical amount, are commercial or financial information. TADA and TRVA respectfully request that the requested information remain confidential and not subject to the Texas Public Information Act. Respectfully submitted, Karen Phillips General CounselIEVP Enclosure C: Ms. Laurie B. Hobbs Assistant General Counsel Office of Consumer Credit Commissioner 2601 N. Lamar Blvd. Austin, Texas 78705 Mr. Steve Wolfert 7629 Bryn Mawr Dr. Dallas, Texas 75225 T FIN. CoDE ANN. 8 ‘ § 348.006(1) (Vernon Supp. 2009). Page 11 C. Office of Consumer Credit Commissioner 2. Discussion of and Possible Vote to Take Action on the Adoption of New 7 TAC §84.205, Concerning Documentary Fee Reasonableness Standards, Relating to the Regulation of Motor Vehicle Retail Installment Sales. The purpose of this rule is to provide PURPOSE: reasonableness standards for the agency’s review of a retail seller’s proposed increase to a documentary fee in accordance with House Bill 3621. The bill removes the $50 cap and requires that a documentary fee not exceed a reasonable amount. for handling documents relating to the sale and financing of a motor vehicle. House Bill 3621 authorizes the agency to review the amount of a documentary fee charged for reasonableness and to set standards concerning reasonable amounts. ( RECOMMENDED ACTION: The agency requests that the Finance Commission approve new 7 TAC §84.205 -with changes as previously published in the Texas Register. RECOMMENDED MOTION: I move that we approve new 7 TAC §84.205 with changes as previously published in the Texas Register. 4—25 ADOPT NEW 7 TAC §84.205 Page 1 of 7 Title 7. Banking and Securities Part 5. Office of Consumer Credit Commissioner Chapter 84. Motor Vehicle Installment Sales §‘84. 205 The Finance Commission of Texas (commission) adopts new §84.205, concerning Documentary Fee Reasonableness Standards, with regard to motor vehicle installment sales. The new rule is adopted with changes to the proposal that appeared in the Texas Register on January 8, 2010 (35 TexReg 164). The commission received no written comments on the proposal. The maximum documentary fee for motor vehicle dealers had been $50 for more than 15 years. Due to the rising costs of conducting business, including the additional costs of federal requirements to protect consumer information placed on dealers during this time, the costs of processing motor vehicle retail installment sales contracts has risen and been absorbed by the industry. The 81st Texas Legislature enacted House Bill (MB) 3621 in order to remove the $50 cap on the documentary fee charged on contracts under Chapter 348 of the Texas Finance Code. The bill requires that a documentary fee not exceed a reasonable amount for handling documents relating to the sale and financing of a motor vehicle. Additionally, HB 3621 authorizes the agency to review the amount of a documentary fee charged for reasonableness and to set standards concerning reasonable amounts. The purpose of this rule is to provide reasonableness standards for the agency’s review of a retail seller’s proposed increase to a documentary fee. Due to the complex nature of this issue, the agency conducted two rounds o pre-comment with interested stakeholders. This adoption incorporates suggestions received from these informal comments. Having greatly benefitted from the informal comment process, the resulting adoption provides increased clarity and consistency to licensees regarding the reasonableness standards for documentary fees. Section 84.205(a) provides the statutory authority for the agency’s review of documentary fees under Texas Finance Code, §348.006(e). Subsection (a) also includes applicability language limiting the section to retail sales as defined by the Texas Transportation Code. In response to informal comments received, the following sentence has been added to the end of subsection (a): “A documentary fee may only include costs that are imposed uniformly in cash and credit transactions.” Please refer to the discussion under subsection (d) for full information regarding this addition. Section 84.205(b) describes permissible documentary fee costs, stating that such costs must directly relate to the retail seller’s handling and processing of documents for the sale and financing of a motor vehicle in compliance with state and federal law. Section 84.205(c) discusses the costs directly relating to the sale of a motor vehicle. For a cost directly relating to the sale of a motor vehicle to be included in a documentary fee, it must be incurred either concurrently or after (and not before) the negotiation and preparation of the 4—26 ADOPT NEW 7 TAC §84.205 Page 2 of 7 buyer’s order, the bill of sale, or the purchase agreement. Costs may also directly relate to the evaluation by the retail seller of the creditworthiness of the retail buyer, the completion of the contract, or the perfection of the lien against a motor vehicle. In response to informal comments received, the phrase “and execution” has been deleted from the last sentence in subsection (c), resulting in the middle phrase allowing costs relating to “the completion of the retail installment sales contrac t by the retail seller.” A retail installment sales contract may be prepared and completed in a transaction that ultimately results in a cash sale. in contrast, the execution of a retail installment sales contract only occurs in a financed transaction, and thus, would be considered an excluded finance charge under subsection (d). For further information regarding this deletion, please refer to the discussion under subsection (d). Section 84.205(d) outlines costs excluded from a reasonable documentary fee. Subsection (d) is divided into four paragraphs, providing: (1) the general rule that costs are prohibited from inclusion if incurred after the actual transfer of title or when the title is legally obligated to have been transferred, whichever is earlier (applicable to both the purchased vehicle and any trade-in); (2) the exclusion of the costs associated with negotiation or assignment of the contract; (3) the exclusion of the costs of other parties incurred for the credit evaluation of the retail buyer; and (4) a list of other excluded costs (e.g., advertising, processing of manufacturer or distributor’s rebates). ( In response to informal comments received, the following sentence has been added to the end of subsection. (d)(4): “A documentary fee may not include the cost of prepar ing the Truth in Lending disclosure statement or any other cost that would be considered a finance charge under the Truth in Lending Act (15 U.S.C. §l601-l667f).” This revision has resulted from an analysis of provisions in the Texas Finance Code and the federal Truth in Lending Act. The analysis is outlined in the following paragraphs. As discussed earlier, the Texas Finance Code was recently amended to author ize a motor vehicle dealer to increase its documentary fee. The statutory ceiling for the docum entary fee is a “reasonable” amount. Under Texas Finance Code, §348.006(e), the comniissione r may review the motor vehicle dealer’s documentary fee and may “consider the resources required by the retail seller to perform the retail seller’s duties under state and federal law with respect to the handling and processing of documents relating to the sale and financing of a motor vehicle.” Motor vehicle dealers who engage in retail installment sales transactions for the sale of their motor vehicles include the documentary fee in retail installment sales contracts. Section 348.006(e) allows a motor vehicle dealer to include the cost of resourc es relating to both the sale and financing of motor vehicles. In considering the costs a motor vehicle dealer may include in its documentary fee, the agency must also consider the state and federal regulations that govern how the documentary fee may be included in the retail installm ent sales contract. Congress enacted the Truth in Lending Act (TILA) to ensure that consum ers receive accurate information from creditOrs in a precise and uniform manner that allows them to 4—27 ADOPT NEW 7 TAC §84.205 Page 3 of 7 compare the cost of credit. Rodash v. AIB Mortgage Co., 16 F.3d 1142, 1144 (11th Cir. 1994). TILA applies to credit transactions in which: “The credit is offered or extended to consumers; The offering or extension of credit is done regularly; The credit is subject to a finance charge or is payable by a written agreement in more than four installments; and The credit is primarily for personal, family, or household purposes.” 12 C.F.R. §226.1(c)(1). Virtually every motor vehicle retail installment sales transaction conducted by a Chapter 348 licensee is subject to TILA. TILA provides statutory and actual damages for creditors who fail to disclose in compliance with TILA requirements. In determining what costs may be included in the review of the documentary fee, the agency must be cognitive of the TILA definition of a “finance charge.” One of the core elements of TILA is the disclosure of the finance charge. In order to accomplish its goal of disclosing accurate and useful information regarding the cost of credit, TILA requires creditors to disclose the Annual Percentage Rate (APR) for each transaction. The calculation of the annual percentage rate is largely controlled ly the amount of the finance charge computed under TILA. TILA defines “finance charge” as: “[T]he amount of the finance charge in connection with any consumer transaction shall be determined as the sum of all charges, payable directly or indirectly by the person to whom the credit is extended, and imposed directly or indirectly by the creditor as an incident to the extension of credit. The finance charge does not include charges of a type chargeable in a comparable cash transaction.” 15 U.S.C. §1605. If a fee or charge is considered to be a finance charge under TILA, the fee or charge must be disclosed as a finance charge. TILAimposes a duty on the creditor to disclose the fmance charge in a meaningful, clear, and conspicuous manner. Therefore, if any cost that is a finance charge under TILA is included in the documentary fee calculation, the documentary fee cannot be included in the retail installment sales contract without violating TILA. A documentary fee that includes a fmance charge under TILA would not be a correct disclosure of a finance charge and therefore would result in a TILA violation. In order to be excluded from the TILA definition of finance charge, a cost associated with a documentary fee would have to arise in a comparable cash transaction. This is why the agency has added the requirement in § 84.205(a) that the documentary fee only include costs that are imposed uniformly in cash and credit transactions. The amendment to subsection (d)(4) since the proposal provides a specific exclusion for costs associated with the preparation of the Truth in Lending disclosure statement. This amendment is based on the Official Staff Commentary on Regulation Z (“Commentary”). The Commentary sets out in the definition section of finance charge that costs associated with the 4—28 ADOPT NEW 7. TAC §84.205. Page 4 of 7 preparatiori of the. TILA disclosure statement are a finance charge even if charges are being compared with those in comparable cash transactions. Official Staff Commentary to Regulation Z, 12 C.F.R. §226.4(a)1.ii.B. Any documentary fee used by a motor vehicle dealer that contains costs for the preparation of TILA disclosures will violate TILA for failing to correctly disclose those costs as a finance charge. Subsection (e) of Section 348.006 must be interpreted and implemented so that a motor vehicle dealer can comply with both state and federal law. Any interpretation of subsection (e) that makes it impossible for the licensee to comply with federal law is untenable. Therefore, the rule has been amended to specifically exclude the cost for the preparation of the TILA disclosures and any other charge that would be a finance charge under TILA. Section 84.205(e) details three critical tests that must be met for a documentary fee to be considered reasonable. To be reasonable, proposed costs must be: (1) allowable, (2) allocable, and (3) meet the prudent business person standard. Much of the language in subsection (e) is patterned after Office of Management and Budget Circular A-87 (0MB Circular A-87) used by various federal agencies, including the U.S. Department of Housing Urban and Development. 0MB Circular A-87 establishes auditing criteria under which grants, cost-reimbursement contracts, and other agreements are reviewed. Since the proposal, §84.205(e)(2)(A)(ii) regarding allowable costs has been revised in order to provide parallel construction by adding “federal” to the first listing of laws with which the costs must comply. Also included in §84.205(e) is information concerning the agency’s review of a documentary fee. The commissioner will only review a documentary fee for reasonableness if it is above $125. Texas Finance Code, §348.006(f) states: “A documentary fee charged in accordance with this section before September 1, 2009, is considered reasonable for purposes of this section.’ Thus, $50 is the statutory safe harbor remaining for dealers that do not increase their documentary fees. A dealer, however, must provide the OCCC with written notice before charging a documentary fee in excess of $50. A documentary fee filing above $50 up to and including $125 will be considered reasonable by the OCCC. Although the statutory safe harbor is $50, the agency acknowledges the increased costs of compliance with state and federal laws that have evolved over the 15-year period the $50 cap was in place in arriving at the $125 amount for the reasonable documentary fee. These increased costs include: compliance with• Federal Trade Commission regulations, compliance with the Specially Designated Nationals List regulation, compliance with the Gramm-Leach-Bliley Act, compliance with the Texas Department of Transportation’s titling requirements, and calculation of the proper registration fees (over 1,600 different registration fees). Section 84.205(f) outlines the commissioner’s authority to reduce or suspend unreasonable documentary fees. The agency has received informal requests for clarification concerning the $125 aniount provided in the second sentence and the $50 amount provided in the third and final sentence of subsection (f). The $125 is intended to be a safe harbor for those motor vehicle dealers who 4—29 ADOPT NEW 7 TAC §84.205 Page 5 of 7 properly file their requests to increase their documentary fees. If a dealer has submitted its request to charge an increased documentary fee to the agency and is later discovered to have charged an unreasonable amount, restitution will only be required for the unreasonable amount beyond $125. However, should a dealer not file a request to increase its fee and is subsequently discovered charging an unreasonable amount, that dealer will be required to reduce its fee to $50. In other words, a reduction down to $125 is available to documentary fee request “filers,” and a reduction down to $50 applies to “nonfilers.” The new rule is adopted under Texas Finance Code, §348.006(h) (Acts 2009, 81st Leg.), which authorizes the commission to adopt rules relating to the standards for a reasonableness determination or disclosures. The new rule is also adopted under Texas Finance Code, § 11.304, which authorizes the commission to adopt rules to. enforce Title 4 of the Texas Finance Code. Additionally, Texas Finance Code, §348.5 13 grants the commission the authority to adopt rules to enforce the motor vehicle installment sales chapter. The statutory provisions affected by the new rule are contaifled in Texas Finance Code, Chapter 348; §84.205. Documentary Fee Reasonableness Standards. (a) Generally. When reviewing a seller’s documentary fee increase for reasonableness under Texas Finance Code, 348.006(e), the commissioner may consider the resources required by the seller to perform the seller’s duties under state and federal law with respect to the handling and processing of documents relating to the sale and financing of a motor vehicle. This section only applies to retail sales as defined by the Texas Transportation Code. A documentary fee may only include costs that are imposed uniformly in cash and credit transactions. (b) Permissible documentar fee costs. For.à cost to b included in a documentary fee, a cost must directly relate to the retail seller’s handling and processing of documents for the sale and financing of a motor vehicle in compliance with state and federal law. (c) Costs relating to sale of motor vehicle For a cost to be included in a documentary fee, the cost must be incurred either concurrently or after the negotiation and preparation of the buyer’s order, the bill of sale, or the purchase agreement and must directly relate to the sale of a motor vehicle. Any costs or resources expended prior to the negotiation and preparation of the buyer’s order, the bill of sale, or the purchase agreement may not be included in the documentary fee. The cost may also directly relate to the evaluation by the retail seller of the creditworthiness of the retail buyer, the completion of the retail installment sales contract by the retail seller, or the perfection of the lien against a motor vehicle. (d) Costs excluded. (1) Generally. A documentar’ fee may not include any costs or resources expended the title of a purchased motor vehicle is actually transferred or when the title is legally after obligated to have been transferred, whichever is earlier. If the sale includes a trade-in vehicle, the documentary fee may not include costs or resources expended after the title of the trade-in is 4—30 ADOPT NEW 7 TAC §84.205 Page 6 of 7 actually transferred or when the title is legally obligated to have been transferred, whichever is earlier. (2) Costs associated with negotiation or assignment of contract. The retail seller cannot include any costs associated with either the negotiation of or the assign ment of the retail installment sales contract to another financial institution or related finance company. (3) Costs of credit evaluation by other parties. A retail seller may not include the cost of any resource or expense in the documentary fee analysis that relates to the evaluation of the creditworthiness of the prospective retail buyer by an entity that may purchase the underlying retail installment sales contract. (4) Other excluded costs. The retail seller may not include any costs associated with advertising, the retail seller’s credit arrangements for the purchase of its invent ory, the processiig of manufacturer or distributo?s rebates, the compensation of a person for the sale of the motor vehicle, the price of any report on the condition or history of the motor vehicle to be purchased or tra&d-in, or the cost associated with the disbursement of money (i.e., certifie d checks or capital expenses). A retail seller cannot increase any authorized charge or expens e from a third party associated with the documentary fee. A documentary fee may not includ e the cost of preparing the Truth in Lending disclosure statement or any other cost that would be considered a finance charge under the Truth in Lending Act (15 U.S.C. §16Ol-l667f). (e) Reasonable documentary fee. (1) To be reasonable, a documentary fee cannot exceed the amount necessary to cover the cost of performing the processing and handling of the documents required for the sale and financing of a motor vehicle. (2) To be considered reasonable, proposed costs must meet three critical tests: (A) Allowable. For a cost to be allowable, it must meet the following criteria: vehicle (i) be necessary for the proper and efficient sale and financing of a motor (ii) be authorized or not prohibited under local, state, or federal laws or regulations or be necessary in order to comply with a local, state, or federal law or regulatiçg pcipIes; and (iii) be determined in accordance with generally accepted accounting (iv) be adequately documented, including any applicable credits. (B) Allocable. Allocable costs are logically related to, or required in the performance of the handling and processing of documents relating to the sale and financing of a motor vehicle. In determining whether a cost is allocable, consideration will be given to whether 4—31 ADOPT NEW 7 TAC §84.205 Page 7 of 7 the gpods or services involved are chargeable or assignable to the objective of processing and handling of the documents required for the sale and financing of a motor vehicle in accordance with relative benefits received. (C) Prudent business person. The prudent business person standard is the amount a prudent business person would pay in a competitive marketplace. A cost can be allowable and allocable, and still not be what a prudent business person would pay (e.g.. hiring a limousine to deliver documents). In determining whether a given cost is prudent, consideration will be given to: (i) whether the cost is of a type generally recognized as ordinary, customary, and necessary for the processing and handling of the documents for the sale and financing of a motor vehicle; (ii) the restraints or requirements imposed by such factors as sound business practices, arms-length bargaining, and federal, state and other laws and regulations; (iii) market prices for comparable goods or services; and (iv) the necessity for the cost. (3) The Office of Consumer Credit Commissioner will review any written notice of an increased documentary fee over $125 provided by a seller. The review may include an analysis of the resources required by the seller to perform the seller’s duties under state and federal law with respect to the handling and processing of documents relating to the sale and financing of a motor vehicle. The review may result in a determination of the maximum amount of a documentary fee that a specific seller may charge. A retail seller must comply with the Truth in Lending Act when disclosing a documentary fee in cash and financed transactions. (f) Reduction or suspension of unreasonable documentary fee. The commissioner may order a seller to reduce its documentary fee to a reasonable. amount retroactively. The order to reduce a documentary fee retroactively will require the seller to provide restitution to all retail buyers who were charged a fee in excess of the amount the commissioner determines to be reasonable over $125. The commissioner may also suspend by order a seller’s ability to charge any documentary fee above $50 for a specified period of time. Certification This agency hereby certifies that the adoption has been reviewed by legal counsel and found to be within the agency’s legal authority to adopt. Issued in Austin, Texas on February 19, 2010. Sealy Hutchings General Counsel Office of Consumer Credit Commissioner 4:l2