ABFS Celebrates 20

advertisement

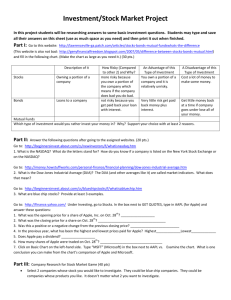

APPROPRIATE BALANCE FINANCIAL SERVICES, INC. Market Recap & Outlook After fluctuating in a frustratingly narrow trading range for the first 9½ months of 2004, stocks finally broke out to higher levels the last ten weeks of the year, and most indexes finished the year with gains. The Dow was up 5.3%, the NASDAQ gained 8.6%, and the S&P 500 rose 10.9%. Volume 10 Issue 1 | January 24, 2005 ABFS Celebrates 20-Year Anniversary By Bruce Yates, ABFS Founder and President I am proud to announce that ABFS has reached a major milestone: late last year we reached our 20th anniversary as a company. When I started ABFS in late 1984, I had no idea it would become the firm it is today. With Because most of 2004 was marked by repeated sixteen employees—including six advisors— rallies and declines, it was a particularly diffi- we now serve clients in 26 states and manage more than $365 million in client assets. This Short-term gains can be fleeting. exceeds anything I imagined when I left ShearThe first three weeks of 2005 have son 20 years ago to set off on my own (living on my wife’s teaching salary for the first few already erased more than 2/3 of the years while ABFS got established). Dow’s 2004 total return—and more than 3/4 of the NASDAQ’s. Tsunami Tragedy 2004 ended with a sobering display of Mother Nature’s awesome power. The South Asia tsunami has filled TV screens and newspapers in recent weeks with images of devastation, as more than 225,000 are now confirmed dead and millions more homeless. The outpouring of aid from around the world has been heartwarming, but it will surely take years for the millions of survivors to rebuild their lives. In a small effort to help, ABFS has matched employee donations for tsunami relief, and altogether our donations now total more than $4,500. ♦ cult year for active managers (like ABFS) who use sell disciplines to limit risk. Many got “whipsawed,” as each successive rally quickly reversed direction and triggered sale of recently purchased holdings. In that environment, it is no surprise that, while all of ABFS’ mutual fund strategies advanced for the year (see graphs at the back of this newsletter), our least active strategy— Index Plus—did the best. Its 14.4% return beat not only our other strategies, but the S&P, Dow and NASDAQ as well. The fact that stocks made gains in 2004 is encouraging, but it is important to remember that short-term gains can be fleeting. The first three weeks of 2005 have already erased more than 2/3 of the Dow’s 2004 total return—and more than 3/4 of the NASDAQ’s. Clearly, limiting losses remains important. In fact, much of this On Balance is devoted to comparing our active investment style to the less active “buy and hold” approach to investing. Economy and Interest Rates Amid flagging but still positive economic (See Market Recap on page 2) Much of ABFS’ success is attributable to the contributions of my partner, Bob Pennell. We joined forces (ultimately merging his firm, Harvard Financial Advisors, into ABFS) more than ten years ago. Bob’s insights and “market sense” have been invaluable in shaping ABFS’ investment strategies and services. But it is more than Bob—or me—that has enabled ABFS to consistently grow and improve (See 20-Year Anniversary on page 6) Seminar and Open House Join us on March 22nd for a seminar and open house to celebrate our first twenty years! First, at 3:30PM, we will host a seminar on the 2nd floor of our building to discuss the current economic and market outlook. That will be followed by an open house here in our offices on the 9th floor from 5:00PM to 7:00PM. Hors d’oeuvres will be served, and parking validated, so we hope many of you will come. (Maps and directions are available by phone or e-mail.) Feel free to bring friends or other guests, but please RSVP, since space is limited and we need to know how many people to expect. ♦ Indicators or Tea Leaves? Predicting 2005 Stock Market Results • • • • • • Santa Claus Rally: The 7-day period ending on the second trading day of January, since 1969, has produced an average stock return of +1.7%. When negative, it usually precedes bear markets or corrections. Result this year: -1% Mid-decade years: There has never been a down market in a year number ending in 5. Undoubtedly a statistical coincidence, but interesting nonetheless. First 5 trading days: Since 1950, the year has been profitable 29 of the 34 times it rose the first week. When down the first week, half of the years were up and half down. Result this year: -2%. Post-election years: The first year of a presidential term has tended to be negative for stocks. When the first 5 days were also down, 6 of the last 8 post-election years had full-year losses of more than 11%. Three unlikely: Only twice in the past 50 years has the S&P 500 produced doubledigit returns (which it did in 2003 and 2004) three years in a row. The January Effect (as January goes, so goes the year): Has only failed 5 times in 50 years, and only once in a post-election year. One week still remains in January... ♦ (Market Recap—cont. from page 1) growth, the Federal Reserve is proceeding with its policy of “measured” interest rate hikes (five since June). The overnight Fed Funds rate rose from 1% in June to 2¼% at year-end, and the Fed appears poised to continue raising rates until they reach a “neutral” level (neither stimulative nor restrictive). That likely equates to a Fed Funds rate between 3.5% and 4%, which will entail multiple additional rate hikes in 2005 and 2006. Much to the consternation of most experts, longer-term bond yields (which are controlled by market forces, not the Fed) did not rise over the past six months. A survey of 55 economists in mid-2004 revealed that all but one of them expected the yield on 10-year Tnotes to rise by year-end. Instead, de- Recent Fixed Income Results Annual total returns as of Dec. 31, 2004* Last 12 3 Yrs Months (per yr) ABFS Income Securities Accounts 5.9% 10.9% Short-Term High Yield Bonds 4.5% 4.5% 1-5 Year Corporate/ Treasury Bonds 1.7% 3.9% * Pre-tax returns for ABFS Income Securities strategy are for accounts invested for the entire period, after all fees and expenses. Individual results vary, and past performance should not be construed as indicative of future results. Returns include all discretionary assets in all discretionary accounts, but exclude accounts with tax-exempt (municipal) securities in order to make comparison with taxable alternatives meaningful. Comparative figures are for the Strong Short-term High Yield Fund (STHBX) and Vanguard Short-Term Bond Index (VBISX), which mimics the Lehman 1-5 year Corporate/Treasury Index. Although these funds share some characteristics with the ABFS Income Securities strategy, the ABFS strategy may utilize substantially different types of securities, including mutual funds, convertible securities, and/or income-oriented stocks, making it substantially different from these and any other funds, indexes or benchmarks. Minimum account size for this strategy: $100,000 (but requires a total of $300,000 managed by ABFS). spite rising inflation and Fed (shortterm) rate hikes, bond yields actually fell slightly—a phenomenon known as “flattening” of the yield curve. There are several possible explanations. One is that bond investors are worried about waning economic growth, and fear further weakness ahead. Another possible explanation is related to the burgeoning U.S. trade deficit. Foreign governments (especially Chinese and Japanese central banks) have—due to huge trade surpluses with the U.S.—had so much excess cash that they have been major purchasers of U.S. treasury securities. This demand has helped keep U.S. interest rates down. Unfortunately, it is a phenomenon that may not last, since the declining dollar is making many foreigners disenchanted with U.S. securities. As the Fed continues hiking short-term rates in 2005, bond yields are likely to rise, not necessarily in lock step with the Fed Funds rate, but certainly moving in the same direction. If the Fed Funds rate ends up at 3.5% to 4% (from 2%), we expect the yield on 10year T-notes—which is currently around 4¼%—to rise to at least 5%. Record low interest rates have made fixed income investing difficult the past few years. We are pleased with the returns that our Income Securities accounts have produced in this environment (see table at left). However, just as the prospect of rising inflation and interest rates caused us to predict lower fixed income returns in 2004 (confirmed by the actual results in the table), fixed income investors— 2 including ABFS clients—should continue to expect only mid-single-digit total returns for the next few years. Non-ABFS fixed income investors seeking higher yields should resist the urge to load up on real estate investment trusts (REITs), junk bonds and other high-yielding securities. Although those vehicles have performed well the past few years, they are increasingly risky, since their values could drop dramatically if the real estate bubble and/or economic recovery seriously falter. Speaking of real estate, the real estate boom accelerated in 2004, as low interest rates and a “can’t lose” mentality fueled prices. This is especially true in growing metropolitan areas, where home buyer expectations have reached “irrational exuberance” levels. A Los Angeles survey revealed that home buyers there expect their homes to appreciate an average of 22% per year over the next decade, and two-thirds fear being left out if they don’t buy now. San Francisco and Boston surveys revealed similar attitudes, reflecting a growing “bubble” mentality. The pin that pricks the real estate bubble may very well be rising interest rates—both short-term (by the Fed) and long-term (as foreigners reduce U.S. treasury purchases). Just as tech stock speculators had a rude awakening in 2000-2002, people expecting everincreasing real estate prices are likely to be shocked when prices start to weaken in coming years. ♦ What is the “Best” Growth Approach? Buy-and-Hold vs. Active Management 2004’s choppy stock market has made some people wonder if active management (like that offered by ABFS) is really the best investment approach. Some experts—after falling silent when the bear market caused massive losses in many portfolios that were not managed—are again touting the “buy and hold” approach to investing. Even “indexing”—simply holding funds that mimic broad stock indexes like the S&P 500—is gaining popularity again. We therefore thought it would be a good time to compare these dif- ferent approaches, and point out some of the strengths/weaknesses of each. The Importance of Independent Thinking At ABFS, we generally avoid the common Wall Street approach of simply buying stocks and hoping their prices rise. Many investors, mutual funds and money managers tend to buy a diversified portfolio of stocks (or index fund), and then—with minimal changes—wait for rising stock prices to increase the value of their holdings. We believe this is a dangerous approach, and we will explain why. order to meet their goals. What people really need are two things: to avoid depleting their assets (through loss or overspending), and to achieve positive long-term returns that exceed inflation sufficiently to provide for their (and/or their heirs’) long-range needs and objectives. While it is reasonable to measure portfolio returns relative to some index or benchmark (and we do so), one should never lose sight of the importance of those other, more personal goals. stocks are rising, the natural urge is to be more aggressive, and be frustrated that you aren’t getting all the gains you hear about on TV or from neighbors. Unfortunately, both of these emotions—fear of loss and fear of missing out—are usually based on short-term market direction, and they are not necessarily conducive to achieving your long-term financial goals. Fear of loss keeps investors out of the market too long, and fear of missing out encourages people to take too much risk and to At ABFS, because we often tend to err “stay the course” far longer than they on the side of caution (to limit risk), we should. You probably know people who don’t necessarily get the full benefit of got caught up in the speculative internet every stock rally. When the market rises stock fervor a few years ago, and were in any given month, quarter or even forced by the ensuing bear market to postpone retirement, go back to work, Fear and greed might more aptly sell vacation properties or otherwise be called fear of loss and fear of drastically alter their lifestyles. People missing out (we don’t believe most whose stock investments were managed by ABFS were spared that upheaval. people are actually greedy). Three fundamental characteristics of our “active” management style set us apart, and have been key to our success. For one thing, our growth strategies place great emphasis on limiting risk (using stop-loss and other disciplines to eliminate large losses). As a result, ABFS growth strategies are consistently year, our strategies can just as easily less volatile than most stock market indexes, as the graphs at the back of this underperform as outperform. Sometimes we do better and sometimes newsletter show. worse, but we almost never “mimic” the market. That means you will almost Another defining characteristic of our approach is our willingness to raise and always be able to find at least one index that is “doing better” than an ABFS hold “cash” (money markets) during market declines. Although we prefer to growth account. be in the market, at times we use cash to protect principal while we seek pockets Despite—or actually, because of—that lack of correlation between our strateof strength in which to invest. gies and the market’s short-term performance, we are confident that our Lastly, in deciding what to buy, we go approach will enable our clients to to considerable effort identifying specome out ahead over any full market cific areas of opportunity (whether in the U.S. or overseas markets). We try to cycle (bull and bear market). We’d love avoid sectors that are weak, even if eve- to beat the market every month, quarter and year, but that’s not realistic if we ryone else seems to be holding them. consistently think independently. Our Indeed, our ability to think independreal objective is to significantly beat the ently—to be different—may be what market over time, since that is how we attracted you to us in the first place. can best achieve your long-term goals. Our actively managed mutual fund strategies have dramatically outperShort-term Emotions formed all major indexes over time (see vs. Long-term Goals Investors naturally feel one of two emopage 7). However, our independent tions as the stock market moves up and approach makes short-term “apples to down. The two emotions are often reapples” comparisons with indexes— ferred to as “fear and greed.” But they such as the Dow, S&P 500 or might more aptly be called fear of loss NASDAQ—problematic. For proper perspective, our results must not only and fear of missing out (we don’t bebe viewed in the context of return and lieve most people are actually greedy). relative risk, but also in terms of your own long-term goals and needs. When prices are plummeting, it is natural to fear that they will continue falInvestors don’t need to match a certain ling, and to wish you didn’t have any market index every quarter or year in money in the market. Conversely, when 3 If your long-term goal is to increase the value of your portfolio, while limiting the likelihood that your life plans will be disrupted by unforeseen market events, you must think “beyond” shortterm market gyrations (and emotions). Your objective should be to utilize the investment approach most likely to achieve your goals. For most people, that includes limiting exposure to declines that could derail their life plans. Different Markets/ Different Strategies Every investment approach entails trade-offs. Not every strategy works equally well in all circumstances. To illustrate that point, let’s take a look at three different approaches in three common market environments. Three environments occur repeatedly in the stock market: extended uptrends (bull markets); extended downtrends (bear markets); and choppy periods (sideways or “trading range” markets). For purposes of this discussion, we will consider in each environment three investment approaches: active management (such as that ABFS employs); a “buy-and-hold” approach (which might include individual stocks, index funds and/or other mutual funds); and staying out of the market altogether. Which of these approaches performs best in the short run depends very much on which of the three market environments exists. Which approach is best in the long run depends on how each one handles combinations of those environments. • Bull Markets In a roaring bull market, it’s pretty easy to make money. A buy-and-hold approach works very well. In fact, the more aggressive the stocks or funds a person buys and holds, the more money they make during extended uptrends. An actively managed approach should also do well in a bull market, since it should stay pretty fully invested, ideally in relatively strong market sectors. In fact, both active management and a buy-and-hold approach should do far better than staying out of the market altogether. Which of the two will do best, however, depends on the nature and duration of a given bull market, and the relative skill of the active manager. • Choppy (Sideways) Markets During a prolonged period of choppiness (as we saw for most of 2004), none of the three approaches is likely to produce much of a return. Staying out of the market (e.g., in money markets) will produce a positive, but low, return. A buy-and-hold approach may be able to “ride through” choppy periods. It may, therefore (especially if the choppiness ends on an up-note, as 2004 did), produce better returns than staying out of stocks altogether. Active management, on the other hand, which does best (relatively speaking) when stocks move in one direction or the other for awhile, struggles during choppy periods. When there are no extended trends in either direction, shortlived rallies and corrections tend to cause “whipsaws” (purchases quickly followed by market reversals that trigger sales). And repeated whipsaws can produce numerous small losses. As a result, active management often underperforms one or both of the other approaches during such times. ter rally made both of them look better by year-end. • Bear Markets In the third market environment—an extended market decline—staying out of the market altogether will at least produce a small positive (i.e., money market) return. The worst returns (i.e., biggest losses) are likely to result from remaining fully invested. Active management may or may not be better than staying out altogether, but should do significantly better than the buy-and-hold approach. Active disciplines can reduce losses, and may even—if they use a “tactical” (opportunistic) approach to security selection—make money during a bear market. That’s because even in bear markets, a few opportunities may arise in sectors that buck the trend and do relatively well. An actively managed approach that can identify those pockets of strength may be able to produce positive returns (as the ABFS mutual fund strategies did during the bear market of 2000-2002), while most investors are losing money. (Of course, there is no assurance that ABFS or any active manager will do so in every bear market.) Which Trade-offs Do You Choose? Clearly, no single approach provides optimal results in all three market environments, and each approach involves trade-offs. Since we as investors don’t know what investment environments lie immediately ahead, we must simply try Whether either the buy-and-hold or active approach is better than simply staying out of the market depends on whether the choppiness ultimately turns into an uptrend or downtrend. For 9½ months of 2004, for example, staying out of the market was better than the other two approaches, but a fourth quar4 to understand the impact of those different trade-offs, and decide which ones we are willing to live with. Many investors are so concerned about missing out when stocks are rising that they endure large bear market losses by staying fully invested. Other investors are so conservative (and afraid of losing money) that they aren’t willing to invest in stocks at all. Neither extreme is really necessary, and generally neither is in your best interest. Staying out of stocks altogether denies you the opportunity to benefit from stocks’ high historical returns (relative to bonds and many other assets). Holding stocks “through thick and thin,” on the other hand, lets you participate in the market’s gains, but you may give those gains back during bear periods. And therein lies the real fundamental problem with the buy-and-hold approach; it provides little or no protection against major market declines. During the recent bear market (early 2000 to late 2002), the S&P 500 dropped 47.5% and the NASDAQ dropped 77.9%. By simply “hanging on,” many buy-and-hold stock investors ended up losing half to three-quarters of their capital. Although stocks may not experience a bear market as severe as that of 20002002 again any time soon, it is foolhardy to assume that stocks are immune to steep and/or extended declines. In- dexing or otherwise remaining fully invested may assure that you don’t underperform “the market,” but it could also create losses that take many years to recoup. Thus, lack of downside protection is arguably the biggest risk of a buy-and-hold approach. Rather than staying entirely out of stocks or staying fully invested, we believe it is more prudent to use active management in order to (a) participate in much/most of the stock market’s gains, and (b) limit exposure to major declines. Limiting portfolio declines/ losses is more important than you think. More Risk = Less(!) Return? Everyone knows that risk and return go hand in hand. But many investors misinterpret that concept. They assume that paper losses in risky stocks or funds will be “worth it” in the long run because those losses will be more than offset by spectacular returns in bull markets. This leads to the misconception that the best long-term returns simply require willingness to endure more volatility (and paper losses) along the way. While it is true that investments with unusually high return potential generally entail higher risk, you cannot assume that just because something en- There is a misconception that the best long-term returns simply require willingness to endure more volatility (and paper losses)...longterm returns are not necessarily proportionate to the risk you take. tails high risk, it will produce high returns, either in the short or long run. Many high risk investments end up disastrously (e.g., defunct internet stocks and numerous hedge fund collapses). But even “good” ones don’t necessarily pay off in the end. Let’s examine why. High returns only result from high-risk investments when those investments are successful far in excess of negative setbacks they suffer. When problems (with an individual company or stock, its sector or the entire market) cause stocks to lose large portions of their value, there may be no reward for having taken that extra risk. In fact, one of the most surprising facts for most people is that—even after many years and multiple bull and bear markets— taking extra risk may leave them with lower cumulative returns (i.e., less money) than a more conservative approach. To illustrate this fact, consider aggressive growth stocks, which tend to produce very high returns during bull markets and rallies. Do such stocks (or funds containing them) also produce the best bottom line in the long run? Not necessarily. As of last month, according to mutual fund tracker Lipper, most aggressive growth mutual funds were still down 50% or more from where they were five years ago. Even over the last ten years, which included the roaring bull market of the late 1990s, their average annual return was only 6.1%. That’s less than government bonds, which averaged 6.6% per year over the same period. gains. We discussed this principle at length in our January, 2004 article, Investing Like Animals: Lessons on Risk and Return (give us a call if you would like a reprint). For example, losing 50% in an investment doesn’t just require a 50% gain to make that money back; your remaining capital has to earn 100% to be “even” again. Because of this principle, the S&P 500, which declined 47.5% during the recent And bear in mind that even getting bear market, will need a gain of 90% 6.1% required being in (and staying in) (from its 2002 low) to get back to its those funds the entire ten years. Many March, 2000 peak. And the larger the investors only get drawn into aggressive loss, the more dramatic the gain reinvestments after seeing big gains (they quired to recoup it. For the NASDAQ buy near the top, driven by fear of miss- (which declined 77.9%), the gain reing out), and later—after those investquired will be 352% from its low! It ments experience steep declines—get could literally take a decade or more for scared and sell them. For investors who many investors to fully recoup the did either of those things, the average losses from that one bear market. 10-year return would be significantly less than 6.1%. Here and Now You may think none of the above is relevant because it is all ancient history. In other words, long-term returns are But human nature doesn’t change and not necessarily proportionate to the amount of risk you take, and buying and we are all subject to human emotions, holding stocks or funds does not assure so history often repeats itself. These concepts are important to consider now you of high returns (even in the long because they pertain to your future. You run). In fact, taking lots of risk in the already may be feeling an urge to bestock market (or even just holding “average-risk” stocks without somehow come more aggressive in order to avoid “missing out” if the late-2004 stock limiting your losses) may leave you rally continues in 2005. We want to with less money than a more actively make sure you don’t put yourself in a managed approach that produces more situation where unexpected market modest gains during rallies, but limits events could deplete so much of your downside risk. capital that it takes you years to recover. Pain Trumps Gain Why are losses such a big deal? It’s not Perhaps the most basic question you must ask yourself is whether there exthat we think stocks will lose money ists a real possibility that another major more years than they make it, or that stocks will experience larger losses than market decline will occur in the years ahead. As dramatic as the 2000-2002 they do gains. The real issue is how bear market was, many experts believe badly large losses “hurt” your capital. that it was only the first stage of a much Large losses impact capital much more larger secular decline necessary to correct excesses of the late Nineties. dramatically than the same percentage 5 Consider the Japanese Nikkei 225 index (sort of a Japanese version of the U.S. Dow Industrial Average). Following its speculative peak of 38,915 in December of 1989, the Nikkei suffered multiple declines (albeit with intermittent rallies that drew investors back in) over the following 13 years. It finally bottomed out in 2003 at less than 8,000, a total decline of roughly 80%. In fact, a “buyand-hold” Nikkei investor who has remained fully (planning to ride out its declines) is still down more than 70%...after fifteen years! We’re not saying that will happen to U.S. markets, but neither are we sanguine about the outlook. Economists point to troubling trends as cause for Rising inflation, huge budget and trade deficits, record consumer debt, a weak U.S. dollar, waning earnings growth...it isn’t hard to envision scenarios that could trigger another bear market. concern: rising inflation; huge budget and trade deficits; a rapidly developing real estate bubble; record consumer debt; a weak U.S. dollar; still-high (by historical standards) stock valuations and waning earnings growth; and a tenuous geopolitical environment. It isn’t hard to envision scenarios that could trigger another bear market. Conclusions We believe that ABFS’ active management offers substantially better tradeoffs than simply “indexing” or taking a buy-and-hold approach to the stock market. Using ABFS may mean that you occasionally experience lower short-term returns, but that is a small price to pay for knowing you are less vulnerable to potentially debilitating losses. We are confident that our approach offers a higher likelihood of achieving your long-term financial goals than any alternative we’ve seen. It is important, however, to remember that each ABFS growth strategy is designed to accommodate certain risk/ return comfort levels and expectations. You should periodically ask yourself (and discuss with your ABFS advisor) whether a particular strategy you are utilizing still meet your needs. If your goals or comfort level change (e.g., if you want to be a little more aggressive), don’t throw caution to the wind. Just ask your advisor about the advisability of shifting some money to a different strategy. On the other hand, if your needs and objectives have not changed, simply remind yourself that occasional fear of “missing out” is perfectly natural, and refocus on your long-term goals. That is what we do. ♦ (20-Year Anniversary—cont. from pg. 1) the services we offer. ABFS owes much of its success to our exceptional group of dedicated associates/employees, half of whom have been with ABFS for more than a decade. Over the past few years, we have gone to considerable effort and expense to increase the “depth” of talent here at ABFS. It wasn’t long ago that I personally managed all of the firm’s fixed income portfolios and Bob managed all of our growth strategies. Today, I am assisted in the fixed income area by Mary Ann Ferreira, who has over 15 years of experience in the bond industry. And Bob has been working closely with Eddie Woo for more than eight years now, managing and constantly improving the ABFS growth strategies. office on a given day. Building a strong team also has important long-term implications for ABFS— and you. Because ABFS is no longer dependent on me—or indeed any one person—for its existence, there is much less chance that our ability to carry on as a firm will be disrupted in the future. While Bob and I expect to remain involved in ABFS for many years to come, we are also developing a longterm succession plan that will enable ABFS to continue serving your needs— and those of your children—far into the future. Which brings me to one final point as I reflect upon ABFS’ 20-year history. I want to thank all of you—our clients— for your loyalty and trust, without which ABFS could never have come this far. You have stuck with us through both bull and bear markets, as we worked to refine and improve our investment techniques and disciplines. We are both honored and humbled by the faith you exhibit in us by trusting us to manage your investments. As I look forward to ABFS’ next twenty years, I am proud to say that ABFS has never been stronger—or in a better position to help you reach your goals— Last year, we also hired a Chief Operatthan we are right now. With virtually no ing Officer/General Manager—Phil corporate debt, steady growth, and the Platt. Phil oversees many of the day-tomost talented group of employees ever, day operations of the business (staffing, we are deeply committed to providing administration, regulatory compliance, the best investment management availetc.). Not only has that freed up time for able anywhere. As we continue to grow Bob, me and others, but having Phil in orderly fashion, we plan to continue running the business full time (rather improving existing services and investthan Bob and me squeezing it in while ment processes, while remaining true to managing investments) has significantly our basic approach. Rather than blindly improved the overall quality and effiseeking the most thrilling returns, we ciency of our operations. will continue paying special attention to risk. And as we strive to be worthy of This increasingly robust “team” apyour continued trust and confidence, we proach, combined with constant adwill make every effort to produce revances in technology, have enabled sults that provide you with both finanABFS to keep growing, while simultacial security and peace of mind. ♦ neously improving the services we alOn Balance is published quarterly by Appropriate Balance ready provide. It is also allowing Bob Financial Services, Inc. (ABFS), a Washington corporation, which is registered with the U.S. Securities and Exchange and me to get our work/personal lives Commission as a Registered Investment Advisor. Information into better balance, taking some long herein is from sources believed to be reliable, but whose accuracy we do not guarantee. Subscriptions are free to clients overdue vacation time while still reof ABFS and others at the sole discretion of ABFS. Reproduction without express permission of ABFS is prohibited. On maining involved in important ABFS Balance is not reviewed, endorsed, or approved by any regulamatters, such as strategic investment tory agency. Employees of ABFS may buy and sell the same securities owned by or purchased for clients, but manipulative decisions. It is nice to know that ABFS' trading or placing employee orders ahead of client orders is strictly prohibited. Certain employees of ABFS (Bruce Yates, strong, experienced team of investment Marhe Youch, Mary Ann Ferreira and Phil Platt) are concurmanagers, advisors and staff can assure rently registered representatives of Pacific West Securities, Inc., a registered broker/dealer. The latest version of our disclosure that your investments needs are being document, SEC Form ADV-Part II, is available at any time upon request. met, even if any one of us is not in the 6 PERFORMANCE OF ABFS GROWTH STRATEGIES Inception through December 31, 2004 1 Graph shows model portfolio performance RETURN & RISK DATA Cumulative (graph period) $210,113 SD MDD 2.5% -12.2% Value Plus $198,574 2.2% -9.1% +26.4% +16.8% +9.5% +0.7% +14.0% +7.0% -5.7% (31%) Managed Risk $195,470 1.6% -6.2% +22.9% +15.7% +14.2% +4.0% +12.7% +2.7% -4.2% (22%) +6.9% -0.4% +20.1% +14.4% -6.6% (31%) -9.1% -12.0% -22.2% +28.5% +10.7% -39.3% -21.1% -31.5% +50.0% +8.6% -18.6% (100%) -32.4% (174%) ABFS Strategies 1 Momentum Growth Investment 2 Index Plus $146,287 Indexes S&P 500 NASDAQ $107,320 $99,210 1 2 3 4 1 3 Avg Yearly Risk/ MDD (and as a 2004 % of S&P 500) 4 +7.3% -7.0% (38%) Component Returns for Each Year 2 1999 2000 2001 2002 2003 +50.4% +5.5% +5.5% -1.7% +19.0% Value of $100,000 Risk/Volatility 1.7% -12.4% n/a n/a 5.7% -47.5% 9.9% -77.9% +21.1% +85.6% The first three ABFS strategies have existed under their current approach and trading disciplines since the beginning of 1999 (the entire graph period). The Index Plus strategy began in early 2000, so its first full year of data is 2001. Accordingly, the Index Plus graph line begins on 1/1/2001, originating at the same point as the S&P 500 stood on that date (since that is the index it attempts to outperform). Yearly return figures are actual net returns to clients after all fees and expenses. “Cumulative” data are for all of the individual “component” years (same as graph period, except for Index Plus, which only has data from 2001 on), compounded at the end of each year. “Value of hypothetical $100,000 investment” includes all component year returns, compounded at the end of each year. Risk/Volatility Measures (larger numbers = higher volatility/risk): SD = monthly standard deviation of return. MDD = maximum draw-down in account value from any high point to subsequent low point during the period. This is the worst decline in account value an investor had to “endure” in order to achieve that strategy or index’s return. Average yearly MDD (i.e., largest decline endured). Unlike “Cumulative” MDD, which is the worst decline over the entire graph period, this is the average of the worst declines in each individual year. This provides an idea of the average declines in value investors had to endure from year to year. The figures in parentheses show how each one compares to (as a percentage of) the S&P 500’s average MDD. IMPORTANT: The above is not complete without “Notes Regarding ABFS Growth Strategy Performance” on reverse side. 7 Notes Regarding ABFS Growth Strategy Performance GENERAL The data in the graph and table on the reverse side are for informational purposes only. Proper interpretation requires some knowledge of market risks, returns and portfolio theory. This information is best used by professionals, and the general public should not act based on it without substantial explanation, qualification, and discussion. We believe – but do not guarantee – that these data are accurate. Of course, there is no assurance that future returns, declines, or volatility will in any way resemble the past, or that results will even be profitable. Some of these results were achieved during unusually positive periods for U.S. equity markets. We do not intend to imply that high relative returns will be produced on an ongoing basis, and periods of negative returns should be expected. Investors should be prepared to endure such periods, and should be sure money invested in growth portfolios is of a long-term nature (not needed for at least 5-10 years). The first three ABFS growth strategies shown (or their predecessors, which were also managed by Robert Pennell, the current primary growth manager) have existed since late 1986. However, their methodology has evolved and changed significantly over the years, and a major modification occurred in late 1998. This modification included the implementation of much stricter sell disciplines, which are intended to help optimize risk-adjusted returns and reducing absolute downside exposure. Because of the significance of the change in late 1998, we believe only the performance since then is representative of these strategies’ current management style, and hence only that period is shown. The fourth ABFS strategy shown—the Index Plus (NonTimed) mutual fund strategy—has only existed since early 2000; its first full year of client data is 2001. Due to these limited track records, investment decisions should not be based solely on these results. Investors should make sure they fully understand and agree with each management style utilized. Due to our emphasis on stoploss disciplines, much of the return in the ABFS growth strategies is expected to be in the form of short-term capital gains, making these strategies most attractive for tax-sheltered accounts and/or clients wishing to reduce exposure to large declines, rather than for taxable investors who are concerned with minimizing taxes. RETURNS Returns for ABFS strategies in the table are “iterative internal rate of return” figures for actual client portfolios. The figures for each “component” year include all client portfolios (even new and terminated accounts) that were invested in that strategy for the entirety of that year (or other period as noted), but exclude any non-managed securities (which were occasionally held at clients’ request) in those accounts. The Cumulative “Value of $100,000 Investment” is calculated by simply compounding the actual returns for the component periods at the end of each year. Note that for Index Plus, all data are for a period two years less than for the other three strategies, due to its later introduction. Returns are calculated on a dollar-weighted basis; that is, they include the actual beginning values, all expenses (including management fees), and deposits and withdrawals for all accounts, calculated as one large “portfolio” for each strategy. Returns are therefore net of all fees and transaction charges, and include reinvestment of all dividends and earnings. Returns ignore tax implications, which may be a significant consideration for taxable accounts. Actual individual client returns usually differ somewhat, depending on such factors as each client’s beginning date, transaction costs (which vary by account size), additions and withdrawals during the period, etc. “S&P 500” data are for the Vanguard Index 500 Fund (VFINX) total return, including all dividends. “Nasdaq” data are for the Nasdaq Composite index price only. GRAPH Unlike the return figures in the data table, which are for actual client accounts, the graph lines for ABFS strategies are not drawn from actual account values, but rather are plotted using a model portfolio with the same mix and proportions of mutual funds held for clients, adjusted daily for purchases and sales made in actual client accounts. The model performance of the graph takes into account a model performance fee; however, model trading does not involve financial risk and cannot completely account for the impact of financial risk involved with actual trading. Model trading or model performance may not reflect the impact that material economic and market factors might have had on the management of actual client accounts. The performance results of a model portfolio do not reflect actual investors’ ability to withstand losses or to adhere to a particular trading strategy in spite of trading losses, which can adversely affect actual trading performance (results). Therefore, although we believe the graph is a rough visual approximation of account fluctuations, it is not meant to precisely represent or take the place of the actual account returns that are reflected in the figures below the graph. Note that the Managed Risk strategy often contains individual convertible bonds as well as funds. Since the graph reflects only mutual funds, a short-term bond fund was used to represent the allocation to convertibles. This substitution is not intended to imply that convertibles and short-term bond funds are equivalent (convertible bonds are in fact riskier), but rather to somehow attempt to account for them in the graph. Since the return figures in the table reflect actual clients’ managed holdings, including convertibles, they do incorporate the actual impact of the convertibles on returns. RISK/VOLATILITY Generally, investment analysts measure portfolio risk using some type of volatility measure that includes both realized and unrealized (paper) gains and losses. Two such volatility figures are shown in the accompanying table: SD = monthly standard deviation of return for the period. SD reflects the range of variation in return, both up and down. MDD = maximum draw-down (decline) in account value from any high point to subsequent low point during the period. Unlike SD, MDD focuses only on downside fluctuation (which some people consider more useful as a measure of risk than fluctuation up and down). In essence, it shows the worst decline in value “endured” during the period in order to achieve the resulting return. Note that SD and MDD figures for the ABFS strategies are not calculated from actual client account values, but rather using the same model portfolio data used to create the graph (as described in the “Graph” section above). MDD and SD figures should therefore only be considered a rough approximation of, not an exact measure of, the actual fluctuation experienced by client accounts. Although SD and MDD figures indicate each strategy’s volatility and declines during the periods shown, they cannot indicate all types or amounts of risk taken in each strategy, and how those risks differ from the S&P 500 or Nasdaq indexes. For example, the S&P 500 is an index of U.S. large company stocks. ABFS growth strategies, while primarily utilizing mutual funds containing stocks, often employ funds containing types of securities different than the S&P 500, such as small company stocks, foreign stocks, domestic or foreign bonds, convertible securities, and/or cash equivalents. The Managed Risk strategy may also contain individual convertible securities in addition to mutual funds. We believe the flexibility to use a wide variety of securities and market sectors facilitates enhanced risk-adjusted performance, but investors should be aware that some individual holdings purchased in these strategies may have substantially different (and greater) risks than the S&P 500 and/or Nasdaq, and that direct comparison with these or any other indexes is not possible. The comparisons in the table and graph are only meant to provide a general idea of relative return and volatility, and should not be taken to imply that ABFS strategies are actually similar to the S&P 500, Nasdaq, or any other index or investment. ABFSDGPDisc012005 8 ABFS Growth Strategies - Comparative Performance through December 31, 2004 20.0% 14.4% Last 12 Months 10.7% 10.0% 2004 was a difficult year for active managers, as repeated market reversals caused “whipsaws” for those employing buy and sell disciplines. As a result, ABFS’ least active strategy (Index Plus) and the indexes themselves were the best performers. 7.0% -10.0% -7.5% -5.7% -20.0% -6.2% -7.2% -6.2% -18.6% -30.0% S&P 500 NASDAQ ABFS INDEX PLUS ABFS M OM ENTUM GROWTH Total Return ABFS VALUE PLUS ABFS M ANAGED RISK Risk (MDD) 36.8% 10.8% 25.5% 11.5% 20.4% 22.8% Last 3 Years The latest 3 years include the final year of the bear market, followed by two up years. All four ABFS strategies significantly beat the market over this period, while substantially limiting risk. 0.0% -20.0% -40.0% 2.7% 0.0% 40.0% 20.0% 7.3% 8.6% -12.4% -6.9% -7.2% -6.2% -33.0% -45.9% -60.0% S&P 500 NASDAQ ABFS INDEX PLUS Total Return Last 5 Years The S&P 500 and Nasdaq have yet to recoup their bear market losses; both still have negative returns for the past five years. Lower risk—plus careful fund selection— provided investors in ABFS’ strategies not only solid positive returns, but the luxury of sleeping soundly as well. 80.0% 60.0% 40.0% 20.0% 0.0% -20.0% -40.0% -60.0% -80.0% -100.0% ABFS M OM ENTUM GROWTH ABFS VALUE PLUS ABFS M ANAGED RISK Risk (MDD) 57.1% 59.0% 39.7% -11.4% -46.5% -12.2% -9.1% -6.2% -47.5% -77.9% S&P 500 NASDAQ ABFS M OM ENTUM GROWTH Total Return ABFS VALUE PLUS ABFS M ANAGED RISK Risk (MDD) NOTES Total Return for ABFS strategies is actual net total return for client portfolios after all fees and expenses. 3-year and 5-year figures are actual yearly returns, compounded at the end of each year. Indexes are the Vanguard Index 500 (VFINX), including dividends, and NASDAQ Composite (index only). MDD = maximum draw-down in account value from any high point to subsequent low point during the period. It is the worst decline in account value an investor had to “endure” in order to achieve that strategy or index’s return. Unlike Total Return figures, which are for actual client accounts, the MDDs for ABFS strategies are based on a model portfolio with the same mix and proportions of mutual funds held for clients in these strategies, adjusted daily for purchases and sales made in actual client accounts. Thus, while MDDs are believed to be representative of actual relative declines in client accounts, they are only approximations thereof. Past MDDs should not be taken to guarantee similarly low MDDs – or “sleeping soundly” – in the future. For additional details and information, including data since inception and year-by-year returns, see “Performance of ABFS Growth Strategies” sheet. IMPORTANT: The above is not complete without notes and disclosures on reverse side. Appropriate Balance Financial Services 425-451-0499 Notes Regarding ABFS Growth Strategy – Comparative Performance GENERAL The data in the bar graphs on the reverse side are for informational purposes only. Proper interpretation requires some knowledge of market risks, returns and portfolio theory. This information is best used by professionals, and the general public should not act based on it without substantial explanation, qualification, and discussion. We believe – but do not guarantee – that these data are accurate. Of course, there is no assurance that future returns, declines, or volatility will in any way resemble the past, or that results will even be profitable. Some of these results were achieved during unusually positive periods for U.S. equity markets. We do not intend to imply that high relative returns will be produced on an ongoing basis, and periods of negative returns – with declines larger than those experienced during these periods – should be expected. Investors should be prepared to endure such periods, and should be sure money invested in growth portfolios is of a long-term nature (not needed for at least 5-10 years). Three of the ABFS growth strategies shown (Momentum Growth, Value Plus, and Managed Risk—or their predecessors, which were also managed by Robert Pennell, the current primary growth manager) have existed since late 1986. However, their methodology has evolved and changed significantly over the years, and a major modification occurred in late 1998. This modification included the implementation of much stricter sell disciplines, which are intended to help optimize risk-adjusted returns and reducing absolute downside exposure. Because of the significance of the change in late 1998, we believe only the performance since then (which includes all of the periods shown in these bar graphs) is representative of these strategies’ current management style. The fourth ABFS strategy shown—the Index Plus (NonTimed) mutual fund strategy—has only existed since early 2000; its first full year of client data is 2001. Due to these limited track records, investment decisions should not be based solely on these results. Investors should make sure they fully understand and agree with each management style utilized. For additional detail and information, including results since inception and year-by-year return data, see sheet entitled “Performance of ABFS Growth Strategies.” Due to our emphasis on stop-loss disciplines, much of the return in the ABFS growth strategies is expected to be in the form of short-term capital gains, making these strategies most attractive for tax-sheltered accounts and/or clients wishing to reduce exposure to large declines, rather than for taxable investors who are concerned with minimizing taxes. RETURNS Returns for ABFS strategies in the bar graphs are “iterative internal rate of return” figures for actual client portfolios. The figures for each individual year include all client portfolios (even new and terminated accounts) that were invested in that strategy for the entirety of that year, but exclude any non-managed securities (which were occasionally held at clients’ request) in those accounts. The returns for the 3-Year and 5-Year periods are calculated by simply compounding the actual returns for the component periods at the end of each year. Returns are calculated on a dollar-weighted basis; that is, they include the actual beginning values, all expenses (including management fees), and deposits and withdrawals for all accounts, calculated as one large “portfolio” for each strategy. Returns are therefore net of all fees and transaction charges, and include reinvestment of all dividends and earnings. Returns ignore tax implications, which may be a significant consideration for taxable accounts. Actual individual client returns usually differ somewhat, depending on such factors as each client’s beginning date, transaction costs (which vary by account size), additions and withdrawals during the period, etc. “S&P 500” data are for the Vanguard Index 500 Fund (VFINX) total return, including all dividends. “Nasdaq” data are for the Nasdaq Composite index price only. RISK/VOLATILITY Generally, investment analysts measure portfolio risk using some type of volatility measure that includes both realized and unrealized (paper) gains and losses. The volatility figure used on this sheet is MDD. MDD stands for maximum draw-down, and represents the largest decline in account value from any high point to subsequent low point during the period. Unlike some other volatility measures, such as standard deviation, MDD focuses only on downside fluctuation (which some people consider more useful as a measure of risk than fluctuation up and down). In essence, it shows the worst decline in value “endured” during the period in order to achieve the resulting return. Note that, unlike the return figures, which are for actual client accounts, MDD figures and bars for ABFS strategies are not drawn from actual account values, but rather are plotted using a model portfolio with the same mix and proportions of mutual funds held for clients, adjusted daily for purchases and sales made in actual client accounts. The model performance of the graph takes into account a model performance fee; however, model trading does not involve financial risk and cannot completely account for the impact of financial risk involved with actual trading. Model trading or model performance may not reflect the impact that material economic and market factors might have had on the management of actual client accounts. The performance results of a model portfolio do not reflect actual investors’ ability to withstand losses or to adhere to a particular trading strategy in spite of trading losses, which can adversely affect actual trading performance (results). Therefore, although we believe the MDD bars are a rough visual approximation of account MDDs, they are not meant to precisely represent exact account declines. Note that the Managed Risk strategy often contains individual convertible bonds as well as funds. Since the charts reflect only mutual funds, a short-term bond fund was used to represent the allocation to convertibles. This substitution is not intended to imply that convertibles and short-term bond funds are equivalent (convertible bonds are in fact riskier), but rather to somehow attempt to account for them in the charts. Since the return figures in the charts reflect actual clients’ managed holdings, including convertibles, they do incorporate the actual impact of the convertibles on returns. Although MDD figures indicate each strategy’s worst declines during the periods shown, they cannot indicate all types or amounts of risk taken in each strategy, and how those risks differ from the S&P 500 or Nasdaq indexes. For example, the S&P 500 is an index of U.S. large company stocks. ABFS growth strategies, while primarily utilizing mutual funds containing stocks, often employ funds containing types of securities different than the S&P 500, such as small company stocks, foreign stocks, domestic or foreign bonds, convertible securities, and/or cash equivalents. The Managed Risk strategy may also contain individual convertible securities in addition to mutual funds. We believe the flexibility to use a wide variety of securities and market sectors facilitates enhanced risk-adjusted performance, but investors should be aware that some individual holdings purchased in these strategies may have substantially different (and greater) risks than the S&P 500 and/or Nasdaq, and that direct comparison with these or any other indexes is not possible. The comparisons in the bar graphs are only meant to provide a general idea of relative return and downside volatility, and should not be taken to imply that ABFS strategies are actually similar to the S&P 500, Nasdaq, or any other index or investment. ABFSBARGDisc010705