PR Metrics

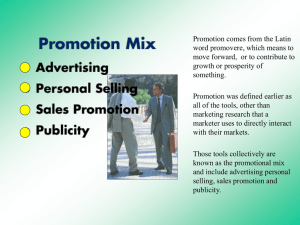

advertisement